Industrial Powder Coatings Market Size 2025-2029

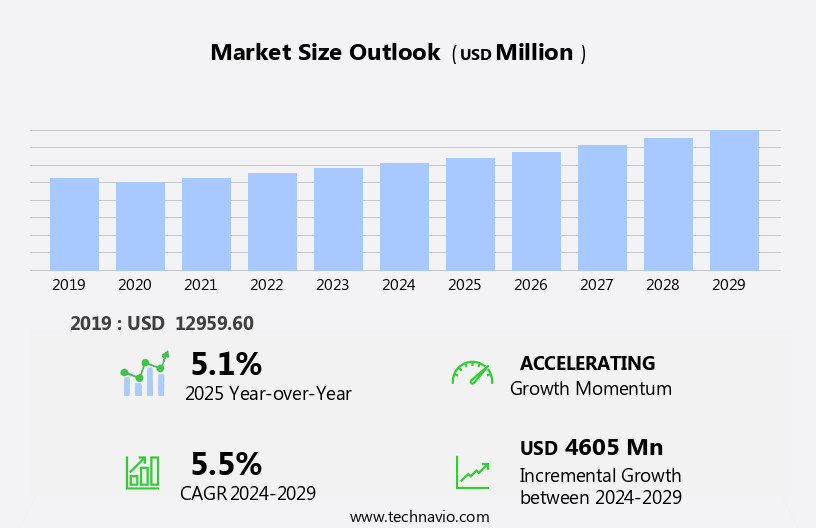

The industrial powder coatings market size is forecast to increase by USD 4.61 billion at a CAGR of 5.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the superior performance characteristics of these coatings compared to traditional liquid coatings. The advantages of powder coatings, such as their durability, resistance to chipping and scratching, and ability to produce a wide range of colors and finishes, have led to their increasing adoption in various industries, including automotive, construction, and appliances. However, the market's expansion is not without challenges. Regulatory hurdles impact adoption, as stricter environmental regulations limit the use of certain raw materials and production methods. For instance, the European Union's REACH regulations have imposed restrictions on the use of certain chemicals, necessitating the development of alternative formulations.

- Additionally, supply chain inconsistencies temper growth potential due to the dependence on raw material suppliers and logistics networks. Addressing these challenges requires strategic partnerships, continuous innovation, and a focus on sustainability. Companies that can navigate these obstacles while delivering high-performance, eco-friendly powder coatings will be well-positioned to capitalize on the market's growth opportunities.

What will be the Size of the Industrial Powder Coatings Market during the forecast period?

- The industrial powder coating market in the US is experiencing significant growth, driven by the demand for high-performance coatings with superior chemical and abrasion resistance. Powder coating suppliers continue to innovate, introducing new technologies such as robotic coating applications and airless spray systems, to enhance coating thickness and improve surface engineering. Quality assurance is a key focus, with the implementation of stringent powder coating standards and testing procedures to ensure durability and performance. Weather resistance and fire retardancy are essential requirements for many industries, leading to increased demand for powder coatings with enhanced UV and heat resistance.

- Environmental regulations are also influencing market trends, with a shift towards bio-based coatings and water-based alternatives. Additive Manufacturing and 3D printing are emerging applications for powder coatings, offering opportunities for increased customization and efficiency in industrial finishing. Industrial automation and HVLP spray systems are also driving demand for durable finishes in sectors such as automotive, construction, and electrical equipment. Powder coating distributors play a crucial role in providing powder coating services and ensuring coating performance meets industry standards. Corrosion protection and Protective Coatings remain a significant market, with powder coating technology offering superior wear resistance and coating thickness compared to solvent-based alternatives.

- Sustainability initiatives are a growing trend, with powder coating suppliers investing in research and development to produce high-performance, eco-friendly coatings. Electrostatic guns and fluidized bed applications are also gaining popularity due to their energy efficiency and reduced environmental impact.

How is this Industrial Powder Coatings Industry segmented?

The industrial powder coatings industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Thermosets

- Thermoplastics

- End-user

- Automotive

- Appliances

- Construction

- Electronics

- Others

- Method

- ESD

- FBC

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

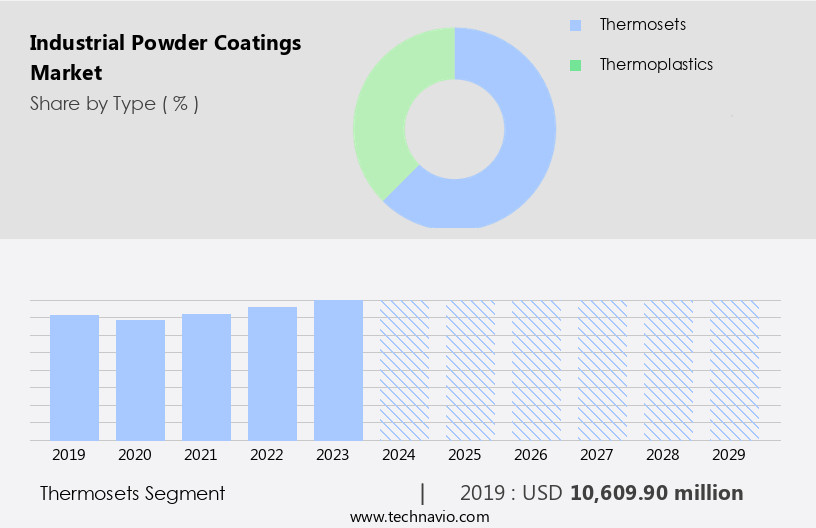

The thermosets segment is estimated to witness significant growth during the forecast period.

In the market, thermoset powder coatings hold a significant position due to their unique properties. These coatings are formed by applying finely ground resin particles to a substrate using electrostatic spray deposition. Once heated, the resins undergo a chemical reaction, resulting in a hard, infusible coating. The cured thermoset powder coating offers superior resistance to various factors, including abrasion, chemicals, impact, and heat. Quality control is crucial in the powder coating process, ensuring consistent film thickness and surface preparation. Powder coating equipment, such as fluidized bed coating and electrostatic spray deposition systems, play a vital role in achieving optimal results.

Powder coating suppliers provide a range of products, catering to diverse industries and their specific requirements. Powder coating services ensure proper application, and powder coating standards ensure uniformity and quality. However, challenges such as powder coating defects, VOC emissions, and powder coating failure can impact the performance and durability of the coatings. Personal Protective Equipment and safety measures are essential during the application process. The powder coating industry is continually evolving, with advancements in energy efficiency and UV resistance. Corrosion resistance is another essential factor driving the market's growth, particularly in industries where coatings are exposed to harsh conditions.

Powder coating distributors facilitate the supply chain, ensuring seamless delivery and availability of products. The market is driven by the demand for durable, high-performance coatings in various industries. Thermoset powder coatings, with their exceptional chemical and abrasion resistance, are a popular choice for applications that require long-lasting protection. Quality control, powder coating equipment, and powder coating services are essential components of the powder coating process, ensuring optimal results. The market's future growth is expected to be influenced by factors such as advancements in technology, increasing demand for eco-friendly coatings, and the need for higher impact and UV resistance.

The Thermosets segment was valued at USD 10.61 billion in 2019 and showed a gradual increase during the forecast period.

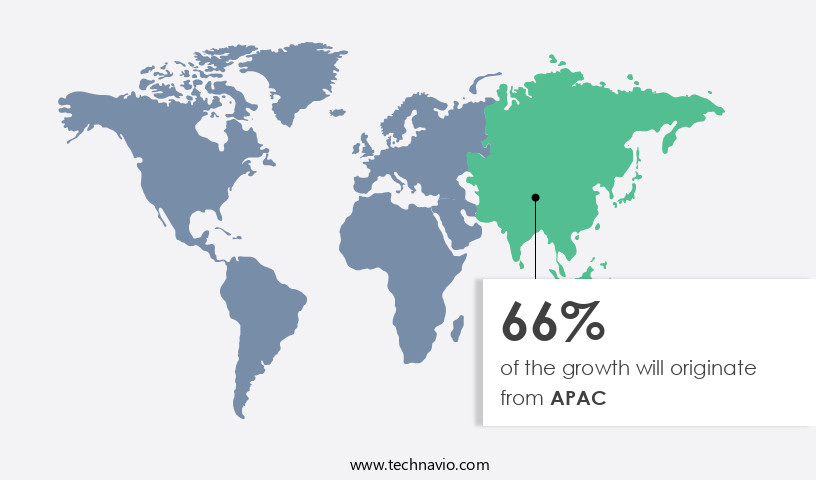

Regional Analysis

APAC is estimated to contribute 66% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia-Pacific (APAC) region is experiencing notable growth, driven by the increasing production in various sectors. In the automotive industry, China produced approximately 21 million units in the first three quarters of 2024, marking a 2% year-on-year increase. This growth is mirrored in Japan, where car production saw a 17% rise in 2023, totaling 7.5 million units. South Korea also experienced a significant increase of 13.5%, producing around 4 million units. This in automotive production has led to a substantial demand for industrial powder coatings. Beyond the automotive sector, substantial investments in infrastructure and the expansion of industries such as electronics, Medical Devices, and furniture have further fueled market growth.

Powder coating is preferred due to its superior qualities, including chemical resistance, abrasion resistance, and corrosion resistance. The powder coating process ensures consistent film thickness and high-quality results through rigorous surface preparation, powder coating equipment, and powder coating inspection. Powder coating troubleshooting and safety measures, such as the use of personal protective equipment, are essential in maintaining a smooth production line. Powder coating suppliers and distributors play a crucial role in providing high-quality products and services to meet the increasing demand. Powder coating manufacturers employ various techniques, including electrostatic spray deposition and fluidized bed coating, to cater to diverse industry requirements.

Energy efficiency and environmental considerations, such as VOC emissions, are also key factors influencing market trends. As the market evolves, powder coating standards and regulations continue to evolve, ensuring the production of high-quality, sustainable coatings. Despite these advancements, powder coating defects remain a challenge, requiring continuous research and innovation to address.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Industrial Powder Coatings market drivers leading to the rise in the adoption of Industry?

- The superior performance characteristics of a product or service are the primary factor influencing market demand. As a professional and knowledgeable Virtual Assistant, I understand the significance of this key driver in business success. Powder coatings have gained significant traction in industrial applications due to their superior performance characteristics. The powder coating process involves applying a fine, dry powder that adheres to the surface and is then cured using heat. This results in a tough, hard finish that offers superior resistance to chipping, scratching, fading, and wearing compared to traditional liquid paints. This makes powder coatings an excellent choice for surfaces exposed to high traffic, harsh weather, and mechanical stress, such as automotive parts, machinery, and Outdoor Furniture. Another key advantage of powder coatings is their corrosion resistance. The seamless and uniform layer formed by powder coatings acts as a barrier against moisture, chemicals, and UV radiation, significantly extending the lifespan of the coated product.

- Quality control is essential in the powder coating process, and film thickness and surface preparation are critical factors to ensure optimal results. Powder coating lines utilize specialized equipment, such as powder coating guns and conveyor systems, to ensure consistent application and uniformity. Powder coating troubleshooting is also an essential aspect of the process, addressing issues such as poor adhesion, orange peel texture, or uneven coverage. Overall, the powder coating market continues to grow due to its ability to provide durable, corrosion-resistant coatings for various industries.

What are the Industrial Powder Coatings market trends shaping the Industry?

- The increasing importance of sustainability is a notable trend in today's market. Professionals and consumers alike are prioritizing eco-friendly practices and solutions. The powder coating market is witnessing significant growth due to the increasing demand for sustainable and eco-friendly coatings. Sustainability and environmental concerns are driving businesses and manufacturers to seek alternatives that offer superior performance while minimizing environmental impact. One such trend is the adoption of bio-based coatings, which replace traditional fossil-based resins with renewable sources. These formulations not only reduce the consumption of non-renewable resources but also lower CO2 emissions, contributing to climate goals.

- For instance, Axalta Coating Systems recently introduced the Alesta BioCore range, showcasing innovation in this area. The demand for powder coatings with enhanced chemical and abrasion resistance is also increasing, making it essential for powder coating suppliers and distributors to offer high-performance coatings that meet industry standards. The powder coating service sector is growing as businesses seek to improve the durability and longevity of their products. The market dynamics are driven by factors such as increasing demand for sustainable coatings, growing awareness of environmental regulations, and the need for high-performance coatings with excellent chemical and abrasion resistance.

How does Industrial Powder Coatings market faces challenges face during its growth?

- The escalating costs of raw materials poses a significant challenge to the industry's growth trajectory. The market faces a substantial challenge from rising raw material costs, primarily affecting the prices of key components like resins and pigments. These increases, driven by factors such as supply chain disruptions, geopolitical tensions, and fluctuating demand, have significantly impacted both manufacturers and end-users. For instance, the price of polyester resins, a primary ingredient in powder coatings, has d. In April 2024, the cost of importing ZJ9033D polyester resins from China to India reached approximately USD1.40 per kg, amounting to around USD14,250 for 10,000 kg.

- Compared to early 2022 imports, the same resins were priced at around USD1 per kg. Techniques such as electrostatic spray deposition and fluidized bed coating help improve the corrosion resistance and energy efficiency of powder coatings, mitigating some of these cost pressures. However, the ongoing increase in raw material costs remains a significant market dynamic.

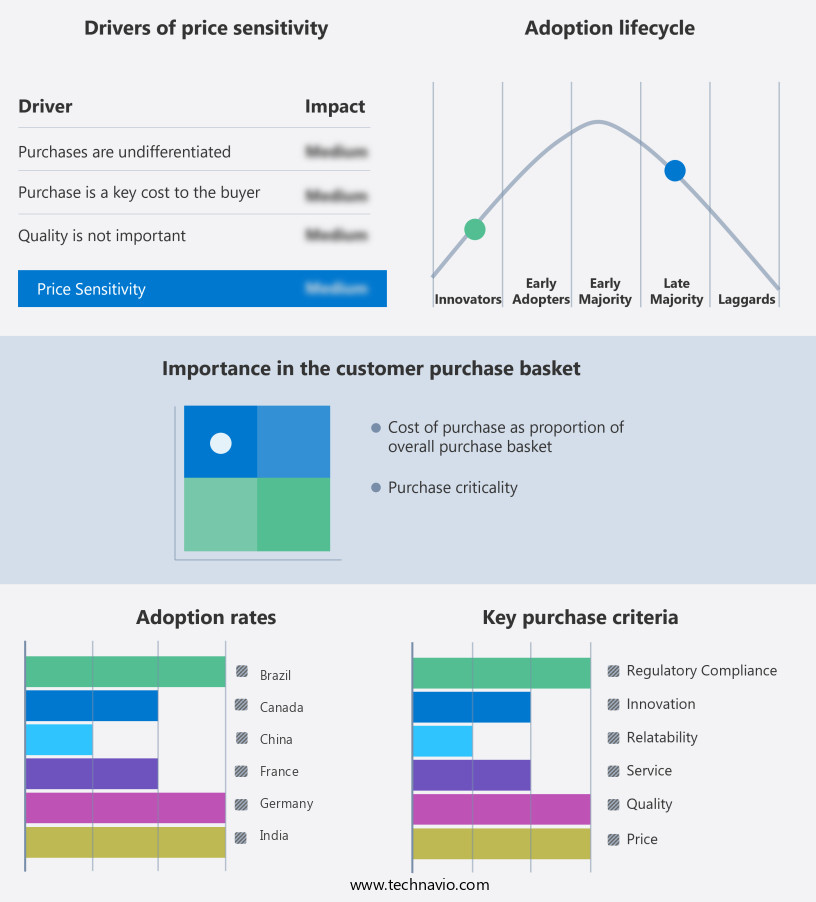

Exclusive Customer Landscape

The industrial powder coatings market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the industrial powder coatings market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, industrial powder coatings market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Akzo Nobel NV - The company offers industrial powder coatings for various applications like Coil and Extrusion Coatings, Packaging Coatings, and Wood Finishes and Adhesives.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akzo Nobel NV

- Asian Paints Ltd.

- Axalta Coating Systems Ltd.

- BASF SE

- Hempel AS

- Henkel AG and Co. KGaA

- Hentzen Coatings Inc.

- IBA Kimya A.S.

- Jotun AS

- Kansai Paint Co. Ltd.

- Keyland Polymer Material Sciences LLC

- Nippon Paint Holdings Co. Ltd.

- PPG Industries Inc.

- Pulverit S.p.A.

- RPM International Inc.

- ST Powder Coatings S.p.A.

- The Sherwin Williams Co.

- TIGER Coatings GmbH and Co. KG

- VITRACOAT

- WEG S.A

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Industrial Powder Coatings Market

- In January 2024, PPG Industries, a leading coatings manufacturer, introduced a new line of high-performance powder coatings called "Duranar XL" (PPG Industries, 2024). This innovative product range offers enhanced durability and resistance to corrosion, targeting industries such as transportation and construction.

- In March 2025, AkzoNobel and Axalta Coating Systems announced a strategic partnership to expand their powder coatings business in the Asia Pacific region (AkzoNobel, 2025). This collaboration aims to strengthen their market position and improve their combined offering to customers in this rapidly growing market.

- In May 2024, BASF SE completed the acquisition of Chemetall GmbH, a leading global supplier of Specialty Chemicals for surface treatment (BASF, 2024). This acquisition significantly expanded BASF's portfolio in the Powder Coatings Market, providing them with a broader range of products and technologies.

- In October 2025, the European Union approved new regulations on the use of powder coatings containing fluorinated organic compounds (European Commission, 2025). These regulations set strict emission limits and require manufacturers to adopt alternative technologies, driving innovation and investment in the development of eco-friendly powder coatings.

Research Analyst Overview

The industrial powder coating market continues to evolve, with ongoing advancements in technology, quality control, and application techniques shaping its landscape. This dynamic industry encompasses various aspects, including powder coating lines, processes, equipment, suppliers, and standards. Powder coating lines are integral to the production process, ensuring efficient and consistent application of the coating. Quality control plays a pivotal role in these lines, with stringent measures in place to maintain film thickness and surface preparation. Powder coating process variants, such as electrostatic spray deposition and fluidized bed coating, offer unique benefits in terms of energy efficiency and coating uniformity.

Surface preparation is a critical step in the powder coating process, as it directly impacts the adhesion and overall performance of the coating. Proper cleaning, pretreatment, and priming are essential to achieving optimal results. Powder coating equipment, including spray booths and personal protective equipment, must also adhere to stringent safety and performance standards. Powder coating suppliers and distributors play a crucial role in the industry, providing a diverse range of products and services to meet the varying needs of manufacturers. Chemical resistance, abrasion resistance, corrosion resistance, impact resistance, and UV resistance are just a few of the properties that powder coatings offer, making them an attractive choice for numerous industries.

However, challenges persist in the powder coating market. Powder coating defects, VOC emissions, and powder coating failure are common issues that must be addressed through continuous research and development. Coating thickness and powder coating inspection are essential components of quality control, ensuring that the final product meets the desired specifications. Safety and energy efficiency are also key considerations in the powder coating industry. Proper handling and disposal of powders, as well as the use of personal protective equipment, are essential to maintaining a safe working environment. Energy efficiency is another important factor, with ongoing efforts to reduce the environmental impact of the powder coating process.

The industrial powder coating market is a dynamic and evolving landscape, with ongoing advancements in technology, quality control, and application techniques. Powder coating lines, processes, equipment, suppliers, and standards all play a role in shaping the industry's future. By addressing challenges such as powder coating defects, VOC emissions, and powder coating failure, and focusing on safety, energy efficiency, and performance, the industry continues to innovate and meet the needs of various industries.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Industrial Powder Coatings Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

234 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market growth 2025-2029 |

USD 4.61 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.1 |

|

Key countries |

China, India, US, Japan, South Korea, Germany, UK, Canada, Brazil, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Industrial Powder Coatings Market Research and Growth Report?

- CAGR of the Industrial Powder Coatings industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the industrial powder coatings market growth and forecasting

We can help! Our analysts can customize this industrial powder coatings market research report to meet your requirements.