Insurance Software Market Size 2025-2029

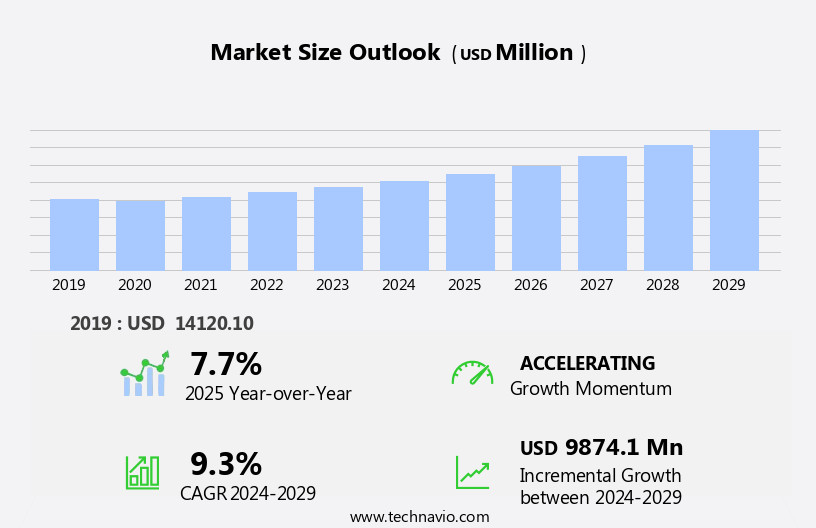

The insurance software market size is forecast to increase by USD 9.87 billion, at a CAGR of 9.3% between 2024 and 2029.

- The market is experiencing significant growth and transformation, driven by increasing government regulations mandating insurance coverage in developing countries and the integration of wearables into customer engagement metrics for life insurance. These trends reflect a growing emphasis on risk management and personalized customer experiences. However, the market also faces challenges, including a tightening regulatory environment for insurance players. Compliance with evolving regulations is essential to maintain market position and mitigate potential penalties. Additionally, the integration of wearables presents opportunities for more accurate risk assessment and personalized pricing, but also raises concerns around data privacy and security.

- To capitalize on market opportunities and navigate challenges effectively, insurance providers must stay informed of regulatory changes and invest in robust data security measures. By embracing technology and adapting to regulatory requirements, insurers can enhance their offerings and build stronger relationships with customers.

What will be the Size of the Insurance Software Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities shaping its landscape. Entities reporting and analytics, user experience (UX), regulatory reporting, integration APIs, database management, machine learning (ML), data security, cloud computing, data privacy, sales management, and various other components are increasingly integrated to offer comprehensive solutions. Policy issuance, customer portals, document management, and broker management are seamlessly integrated into the policy lifecycle, enabling efficient and effective operations. Predictive analytics, microservices architecture, and agile development are transforming the industry, allowing insurers to make data-driven decisions and respond quickly to market trends. User interface (UI) and mobile applications are essential for enhancing the customer experience, while API integrations and sales force automation streamline internal processes.

Actuarial modeling, billing systems, quality assurance (QA), commission management, and premium calculation are crucial for accurate risk assessment and pricing. Data analytics, claims management, reporting & analytics, and machine learning (ML) are at the forefront of innovation, enabling insurers to detect fraud, process claims efficiently, and gain valuable insights from vast amounts of data. Data security, cloud computing, and data privacy are paramount in ensuring the protection of sensitive information. The ongoing evolution of the market reflects the industry's commitment to meeting the ever-changing needs of customers and regulatory requirements. The integration of these advanced technologies and processes will continue to reshape the market, offering new opportunities for growth and efficiency.

How is this Insurance Software Industry segmented?

The insurance software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- On-premises

- Cloud-based

- Type

- Life insurance

- Accident and health insurance

- Property and casualty insurance

- Others

- End-user

- Insurance companies

- Agencies

- Brokers

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Deployment Insights

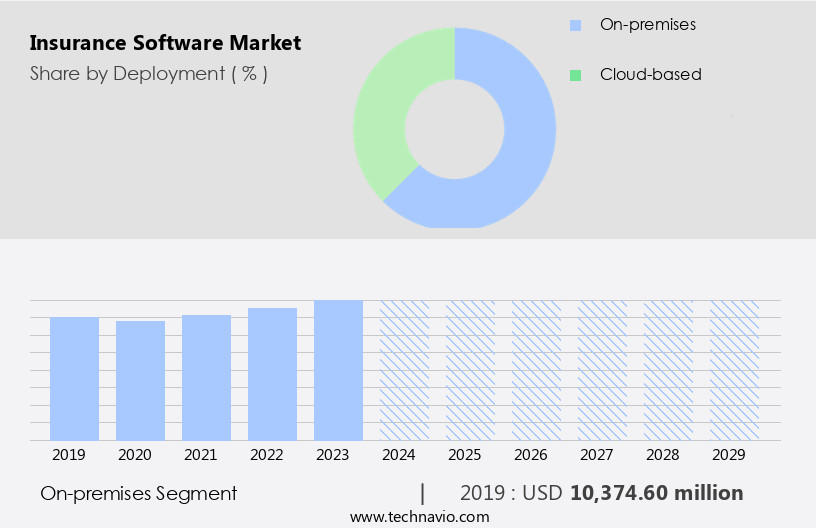

The on-premises segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth due to the adoption of advanced technologies such as predictive analytics, microservices architecture, and artificial intelligence (AI) in policy administration, claims management, and risk management. Customer portals and document management systems facilitate seamless interaction between insurers and policyholders, enhancing the user experience (UX). Policy issuance and renewal management are streamlined through API integrations and agile development, enabling real-time processing. Mobility is a key trend, with insurers developing mobile applications to cater to the growing demand for on-the-go access to insurance services. Data analytics and regulatory reporting are essential components, ensuring compliance with industry regulations and providing valuable insights for strategic decision-making.

Policy lifecycle management and broker management are critical functions that require robust, secure, and scalable solutions. Database management and machine learning (ML) algorithms enable efficient data processing and fraud detection. Billing systems, commission management, and sales force automation optimize revenue generation and sales processes. Quality assurance (QA) and software testing ensure the reliability and accuracy of the software, while actuarial modeling and premium calculation provide essential risk assessment capabilities. Cloud computing and data privacy are essential considerations for insurers, offering flexibility, cost savings, and enhanced security. Workflow automation and claims processing are crucial for operational efficiency, reducing manual intervention and processing time.

Channel management and renewal management enable insurers to effectively engage with customers and retain policyholders. Risk management solutions help insurers assess, mitigate, and manage risks, ensuring the financial stability and growth of their business.

The On-premises segment was valued at USD 10.37 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

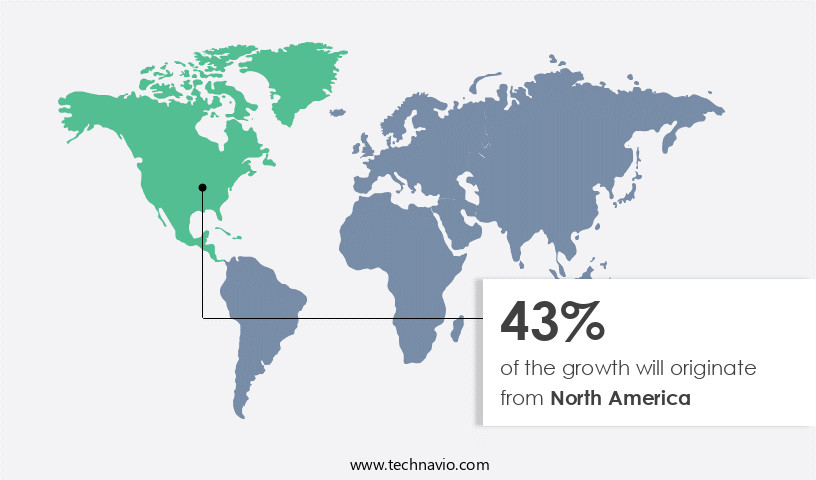

North America is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic insurance industry, North America continues to lead the global market in terms of gross written premiums for insurance policies. This dominance is attributed to the region's robust economy and the increasing adoption of technology-driven innovations. Advanced insurance software solutions are in high demand, with a focus on customer portals, document management, predictive analytics, policy issuance, microservices architecture, broker management, policy lifecycle management, user interface, API integrations, agile development, data analytics, mobile applications, policy administration, actuarial modeling, billing systems, quality assurance, commission management, sales force automation, artificial intelligence, claims management, reporting & analytics, user experience, regulatory reporting, integration APIs, database management, machine learning, data security, cloud computing, data privacy, sales management, premium calculation, agent portals, fraud detection, software testing, claims processing, channel management, workflow automation, renewal management, and risk management.

The region's significant use of the Internet, wireless technologies, and cloud-based services necessitates increased spending on advanced insurance software to maintain competitiveness.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and innovative sector, offering a range of solutions designed to streamline and optimize insurance operations. From policy administration and underwriting to claims processing and risk management, these software solutions leverage advanced technologies like artificial intelligence, machine learning, and blockchain to enhance efficiency and accuracy. Key players in this market prioritize user-friendly interfaces, seamless integration, and robust security features. Additionally, cloud-based platforms enable remote access and real-time data sharing, making insurance software an essential tool for insurers seeking to adapt to the digital age. Other essential features include automated workflows, real-time analytics, and configurable reporting tools. Ultimately, insurance software empowers insurers to deliver superior customer experiences, reduce fraud, and improve overall business performance.

What are the key market drivers leading to the rise in the adoption of Insurance Software Industry?

- In developing countries, the market for insurance is primarily driven by increasing government regulations mandating insurance coverage. These regulations serve to expand the scope and reach of insurance services, making them a necessary requirement for various sectors and populations. This regulatory push is a significant factor fueling market growth in these regions.

- In the global insurance industry, technology plays a pivotal role in streamlining operations and enhancing customer experience. Insurance software solutions have gained significant traction due to their ability to offer advanced functionalities such as data analytics, policy administration, actuarial modeling, billing systems, commission management, sales force automation, claims management, and artificial intelligence. These solutions enable insurers to gain valuable insights from data, improve underwriting accuracy, and provide personalized offerings to customers. Moreover, mobile applications have become an integral part of the insurance value chain, offering convenience and accessibility to policyholders. Quality assurance (QA) processes ensure the reliability and accuracy of these systems, while AI and machine learning algorithms facilitate automation and fraud detection.

- The market is driven by the need for digital transformation, increasing competition, and evolving customer expectations. The market is expected to grow steadily, with a focus on innovation and integration of emerging technologies such as blockchain, IoT, and cloud computing. Policy administration systems form the backbone of insurance operations, managing the entire policy lifecycle from quoting to issuance, renewal, and cancellation. Actuarial modeling helps insurers assess risk and price policies accurately, while billing systems ensure timely and accurate invoicing and payment processing. Commission management solutions streamline the commission calculation and distribution process, while sales force automation enables insurers to manage their sales teams more effectively.

- Claims management solutions facilitate faster and more efficient processing of claims, improving customer satisfaction and reducing operational costs. In summary, insurance software solutions are transforming the insurance industry by offering advanced functionalities, improving operational efficiency, and enhancing customer experience. The market is expected to continue growing, driven by the need for digital transformation, increasing competition, and evolving customer expectations.

What are the market trends shaping the Insurance Software Industry?

- The integration of wearable technology into customer engagement metrics is a significant market trend in the life insurance industry. Wearables provide real-time health data, enabling insurers to offer personalized policies and enhance customer experience.

- The market is experiencing significant growth due to the integration of advanced technologies such as reporting & analytics, user experience (UX), regulatory reporting, integration APIs, database management, machine learning (ML), data security, cloud computing, data privacy, sales management, and more. These technologies are revolutionizing the industry by enabling insurers to make data-driven decisions, improve customer engagement, and streamline operations. Reporting & analytics and ML are key drivers in the market, providing insurers with valuable insights into consumer behavior and risk assessment. Wearable technology, specifically sensor-based wearables, is redefining customer engagement methods and processes for life insurers.

- Real-time consumer data from these devices offers immense opportunities for insurers to tailor their services and products to individual customers, maximizing profits while minimizing risks. Integration APIs and cloud computing facilitate seamless data sharing and access, while database management ensures data security and privacy. User experience (UX) design prioritizes ease of use and immersive, harmonious interfaces, enhancing customer satisfaction. Regulatory reporting requirements are met efficiently through automated systems, reducing compliance costs and ensuring regulatory compliance. In summary, the market is undergoing a digital transformation, driven by advanced technologies and a focus on customer-centric solutions.

- These developments are shaping the future of the industry, offering insurers new opportunities to innovate and grow.

What challenges does the Insurance Software Industry face during its growth?

- The insurance industry faces significant growth constraints due to the increasingly stringent regulatory landscape that players must navigate.

- The market is a critical sector that caters to the needs of insurance companies and agents. Premium calculation, claims processing, renewal management, channel management, risk management, workflow automation, and fraud detection are key functionalities of insurance software. Regulatory bodies, such as the National Association of Insurance Commissioners (NAIC) in the US, play a crucial role in implementing new laws and regulations to ensure industry compliance. One recent development is the Own Risk and Solvency Assessment (ORSA), an internal process that assesses the risk management capabilities of insurer organizations, individuals, or insurance groups. This add-on to the existing assessment framework is mandatory and requires a thorough evaluation of an organization's risk management practices.

- Software testing is essential to ensure the software's accuracy and reliability. It includes various stages such as unit testing, integration testing, system testing, and user acceptance testing. Effective channel management is another crucial aspect, enabling insurers to manage their distribution networks efficiently and engage with agents through agent portals. Workflow automation streamlines processes, reducing manual intervention and errors. Renewal management automation ensures seamless renewal processing, reducing the administrative burden and improving customer satisfaction. Risk management solutions help insurers identify, assess, and mitigate risks, enhancing their overall risk profile. Fraud detection software is an essential component, helping insurers identify and prevent fraudulent activities, thereby minimizing losses.

Exclusive Customer Landscape

The insurance software market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the insurance software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, insurance software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture PLC - Accenture's insurance technology, ALIP, delivers SaaS solutions and digital integration services for life insurance and annuities.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- Acturis Group

- Applied Systems Inc.

- Aptitude Software Group Plc

- Axxis Systems SA

- Dell Technologies Inc.

- Ebix Inc.

- Enlyte

- Guidewire Software Inc.

- Hyland Software Inc.

- International Business Machines Corp.

- Microsoft Corp.

- Oracle Corp.

- Rocket Software Inc.

- Salesforce Inc.

- SAP SE

- Solartis LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Insurance Software Market

- In January 2024, InsureTech innovator, Digital Insurance Group (DIG), announced the launch of its new AI-driven underwriting platform, "RiskSense," designed to streamline underwriting processes for property and casualty insurers. This development marks a significant advancement in the use of artificial intelligence and machine learning in the market (Digital Insurance Group Press Release).

- In March 2024, leading insurance software providers, Sapiens International Corporation and Duck Creek Technologies, announced their strategic partnership to integrate Sapiens' core insurance platform with Duck Creek's digital engagement solutions. This collaboration aims to provide insurers with a comprehensive, end-to-end digital platform, enhancing customer experience and operational efficiency (Sapiens International Corporation Press Release).

- In May 2024, Majesco, a global provider of cloud-native core insurance platforms, raised USD100 million in a Series D funding round led by BlackRock. The investment will support Majesco's continued growth, product development, and expansion into new markets (Majesco Press Release).

- In April 2025, the European Insurance and Occupational Pensions Authority (EIOPA) approved the use of blockchain technology for insurance applications, marking a significant regulatory milestone in the market. This approval paves the way for increased adoption of blockchain technology in insurance operations, improving transparency, security, and efficiency (EIOPA Press Release).

Research Analyst Overview

- In the dynamic market, embedded insurance solutions are gaining traction, enabling businesses to offer insurance coverage directly to their customers. Regulatory compliance remains a top priority, with insurers focusing on core insurance functions and implementing robust data governance practices. Business intelligence (BI) and insurance analytics are key drivers of growth, providing valuable insights for risk assessment and actuarial science. Legacy system modernization and digital transformation are essential for insurance companies and financial institutions to remain competitive. Disaster recovery and high availability are critical components of system architecture, ensuring business continuity. Deployment strategies vary, with some opting for cloud-based solutions, while others prefer on-premises or hybrid models.

- Third-party administrators (TPAs) play a crucial role in managing claims and support services, requiring robust API security and maintenance contracts. Financial reporting and policy automation are essential for efficient operations, while data migration and user roles ensure seamless integration and access control. Open banking and claims adjusters are also shaping the future of the insurance industry, with the potential to streamline processes and improve customer experience. Insurance software solutions must address data visualization, ensuring that stakeholders can easily interpret complex data. Deployment strategies, disaster recovery, and risk assessment are critical components of digital transformation, with insurers and financial institutions investing heavily in these areas.

- Legacy system modernization and API security are also key focus areas, as insurers seek to improve operational efficiency and mitigate risks. Data migration and user roles are essential components of system architecture, ensuring seamless integration and access control. Policy automation and financial reporting are critical for efficient operations, while regulatory compliance and risk assessment are top priorities for insurers and financial institutions. Insurance analytics and BI are driving growth in the market, providing valuable insights for actuarial science and claims adjusters. Insurers and financial institutions are investing heavily in digital transformation, with a focus on modernizing legacy systems and implementing robust API security.

- Disaster recovery and high availability are essential components of system architecture, ensuring business continuity. Policy automation and financial reporting are critical for efficient operations, while regulatory compliance and risk assessment are top priorities. Embedded insurance solutions are gaining popularity, enabling businesses to offer insurance coverage directly to their customers. Data governance and data migration are essential components of digital transformation, with insurers and financial institutions investing heavily in these areas. Insurance analytics and BI are driving growth in the market, providing valuable insights for actuarial science and claims adjusters. The market is witnessing significant growth, with a focus on digital transformation and regulatory compliance.

- Embedded insurance solutions are enabling businesses to offer insurance coverage directly to their customers, while data governance and data migration are essential components of modernization efforts. Insurance analytics and BI are driving growth, providing valuable insights for risk assessment and actuarial science. Legacy system modernization and digital transformation are critical components of the market, with a focus on regulatory compliance and risk assessment. Embedded insurance solutions are enabling businesses to offer insurance coverage directly to their customers, while insurers and financial institutions invest in data governance and migration. Insurance analytics and BI are driving growth, providing valuable insights for actuarial science and claims adjusters.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Insurance Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

224 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.3% |

|

Market growth 2025-2029 |

USD 9874.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.7 |

|

Key countries |

US, China, Canada, UK, Japan, Germany, India, South Korea, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Insurance Software Market Research and Growth Report?

- CAGR of the Insurance Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the insurance software market growth of industry companies

We can help! Our analysts can customize this insurance software market research report to meet your requirements.