Insoluble Sulfur Market Size 2024-2028

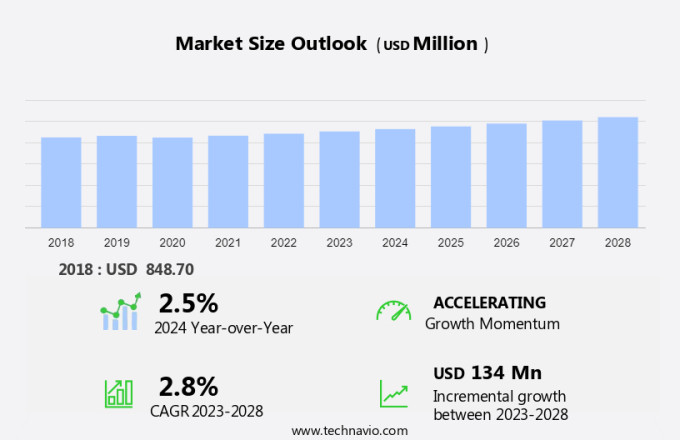

The insoluble sulfur market size is forecast to increase by USD 134 million at a CAGR of 2.8% between 2023 and 2028. The market is experiencing significant growth due to its essential role as a vulcanization accelerator in the production of various rubber products. This includes tires, which are in high demand due to increasing consumer preference for high-performance and eco-friendly options. Additionally, insoluble sulfur products are used as heat resistant agents in rubber industry applications, such as adhesives and footwear. With the rise of electric vehicles and the continuing influence of fashion trends, including athleisure trends, the demand for insoluble sulfur is expected to continue. However, market growth is challenged by the volatility in raw material prices, which can impact the profitability of manufacturers.

Insoluble sulfur products play a crucial role in the production of various rubber items, including tires and adhesives. These sulfur-based compounds, often used as vulcanization accelerators, enhance the heat resistance and durability of rubber products. The rubber industry, a significant contributor to the manufacturing sector, relies heavily on insoluble sulfur products for tire manufacturing. Tires are a vital component of sustainable transportation solutions, particularly in the context of the increasing popularity of electric vehicles. Insoluble sulfur products help improve tire performance, ensuring longevity and safety under diverse temperature conditions.

In the realm of footwear and fashion trends, insoluble sulfur products contribute to the production of high-quality, long-lasting rubber soles. These products' adhesives and sealants properties also facilitate the bonding of various materials in footwear manufacturing. Beyond tire and footwear applications, insoluble sulfur products find extensive use in industrial applications, such as cable and wire production. Their heat resistance and stability make them indispensable in creating products that can withstand extreme temperatures and conditions. The rubber industry's commitment to quality standards necessitates the use of insoluble sulfur products in various grades. Regular grades cater to everyday applications, while high dispersion grades offer improved dispersion for better uniformity in rubber compounds.

High stability grades ensure consistent performance under extreme conditions, and special grades cater to specific industrial requirements. Inorganic sources of insoluble sulfur are preferred due to their superior performance and environmental sustainability. These sources contribute to the production of eco-friendly rubber products, aligning with the growing demand for sustainable manufacturing practices. In summary, insoluble sulfur products are an integral part of the rubber industry, enhancing the performance and durability of rubber products in various applications, from tires and footwear to industrial applications like cable and wire production. Their importance is further focused in the context of sustainable transportation solutions and the increasing demand for eco-friendly manufacturing practices.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Tire

- Industrial

- Footwear

- Others

- Geography

- APAC

- China

- India

- Europe

- Germany

- Italy

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

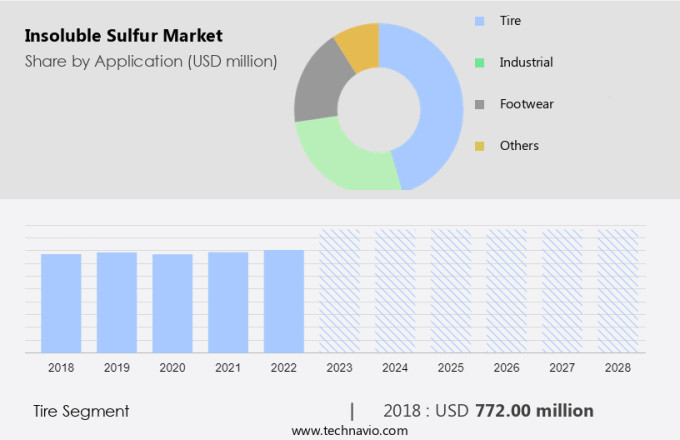

The tire segment is estimated to witness significant growth during the forecast period. Insoluble sulfur plays a significant role in the rubber industry, particularly in the production of tires. This market segment is poised for substantial growth due to the rising automobile production and demand worldwide. Insoluble sulfur is an essential component in tire manufacturing, enhancing the adhesive property and heat resistance. Its usage extends beyond tires, finding applications in the production of rubber products for various industries, including footwear and athletic gear, which aligns with current fashion trends. In the tire industry, insoluble sulfur is crucial for high-performance applications in bicycle and motorcycle tires, ensuring safety and control in diverse weather and surface conditions.

The increasing popularity of electric vehicles also contributes to the market's growth, as insoluble sulfur is used in their battery systems for improved performance and longevity. Insoluble sulfur's versatility and benefits make it an indispensable ingredient in the rubber industry.

Get a glance at the market share of various segments Request Free Sample

The tire segment accounted for USD 772.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

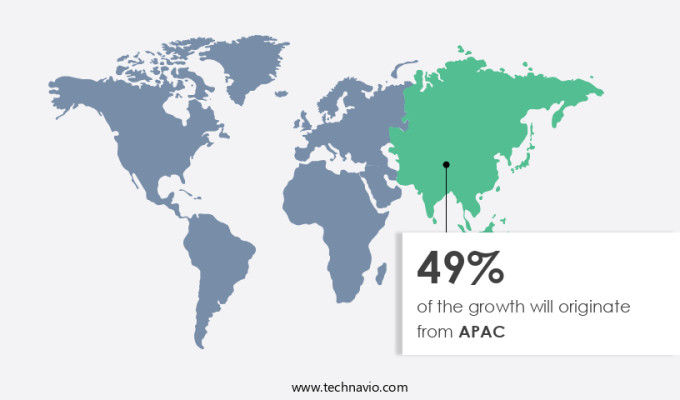

APAC is estimated to contribute 49% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Insoluble sulfur is a critical component in the manufacturing of tires, particularly for automobile rubber parts. In 2023, the Asia Pacific region led the market due to the increasing demand for tires in countries like South Korea, Japan, China, and India. The expansion of automobile manufacturing industries and the establishment of production plants by Western companies in developing countries, especially India and China, are significant contributors to the market's growth. China's insoluble sulfur consumption is a primary growth driver, primarily due to the burgeoning tire production industry in the country. South Korea and India are also expected to contribute significantly to the regional market's growth during the forecast period.

Insoluble sulfur is used as a curing agent in tire manufacturing, ensuring the tires' thermal stability and meeting quality standards. The growing passenger car fleet, including electric vehicles, and the demand for high-performance tires for on-road vehicles, including defense vehicles, further boost the market's growth. The market's sustainability is aligned with the global push for sustainable transportation solutions.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing demand from the rubber industry is notably driving market growth. Insoluble sulfur, a vital industrial raw material, is employed in various high-performance applications due to its exceptional properties. Regular grades of insoluble sulfur are widely used as a rubber additive to enhance wear ability, fatigue resistance, and aging resistance in rubber pipes, shoes, latex, belt tires, and the tire industry. High stability grades are preferred for their superior resistance to sulfur volatilization during rubber processing. Special grades of insoluble sulfur find extensive use in industries such as cable and wire manufacturing, pipelines, and sulfuric acid production. In wire manufacturing, insoluble sulfur is used to produce sulfurated hydrogen for insulation purposes. In the production of sulfur dioxide, insoluble sulfur is used as a feedstock. Insoluble sulfur's unique properties make it an indispensable component in the production of macromolecule polymers like polythiophene and polyphenylene sulfide.

Furthermore, it is used in the production of industrial chemicals such as carbon disulfide and menthol. In the food industry, insoluble sulfur is used as a taste enhancer, adding a clove taste to various food items, including chocolate. Multinationals and rubber processors rely on insoluble sulfur's consistent quality and performance to meet the growing demand for high-performance products in various industries. Thus, such factors are driving the growth of the market during the forecast period.

Market Trends

Growing demand for high-performance and eco-friendly tires is the key trend in the market. Insoluble sulfur, a vital industrial raw material, is available in various grades, including Regular Grades, High Stability Grades, and Special Grades. These grades cater to diverse industrial applications, such as cable and wire manufacturing, pipe production, and retail sales. In the tire industry, insoluble sulfur functions as a rubber additive, enhancing the wear ability, fatigue resistance, and aging resistance of rubber pipes, shoes, latex, belt tires, and even radial tires. Multinationals in the wire manufacturing, cables, pipelines, and tire industries utilize insoluble sulfur extensively.

In addition, sulfurated hydrogen and sulfur dioxide are common byproducts of insoluble sulfur production. The macromolecule polymer, carbon disulfide, is another derivative used in rubber processing. Insoluble sulfur's unique properties make it indispensable in industries, contributing to the production of various end-products, from menthol and clove taste in food industries to chocolate and other essential commodities. Thus, such trends will shape the growth of the market during the forecast period.

Market Challenge

Volatility in raw material prices is the major challenge that affects the growth of the market. Insoluble sulfur, a crucial ingredient in various industries, is available in Regular Grades, High Stability Grades, and Special Grades, each catering to distinct industrial applications. In the cable and wire sector, insoluble sulfur is employed as a rubber additive, enhancing wear ability, fatigue resistance, and aging resistance. In pipe manufacturing, it is used to produce rubber pipes, ensuring durability and flexibility. Retail sales include its usage in menthol and clove taste for food items like chocolate. In the tire industry, insoluble sulfur is integral to the production of raw rubber, contributing to the strength and elasticity of radial tires.

Moreover, multinationals in wire manufacturing and cables, pipelines, and sulfurized hydrogen or sulfur dioxide production rely on insoluble sulfur as a macromolecule polymer component. Carbon disulfide, a byproduct of insoluble sulfur production, is used in the rubber industry and tire manufacturing. Overall, insoluble sulfur plays a vital role in numerous industries, from cable and wire to tire manufacturing and rubber processing. Hence, the above factors will impede the growth of the market during the forecast period

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Changde Dingyuan Chemical Industrial Ltd. - The company offers insoluble sulfur for tires, rubber shoes, rubber tubes, cables, and medicines.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Chemspec Ltd.

- Eastman Chemical Co.

- Grupa Azoty SA

- Henan Kailun Chemical Co. Ltd.

- Heze Great Bridge Chemical Co. Ltd.

- Lanxess AG

- Leader Technologies Co. Ltd.

- Lions Industries Sro

- Nynas AB

- Oriental Carbon and Chemicals Ltd

- Qingdao Xiongxiang Rubber Co. Ltd.

- Sanshin Chemical Industry Co. Ltd.

- Schill Seilacher Struktol GmbH

- Shandong Yanggu Huatai Chemical Co. Ltd.

- Shikoku Chemicals Corp

- Successmore Being Public Co. Ltd.

- Willing New Materials Technology Co. Ltd.

- Wuxi Huasheng Rubber New Material Technology Co. Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Insoluble sulfur products play a crucial role in the rubber industry, acting as vulcanization accelerators for rubber polymers. These products enhance the adhesive property and thermal stability of rubber, making them essential in tire manufacturing applications. In the tire industry, insoluble sulfur is used as a curing agent for both on-road vehicles and defense vehicles, contributing to the production of high performance tires. Beyond tires, insoluble sulfur finds application in various sectors. In the automotive sector, it is used as a heat resistant agent in automobile rubber parts, ensuring stability and durability. The chemical stability and purity levels of insoluble sulfur make it suitable for use in industrial applications such as cable and wire manufacturing, pipe production, and sulfurated hydrogen production.

Insoluble sulfur also finds use in the production of rubber products for footwear and fashion trends, including athleisure and latex shoes. In the chemical industry, insoluble sulfur is used as a raw material in the production of fertilizers and various chemicals. Despite its importance, the supply of insoluble sulfur can be affected by natural disasters and other factors. However, the market for insoluble sulfur remains stable due to its cost-effective supply and wide range of applications in various industries. Insoluble sulfur's versatility extends to tire manufacturing, where it is used in regular, high stability, and special grades.

Its use in tire shipment and automobile production contributes to the growth of the tire industry. The market is expected to continue growing due to increasing demand for sustainable transportation solutions, including electric vehicles, and the ongoing development of high performance tires.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.8% |

|

Market growth 2024-2028 |

USD 134 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.5 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 49% |

|

Key countries |

China, US, India, Germany, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Changde Dingyuan Chemical Industrial Ltd., Chemspec Ltd., Eastman Chemical Co., Grupa Azoty SA, Henan Kailun Chemical Co. Ltd., Heze Great Bridge Chemical Co. Ltd., Lanxess AG, Leader Technologies Co. Ltd., Lions Industries Sro, Nynas AB, Oriental Carbon and Chemicals Ltd, Qingdao Xiongxiang Rubber Co. Ltd., Sanshin Chemical Industry Co. Ltd., Schill Seilacher Struktol GmbH, Shandong Yanggu Huatai Chemical Co. Ltd., Shikoku Chemicals Corp, Successmore Being Public Co. Ltd., Willing New Materials Technology Co. Ltd., and Wuxi Huasheng Rubber New Material Technology Co. Ltd |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch