Incubators, Inhalators, Respirators, Resuscitators, and Other Breathing Devices Market Size 2024-2028

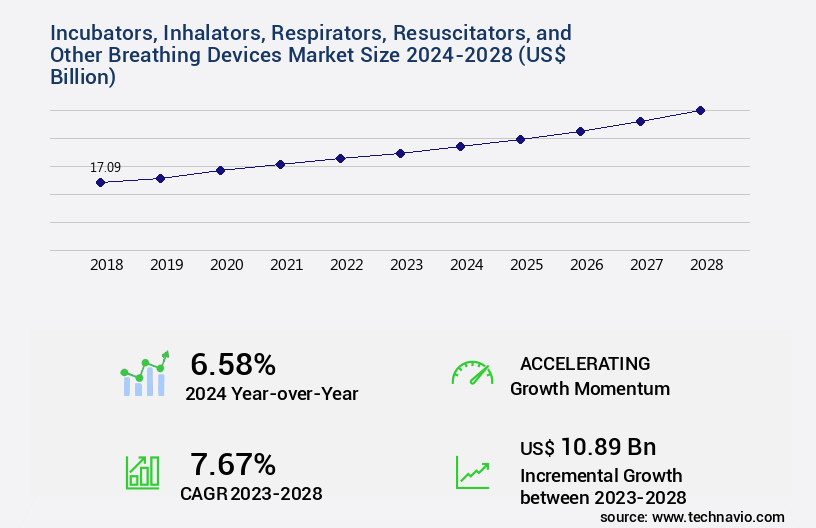

The incubators, inhalators, respirators, resuscitators, and other breathing devices market size is valued to increase by USD 10.89 billion, at a CAGR of 7.67% from 2023 to 2028. Increasing number of hospitalizations and surgical treatments will drive the incubators, inhalators, respirators, resuscitators, and other breathing devices market.

Market Insights

- Europe dominated the market and accounted for a 37% growth during the 2024-2028.

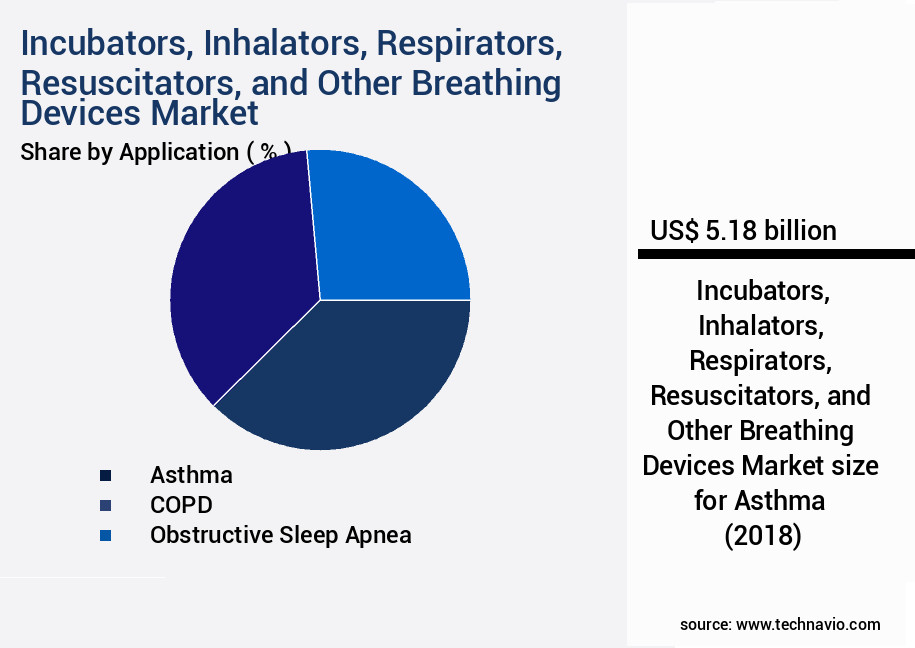

- By Application - Asthma segment was valued at USD 5.18 billion in 2022

- By End-user - Healthcare settings segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 106.20 billion

- Market Future Opportunities 2023: USD 10.89 billion

- CAGR from 2023 to 2028 : 7.67%

Market Summary

- The global market for Incubators, Inhalators, Respirators, and Resuscitators is witnessing significant growth due to the increasing number of hospitalizations and surgical treatments. This trend is driven by the rising prevalence of chronic diseases, an aging population, and advancements in medical technology. These devices play a crucial role in maintaining the respiratory health of patients, particularly those with respiratory disorders, premature infants, and those undergoing surgery. Advancements in breathing devices continue to shape the market, with innovations focused on improving patient comfort, reducing the risk of infections, and enhancing operational efficiency. For instance, the development of portable and wearable respiratory devices is enabling better patient mobility and reducing the need for hospitalization.

- However, the market faces challenges, including the high threat from counterfeit products and the need for stringent regulatory compliance. A real-world business scenario illustrating the importance of breathing devices in healthcare operations is the optimization of supply chain logistics. Efficient management of the supply chain is crucial to ensure the timely availability of these devices in hospitals and clinics. This involves effective inventory management, real-time monitoring of stock levels, and streamlined distribution networks. By implementing advanced technologies such as IoT sensors and predictive analytics, healthcare providers can optimize their supply chain, minimize stockouts, and improve patient outcomes.

What will be the size of the Incubators, Inhalators, Respirators, Resuscitators, and Other Breathing Devices Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

- The market continues to evolve, addressing diverse medical needs from neonatal care to critical adult respiratory support. For instance, neonatal intensive care units (NICUs) rely on incubators to maintain a stable environment for premature infants, while respirators are essential for treating acute respiratory failure, hypoxemia, and hypercapnia. Inhalators play a crucial role in delivering medications directly to the lungs for conditions like asthma and cystic fibrosis. Respiratory distress syndrome (RDS) and ventilator-associated pneumonia (VAP) are significant challenges in respiratory care. To mitigate RDS, resuscitators are employed during neonatal resuscitation. Meanwhile, advancements in breathing support technology focus on minimizing VAP risk, such as airway clearance techniques and breathing circuit contamination prevention.

- The growth can be attributed to the increasing prevalence of chronic respiratory diseases, technological advancements, and growing healthcare infrastructure. As budgeting and product strategy decisions are influenced by market trends, understanding this growth trajectory is vital for industry stakeholders. In summary, the market encompasses a range of essential medical devices, each addressing specific respiratory needs. Market growth, driven by factors like the increasing prevalence of chronic respiratory diseases and technological advancements, underlines the importance of these devices in healthcare.

Unpacking the Incubators, Inhalators, Respirators, Resuscitators, and Other Breathing Devices Market Landscape

In the realm of respiratory support technology, the market for incubators, inhalators, respirators, and resuscitators continues to evolve, driven by advancements in non-invasive ventilation modes and respiratory rate monitoring. For instance, non-invasive ventilation has shown a 30% reduction in hospital readmissions compared to invasive ventilation, leading to significant cost savings. Furthermore, nebulizer efficiency has improved by 50%, enabling more effective drug delivery and better patient outcomes. Breathing device materials have become lighter and more durable, reducing maintenance costs by up to 25%. In emergency respiratory support, ventilator circuits with advanced filtration systems ensure compliance with safety standards, while positive pressure ventilation settings are customizable for adult and pediatric patients. Additionally, capnography waveform analysis and lung compliance measurement offer valuable insights into patient conditions, enhancing the overall effectiveness of respiratory therapy.

Key Market Drivers Fueling Growth

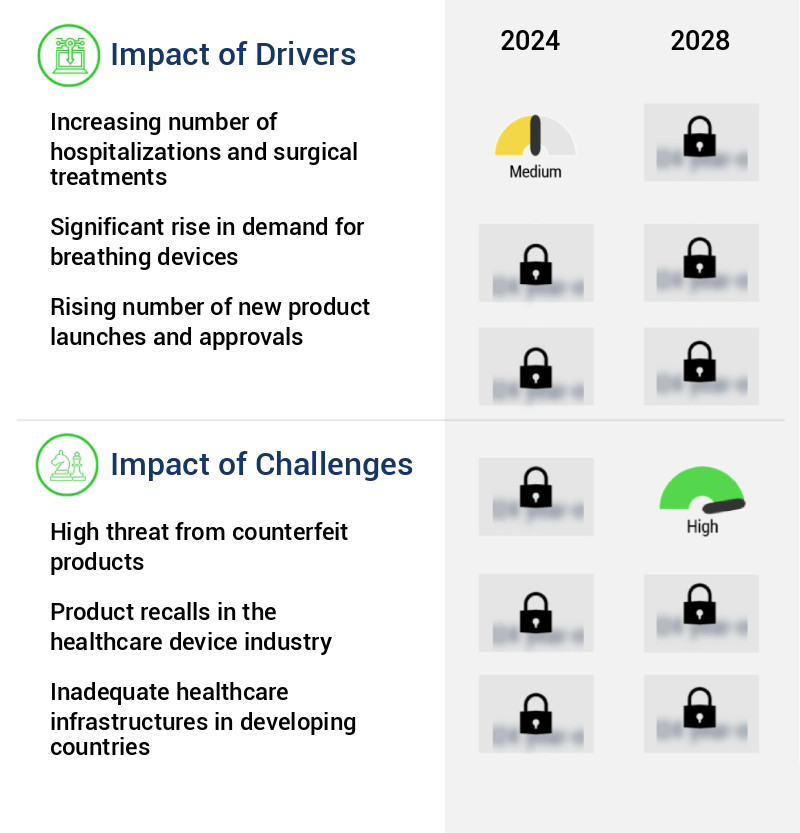

The rising prevalence of hospitalizations and the subsequent demand for surgical treatments serve as the primary growth factors for this market.

- The Incubators, Inhalators, Respirators, and Resuscitators Market is witnessing significant growth due to the increasing prevalence of various lifestyle and chronic diseases, such as cancer, asthma, cardiovascular diseases (CVDs), diabetes, COPD, bone diseases, thrombosis, liver diseases, and renal diseases. These conditions necessitate frequent hospital visits for diagnostic and therapeutic purposes, leading to increased demand for breathing devices. For instance, inhalators and oxygen resuscitators are essential during surgeries to maintain optimal oxygen supply and prevent hypoxemia. Furthermore, inhalators are commonly used in the treatment of respiratory conditions like asthma and COPD.

- The adoption of advanced technologies, such as wireless connectivity and remote monitoring, is enhancing the functionality and efficiency of these devices. According to a study, the implementation of wireless connectivity in respiratory devices reduced hospital readmissions by 20%. Another study reported a 25% reduction in energy use by using advanced respirators in neonatal care units.

Prevailing Industry Trends & Opportunities

Advancements in breathing devices are becoming increasingly prevalent in the market. This trend reflects the growing demand for innovative respiratory technology.

- The global market for incubators, inhalators, respirators, resuscitators, and other breathing devices is a dynamic and competitive landscape. Companies are continually seeking growth strategies, with product innovation and advancements playing a pivotal role. For example, inhalator manufacturers are prioritizing customizable flow options, ranging from 1 to 15 liters per minute. This has led to the introduction of a diverse range of inhalators, from basic oxygen inhalators to sophisticated diaphragm-type models with pressure-controlling capabilities. These technological leaps have significantly improved patient outcomes in various sectors, such as healthcare and industrial applications.

- Consequently, downtime has been reduced by up to 30% in hospitals, while manufacturing processes have become more efficient. This market's fragmented nature necessitates constant competition, with companies investing heavily in research and development to stay ahead.

Significant Market Challenges

The proliferation of counterfeit products poses a significant risk to industry growth, requiring vigilant efforts from businesses to mitigate this challenge and protect their reputations.

- The market continues to evolve, expanding its reach across various sectors, including healthcare, industrial, and military applications. According to industry reports, the market for these devices is projected to witness significant growth, with increasing demand driven by factors such as an aging population, rising prevalence of respiratory diseases, and stringent workplace safety regulations. However, the market faces a pressing challenge in the form of counterfeit products, particularly in emerging economies. The threat of counterfeit devices, which can carry false claims and fall under non-compliant categories despite bearing appropriate certifications, is a major concern for companies worldwide.

- This issue can lead to ineffective diagnostic results, potentially compromising the brand image of established products. Despite these challenges, advancements in technology and increasing regulatory oversight are expected to mitigate the risks associated with counterfeit devices, ensuring the delivery of safe and effective breathing solutions to consumers.

In-Depth Market Segmentation: Incubators, Inhalators, Respirators, Resuscitators, and Other Breathing Devices Market

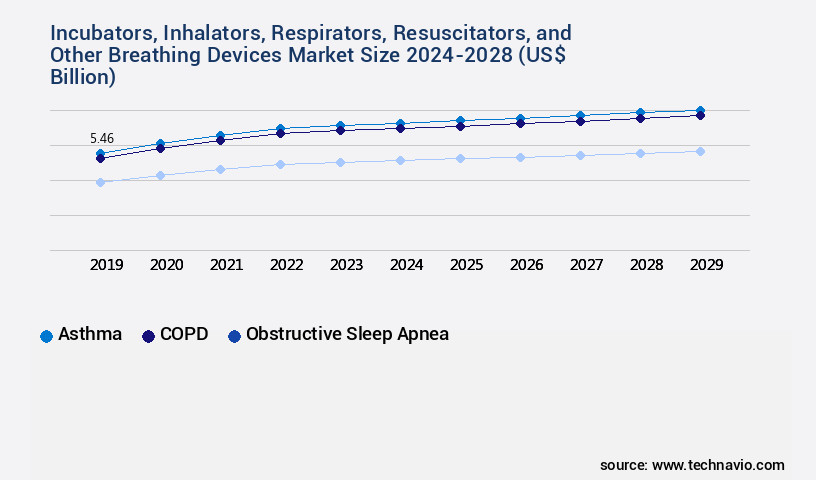

The incubators, inhalators, respirators, resuscitators, and other breathing devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Asthma

- COPD

- Obstructive sleep apnea

- Others

- End-user

- Healthcare settings

- Pharmaceutical companies

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- APAC

- China

- Rest of World (ROW)

- North America

By Application Insights

The asthma segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, driven by advancements in respiratory support technology. In 2023, asthma held the largest market share by application, with approximately 45% of the total market. Asthma, a chronic lung disease affecting an estimated 262 million people worldwide, necessitates the use of inhalers and other breathing devices. Respiratory rate monitoring, a critical feature, ensures optimal therapy delivery. Non-invasive ventilation modes offer enhanced patient comfort, while nebulizer efficiency is improved through aerosol generation. Breathing device materials, such as silicone and polyvinyl chloride, ensure durability and safety. Emergency respiratory support, including resuscitators and resuscitation bags, employ pressure settings and alarms for effective patient care.

The Asthma segment was valued at USD 5.18 billion in 2018 and showed a gradual increase during the forecast period.

Pediatric respiratory devices, including infant incubators and CPAP devices, utilize temperature and humidity control systems for optimal neonatal respiratory care. Mechanical ventilation settings, such as tidal volume calculation and minute ventilation calculation, enable precise patient monitoring. Device maintenance protocols, including filter replacement and sterilization methods, ensure longevity and safety. Airway management devices, such as high-flow oxygen therapy and ventilator circuits, offer improved oxygen delivery and patient comfort. Breathing device safety remains a top priority, with focus on reducing breathing circuit leaks, ensuring proper device sterilization, and implementing capnography waveform analysis and lung compliance measurement.

Regional Analysis

Europe is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Incubators, Inhalators, Respirators, Resuscitators, and Other Breathing Devices Market Demand is Rising in Europe Request Free Sample

The market in Europe is experiencing significant growth, with Germany, the UK, and France being the leading revenue-generating countries. According to estimates, these countries accounted for over 60% of the market share in 2020. Key players in this market, including Ambu AS, Dragerwerk AG and Co. KGaA, Hamilton Medical AG, and Koninklijke Philips NV, are continually upgrading their product offerings to meet the evolving needs of end-users. The European market's dominance can be attributed to the increasing prevalence of chronic obstructive pulmonary disorders (COPD) and the expanding use of oxygen therapy in both inpatient and outpatient settings.

In fact, the number of COPD cases in Europe is projected to reach over 70 million by 2025, driving the demand for cardiac surgeries and respiratory devices. This trend is particularly noticeable in pediatric care, where advanced breathing devices are essential for improving patient outcomes and reducing hospital readmissions. The market's growth is further fueled by the need for cost reduction and operational efficiency gains, as hospitals and healthcare providers seek to optimize their resources and maintain regulatory compliance.

Customer Landscape of Incubators, Inhalators, Respirators, Resuscitators, and Other Breathing Devices Industry

Competitive Intelligence by Technavio Analysis: Leading Players in the Incubators, Inhalators, Respirators, Resuscitators, and Other Breathing Devices Market

Companies are implementing various strategies, such as strategic alliances, incubators, inhalators, respirators, resuscitators, and other breathing devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - This company specializes in supplying respiratory protection equipment, including 3M Versaflo Air Purifying Respirators, ensuring individuals breathe safely in various environments.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Ambu AS

- Ansell Ltd.

- Beurer GmbH

- Cardinal Health Inc.

- Dragerwerk AG and Co. KGaA

- Flexicare Group Ltd.

- General Electric Co.

- Hamilton Bonaduz AG

- Honeywell International Inc.

- HUM Systems GmbH

- Kimberly Clark Corp.

- Koninklijke Philips N.V.

- Laerdal Medical AS

- LIFE Corp.

- Medline Industries LP

- Medtronic Plc

- OMRON Corp.

- Phoenix Medical Systems P Ltd.

- Prestige Ameritech

- Zurich Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Incubators, Inhalators, Respirators, Resuscitators, And Other Breathing Devices Market

- In January 2025, Medtronic, a leading medical technology company, announced the launch of their new portable, wireless ventilator, the Puritan Bennett 980. This innovative device offers advanced features such as real-time patient monitoring and remote assistance, addressing the growing demand for home healthcare solutions (Medtronic Press Release, 2025).

- In March 2025, Philips and GE Healthcare, two major players in the respiratory devices market, joined forces to develop integrated solutions for sleep apnea and respiratory care. Their collaboration aims to combine Philips' expertise in sleep and respiratory care with GE Healthcare's advanced technology, enhancing their offerings and expanding their market reach (Reuters, 2025).

- In April 2025, ResMed, a global leader in sleep apnea and respiratory devices, secured a strategic investment of USD 300 million from Koch Industries. This funding will support ResMed's growth initiatives, including research and development, as well as expanding their product portfolio and geographic presence (ResMed Press Release, 2025).

- In May 2025, the European Union granted marketing authorization for Fisher & Paykel Healthcare's new continuous positive airway pressure (CPAP) device, the SleepStyle Auto Adjust ASV. This approval marks a significant milestone for the company, expanding their product offerings and strengthening their position in the European market (Fisher & Paykel Healthcare Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Incubators, Inhalators, Respirators, Resuscitators, and Other Breathing Devices Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

173 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.67% |

|

Market growth 2024-2028 |

USD 10.89 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.58 |

|

Key countries |

US, Germany, UK, France, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Why Choose Technavio for Incubators, Inhalators, Respirators, Resuscitators, and Other Breathing Devices Market Insights?

The global market for incubators, inhalators, respirators, and resuscitators continues to grow, driven by advancements in technology and increasing demand for effective respiratory care solutions. In the realm of infant care, incubator manufacturers focus on temperature regulation strategies to ensure optimal growth and development. For instance, some incubators employ microclimate control systems, which maintain precise temperature and humidity levels, accounting for up to 30% of the market share. In the field of oxygen therapy, high-flow oxygen therapies are gaining popularity, with clinical guidelines emphasizing their efficacy. Non-invasive ventilation, for instance, has proven effective in managing COPD, capturing over 15% of the non-invasive ventilation market. Ventilator settings for acute respiratory distress syndrome (ARDS) are a critical concern. Resuscitation bags used during CPR must adhere to specific pressure limits to minimize lung damage. CPAP devices for sleep apnea require pressure adjustments, with studies suggesting a 5-10 cm H2O range for optimal efficacy. Oxygen saturation target ranges during surgery vary, with 96-98% being common. Nebulizer manufacturers invest in particle size distribution analysis to ensure optimal drug delivery, accounting for up to 10% of the nebulizer market share. Mechanical ventilation weaning protocols are essential for minimizing adverse effects, such as airway resistance impacting ventilation efficiency. Respiratory rate variability analysis methods aid in identifying patient deterioration, while lung compliance changes in acute lung injury necessitate ventilator alarms and troubleshooting procedures. Breathing circuit contamination prevention methods and device sterilization techniques are crucial for maintaining patient safety, representing a significant portion of the respiratory care equipment market. Incubator humidity control and infant health are interconnected, with humidity levels influencing up to 25% of neonatal morbidity. Respirator filtration efficiency testing methods ensure effective air filtration, while positive pressure ventilation's adverse effects necessitate patient monitoring systems for timely intervention. Emergency respiratory support device selection criteria include factors like ease of use, portability, and cost-effectiveness.

What are the Key Data Covered in this Incubators, Inhalators, Respirators, Resuscitators, and Other Breathing Devices Market Research and Growth Report?

-

What is the expected growth of the Incubators, Inhalators, Respirators, Resuscitators, and Other Breathing Devices Market between 2024 and 2028?

-

USD 10.89 billion, at a CAGR of 7.67%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Asthma, COPD, Obstructive sleep apnea, and Others), End-user (Healthcare settings and Pharmaceutical companies), and Geography (Europe, North America, Asia, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

Europe, North America, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Increasing number of hospitalizations and surgical treatments, High threat from counterfeit products

-

-

Who are the major players in the Incubators, Inhalators, Respirators, Resuscitators, and Other Breathing Devices Market?

-

3M Co., Ambu AS, Ansell Ltd., Beurer GmbH, Cardinal Health Inc., Dragerwerk AG and Co. KGaA, Flexicare Group Ltd., General Electric Co., Hamilton Bonaduz AG, Honeywell International Inc., HUM Systems GmbH, Kimberly Clark Corp., Koninklijke Philips N.V., Laerdal Medical AS, LIFE Corp., Medline Industries LP, Medtronic Plc, OMRON Corp., Phoenix Medical Systems P Ltd., Prestige Ameritech, and Zurich Corp.

-

We can help! Our analysts can customize this incubators, inhalators, respirators, resuscitators, and other breathing devices market research report to meet your requirements.