Interventional Oncology Market Size 2025-2029

The interventional oncology market size is valued to increase USD 1.66 billion, at a CAGR of 9% from 2024 to 2029. The increase prevalence of cancer will drive the interventional oncology market.

Major Market Trends & Insights

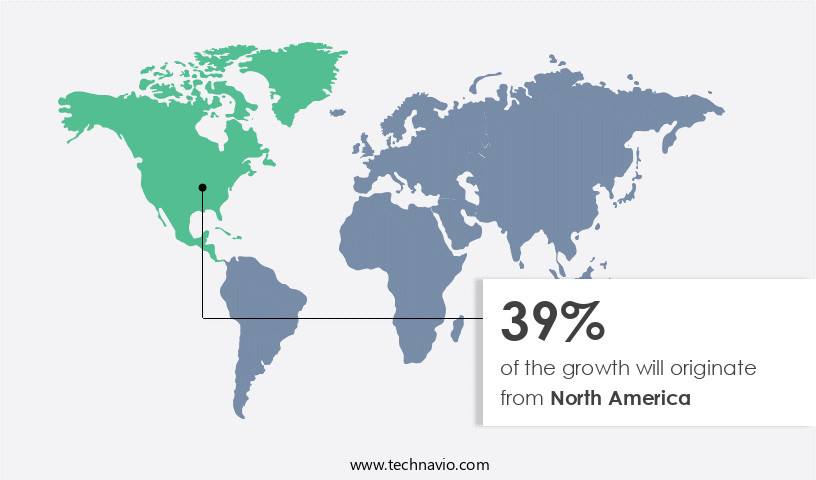

- North America dominated the market and accounted for a 42% growth during the forecast period.

- By End-user - Hospitals and diagnostic centers segment was valued at USD 1.88 billion in 2023

- By Product - Particle embolization segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 91.12 million

- Market Future Opportunities: USD 1,663.40 million

- CAGR : 9%

- North America: Largest market in 2023

Market Summary

- The market represents a dynamic and evolving landscape, driven by advancements in core technologies and applications, such as Minimally Invasive Surgery (MIS) and image-guided procedures. This market encompasses various service types, including diagnostic and therapeutic interventions, and product categories, like catheters, imaging systems, and therapeutic devices. Regulatory frameworks and guidelines, such as the U.S. Food and Drug Administration (FDA), play a crucial role in shaping market growth. Despite the growing focus on the adoption of MWA (Microwave Ablation) and other minimally invasive techniques, the high cost of interventional oncology procedures remains a significant challenge. However, the market continues to unfold with opportunities, particularly in emerging regions like Asia Pacific, where the prevalence of cancer is on the rise.

- According to a recent study, the market is projected to account for approximately 20% of the overall oncology market by 2026, underscoring its increasing significance in cancer care. Related markets such as radiology and diagnostic imaging also contribute to the broader context of interventional oncology.

What will be the Size of the Interventional Oncology Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Interventional Oncology Market Segmented and what are the key trends of market segmentation?

The interventional oncology industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Hospitals and diagnostic centers

- Ambulatory surgery centers

- Research and academic institutes

- Product

- Particle embolization

- Ablation

- Support devices

- Disease Type

- Liver cancer

- Lung cancer

- Kidney cancer

- Bone metastases

- Others

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

The hospitals and diagnostic centers segment is estimated to witness significant growth during the forecast period.

Interventional oncology is a dynamic and evolving market, with hospitals and diagnostic centers playing pivotal roles in its growth. Hospitals serve as the primary healthcare facilities, hosting advanced interventional radiology wards and multidisciplinary teams. These teams offer a range of minimally invasive procedures, such as image-guided biopsies, radiofrequency ablation, laser ablation, and embolization techniques. Hospitals are also the hub for clinical trials and research, driving the development of innovative oncology treatments. Diagnostic centers are instrumental in early cancer detection and accurate diagnosis. Technologies like CT, MRI, and PET scans are widely used to identify and characterize tumors.

Early detection is crucial for timely treatment and enhancing patient survival. In terms of treatment response and procedural efficiency, minimally invasive procedures like image-guided surgery, catheter navigation, and microwave ablation have gained significant traction. These procedures offer improved quality of life for patients and reduced adverse events compared to traditional open surgeries. Radiation therapy, including stereotactic body radiotherapy and interstitial brachytherapy, is another essential component of interventional oncology. Targeted drug delivery systems, such as drug-eluting beads, have shown promising results in enhancing treatment effectiveness. High-intensity focused ultrasound and thermal ablation are other emerging treatment modalities that are gaining popularity due to their precision and minimal invasiveness.

The Hospitals and diagnostic centers segment was valued at USD 1.88 billion in 2019 and showed a gradual increase during the forecast period.

The market is expected to witness substantial growth in the coming years. According to recent studies, the market for image-guided surgery is projected to expand by 18%, while the market for minimally invasive procedures is anticipated to grow by 15%. The adoption of targeted therapy and precision oncology is also expected to fuel market growth, with a projected increase of 12% and 14%, respectively. These trends underscore the continuous unfolding of market activities and the evolving patterns in interventional oncology.

Regional Analysis

North America is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Interventional Oncology Market Demand is Rising in North America Request Free Sample

The market in North America, primarily driven by the United States and Canada, continues to dominate the global landscape, generating substantial revenue. In 2024, the market was valued at approximately USD 2.68 billion, with North America accounting for a significant share. Factors fueling growth include the increasing adoption of minimally invasive procedures and advancements in interventional oncology techniques, such as radiofrequency ablation (RFA), transarterial chemoembolization (TACE), and cryoablation.

The rising prevalence of cancer cases in the region further boosts demand for these innovative treatment options. By 2024, the market is projected to experience significant expansion due to the growing focus on early cancer detection and the development of new technologies.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing adoption of minimally invasive techniques for the treatment of various types of cancer. One such technique, radiofrequency ablation (RFA), is gaining popularity in the treatment of bone metastases and liver cancer. According to a study, RFA for liver cancer has shown a five-year survival rate of up to 70%, comparable to surgical resection. Another minimally invasive technique, image-guided biopsy, is increasingly being used for the diagnosis of lung nodules, reducing the need for invasive surgical procedures. In the field of pancreatic cancer, targeted drug delivery using yttrium-90 microspheres has shown promising results, with clinical trials demonstrating a 12-month survival rate of 40%.

Chemoembolization, a common interventional oncology procedure for hepatocellular carcinoma, has a complication rate of approximately 10-20%, according to a study. However, minimally invasive surgery safety protocols and advancements in catheter navigation are helping to mitigate these risks. Thermal ablation techniques, including cryoablation for renal cell carcinoma and high-intensity focused ultrasound for prostate cancer, have shown high efficacy rates. Long-term survival after radioembolization for liver cancer has been reported to be as high as 60%, according to a study. Stereotactic body radiotherapy (SBRT) for lung cancer and interstitial brachytherapy for head and neck cancers are other interventional oncology treatments gaining traction.

However, radiation dose optimization in brachytherapy is a key challenge, as high doses can lead to side effects. The development of new ablation devices and treatment planning software advancements are driving innovation in the market. For instance, a recent study reported a 95% success rate for a new ablation device in treating liver tumors. Clinical trial results of new therapies, such as immunotherapies and gene therapies, are also contributing to market growth. Compared to traditional cancer treatments, interventional oncology procedures offer several advantages, including reduced recovery time, lower risk of complications, and improved patient outcomes.

For instance, a study found that patients undergoing RFA for liver cancer had a shorter hospital stay and faster recovery time compared to those undergoing surgical resection.

What are the key market drivers leading to the rise in the adoption of Interventional Oncology Industry?

- The prevalence of cancer serves as the primary driver for market growth in this industry.

- Cancer continues to pose a significant global health concern, with the number of new cases worldwide remaining substantial in 2024. Prevalent types include lung, liver, stomach, colorectal, breast, and esophageal cancers. In India, for instance, over 1.5 million new cases are projected this year, with breast and oral cancers being the most common among women and men, respectively. Underlying factors contributing to the escalating cancer burden include lifestyle modifications, unhealthy diets, smoking, decreased pregnancies, and prolonged UV exposure. These factors are notably associated with breast, lung, and colorectal cancers.

What are the market trends shaping the Interventional Oncology Industry?

- The increasing emphasis on the implementation of the Mobile Application Development using Material Design (MAD) approach is a notable market trend. This adoption is becoming increasingly mandatory in the industry.

- The Minimally Invasive Wafer Ablation (MWA) market has gained significant traction due to its numerous advantages over traditional procedures. MWA offers a flexible approach to treating various cancers, including Hepatocellular Carcinoma (HCC), with a procedure time ranging from 5 to 10 minutes. This efficiency, coupled with enhanced efficacy and reduced complications, has led to a surge in adoption rates. The market's growth is particularly pronounced in the treatment of liver and lung cancers, driven by the increasing need for effective therapeutic solutions.

- Companies are actively investing in the development of innovative MWA devices to cater to this burgeoning demand. For example, MedWaves Inc. Is one such organization focusing on advancing MWA technology. The adoption of MWA devices is poised to redefine cancer treatment, offering patients faster recovery times and improved outcomes.

What challenges does the Interventional Oncology Industry face during its growth?

- The exorbitant costs associated with interventional oncology procedures pose a significant challenge and hinder the growth of the industry.

- The liver cancer treatment market is marked by significant financial challenges, with the high costs of advanced procedures like radioembolization and microwave ablation (MWA) acting as major growth inhibitors. While TACE procedures cost approximately USD 17,000, radioembolization and MWA can exceed USD 31,000. These costs primarily stem from intraprocedural labor and the complexity of the treatments. MWA costs vary depending on patient-specific factors, such as tissue size and location, which impact the number of probes needed and overall procedure cost. Additional expenses, including surgeon fees, operating room costs, and post-surgical staffing, further increase financial burdens.

- Consequently, patients often opt for more affordable alternatives, despite the superior efficacy of these advanced treatments. This ongoing financial challenge underscores the need for cost reduction strategies and potential advancements in treatment technologies to make these procedures more accessible to a broader patient population.

Exclusive Customer Landscape

The interventional oncology market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the interventional oncology market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Interventional Oncology Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, interventional oncology market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AngioDynamics Inc. - The NanoKnife 3.0 System from an unnamed research analyst's perspective is a groundbreaking interventional oncology solution.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AngioDynamics Inc.

- Becton Dickinson and Co.

- Boston Scientific Corp.

- Cook Group Inc.

- Elekta AB

- HealthTronics Inc.

- Hologic Inc.

- IceCure Medical Ltd.

- INSIGHTEC Ltd.

- Johnson and Johnson

- Medtronic Plc

- MedWaves Inc.

- Merit Medical Systems Inc.

- Mermaid Medical Group

- Profound Medical Corp.

- Quantum Surgical SAS

- Siemens AG

- Sirtex Medical Pty Ltd.

- Teleflex Inc.

- Terumo Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Interventional Oncology Market

- In January 2024, Merit Medical Systems, a leading medical device manufacturer, announced the FDA approval of its Nexus Tumor Ablation System for the treatment of soft tissue sarcoma and primary liver cancer. This approval marked a significant expansion of Merit Medical's interventional oncology portfolio (Merit Medical Systems Press Release, 2024).

- In March 2024, Boston Scientific and Philips entered into a strategic collaboration to integrate Philips' Blueвенe CT imaging technology with Boston Scientific's interventional oncology systems. This partnership aimed to enhance real-time imaging capabilities during minimally invasive procedures (Boston Scientific Press Release, 2024).

- In May 2024, Medtronic completed the acquisition of Insightec, a leader in MR-guided focused ultrasound therapy for the treatment of various conditions, including uterine fibroids and liver tumors. This acquisition strengthened Medtronic's interventional oncology offerings and expanded its presence in the therapeutic ultrasound market (Medtronic Press Release, 2024).

- In April 2025, Intuitive Surgical received FDA approval for the expansion of its da Vinci Xi Surgical System's indications to include interventional oncology procedures. This approval enabled the system to be used for a broader range of minimally invasive cancer treatments (Intuitive Surgical Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Interventional Oncology Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

226 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9% |

|

Market growth 2025-2029 |

USD 1663.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Key countries |

US, UK, Canada, China, Germany, Japan, India, France, South Korea, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of interventional oncology, various innovative techniques and technologies continue to shape the treatment landscape. Treatment planning plays a crucial role in ensuring optimal patient outcomes, with procedural complications a constant concern. Two prominent minimally invasive procedures gaining traction are radiofrequency ablation and laser ablation, which offer improved procedural efficiency and reduced adverse events compared to traditional surgical interventions. Oncology imaging plays an essential role in the accurate identification and localization of tumors, enabling targeted therapy and improving treatment response. Radiation therapy, a cornerstone of cancer treatment, has seen advancements in precision with the adoption of stereotactic body radiotherapy and interstitial brachytherapy.

- Drainage procedures, embolization techniques, and thermal ablation are other interventional oncology methods contributing to enhanced patient survival. Device technologies, such as image-guided surgery and catheter navigation, have revolutionized the field by enabling real-time visualization and precise delivery of therapies. Targeted drug delivery, using drug-eluting beads and microwave ablation, offers enhanced treatment efficacy and reduced side effects. High-intensity focused ultrasound and tumor ablation are additional minimally invasive techniques demonstrating promising clinical outcomes. Quality of life and procedural efficiency are critical factors driving the adoption of these interventional oncology methods. Precision oncology, with its focus on individualized treatment plans, is a growing trend in the field.

- Despite these advancements, ongoing research and innovation are necessary to address adverse events and improve patient outcomes. In the realm of radiation therapy, advances in radiation safety and vascular access have led to increased patient safety and improved treatment efficacy. Targeted therapy, with its ability to deliver therapies directly to tumors, is a promising area of research. Adverse events remain a concern, necessitating ongoing research and development to minimize their impact on patients. In summary, the market is characterized by continuous innovation and evolution, with a focus on improving patient outcomes, reducing procedural complications, and enhancing treatment efficiency.

- The integration of advanced technologies, such as imaging and targeted drug delivery, is driving the growth and development of this dynamic field.

What are the Key Data Covered in this Interventional Oncology Market Research and Growth Report?

-

What is the expected growth of the Interventional Oncology Market between 2025 and 2029?

-

USD 1.66 billion, at a CAGR of 9%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (Hospitals and diagnostic centers, Ambulatory surgery centers, and Research and academic institutes), Product (Particle embolization, Ablation, and Support devices), Disease Type (Liver cancer, Lung cancer, Kidney cancer, Bone metastases, and Others), and Geography (North America, Europe, Asia, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Increase prevalence of cancer, High cost of interventional oncology procedures

-

-

Who are the major players in the Interventional Oncology Market?

-

Key Companies AngioDynamics Inc., Becton Dickinson and Co., Boston Scientific Corp., Cook Group Inc., Elekta AB, HealthTronics Inc., Hologic Inc., IceCure Medical Ltd., INSIGHTEC Ltd., Johnson and Johnson, Medtronic Plc, MedWaves Inc., Merit Medical Systems Inc., Mermaid Medical Group, Profound Medical Corp., Quantum Surgical SAS, Siemens AG, Sirtex Medical Pty Ltd., Teleflex Inc., and Terumo Corp.

-

Market Research Insights

- The market encompasses a range of minimally invasive surgical techniques and technologies, including treatment optimization in interventional radiology. This sector continues to evolve, with a growing emphasis on data acquisition and intraoperative monitoring during procedures. For instance, image fusion and clinical workflow improvements have reduced recovery time and enhanced procedure safety. However, device safety remains a critical consideration, with patient selection, treatment guidelines, and regulatory approval key factors in minimizing complication rates. Ablation efficacy and procedure safety are also crucial performance indicators, with real-time imaging and patient selection criteria essential for optimal treatment outcomes.

- Device innovation continues to drive advancements in this field, with ongoing research focusing on tumor localization, outcome prediction, and treatment algorithm development. Clinical trials are underway to evaluate the effectiveness and safety of various oncology devices, contributing to the standardization and refinement of interventional oncology procedures.

We can help! Our analysts can customize this interventional oncology market research report to meet your requirements.