Meat Packaging Market Size 2025-2029

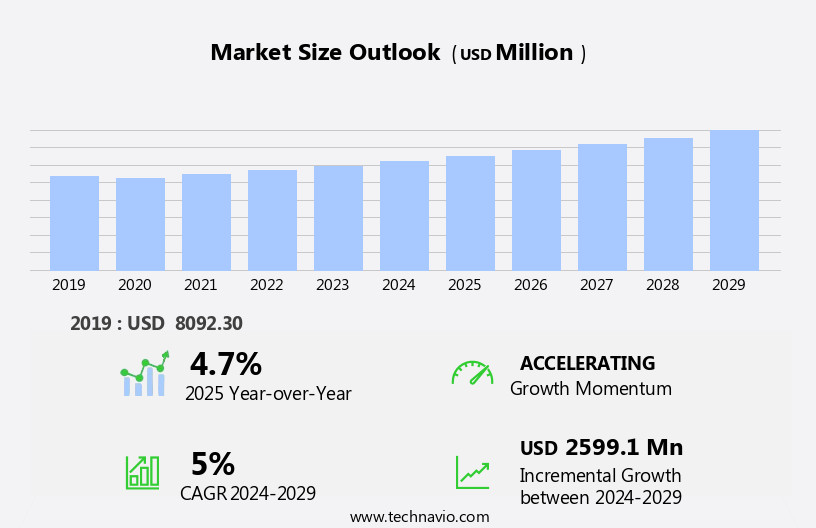

The meat packaging market size is forecast to increase by USD 2.6 billion, at a CAGR of 5% between 2024 and 2029.

- The market is driven by the increasing recognition of meat products' nutritional value and the resulting demand for superior packaging solutions. Consumers are increasingly seeking meat products that maintain freshness and enhance the visual appeal of the meat, leading to a growing emphasis on advanced packaging technologies. However, this market faces significant challenges, primarily the environmental impact of plastic packaging. The extensive use of plastic films in meat packaging contributes to a substantial amount of plastic waste, raising concerns about sustainability and the need for eco-friendly alternatives. Companies must navigate this challenge by exploring innovative, sustainable packaging solutions, such as biodegradable films, to meet evolving consumer demands and regulatory requirements.

- The market's strategic landscape is characterized by a constant push for improved product quality, longer shelf life, and more sustainable packaging options. Companies that successfully address these challenges will capitalize on the growing demand for meat products and differentiate themselves in the competitive marketplace.

What will be the Size of the Meat Packaging Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities shaping its landscape. Food safety remains a top priority, driving the adoption of advanced packaging solutions such as edible coatings, carbon dioxide, and vacuum packaging. Recycling programs and sustainability initiatives have led to the rise of recyclable packaging, compostable packaging, and the use of renewable materials like polypropylene (PP) and polyethylene (PE). Automation and high-speed packaging lines have transformed production processes, with inspection systems, forming machines, and sealing machines ensuring seal integrity and preventing microbial growth. Oxygen scavengers, intelligent packaging, and temperature control systems help extend shelf life, while RFID tags enable real-time tracking and traceability.

Packaging machinery, including filling machines and shrink wrapping systems, streamline operations and improve efficiency. Leak detection and shelf-life prediction models are essential tools for maintaining product quality and ensuring consumer satisfaction. Regulations and standards continue to evolve, with an increasing focus on food safety, temperature control, and waste reduction. Product handling and distribution packaging solutions are crucial in the market, with the cold chain and the supply chain requiring specialized packaging to maintain product quality and freshness. The market's continuous dynamism is reflected in the ongoing development of new technologies, such as active packaging, skin packaging, and antimicrobial packaging, which offer innovative solutions to meet the evolving needs of the industry.

How is this Meat Packaging Industry segmented?

The meat packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Packaging

- Flexible packaging

- Rigid packaging

- Type

- Pork

- Poultry

- Beef

- Goat meat or mutton

- Seafood

- Material

- Plastic (Flexible, Rigid, Semi-Rigid)

- Paper & Paperboard

- Metal

- Glass

- End-use

- Retail

- Food Service

- Industrial

- Technology

- Modified Atmosphere Packaging (MAP)

- Vacuum Packaging

- Active Packaging

- Sustainable Packaging

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

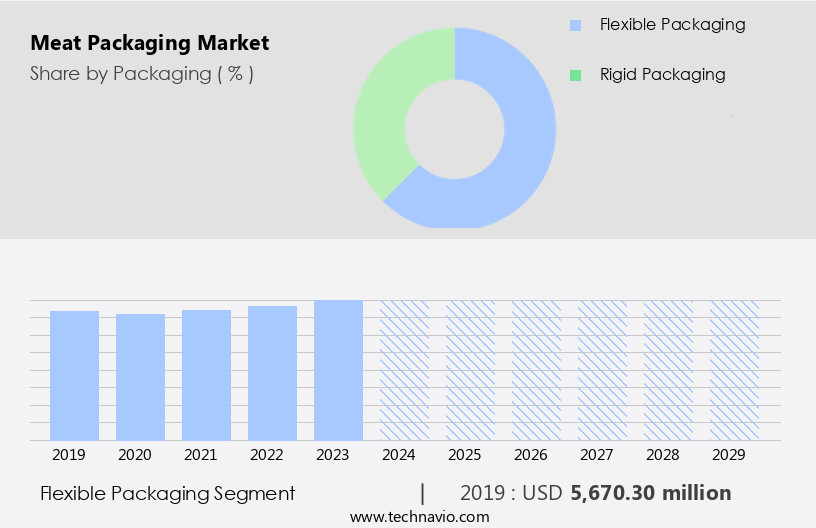

By Packaging Insights

The flexible packaging segment is estimated to witness significant growth during the forecast period.

In the competitive landscape of the market, cost-effective solutions have become a priority for manufacturers to maintain profitability amidst increasing production volumes. Flexible packaging, with its ability to reduce transportation, storage, and handling costs, has emerged as a preferred choice for meat packaging. This packaging method, which includes skin, individual wrap, layer-packed, multi-wrap, tray wrap, modified atmospheric, and vacuum packaging, offers benefits such as lighter weight and smaller storage space. Moreover, the integration of advanced technologies like high-speed packaging lines, automation, inspection systems, oxygen scavengers, intelligent packaging, and packaging machinery, enhances the efficiency and quality of meat packaging.

Forming machines, made of materials like polyvinyl chloride (PVC) and polyethylene (PE), facilitate the production of various meat trays and food service packaging. Food safety and quality control are paramount in the meat packaging industry. Sealing machines ensure the integrity of the seal, while carbon dioxide and vacuum packaging extend the shelf life of meat products. Recycling programs and the use of recyclable packaging materials contribute to sustainability efforts. Edible coatings and active packaging, infused with antimicrobial agents, maintain product freshness and prevent microbial growth. Temperature control during transportation and distribution is crucial for maintaining the quality and safety of meat products.

Packaging regulations, such as those related to gas flushing, smart packaging, and RFID tags, ensure compliance with food standards. Compostable and form-fill-seal packaging are gaining popularity due to their eco-friendly nature. Packaging design, including tray packaging, flow wrapping, and barrier films, plays a significant role in attracting consumers. Leak detection systems and shelf-life prediction models further enhance the quality and reliability of meat packaging.

The Flexible packaging segment was valued at USD 5.67 billion in 2019 and showed a gradual increase during the forecast period.

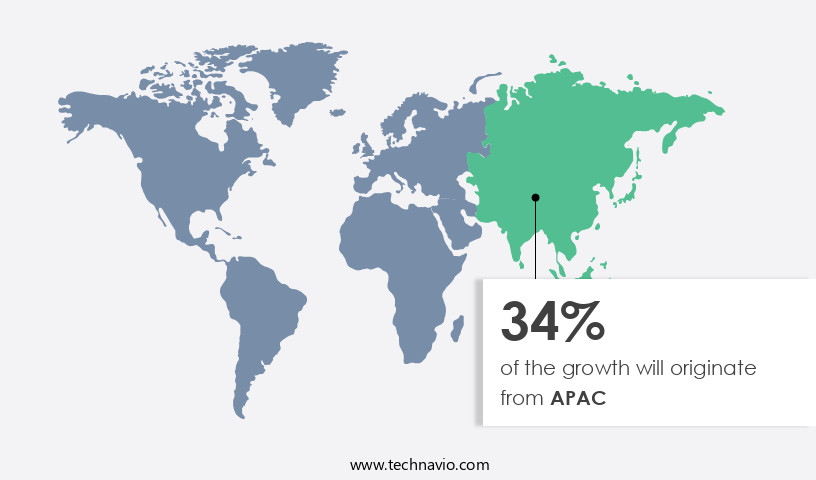

Regional Analysis

APAC is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the market, APAC holds the largest share in 2024, with China and India being significant contributors. The region's growth is attributed to the increasing population and rising demand for meat and meat products. Consumption of meat has been on a steady increase since the 1990s, with China being the largest consumer, consuming approximately 105 million tons in 2023. To cater to this demand, high-speed packaging lines and automation have become essential. Packaging machinery, including forming machines, filling machines, and sealing machines, are in high demand. Inspection systems, such as X-ray and metal detection, ensure food safety. Oxygen scavengers and carbon dioxide are used to extend shelf life and prevent microbial growth.

Intelligent packaging with RFID tags and shelf-life prediction models provide real-time information on product freshness. Sustainability is a key trend, with recyclable and compostable packaging gaining popularity. Packaging regulations mandate temperature control and seal integrity. Edible coatings and antimicrobial packaging are used to enhance product quality and safety. The market also focuses on reducing packaging waste through efficient product handling and form-fill-seal packaging. The use of barrier films and skin packaging minimizes product exposure to air and contaminants. The cold chain ensures proper temperature control during distribution. Overall, the market is dynamic, with continuous advancements in technology and evolving consumer preferences shaping its trends.

Market Dynamics

The Global Meat Packaging Market is dynamic, driven by evolving consumer preferences and food safety standards. Meat packaging solutions are critical for preserving freshness and extending shelf life. Vacuum packaging for meat and Modified Atmosphere Packaging (MAP) for meat are leading technologies, ensuring optimal product quality. The industry is rapidly adopting sustainable meat packaging materials to address environmental concerns. Key applications include fresh meat packaging, frozen meat packaging, and processed meat packaging, catering to diverse consumer needs. Poultry packaging, beef packaging, and other meat types rely on specialized meat trays and high-barrier films for meat. The demand for flexible meat packaging continues to grow, integrating smart packaging for meat technologies for enhanced traceability. Analyzing meat packaging materials and meat packaging market trends is essential, with automation in meat packaging lines increasing efficiency and ensuring rigorous food safety meat packaging for retail meat packaging and beyond.

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Meat Packaging Industry?

- The increasing recognition of meat products' high nutritional value serves as the primary catalyst for market growth.

- Meat packaging plays a crucial role in preserving the quality and safety of meat products, making it an essential aspect of the meat industry. The increasing consumption of meat products, driven by their nutritional benefits, necessitates advanced packaging solutions. High-speed packaging lines and packaging automation are integral to meeting the growing demand for meat packaging. Inspection systems, such as X-ray and metal detection, ensure product safety and quality control. Oxygen scavengers and intelligent packaging help extend the shelf life of meat products, while packaging machinery, including forming machines, sealing machines, and polyethylene (PE) and polyvinyl chloride (PVC) equipment, facilitate efficient production.

- Meat packaging is not just about preserving the product but also enhancing its presentation for food service packaging. The supply chain requires robust packaging solutions that can withstand the rigors of transportation and storage. Nutrient-rich meat products, such as those containing omega-3 fatty acids (docosahexaenoic acid, DHA, and eicosapentaenoic acid, EPA), require specialized packaging to maintain their quality and integrity. In conclusion, the market is dynamic and evolving, driven by consumer demand for nutritious and safe meat products. Packaging solutions must cater to the unique requirements of meat products, from ensuring food safety and extending shelf life to enhancing presentation and facilitating efficient production.

What are the market trends shaping the Meat Packaging Industry?

- The increasing demand for plastic films in meat packaging is a notable market trend. This trend is driven by the advantages offered by plastic films in preserving meat freshness and extending its shelf life.

- The market is witnessing significant growth due to the importance of food safety and extended shelf life for meat products. Flexible plastic films, such as those used for shrink wrapping and vacuum packaging, are increasingly being adopted for their ability to maintain product integrity and enhance product appearance. These films also facilitate efficient product handling and distribution, reducing transportation and warehouse costs. Moreover, recycling programs for plastic films contribute to sustainability efforts in the industry. Edible coatings and carbon dioxide packaging are other innovative solutions that improve food safety and shelf life. Seal integrity is crucial in meat packaging to prevent contamination and product recalls.

- Vacuum packaging and filling machines ensure optimal product protection and reduce oxygen exposure, thereby extending the shelf life of meat products. The use of recyclable packaging materials is a growing trend in the industry, addressing environmental concerns while maintaining the functionality and cost-effectiveness of meat packaging solutions.

What challenges does the Meat Packaging Industry face during its growth?

- The growth of the industry is significantly impacted by the environmental consequences of plastic packaging usage. This challenge necessitates continuous innovation and adoption of eco-friendly alternatives to mitigate the adverse effects on the environment.

- The market is witnessing significant growth due to increasing consumer preference for convenient and marketable options. However, this trend poses a challenge to environmental sustainability, as a substantial portion of waste in the US is generated from non-degradable meat packaging. In 2023, approximately 34% of the US waste was attributed to food packaging, with over 88% of this waste being non-degradable, including polypropylene (PP) meat trays, shrink and stretch films, and plastic bags. Chlorine, a common raw material in the manufacturing of these packaging types, contributes significantly to carbon emissions. To mitigate the negative environmental impact, various packaging solutions are gaining popularity.

- These include temperature-controlled cold chain packaging, smart packaging with RFID tags, active packaging with gas flushing, and compostable packaging. Temperature control is crucial in meat packaging to prevent microbial growth and ensure food safety. Smart packaging with RFID tags offers real-time monitoring of temperature and product freshness, while active packaging with gas flushing extends the shelf life of meat products. Compostable packaging, made from renewable resources, is an eco-friendly alternative to traditional packaging. In conclusion, the market is driven by consumer demand for convenience and marketing appeal. However, the environmental impact of non-degradable packaging is a significant concern.

- Innovative packaging solutions, such as temperature-controlled cold chain, smart packaging, active packaging, and compostable packaging, are addressing these concerns while maintaining the necessary functionality and safety requirements for meat packaging.

Exclusive Customer Landscape

The meat packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the meat packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, meat packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amcor Plc - The company specializes in advanced meat packaging solutions, enhancing flavor, preserving quality, and extending shelf life and safety for fresh meat. Through innovative technologies, these offerings ensure optimal consumer experience and adherence to industry standards.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- Amerplast Ltd.

- Berry Global Inc.

- Bollore Inc.

- Cascades Inc.

- Constantia Flexibles Group GmbH

- Coveris Management GmbH

- Crown Holdings Inc.

- EasyPak LLC

- Faerch AS

- Foster International Packaging

- GRUPO ULMA S. COOP

- Omori Machinery Co. Ltd.

- Pactiv Evergreen Inc.

- Sealed Air Corp.

- Smurfit Kappa Group

- Sonoco Products Co.

- Uniflex

- Viscofan SA

- Winpak Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Meat Packaging Market

- In January 2024, Tetra Laval Flexible Packaging, a leading provider of sustainable packaging solutions, announced the launch of its innovative meat packaging solution, FlexTray, in collaboration with Danish Crown, a major European meat processing company (Danish Crown Press Release, 2024). This new packaging format offers improved product protection, longer shelf life, and reduced waste, setting a new standard in the meat packaging industry.

- In March 2024, Sealed Air Corporation, a global leader in food protection, completed the acquisition of Automated Packaging Systems, a prominent manufacturer of automated case-sealing equipment, for approximately USD250 million (Sealed Air Corporation Press Release, 2024). This strategic move aimed to strengthen Sealed Air's position in the market by expanding its product portfolio and enhancing its automation capabilities.

- In May 2024, the European Union (EU) approved the use of natural antimicrobial agents in meat packaging, enabling meat processors to use these substances to extend the shelf life of their products and reduce food waste (EU Commission Press Release, 2024). This regulatory approval marked a significant shift in the market, allowing for more sustainable and cost-effective packaging solutions.

- In April 2025, Amcor, a global packaging solutions provider, announced the completion of its new advanced meat packaging production facility in the United States, with an investment of USD100 million (Amcor Press Release, 2025). This new facility, located in North Carolina, will increase Amcor's production capacity and enable the company to cater to the growing demand for advanced meat packaging solutions in the North American market.

Research Analyst Overview

- The market is characterized by continuous innovation and advancements in technology. Packaging sensors and data matrix codes enhance supply chain visibility, ensuring efficient tracking and traceability of products. Portion packaging, facilitated by gravure and flexographic printing, caters to consumer preferences for convenience. Microbial contamination is a persistent challenge, necessitating rigorous package integrity testing, including tensile strength, barrier properties, and puncture resistance tests. Sous vide packaging and metal detection systems extend shelf life and maintain food safety. Near-infrared spectroscopy (NIRS) and time-temperature indicators (TTIs) optimize packaging cost and improve product quality.

- Sustainable packaging materials, such as bio-based polymers and label adhesion solutions, align with evolving consumer demands. Packaging line optimization, facilitated by digital printing and inkjet technology, boosts efficiency and reduces waste. X-ray inspection and weight checkers ensure product consistency and accuracy. Regardless, market dynamics remain influenced by the ever-evolving regulatory landscape and consumer preferences.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Meat Packaging Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5% |

|

Market growth 2025-2029 |

USD 2599.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.7 |

|

Key countries |

China, US, UK, Japan, Canada, South Korea, Germany, Italy, Brazil, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Meat Packaging Market Research and Growth Report?

- CAGR of the Meat Packaging industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the meat packaging market growth of industry companies

We can help! Our analysts can customize this meat packaging market research report to meet your requirements.