Industrial Starch Market Size 2024-2028

The industrial starch market size is forecast to increase by USD 23.97 billion at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increased utilization of industrial starch as a thickener in various industries. This trend is further fueled by the rising consumption of processed food and beverages, which rely heavily on starch for texture and consistency. However, the market is also subject to challenges, including the fluctuation in raw material prices, which can impact the profitability of manufacturers. The market encompasses a diverse range of starches derived from various agricultural raw materials, including corn, wheat, cassava, potato, and others. Producers must navigate these price fluctuations while maintaining product quality and competitiveness. Additionally, the growing demand for natural and organic food products presents an opportunity for industrial starch manufacturers to offer eco-friendly alternatives, as some traditional production methods involve the use of genetically modified organisms (GMOs). Overall, the market is poised for continued growth, with manufacturers focusing on innovation and cost management to stay competitive.

What will be the Size of the Market During the Forecast Period?

- The market encompasses a diverse range of starches derived from various agricultural raw materials, including corn, wheat, cassava, potato, and others. These starches serve essential functions in numerous industries, such as food and beverage, pharmaceuticals, and paper and textiles. The market's size is substantial, with continuous growth driven by increasing demand for functional ingredients, gums, proteins, and modified cellulose. The supply chain for industrial starches faces several challenges, including transportation issues and natural disasters that can impact the availability of agricultural raw materials. Labor shortages in processing and manufacturing facilities also pose a concern. In response, the industry is exploring innovative solutions, such as the use of native starches and alternative sources like vegetable cells, seeds, tubers, and roots.

- Industrial starches find applications in various sectors, including beverages, nutritional foods, and malt dextrin production. Homopolysaccharides, glucose, and carbohydrates are key components of these starches, which offer unique properties such as thickening, binding, and texturizing abilities. Modified starches, such as those derived from corn, wheat, and potato, undergo chemical or enzymatic modifications to enhance their functionality and stability in different applications. Overall, the market continues to evolve, driven by the demand for sustainable, high-performance, and cost-effective solutions.

How is this Industrial Starch Industry segmented and which is the largest segment?

The industrial starch industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Food and beverage

- Feed

- Pharmaceuticals

- Cardboard and corrugating

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Application Insights

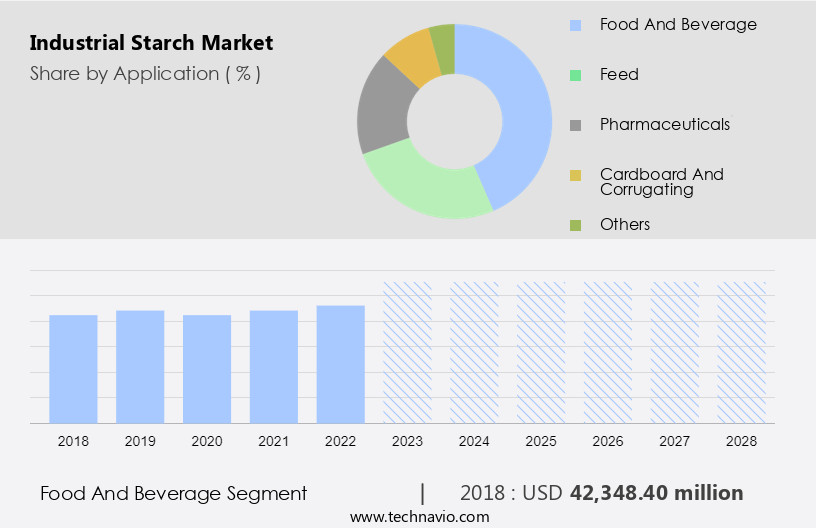

- The food and beverage segment is estimated to witness significant growth during the forecast period.

Industrial starch is a crucial component In the food and beverage industry, serving various functions such as thickening, binding, and stabilizing agents. Corn starch, potato starch, and tapioca starch are common sources of industrial starch, contributing to the texture and consistency of food products. In the beverage industry, starch plays a significant role in enhancing viscosity and preventing phase separation, thereby improving product quality and shelf life. Beyond food and beverages, industrial starches are also utilized in industries like paper, laundry, foundry, air flotation, adhesive, chemical, and textile, among others. The market for industrial starch encompasses various types, including waxy maize, modified starches, and native starch.

Get a glance at the Industrial Starch Industry report of share of various segments Request Free Sample

The food and beverage segment was valued at USD 42.35 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

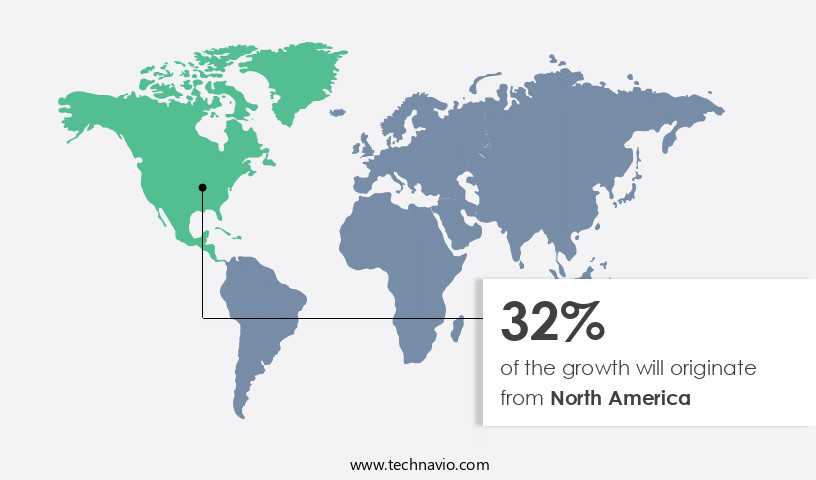

- North America is estimated to contribute 32% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is expected to exhibit moderate growth during the forecast period. Key sources of industrial starch include corn, wheat, and potatoes. Native starch, derived from vegetable cells, seeds, tubers, and roots, is abundant In the region and drives market expansion. Industrial starch finds extensive applications in various industries, including cosmetics, packaging, and food and beverages. The food and beverage sector, specifically convenience foods, processed foods, and thickening agents, is a significant consumer of industrial starch. In 2020, the North American market faced disruptions due to the COVID-19 pandemic. The pandemic's impact was felt across major industries, particularly In the US and Canada.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Industrial Starch Industry?

Increased use of industrial starch as a thickener is the key driver of the market.

- Industrial starch, derived from agricultural raw materials such as corn, wheat, cassava, and potatoes, plays a significant role in various industries. In the food and beverage sector, it functions as a thickening, binding, and texturizing agent. The ability of starches to absorb water and swell when heated makes them an effective thickener, replacing high-calorie sugars or high-cholesterol ingredients. Corn and potato starches are commonly used in processed and convenience foods, including gravies, sauces, soups, savory snacks, desserts, and dairy products. Beyond food applications, industrial starches are employed in diverse industries such as paper, laundry, foundry, air flotation, adhesive, chemical, and textile.

- Waxy maize, a type of modified starch, is used In the production of homopolysaccharides, glucose, and carbohydrates. These substances serve as essential raw materials for various industries, including paper, building materials, cosmetics, and biotechnological products. Functional ingredients like gums, proteins, and modified cellulose are derived from starch. Sustainable materials and eco-friendly alternatives, such as bioplastics, packaging solutions, biodegradable products, and compostable products, are increasingly using starch-based materials to meet global sustainability goals. Clean-label products, which prioritize natural and recognizable ingredients, also rely on industrial starch for its thickening and stabilizing properties. Transportation issues, natural disasters, and labor shortages can impact the supply chain of industrial starch.

What are the market trends shaping the Industrial Starch Industry?

Rising consumption of industrial starch is the upcoming market trend.

- Industrial starch is derived from various agricultural raw materials, including corn, wheat, cassava, potato, and tapioca. The functional properties of this versatile ingredient closely resemble those of amylose and amylopectin. The quality, viscosity, solubility, and resistance to high temperatures of industrial starch depend on the raw material source and the level of processing. Corn starch, for instance, contains a high concentration of amylose and amylopectin, resulting in a smooth texture when gelatinized. Advancements in biotechnology have enabled the genetic modification of crops to produce novel starches with enhanced functionality. This includes waxy maize, a high-amylose starch used as a thickening, binding, and texturizing agent in processed and convenience foods.

- Industrial starch also finds applications in various industries such as paper, laundry, foundry, air flotation, adhesive, and chemical industries. Functional ingredients derived from industrial starch include gums, proteins, modified cellulose, sustainable materials, eco-friendly materials, bioplastics, packaging solutions, biodegradable products, and compostable products. These ingredients contribute to global sustainability goals by reducing the carbon footprint and promoting clean-label products with recognizable, natural ingredients. Industrial starch is used as a thickening agent, stabilizing agent, and fat replacer in various industries. In the food and beverage sector, it is used to produce starch-based sugars, such as maltodextrin and cyclodextrin, and hydrolysates.

What challenges does the Industrial Starch Industry face during its growth?

Fluctuation in raw material prices is a key challenge affecting the industry growth.

- Industrial starch is primarily derived from agricultural raw materials such as potato, maize, wheat, and cassava. The global demand for bioethanol, a significant industrial starch application, is increasing due to the shift towards renewable energy sources. Bioethanol is primarily derived from starch-rich crops like corn, wheat, sugar beet, and cane sugar. However, fluctuating raw material prices, influenced by factors such as natural disasters, labor shortages, and transportation issues, pose challenges for industrial starch manufacturers. Additionally, the cultivation of these crops is affected by changing climatic conditions, leading to unpredictable supply and price fluctuations. Functional ingredients, including gums, proteins, and modified cellulose, are other major applications of industrial starch.

- These ingredients are used in various industries such as food and beverage, feed, mining and drilling, construction and building, adhesive, chemical, and textile industries. The demand for sustainable and eco-friendly materials is driving the market for starch-based bioplastics, packaging solutions, and biodegradable and compostable products. The shift towards clean label products and natural ingredients is also fueling the demand for industrial starches. Industrial starches are used as thickening, stabilizing, and texturizing agents in various applications. They are used in processed and convenience foods, beverages, nutritional foods, and dairy products. In the food industry, they are used as thickening agents, stabilizing agents, and texturizing agents.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGRANA Beteiligungs AG

- Angel Starch and Food Pvt. Ltd.

- Anora Group Plc

- Archer Daniels Midland Co.

- Beneo GmbH

- Cargill Inc.

- Chemstar Products Co.

- Emsland Starke GmbH

- Global Bio chem Technology Group Co. Ltd.

- Ingredion Inc.

- Japan Corn Starch Co. Ltd

- Kent Corp.

- Manildra Flour Mills Pty. Ltd.

- PT Budi Starch and Sweetener Tbk

- Roquette Freres SA

- Royal Avebe

- Tate and Lyle PLC

- Tereos Participations

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of applications, primarily centered around the use of starches derived from various agricultural raw materials such as corn, wheat, cassava, potato, and other crops. These starches serve essential functions in various industries, including food and beverage, feed, paper, textile, and others. The supply chain of industrial starch involves the cultivation of crops, harvesting, processing, and manufacturing of the final product. The agricultural raw materials undergo various processes, including gelatinization, modification, and derivatization, to produce the desired industrial starches. These processes can include the use of chemicals, enzymes, and other additives to enhance the properties of the starch.

In addition, the production of industrial starch can be influenced by several factors, including transportation issues, natural disasters, and labor shortages. Transportation challenges can impact the cost and availability of raw materials, while natural disasters can disrupt supply chains and production facilities. Labor shortages can also lead to increased production costs and potential delays. Functional ingredients, such as gums, proteins, and modified cellulose, are often used in conjunction with industrial starches to enhance the properties of final products. These ingredients can provide texture, consistency, and mouthfeel, among other benefits. Sustainable and eco-friendly materials, such as bioplastics and compostable products, are also gaining popularity in various industries as global sustainability goals become more prominent.

Furthermore, industrial starches are used in a wide range of applications, including thickening, binding, and stabilizing agents in processed foods and convenience foods. They are also used as texturizing agents in beverages, nutritional foods, and dairy products. In the paper industry, they are used as sizing agents, while In the mining and drilling industry, they are used as fat replacers. The market is segmented into various industries, including food and beverage, feed, paper, textile, adhesive, chemical, and others. Each industry has unique requirements for industrial starches, and the market is expected to grow as demand for sustainable and eco-friendly alternatives increases.

Moreover, the production of industrial starches involves the use of various raw materials, including tubers, roots, seeds, and vegetable cells. The processing of these raw materials involves various chemical and enzymatic reactions to produce the desired starch properties. The final products can be sold in various forms, including dry and liquid, and can be used in a wide range of applications. The market for industrial starches is influenced by several factors, including consumer trends, regulatory requirements, and technological advancements. Consumers are increasingly demanding clean-label products with recognizable ingredients, which can impact the use of industrial starches in food and beverage applications.

In addition, regulatory requirements, such as those related to food safety and sustainability, can also impact the production and use of industrial starches. Technological advancements, such as the development of new processing methods and the use of biotechnological products, can provide opportunities for innovation and growth In the market. The production of industrial starches involves the use of various agricultural raw materials and the application of various processing methods to produce the desired properties. The market is influenced by several factors, including consumer trends, regulatory requirements, and technological advancements, and is expected to grow as demand for sustainable and eco-friendly alternatives increases.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

157 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 23.97 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, China, Germany, Canada, and Japan |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Industrial Starch Market Research and Growth Report?

- CAGR of the Industrial Starch industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the industrial starch market growth of industry companies

We can help! Our analysts can customize this industrial starch market research report to meet your requirements.