Ice Cream Market Size 2025-2029

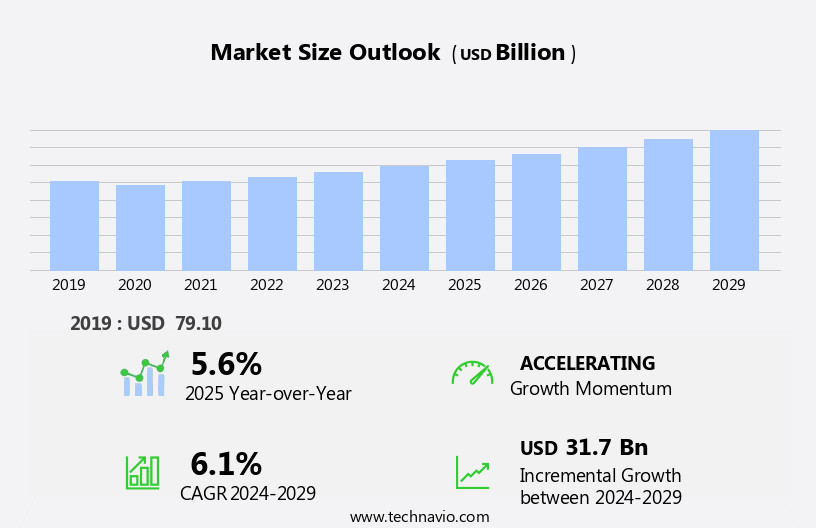

The ice cream market size is forecast to increase by USD 31.7 billion at a CAGR of 6.1% between 2024 and 2029.

- The market is driven by two significant trends: the demand for extended shelf life in ice cream products and the increasing preference for vegan options among millennial consumers. The former is a response to the growing need for convenience and longer preservation periods in the fast-paced modern lifestyle. This trend is pushing manufacturers to invest in advanced technologies and packaging solutions to enhance the product's longevity without compromising taste and quality. The increasing prevalence of obesity and related diseases among consumers, particularly among the younger demographic, is fueling this trend. To cater to dietary restrictions, ice cream manufacturers offer sugar substitutes and fat replacers.

- As a result, companies are responding by launching innovative vegan ice cream offerings to cater to this growing consumer base. However, creating vegan ice cream that matches the taste, texture, and mouthfeel of dairy-based ice cream remains a significant challenge. Companies must invest in research and development to create vegan ice cream that appeals to both health-conscious consumers and traditional ice cream lovers. Effective navigation of these trends and challenges will be crucial for companies seeking to capitalize on the market's growth potential and maintain a competitive edge. Coconut milk, almond milk, cashew milk, and soy milk are some of the common plant-based bases used in vegan ice cream production.

What will be the Size of the Ice Cream Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market exhibits dynamic trends with a focus on catering to various dietary preferences and health-conscious consumers. Lactose-free and plant-based options are gaining popularity among health-conscious consumers, while sugar content and calorie count remain key concerns. Frozen treats, including ice cream sandwiches, milkshakes, sundaes, and novelty items, are innovating with non-dairy alternatives and allergen-free options. Frozen yogurt and frozen desserts also contribute to this market, offering lower fat content and protein options. Ice cream carriers, such as bowls, dippers, and spoons, are designed to enhance the consumer experience.

Competitions and festivals showcase the creativity of ice cream makers, featuring unique flavors and presentations, from ice cream cakes and pies to floats and bars. Dairy ingredients remain essential, but the market is expanding to include a diverse range of frozen desserts. Meanwhile, the rising popularity of vegan ice cream is posing a challenge to traditional dairy-based ice cream brands.

How is this Ice Cream Industry segmented?

The ice cream industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Impulse

- Take home

- Artisanal

- Type

- Dairy

- Non-Dairy

- Flavor

- Chocolate

- Vanilla

- Fruit

- Strawberry

- Others

- Distribution Channel

- Supermarkets and hypermarkets

- Convenience stores

- Ice cream parlors

- Online retail

- Foodservice

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

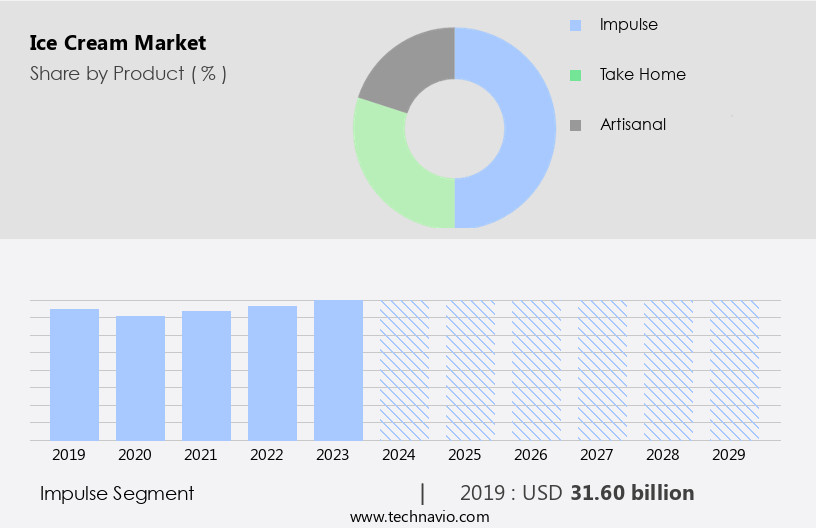

By Product Insights

The Impulse segment is estimated to witness significant growth during the forecast period. In the dynamic the market, companies cater to consumers' evolving preferences through product innovation and diverse offerings. Ice cream mixes and gelato mixes, available in bulk packaging, are popular choices for ice cream parlors and foodservice operators. Online retailers have emerged as significant distribution channels, enabling consumers to explore a wide range of new flavors, including salted caramel, peanut butter, and fruit purees. Consumer preferences lean towards local sourcing, fair trade ingredients, and novel textures, driving the demand for artisan ice cream and gourmet ice cream.

Continuous freezers and frozen dessert machines facilitate efficient production and distribution. Premium ice cream brands highlight unique ingredients, such as cookie dough and chocolate coatings, to cater to health consciousness and indulgence. Soft serve machines and batch freezers cater to the convenience stores and foodservice sectors, while retail packaging and foodservice packaging ensure product freshness. Sorbet mixes and whipped cream are popular add-ons, while flavor trends shift towards healthier options, such as plant-based and low-calorie ice creams. Cold chain logistics plays a crucial role in maintaining product quality and ensuring timely delivery. companies also invest in distribution networks to expand their reach and cater to diverse consumer demographics.

Manufacturers focus on improving freeze-thaw stability through the exploration of cocoa butter alternatives and thickening agents. Overall, the market is a vibrant and evolving landscape, driven by consumer preferences, product innovation, and marketing strategies.

The Impulse segment was valued at USD 31.60 billion in 2019 and showed a gradual increase during the forecast period.

The Ice Cream Market is evolving to meet diverse consumer preferences with rising demand for lactose-free options, gluten-free options, and enhanced protein content in frozen treats. Innovative formats like ice cream bars, novelty ice cream, and indulgent ice cream pies are gaining popularity. Classic offerings such as ice cream sundaes, ice cream milkshakes, and ice cream floats continue to attract loyal consumers. Retail and foodservice sectors are enhancing presentation through ice cream scoops, ice cream dippers, ice cream bowls, and ice cream spoons for an elevated experience. Engagement-driven trends such as ice cream festivals, ice cream competitions, and curated ice cream tours are boosting brand visibility and consumer interaction, driving overall market growth.

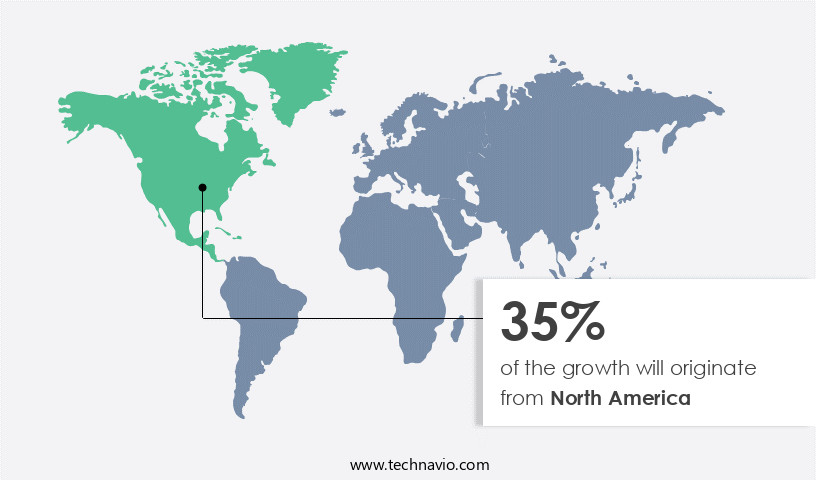

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market is experiencing significant growth, with the US leading the charge in terms of revenue in 2024. Factors driving this expansion include an increase in product innovation and new launches, as well as investments from market participants to meet the rising consumer demand. Health consciousness is a key trend, leading to the popularity of low-fat and plant-based ice cream options. Suppliers are responding by expanding their production capacities in the region. Ice cream mixes, including gelato and frozen yogurt, are in high demand, as are bulk packaging solutions for convenience stores and foodservice operators. Consumers also seek novel textures, such as those found in artisan ice cream and gourmet offerings, as well as unique flavors like salted caramel and peanut butter.

Local sourcing and fair trade ingredients are also gaining favor. Cold chain logistics and continuous freezers ensure the quality and freshness of these offerings. Ice cream machines, from batch to soft serve, cater to various market segments. Retail packaging and foodservice packaging solutions are essential for distribution networks. Additionally, there is a growing interest in sorbet mixes, cake batter, and fruit purees. Fat replacers and sugar substitutes are also important considerations for those with dietary restrictions. Overall, the North American the market is dynamic and evolving to meet the diverse preferences and needs of consumers. Companies are focusing on producing high-protein ice creams using natural food colorings to cater to health-conscious consumers.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Ice Cream market drivers leading to the rise in the adoption of Industry?

- The extended shelf life of ice cream products serves as a significant market driver, making it a key consideration for manufacturers and consumers alike. The market is experiencing significant growth due to innovative strategies implemented by companies to enhance product shelf life and maintain quality. According to the Food and Agriculture Organization of the United Nations, approximately one-third of global food production is wasted each year, leading many retailers to incur substantial losses. This approach not only reduces food waste but also extends the shelf life of the product, ensuring optimal freshness.

- Moreover, the increasing preference for dietary restrictions and texture preferences has led to the development of a diverse range of ice cream flavors and sugar substitutes. Online retailers have also emerged as a popular sales channel, enabling consumers to access a wider variety of ice cream options. The continuous advancement of product innovation continues to fuel market growth. To mitigate this issue, ice cream manufacturers are investing in advanced technology and producing ice cream mixes for bulk packaging.

What are the Ice Cream market trends shaping the Industry?

- Millennials' increasing preference for vegan ice cream represents a significant market trend in the food industry. This demographic group's rising demand for dairy-free and ethically-sourced dessert options is shaping the future of the market. The market is experiencing significant growth due to increasing consumer preferences for plant-based foods and ethical considerations. Health-conscious consumers are shifting towards plant-based diets, which are rich in antioxidants, magnesium, potassium, folate, and various vitamins. Furthermore, the use of fair trade ingredients is becoming increasingly important to consumers, adding another layer of complexity to the market dynamics.

- The importance of cold chain logistics in maintaining the quality and freshness of ice cream products is also a significant market driver. The market is expected to continue expanding due to evolving consumer preferences and the introduction of innovative products that cater to various dietary needs and ethical considerations. This dietary trend is particularly popular among millennials in countries like Australia, Germany, the US, and China. Plant-based ice cream, made from soy, almond, coconut, or other plant milks, is gaining popularity as a healthier alternative to traditional dairy ice cream. Novel textures, such as those found in frozen yogurt mixes, are also driving market expansion. Another favorable trend is the use of unique ingredients, such as salted caramel and peanut butter, to cater to diverse consumer tastes.

How does Ice Cream market faces challenges during its growth?

- The escalating incidence of obesity and its associated health issues among consumers poses a significant challenge to the industry's growth trajectory. Ice cream, a beloved dessert and treat, has been a subject of discussion in the health and wellness sphere due to its caloric and nutritional content. The primary concerns revolve around the high amounts of sugars and fats, particularly saturated fats, present in many commercial ice creams. These components can contribute to an energy imbalance and potential weight gain when consumed excessively without sufficient physical activity. Moreover, added sugars, common in many ice cream varieties, increase calorie intake and may negatively impact health. Ice cream's low nutrient density further complicates matters, potentially leading to overeating due to a lack of satiety.

- Premium ice cream offerings, such as those with chocolate coatings, cookie dough, and fruit purees, cater to consumers' taste preferences but may exacerbate these concerns. To address these issues, ice cream manufacturers and foodservice operators are exploring healthier alternatives, like reduced-fat and low-sugar options, as well as incorporating natural ingredients and nutrient-dense additives. Effective freezer storage and distribution networks are essential for maintaining the quality of ice cream products and ensuring their availability in convenience stores and other retail outlets. Ice cream machines, including soft serve machines, are crucial tools for foodservice operators to create and serve ice cream products efficiently and consistently.

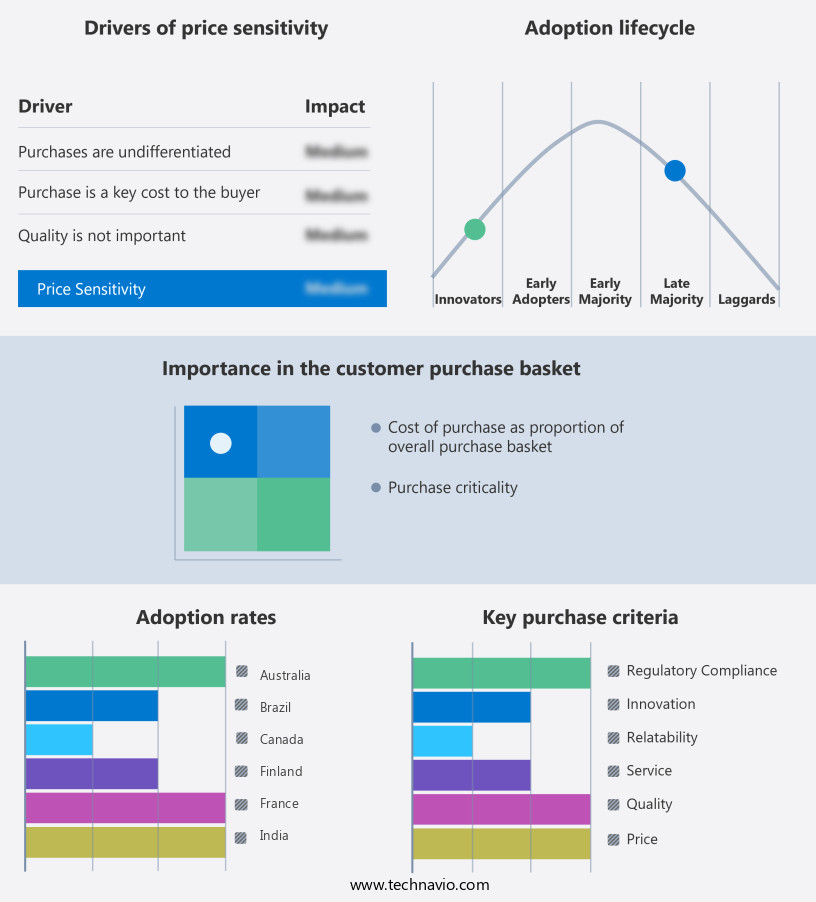

Exclusive Customer Landscape

The ice cream market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ice cream market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ice cream market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agropur Dairy Cooperative - The company specializes in the production and distribution of a wide variety of premium frozen desserts, with a strong focus on ice cream.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agropur Dairy Cooperative

- Aldi Group

- Blue Bell Creameries LP

- Dairy Farmers of America Inc.

- Danone SA

- Eclipse Foods

- Erhard Patissier Glacier

- Ferrero International S.A.

- Gujarat Cooperative Milk Marketing Federation Ltd.

- Humphry Slocombe Group LLC

- Inspire Brands Inc.

- JENIS SPLENDID ICE CREAMS LLC

- Lotte Corp.

- Mars Inc.

- Morinaga and Co. Ltd.

- Nestle SA

- Oatly Group AB

- Perfect Day Inc.

- Unilever PLC

- Vadilal Industries Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Ice Cream Market

- In January 2024, Unilever, a leading ice cream manufacturer, announced the launch of its new plant-based ice cream brand, "The Veganice Cream Co." in the United States. This move was a strategic response to the growing demand for vegan and sustainable food options (Unilever Press Release, 2024).

- In March 2024, Nestlé and Starbucks entered into a major strategic partnership to develop and market Nestlé's ice cream products under the Starbucks brand. This collaboration aimed to capitalize on Starbucks' strong brand recognition and Nestlé's ice cream expertise (Nestlé Press Release, 2024).

- In April 2025, Häagen-Dazs, a premium ice cream brand, secured a significant investment of USD50 million from a private equity firm, Signia Partners. This funding will be used to expand the brand's production capacity and global reach (Bloomberg, 2025).

- In May 2025, the European Union approved new regulations on the labeling of ice cream products, requiring clearer information on sugar, fat, and calorie content. This initiative aims to promote healthier choices and increase consumer transparency (European Commission Press Release, 2025).

Research Analyst Overview

The market continues to evolve, with dynamic market activities unfolding across various sectors. Innovation remains a key driver, as companies introduce new product offerings to cater to diverse consumer preferences. Ice cream mixes, available in bulk packaging, are popular choices for commercial use, with gelato mixes and frozen yogurt mixes gaining traction due to their unique textures and healthier positioning. Peanut butter and salted caramel are among the latest flavor trends, reflecting consumers' increasing demand for indulgent yet familiar tastes. Cold chain logistics and sugar substitutes are essential considerations for manufacturers, ensuring optimal product quality and catering to dietary restrictions.

Health consciousness influences the market, with an emphasis on unique ingredients, local sourcing, and fair trade certifications. Premium ice cream offerings, such as those with chocolate coatings and cookie dough, cater to consumers seeking gourmet experiences. Foodservice operators and convenience stores leverage soft serve machines and batch freezers for quick service, while ice cream parlors and grocery stores offer a more artisanal experience with novel textures and fruit purees. Whipped cream and cake batter add to the overall indulgence, while frozen dessert machines and distribution networks ensure wide availability. Sorbet mixes and fat replacers cater to those with specific dietary needs, further expanding the market's reach.

The continuous evolution of the market reflects the industry's adaptability and commitment to meeting consumer demands. While ice cream remains a popular treat, it's essential for both manufacturers and consumers to be mindful of its caloric and nutritional content. Innovations in ice cream production, such as healthier alternatives and improved distribution networks, can help mitigate potential health concerns and cater to the evolving preferences of consumers.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Ice Cream Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

249 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.1% |

|

Market growth 2025-2029 |

USD 31.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.6 |

|

Key countries |

US, China, Germany, Japan, Canada, UK, India, Brazil, France, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Ice Cream Market Research and Growth Report?

- CAGR of the Ice Cream industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ice cream market growth of industry companies

We can help! Our analysts can customize this ice cream market research report to meet your requirements.