Household Wipes Market Size 2024-2028

The household wipes market size is forecast to increase by USD 1.18 billion at a CAGR of 6.36% between 2023 and 2028.

- The market is experiencing significant growth due to the favorable features of these products, including convenience, ease of use, and effectiveness in cleaning various surfaces. Another trend driving market growth is the alcoholic wipes are gaining popularity for their ability to disinfect surfaces effectively, while eco-friendly wipes made from recyclable material and bio-degradable material are in demand due to growing environmental concerns. However, the market is also faced with challenges, such as fluctuating raw material prices for nonwoven fabric, which can impact the cost of production and, in turn, the final price of the product. Despite these challenges, the market is expected to continue its growth trajectory, driven by consumer demand for convenient and effective cleaning solutions.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing significant growth due to the increasing demand for hygiene and cleanliness in daily life. The market includes various product types such as baby wipes, alcoholic wipes, eco-friendly wipes, disinfecting wipes, wet tissue and wet wipes, and non-antibacterial wipes. Baby wipes hold a major share of the market due to their convenience and necessity for infant care. Air pollution and dust problems have led to an increase in the usage of household wipes for sanitation necessities.

- Furthermore, hygiene awareness and the rise in diarrheal diseases have further boosted the market growth. Household wipes are used on various surfaces, including furniture, kitchen counters, bathrooms, and wood surfaces. Consumer spending on household goods is expected to increase, leading to further growth in the market. Dusting wipes and kitchen wipes are also gaining popularity as they offer a quick and effective solution for daily cleaning needs. The market is also witnessing the introduction of antibacterial and non-antibacterial wipes, catering to different consumer preferences. Overall, the market is poised for steady growth due to the increasing focus on hygiene, cleanliness, and convenience.

How is this market segmented and which is the largest segment?

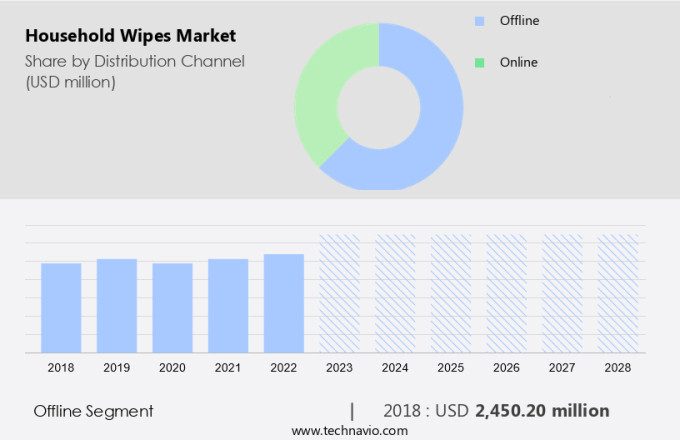

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- UK

- France

- South America

- Middle East and Africa

- North America

By Distribution Channel Insights

- The offline segment is estimated to witness significant growth during the forecast period.

In the market, traditional distribution channels held the largest market share in 2023. Offline sales, achieved through physical stores, accounted for this dominance. Brick-and-mortar retail outlets, such as supermarkets, department stores, and hypermarkets, are the primary distribution points. These channels enable consumers to examine products before making a purchase, offering a tangible advantage over online sales. Other offline distribution points include drugstores and convenience stores. As concerns about air pollution and the need for recyclable materials continue to grow, technological advances in disinfecting wipes are a key focus for market players. Analysts predict that these trends will influence the market significantly in the coming years.

Get a glance at the market report of share of various segments Request Free Sample

The offline segment was valued at USD 2.45 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- Europe is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market is projected to experience significant growth in the upcoming years due to several factors. These include increasing urbanization, evolving consumer lifestyles, and heightened emphasis on cleanliness and hygiene. Moreover, the growing concern over air pollution and the subsequent need for disinfecting wipes add to the market's expansion. In response, numerous global companies have established production facilities in North America to cater to the burgeoning demand. For instance, Rockline Industries, a notable player in the global household wipes industry, relocated its production from Europe to Springdale, Arkansas, USA. The North American market is characterized by a high degree of fragmentation, with prominent players.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Household Wipes Market?

Favorable features of household wipes is the key driver of the market.

- The global market for household wipes is experiencing substantial growth due to the convenience they offer in cleaning various surfaces. The demand for household cleaning products, which includes detergents, cleaning sprays, liquid soaps, and wipes, is on the rise worldwide. Household wipes come in both wet and dry forms, with wet wipes providing the added benefit of reducing water usage and saving time. In the market, companies provide a range of household wipes to cater to diverse consumer needs.

- Moreover, these wipes can be purchased from various retail channels such as hypermarkets, supermarkets, departmental stores, and online stores. Non-antibacterial and antibacterial wipes are popular choices among consumers for maintaining cleanliness in their homes. Biodegradable wipes are also gaining traction due to increasing environmental concerns.

What are the market trends shaping the Household Wipes Market?

Increased preference for scented wipes is the upcoming trend in the market.

- The market is witnessing significant growth due to the increasing emphasis on hygiene and cleanliness in everyday life. companies are catering to this demand by providing a diverse range of household wipes, including baby wipes and alcoholic wipes.

- Among these, scented wipes are gaining popularity, with fragrances such as Citrus Meadows, Tuscan Lavender, and Early Morning Breeze being favored by consumers. These scents not only provide a pleasant aroma but also help disinfect and deodorize surfaces. This innovative packaging allows for easy storage and portability, making it a convenient option for consumers on the go.

Overall, the market is expected to continue growing as consumers prioritize cleanliness and convenience in their daily lives.

What challenges does Household Wipes Market face during the growth?

Fluctuating raw material prices for nonwoven fabric is a key challenge affecting the market growth.

- Disposable household wipes are essential household goods that provide convenience and promote hygiene and cleanliness across various surfaces. These wipes are primarily composed of nonwoven fabric, accounting for approximately 61%-63% of their total composition. The nonwoven fabric offers desirable features such as absorbency, cushioning, stretchability, softness, washability, toughness, and efficient sterility.

- India and China were the leading producers of nonwoven fabric in 2021, making them crucial suppliers for manufacturers of baby wipes, alcoholic wipes, and eco-friendly wipes in developed markets like North America and Western Europe. However, the price volatility of nonwoven fabrics poses a challenge for manufacturers, leading them to explore alternative raw materials like natural fibers, such as bamboo fiber, to mitigate price fluctuations and maintain a stable supply chain.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Albaad Deutschland GmbH

- American Hygienics Corp.

- Amway Corp.

- Colgate Palmolive Co.

- Daio Paper Corp.

- Diamond Wipes International Inc.

- DR. Fischer Ltd.

- Essity AB

- GLR Impex Pvt. Ltd.

- Kao Corp.

- Kimberly Clark Corp.

- Nice Pak Products Inc.

- Reckitt Benckiser Group Plc

- Rockline Industries

- S.C. Johnson and Son Inc.

- The Clorox Co.

- The Procter and Gamble Co.

- Unilever PLC

- Weiman Products LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for convenient and effective cleaning solutions. These wipes cater to various surfaces, including windows, glass, tiles, toilets, floors, metal surfaces, and furniture. They come in different types, such as baby wipes, alcoholic wipes, eco-friendly wipes, disinfecting wipes, and dusting wipes. Bathroom wipes are becoming a popular choice in hypermarkets, supermarkets, departmental stores, and online stores, with many consumers opting for Biom-friendly options that prioritize eco-conscious cleaning solutions for personal hygiene and home care. Consumer spending on household goods is on the rise as hygiene and cleanliness become top priorities. Household wipes address several client goals, including dealing with dust problems, maintaining high levels of sanitation, and promoting hygiene awareness. They are essential in combating air pollution and preventing the spread of diarrheal diseases.

Furthermore, eco-conscious consumers prefer eco-friendly wipes made from recyclable material or biodegradable material. The market offers both antibacterial and non-antibacterial wipes to cater to diverse consumer preferences. Wood wipes, laminate wipes, glass cleaner wipes, stainless steel wipes, multi-surface wipes, and floor wipes are increasingly popular in hypermarket, supermarket, departmental stores, and online stores, offering convenient cleaning solutions for a wide range of surfaces. Biom-friendly options are also gaining traction as consumers seek eco-friendly alternatives for their cleaning needs. Household wipes can be purchased from various retail channels, including hypermarkets, supermarkets, departmental stores, and online stores. Technology plays a crucial role in the development of household wipes, with advancements in material science and manufacturing processes leading to improved performance and sustainability. Analyst support is available to help businesses navigate the market and make informed decisions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

153 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.36% |

|

Market Growth 2024-2028 |

USD 1.18 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.58 |

|

Key countries |

US, China, UK, Japan, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch