Insurance Brokerage Market Size 2025-2029

The insurance brokerage market size is forecast to increase by USD 117.3 billion at a CAGR of 8.2% between 2024 and 2029.

- The market is experiencing significant growth due to the increased demand for various insurance policies. This trend is driven by the expanding economy, population growth, and rising disposable income, leading more individuals and businesses to seek insurance coverage. Additionally, the integration of IT and analytic solutions in the insurance industry is revolutionizing the way policies are underwritten and sold. This digital transformation enables insurance brokers to offer personalized and efficient services, enhancing customer experience and satisfaction. However, the market also faces challenges. Direct purchase of insurance policies by customers through digital channels is becoming increasingly popular, posing a threat to traditional insurance brokers.

- This shift towards self-service models requires brokers to adapt and offer value-added services to differentiate themselves. Furthermore, regulatory compliance and data security concerns are critical challenges that insurance brokers must address to maintain customer trust and adhere to industry standards. Effective risk management and data analytics are essential tools for brokers to navigate these challenges and capitalize on the market opportunities presented by the evolving insurance landscape.

What will be the Size of the Insurance Brokerage Market during the forecast period?

- The market continues to evolve, driven by dynamic market conditions and advancements in technology. Insurance marketing strategies adapt to shifting consumer preferences, with digital platforms and mobile apps becoming increasingly popular. Insurance carriers respond by offering innovative solutions, integrating data analytics and machine learning to assess risk and personalize policies. Renewals and brokerage services remain a focal point, with technology streamlining processes and improving efficiency. Regulations evolve, shaping the industry landscape and driving innovation in areas such as claims processing and policy administration. Financial services and insurance technology intertwine, enabling seamless transactions and real-time data access. Insurance trends, from risk management to liability insurance, unfold across various sectors, with commercial and personal lines adapting to changing risk appetites.

- Online insurance platforms and digital insurance transform the distribution landscape, offering customers convenience and flexibility. Insurance policies continue to evolve, with group insurance, employee benefits, and health insurance adapting to meet changing needs. Insurance technology and insurance regulations shape the future of the industry, with artificial intelligence and machine learning set to revolutionize underwriting and risk assessment. Insurance sales strategies adapt to these changes, with insurance advisors and consultants playing a crucial role in guiding clients through the complexities of the market. Insurance premiums remain a key consideration, with insurance comparisons and customer relationship management becoming increasingly important for insurers and brokers alike.

- The insurance industry continues to evolve, with ongoing innovation and adaptation to market conditions shaping its future.

How is this Insurance Brokerage Industry segmented?

The insurance brokerage industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Non-life insurance

- Life insurance

- End-user

- Individuals

- Corporate

- Channel

- Offline

- Online

- Consumer

- Retail

- Wholesale

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- UAE

- Rest of World (ROW)

- North America

By Type Insights

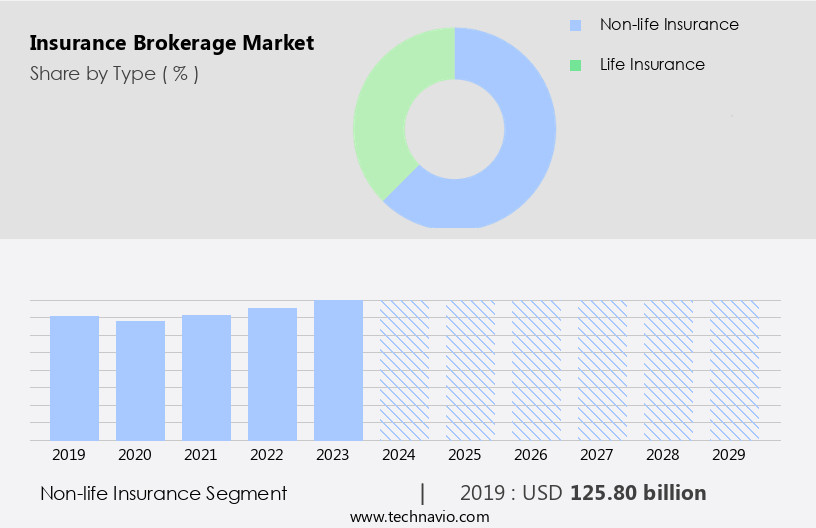

The non-life insurance segment is estimated to witness significant growth during the forecast period.

The market encompasses various entities that shape its dynamics and trends. Artificial intelligence and data analytics are transforming risk management and claims processing, leading to more efficient insurance solutions and consulting services. Mobile apps and online platforms facilitate insurance comparisons and customer relationship management. Insurance fraud remains a significant challenge, necessitating advanced technology and regulatory oversight. Life insurance and non-life insurance segments constitute the insurance market. Non-life insurance, also known as general insurance, covers financial losses from accidents or natural disasters. Its revenue growth is anticipated to outpace life insurance during the forecast period. General insurance policies include personal, industrial, commercial, and marine insurance.

Personal insurance covers medical, accidental, property, and vehicle insurance. Insurance sales, premiums, and distribution continue to evolve, with insurance carriers and brokerage networks adapting to digital trends and changing risk appetites. Insurance litigation and disputes necessitate effective liability insurance coverage. Machine learning and policy administration streamline insurance operations, while group insurance and employee benefits cater to the financial services sector. Insurance technology, including cloud computing, enables efficient policy administration and claims processing. Health insurance and employee benefits are essential components of the insurance market, with insurance advisors and product offerings catering to diverse coverage needs. Insurance trends include increasing use of technology, shifting risk appetites, and evolving regulatory requirements. Renewals and brokerage services remain crucial for maintaining insurance coverage and managing risk.

The Non-life insurance segment was valued at USD 125.80 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the increasing recognition of the importance of risk management and financial protection. This market expansion is fueled by the rising number of high net worth individuals (HNWIs) and a growing working population. In the US alone, there were over 8 million HNWIs in 2023, marking a 5% increase from the previous year. Additionally, approximately 55-60% of women in the US participate in the labor force, representing a substantial market for insurance brokerage firms. Artificial intelligence and machine learning are transforming the insurance industry, with applications in risk assessment, claims processing, and customer relationship management.

Insurance solutions and consulting services are increasingly sought after to help businesses navigate complex commercial insurance landscapes and manage their risk appetites. Mobile insurance apps and online platforms are also gaining popularity, offering convenience and accessibility for personal insurance needs. Insurance carriers and brokers are leveraging data analytics to provide customized insurance policies and improve underwriting accuracy. Group insurance, health insurance, and employee benefits are essential offerings in the market, with a focus on providing comprehensive insurance coverage for businesses and individuals. Insurance trends include the integration of digital insurance and policy administration, as well as the use of cloud computing for streamlined claims processing and insurance comparisons.

Regulations continue to shape the market, with a focus on preventing insurance fraud and ensuring fair insurance practices. Insurance sales, renewals, and claims processing are key areas of focus for insurance brokerage services, with the goal of providing efficient and effective solutions for clients. Insurance technology and financial services are essential partners in the insurance ecosystem, offering innovative solutions to meet the evolving needs of the market. In summary, the market in North America is driven by the growing demand for insurance coverage and financial advice, with a focus on leveraging technology and data analytics to provide customized solutions for businesses and individuals.

The market is characterized by a diverse range of offerings, from commercial insurance to personal insurance and employee benefits, with a commitment to addressing the unique risk management needs of each client.

Market Dynamics

The Insurance brokerage market is undergoing significant transformation, driven by evolving insurance brokerage market trends and technological advancements. Demand for specialized services like commercial insurance brokerage, life insurance brokerage, and health insurance brokerage remains robust, alongside traditional Property & Casualty (P&C) insurance brokerage. The shift towards online insurance brokerage platforms is prominent, offering clients greater accessibility and choice. Brokers are increasingly providing value-added risk management services insurance broker and proactive claims assistance insurance broker. The integration of AI in insurance brokerage is revolutionizing policy recommendations and operational efficiency. Clients increasingly seek customized insurance solutions that cater to specific needs, from small business insurance broker services to comprehensive employee benefits consulting insurance. Growth is particularly strong in niche areas like cyber insurance brokerage. The broader insurance industry outlook for brokers points to continued digital transformation in insurance brokerage, leveraging insurance broker software solutions for improved client experience and offering personalized premiums insurance. This focus on innovation and tailored insurance advisory services is shaping the competitive landscape.

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Insurance Brokerage Industry?

- The primary factor fueling market growth is the heightened demand for insurance policies. The market experiences significant growth due to changing customer demographics and increasing demand for various insurance policies. Brokers focus on offering personalized financial services and security, driving the market's expansion. Baby boomers and millennials, as large population segments, create opportunities for medical, life, accidental, and other insurance types. Maximizing customer benefits is a priority for insurance carriers, leading to the popularity of accidental, life, medical, vehicle, liability, and property insurance.

- Insurance technology and online platforms are transforming the industry, streamlining insurance marketing, renewals, and claims processing. Regulations continue to shape the market, ensuring financial stability and customer protection. Digital insurance solutions further enhance the customer experience, making insurance more accessible and convenient.

What are the market trends shaping the Insurance Brokerage Industry?

- The integration of IT and analytic solutions is a significant trend in the insurance industry, with professionals increasingly relying on technology to enhance operational efficiency and data analysis capabilities. This fusion of technology and analytics is transforming the insurance sector by enabling more accurate risk assessment, personalized customer experiences, and streamlined claims processing.

- The market players leverage IT and analytic solutions to optimize sales and marketing strategies. Data analytics plays a pivotal role in this process, enabling firms to forecast market trends, improve product design, and target customers effectively. Analytic tools help insurance brokers identify hidden data patterns and predict future outcomes using complex models. In the current business landscape, there is a growing emphasis on business intelligence, which involves transforming raw data into valuable marketing insights. This information aids in informed decision-making, policy administration, claims processing, and group insurance management.

- Effective customer relationship management is another crucial aspect of the insurance brokerage industry, which is enhanced through data analytics. Health insurance and employee benefits are significant sectors where data analytics adds value by streamlining insurance comparisons, settlements, and advisory services.

What challenges does the Insurance Brokerage Industry face during its growth?

- The direct purchase of insurance policies by customers poses a significant challenge to the industry's growth, as it requires companies to adapt to evolving consumer preferences and behaviors, and effectively compete with digital platforms that offer convenience and competitive pricing.

- The global insurance industry has witnessed a significant shift towards digital channels, with the increasing use of the Internet and smartphones driving the sale of insurance policies directly from firms. This trend has led to heightened product awareness, elevated customer expectations, and evolved buying behaviors, potentially limiting the growth of the market during the forecast period. In response, brokerage firms have adopted online distribution strategies to maintain their customer base and provide enhanced experiences.

- These approaches enable firms to offer personalized services, streamline processes, and provide real-time information, ensuring a competitive edge in the market. By embracing digital transformation, insurance brokerage firms can effectively cater to the evolving needs of their clients and adapt to the changing market dynamics.

Exclusive Customer Landscape

The insurance brokerage market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the insurance brokerage market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, insurance brokerage market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aon plc - The company specializes in customized insurance solutions, providing professional liability, employee benefits, and risk management services for diverse industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alliant Insurance Services, Inc.

- Aon plc

- Arthur J. Gallagher & Co.

- AssuredPartners, Inc.

- BB&T Insurance Services

- Brown & Brown, Inc.

- Gallagher Bassett Services, Inc.

- Hays Companies

- Higginbotham

- HUB International Limited

- Hylant Group, Inc.

- Jardine Lloyd Thompson Group plc

- Leavitt Group

- Lockton Companies

- Marsh & McLennan Companies, Inc.

- NFP Corp.

- Truist Insurance Holdings, Inc.

- USI Insurance Services

- Willis Towers Watson plc

- Woodruff Sawyer

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Insurance Brokerage Market

- In February 2024, Marsh & McLennan Companies (MMC), a global professional services firm offering risk management, insurance broking, and consulting services, announced the acquisition of Jardine Lloyd Thompson Group plc (JLT), a leading independent insurance broker and risk specialist. This deal, valued at approximately £4.3 billion, significantly expanded MMC's global footprint and market share in the insurance brokerage sector (Marsh & McLennan Companies Press Release, 2024).

- In October 2024, Aon Hewitt, a human capital and benefits consulting business owned by Aon plc, launched its new digital platform, "Aon Digital," designed to simplify the benefits administration process for employers. This technological advancement aimed to streamline the insurance brokerage industry by providing a more efficient and user-friendly experience for clients (Aon Hewitt Press Release, 2025).

- In January 2024, Willis Towers Watson, a leading global advisory, broking, and solutions company, entered into a strategic partnership with Microsoft to develop advanced analytics and digital solutions for the insurance industry. This collaboration aimed to leverage Microsoft's Azure platform and AI capabilities to enhance Willis Towers Watson's risk management and insurance services (Willis Towers Watson Press Release, 2024).

- In June 2024, the European Union's (EU) Insurance Distribution Directive (IDD) came into effect, introducing new rules for the distribution of insurance and reinsurance products in the EU. This regulatory change aimed to improve transparency, consumer protection, and market integrity within the insurance brokerage sector (European Commission, 2025).

Research Analyst Overview

The market in the US is characterized by intricate regulations and reporting requirements, shaped by the involvement of various stakeholders including insurance actuaries, regulators, agents, brokers, consultants, and policyholders. Digital transformation is a significant trend, with data-driven insurance, analytics, and innovation driving improvements in customer experience, claims management, and risk mitigation. Ethical conduct and fraud detection are crucial concerns, necessitating the role of insurance ethics and compliance.

Globalization and licensing have expanded market reach, while partnerships and investment opportunities provide capital for growth. Insurance underwriters and advisors play a pivotal role in policy management and claims adjustment, shaping the industry's response to legislation and sustainability initiatives.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Insurance Brokerage Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

227 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.2% |

|

Market growth 2025-2029 |

USD 117.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.1 |

|

Key countries |

US, UK, Canada, Japan, China, Germany, France, India, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Insurance Brokerage Market Research and Growth Report?

- CAGR of the Insurance Brokerage industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the insurance brokerage market growth of industry companies

We can help! Our analysts can customize this insurance brokerage market research report to meet your requirements.