Industrial Wax Market Size 2024-2028

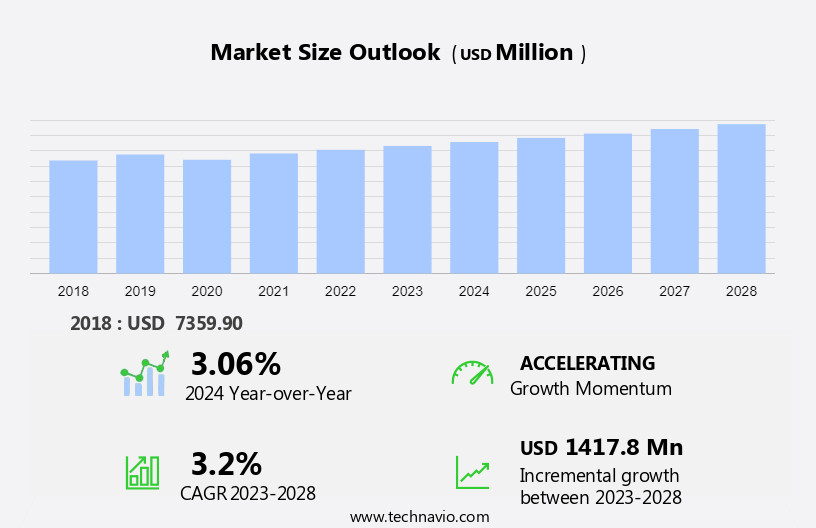

The industrial wax market size is forecast to increase by USD 1.42 billion, at a CAGR of 3.2% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for wax in various applications, particularly in coating industries. Lubricants, lignite, beeswax, coal, and crude oil are essential components In the production of industrial wax. In the realm of hair care and personal care, the demand for microcrystalline wax and paraffin wax continues to rise, fueled by the health and wellness trend. Additionally, the food packaging sector utilizes wax for meat packaging to ensure product freshness and safety. Industrial research and development activities are also driving market growth, leading to the innovation of new types of wax, such as carnauba wax. However, the decline in demand for group I base oil may pose a challenge to market growth. The use of industrial wax extends beyond hair care and food packaging, with applications in skincare products, candle manufacturing, adhesives, fragrances, and construction industries. Overall, the market is poised for growth, driven by its versatility and wide range of applications.

What will be the Size of the Industrial Wax Market During the Forecast Period?

- The market encompasses a diverse range of products, including mineral wax and microcrystalline wax, utilized extensively across various industries. Product applications span from cosmetics, with an increasing focus on green and fragranced options catering to changing consumer behavior and lifestyle, to packaging, where innovation drives the use of wax in creating custom shapes, styles, and colors.

- The market's growth is influenced by factors such as rising per-capita income and increasing living standards in numerous regions. Wax finds applications In the production of candles, tires, and laminated papers, among others, as a moisture barrier and sealant. Rapid industrialization further fuels the demand for high-quality waxes in numerous sectors, making it an essential component in numerous industries.

How is this Industrial Wax Industry segmented and which is the largest segment?

The industrial wax industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

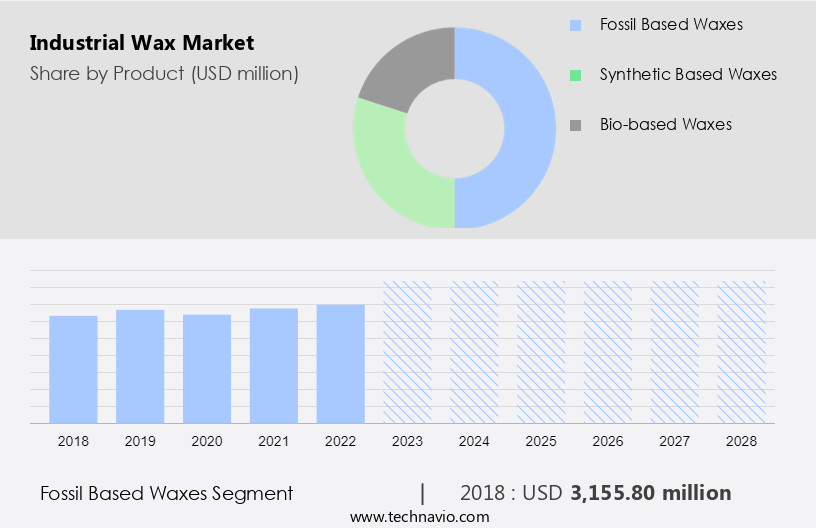

- Fossil based waxes

- Synthetic based waxes

- Bio-based waxes

- End-user

- Candle manufacturing

- Cosmetic

- Packaging

- Coatings and polishes

- Others

- Geography

- APAC

- China

- India

- North America

- Canada

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Product Insights

- The fossil based waxes segment is estimated to witness significant growth during the forecast period.

The market encompasses mineral waxes, such as montan wax and ozokerite, and petroleum waxes, including paraffin, microcrystalline, and petrolatum. Paraffin, derived from oil refining, is a versatile wax with a broad melting temperature range. Its primary use is in sustainable applications, like preserving fruit freshness and as a component in candles. Paraffin's low heat conductivity, poor electrical conductivity, and minimal chemical reactivity make it suitable for micro-actuator applications. Transitioning from solid to liquid, paraffin undergoes volumetric expansion. In addition to candles, waxes find applications in various industries, including candle-based craft materials, decoration, and interior designing. They are also used in traditional candle manufacturing, advanced and innovative applications, changing lifestyles, increasing living standards, and per-capita income growth.

Waxes are integral to green cosmetics, skin-hair care products, food packaging industries, and the cosmetic industry. However, health hazards associated with synthetic products necessitate the popularity of natural waxes, such as beeswax, carnauba wax, candelilla wax, and bio-based products. Mineral waxes, like ozokerite, ceresin, and montan wax, are used in packaging, paper and paperboard, coatings, tires, and other industries. Despite the potential health concerns, the market is expected to grow due to rapid industrialization, increasing demand for high-quality packaging, and the need for moisture barriers and laminated papers.

Get a glance at the market report of share of various segments Request Free Sample

The fossil based waxes segment was valued at USD 3.16 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

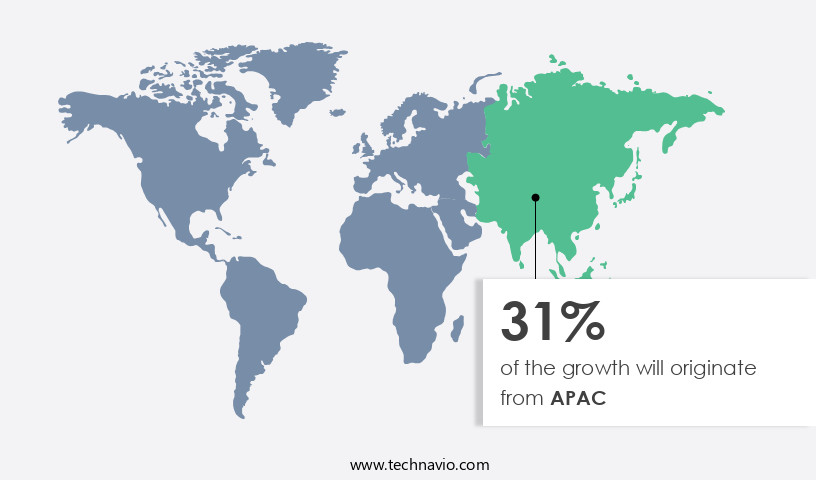

- APAC is estimated to contribute 31% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in APAC is driven by the presence of numerous petroleum refineries, which produce wax as a by-product. As of 2021, there were 316 refineries in APAC, making it a significant contributor to The market. China, in particular, is a major player due to its expanding refinery capacity, which is among the highest In the world. This growth is fueled by the country's increasing demands and ongoing refinery expansion projects. Industrial wax finds applications in various sectors, including candles, cosmetics, food packaging, and interior decoration. Popular types of industrial wax include paraffin wax, bio-based products, carnauba wax, beeswax, candelilla wax, mineral wax, microcrystalline wax, and their derivatives.

In addition, consumer behavior, product shape, style, color, fragrance, and customization are key factors influencing the market's popularity. The market is also witnessing a shift towards natural waxes due to increasing health consciousness and living standards. Industrial waxes are used in various industries, such as candles-based craft materials, decoration, interior designing, traditional candle industry, advanced and innovative applications, and packaging industries. The food packaging, cosmetic, and health and wellness industries are significant end-users, while the meat packaging industry and cosmetic industry are emerging sectors. However, health hazards associated with synthetic products and the implementation of anti-dumping duties pose challenges to the market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Industrial Wax Industry?

Increased demand for industrial wax in coating applications is the key driver of the market.

- The market is experiencing notable growth, primarily due to its extensive applications in various sectors, including cosmetics, packaging, and automotive. Historically, the demand for industrial wax was driven by its use in household candles. However, its industrial relevance has significantly expanded. By 2025, The market is projected to reach approximately USD 8943.8 million. The cosmetics and personal care industry's expansion is a primary driver of industrial wax demand. Waxes are essential In the manufacturing of various beauty products. Moreover, the increasing trend towards sustainable and eco-friendly alternatives to traditional waxes is fostering innovation In the industry. Bio-based waxes, such as carnauba, beeswax, and candelilla wax, are gaining popularity due to their natural origins and reduced environmental impact.

- Paraffin wax, a traditional mineral wax, continues to dominate the market due to its versatility and cost-effectiveness. Industrial waxes are also widely used in packaging applications, particularly In the food and pharmaceutical industries, for their moisture barrier properties. In the automotive sector, mineral waxes like ozokerite, ceresin, and montan wax are used in coatings, tires, and other applications. The changing lifestyle and increasing living standards, coupled with a rising per-capita income, are contributing to the market's growth. Additionally, the demand for green cosmetics, skin-hair care products, and waxes In the beauty industry is driving the market forward. Innovative applications of industrial waxes in various industries, including candles-based craft materials, decoration, and interior designing, are further expanding the market's scope.

What are the market trends shaping the Industrial Wax Industry?

Industrial research and development activities is the upcoming market trend.

- The market is experiencing significant growth due to the expanding applications in various sectors. Notable research collaborations are underway with experienced wax providers to innovate new technologies, such as developing high-performance waxes for use in advanced 3D printers. Wax 3D printing is an emerging technology, with wax serving as a non-degradable alternative to plastic, addressing environmental concerns. Industrial waxes are utilized in diverse industries, including candles for product shape, style, color, and fragrance, as well as in candlemaking craft materials, decoration, and interior designing. Furthermore, the traditional candle industry is evolving, with an increasing focus on natural waxes like paraffin, carnauba, beeswax, candelilla wax, and mineral waxes, including ozokerite, ceresin, and montan wax.

- Industrial waxes also find applications in sectors like cosmetics, skin-hair care products, food packaging industries, coatings, tires, and packaging industries. However, potential health hazards associated with synthetic products have led to the popularity of natural waxes in green cosmetics and the meat packaging industry. The increasing living standard, per-capita income, and changing lifestyle are further driving the demand for industrial waxes in various applications. Quality waxes are essential for product packaging, providing moisture barriers, laminated papers, and preserving the freshness of packaged food. Rapid industrialization and technological advancements continue to fuel the growth of the market.

What challenges does the Industrial Wax Industry face during its growth?

The decline in demand for group I base oil is a key challenge affecting the industry growth.

- Industrial wax, primarily paraffin wax, is produced through the de-waxing or de-oiling process. This involves heating slack wax and mixing it with a solvent, such as ketone, which facilitates crystallization. The mixture is then cooled, and the wax crystallizes, leaving the oil behind. Subsequently, the solvent is distilled, resulting In the production of wax. Paraffin wax is mainly derived from Group I base oils, which are obtained from crude oil fractions after removing paraffin wax and aromatic components. Beyond paraffin wax, the market encompasses various other types, including bio-based products like carnauba wax, beeswax, and candelilla wax, as well as mineral waxes such as ozokerite, ceresin, and montan wax.

- These waxes cater to diverse applications, ranging from candle product manufacturing and decoration in interior designing to coatings, tires, packaging, and food industries. Consumer behavior and changing lifestyle, driven by increasing living standards and per-capita income, have influenced the popularity of candles-based craft materials. Natural waxes, including beeswax, carnauba wax, and candelilla wax, have gained traction due to health and wellness concerns and the rise of green cosmetics, skin-hair care products, and the cosmetic industry. However, potential health hazards associated with synthetic products have led to the increasing use of natural waxes in various industries. The market is dynamic, with advancements and innovations continually shaping its landscape.

Exclusive Customer Landscape

The industrial wax market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the industrial wax market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, industrial wax market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Fuel and Petrochemical Manufacturers

- American Refining Group Inc.

- BASF SE

- Blayson Group Ltd.

- Calumet Specialty Products Partners LP

- Compania Espanola de Petroleos SA

- Evonik Industries AG

- Exxon Mobil Corp.

- Gandhar Oil Refinery India Ltd.

- HollyFrontier Corp.

- Honeywell International Inc.

- Indian Oil Corp. Ltd.

- Kerax Ltd.

- Lodha Petro

- Numaligarh Refinery Ltd.

- Sasol Ltd.

- Shell plc

- Sinopec Shanghai Petrochemical Co. Ltd.

- Sonneborn LLC

- The International Group Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of wax types, including paraffin, bio-based, carnauba, beeswax, candelilla, mineral waxes such as ozokerite, ceresin, and montan, and microcrystalline wax. These waxes find extensive applications in various industries, catering to the demands of different sectors. The popularity of waxes In the industrial sector is driven by their versatility and unique properties. Waxes are used in various product shapes, styles, and colors to enhance the visual appeal of candles, candles-based craft materials, and decoration items in interior designing. In the traditional candle industry, waxes play a pivotal role in maintaining the consistency and quality of the final product.

Further, advanced and innovative wax solutions have gained traction in response to changing lifestyles and increasing living standards. Per-capita income growth in several regions has led to an upward trend in consumer spending on green cosmetics, skin-hair care products, and beauty items, thereby fueling the demand for natural waxes In the cosmetic industry. The food packaging industries represent another significant end-use sector for waxes. Waxes serve as moisture barriers, protecting food products from contamination and extending their shelf life. In the paper and paperboard industry, waxes are used In the production of laminated papers for enhanced durability and water resistance.

In addition, the increasing pace of industrialization has led to the expansion of the wax market in various industries, including coatings, tires, and packaging. Mineral waxes, such as ozokerite, ceresin, and montan, are extensively used In the production of coatings due to their excellent binding properties. In the tire industry, waxes are employed as additives to improve the performance and durability of tires. Despite the numerous benefits offered by waxes, there are concerns regarding the health hazards associated with certain synthetic products. As a result, there is a growing preference for natural waxes in various applications. The meat packaging industry is one such sector where the use of natural waxes is gaining momentum due to the stringent regulations governing food safety.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

194 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.2% |

|

Market Growth 2024-2028 |

USD 1.42 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.06 |

|

Key countries |

China, US, Germany, India, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Industrial Wax Market Research and Growth Report?

- CAGR of the Industrial Wax industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the industrial wax market growth of industry companies

We can help! Our analysts can customize this industrial wax market research report to meet your requirements.