IoT Platform Market Size 2024-2028

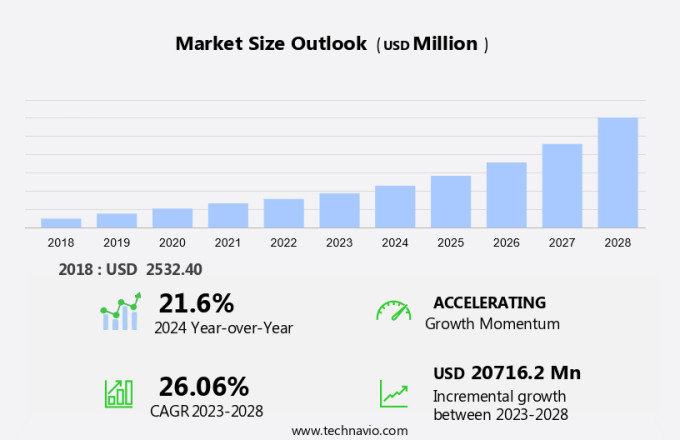

The iot platform market size is forecast to increase by USD 20.72 billion, at a CAGR of 26.06% between 2023 and 2028.

- The Internet of Things (IoT) platform market is experiencing significant growth, driven by the large-scale benefits of using IoT devices in various industries. The integration of IoT technology is revolutionizing business operations, enabling real-time data collection, analysis, and automation. This leads to increased efficiency, cost savings, and improved customer experiences. However, the market faces challenges as well. The development of open Wi-Fi networks, while beneficial for connectivity, also poses security risks. Ensuring data privacy and security is becoming increasingly important as more devices become connected.

- Additionally, the complexity of managing and integrating multiple IoT devices and platforms can be a significant challenge for organizations. Addressing these challenges requires a strategic approach, including robust security measures and effective device management solutions. Companies seeking to capitalize on the opportunities presented by the market must focus on delivering secure, user-friendly, and scalable solutions to meet the evolving needs of their customers.

What will be the Size of the IoT Platform Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The Internet of Things (IoT) platform market continues to evolve, driven by the increasing deployment of wireless sensors and the adoption of open-source platforms. The integration of application programming interfaces (APIs) and system architecture designs into the software development lifecycle facilitates seamless network bandwidth optimization and real-time data streaming. Proprietary platform solutions offer advanced features, while low-power wide-area networks ensure power consumption metrics are maintained. Data storage infrastructure and data analytics pipelines are crucial components, requiring data aggregation protocols and cross-platform compatibility for effective data integration strategies. Cloud platform integration and IoT device authentication are essential for secure data handling.

Predictive maintenance models and firmware updates processes rely on data visualization dashboards and machine learning algorithms for efficient analysis. Network latency reduction and sensor network topology optimization are ongoing efforts to enhance system performance. Hardware compatibility issues persist, necessitating edge computing gateways and device provisioning processes. Security protocols implementation and data governance frameworks are crucial for safeguarding sensitive information. Remote device management and monitoring systems enable real-time system scalability testing and data encryption techniques for enhanced security. APIs and network connectivity standards continue to evolve, ensuring continuous integration and improvement in the IoT ecosystem. The market's dynamics remain fluid, with ongoing innovation and development shaping its future applications across various sectors.

How is this IoT Platform Industry segmented?

The iot platform industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Manufacturing

- Retail

- Healthcare

- ICT

- Others

- Deployment

- Public cloud

- Private cloud

- Hybrid

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

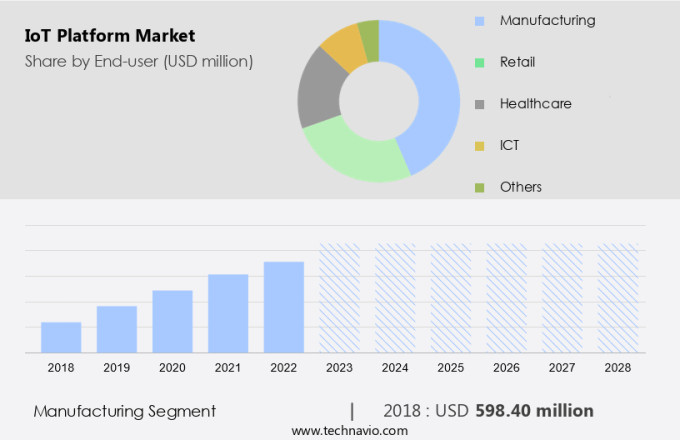

The manufacturing segment is estimated to witness significant growth during the forecast period.

In the IoT market, device interoperability and cross-platform compatibility are crucial for seamless integration of various machines and devices into the Internet of Things ecosystem. Data storage infrastructure and analytics pipelines enable businesses to derive valuable insights from the massive data generated by these connected devices. Power consumption metrics and firmware updates are essential considerations for managing the energy efficiency and maintenance of IoT devices. Predictive maintenance models and real-time data streaming help optimize operations and improve productivity. Manufacturing segments are increasingly adopting IoT technology for inventory management and performance optimization. However, challenges such as heavy investments, security concerns, lack of standardization, and interoperability issues persist.

Open-source platform adoption and API connectivity standards facilitate collaboration and ease of integration. Data visualization dashboards and edge computing gateways provide actionable insights for businesses. Network bandwidth optimization and low-power wide-area networks are essential for efficient data transmission and extended battery life of IoT devices. Cloud platform integration and data governance frameworks ensure secure data access and management. IoT device authentication and security protocols implementation are vital for safeguarding data and maintaining privacy. Network latency reduction and sensor network topology optimization are essential for real-time data processing and analysis. Hardware compatibility issues and system scalability testing are ongoing challenges for IoT device manufacturers.

Machine learning algorithms and remote device management systems enable predictive maintenance and proactive troubleshooting. Data integration strategies and system architecture design are essential for seamless data flow and efficient processing. Overall, the IoT market is evolving rapidly, with a focus on improving interoperability, security, and efficiency.

The Manufacturing segment was valued at USD 598.40 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

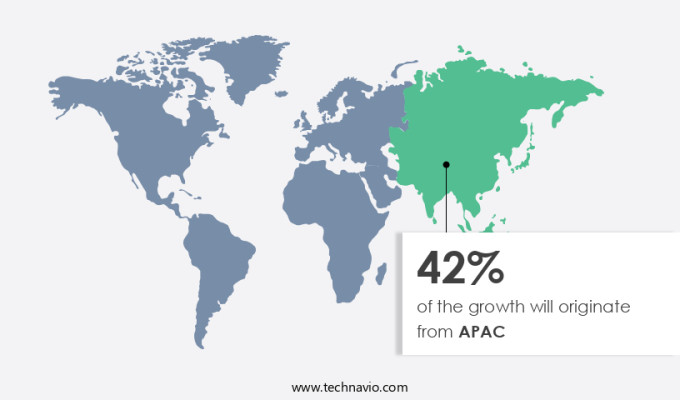

APAC is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth, fueled by the expanding industrial, automotive, and healthcare sectors. These industries are adopting IoT solutions to enhance operational efficiency and gain a competitive edge. The federal government's legislation, including the Affordable Care Act and the HITECH Act, is accelerating the adoption of advanced technologies such as telehealth, mHealth, and nanomedicine, to improve patient care. The region's IoT market growth is further propelled by the expansion of mobile network infrastructure and the increasing adoption of cloud computing. IoT devices require substantial data storage infrastructure and analytics pipelines to process and analyze data in real-time.

Cross-platform compatibility and data visualization dashboards enable seamless data aggregation and integration with various systems. Power consumption metrics and predictive maintenance models are crucial for managing IoT devices' performance and longevity. Firmware updates and data security are essential considerations for IoT platform providers. Open-source platforms and application programming interfaces offer flexibility and customization, while system architecture design and software development lifecycle ensure scalability and reliability. Network bandwidth optimization and low-power wide-area networks are essential for efficient data transmission and reducing power consumption. Device provisioning and authentication processes ensure secure connectivity and data privacy. Security protocols implementation and network latency reduction are critical for maintaining system performance and reliability.

Sensor network topology, hardware compatibility issues, and edge computing gateways are essential considerations for IoT platform design. Data governance frameworks, remote device management, and remote monitoring systems enable real-time data streaming and machine learning algorithms for actionable insights. System scalability testing, data encryption techniques, and api connectivity standards ensure platform reliability and security.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of IoT Platform Industry?

- The significant advantages derived from large-scale IoT device implementation serve as the primary catalyst fueling market growth.

- The Internet of Things (IoT) market is experiencing significant growth due to the increasing adoption of connected devices across various industries. According to recent estimates, over 35 billion devices are expected to be part of this interconnected ecosystem in 2021. IoT devices collect data from sensors and actuators in real-time, transmitting it to a centralized location for analysis. This data enables informed decision-making and drives operational efficiency. Device interoperability and cross-platform compatibility are crucial considerations for organizations implementing IoT solutions. Data storage infrastructure, data analytics pipelines, and data visualization dashboards are essential components of an effective IoT strategy. Power consumption metrics and predictive maintenance models are also vital for optimizing device performance and reducing downtime.

- Firmware updates and data aggregation protocols are essential for maintaining the security and reliability of IoT devices. The IoT landscape integrates various technologies, including data communication, data storage, hardware design, and data mining. Its advantages, such as real-time data processing, improved efficiency, and enhanced productivity, make it a trending topic in the global technology arena.

What are the market trends shaping the IoT Platform Industry?

- Open Wi-Fi network development is gaining significant traction in the current market. This trend reflects the increasing demand for accessible and convenient wireless connectivity solutions.

- The Internet of Things (IoT) market is experiencing significant growth, driven by the deployment of wireless sensors and open-source platform adoption. This technological shift is leading to an increase in real-time data streaming and network bandwidth optimization. System architecture design and software development lifecycle are crucial aspects of IoT, with application programming interfaces (APIs) playing a vital role in facilitating seamless communication between various components. Proprietary platform solutions are also gaining traction due to their ability to offer customized features and enhanced security. The use of low-power wide-area networks (LPWANs) is becoming increasingly popular for IoT applications, as they enable long-range connectivity with minimal power consumption.

- These advancements are contributing to the expansion of the IoT market, with applications spanning various industries and sectors. Network connectivity is a key challenge in the IoT landscape, with the need for reliable and efficient communication between devices and the cloud. The adoption of open-source platforms and the development of APIs are helping to address this issue, allowing for interoperability and easier integration of new devices and services. In conclusion, the IoT market is witnessing dynamic growth, driven by the deployment of wireless sensors, open-source platform adoption, and the use of LPWANs. System architecture design and software development lifecycle are essential components of IoT, with APIs playing a crucial role in facilitating seamless communication between various components.

- The market's continued expansion is expected to bring about numerous opportunities and challenges, requiring a collaborative effort from industry players, researchers, and policymakers.

What challenges does the IoT Platform Industry face during its growth?

- The escalating concerns over privacy and security represent a significant challenge to the expansion of various industries.

- The Internet of Things (IoT) market faces significant challenges in ensuring security for device provisioning and data integration. IoT devices require secure authentication and implementation of robust security protocols to prevent cyberattacks. Network latency reduction and optimizing sensor network topology are also crucial to maintain seamless communication between devices. Hardware compatibility issues can hinder the integration of various devices into a unified cloud platform. Edge computing gateways offer a solution by processing data locally before sending it to the cloud, reducing the amount of data transmitted and improving overall system performance.

- Security remains a major concern for both consumers and enterprises, as hacking IoT devices can result in serious consequences, such as blackouts or exposure of sensitive information. Ensuring secure device provisioning and data integration strategies, along with the implementation of advanced security protocols, is essential to build consumer trust and drive market growth.

Exclusive Customer Landscape

The iot platform market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the iot platform market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, iot platform market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture Plc - The Accenture Insights Platform is a leading Internet of Things (IoT) solution that enables businesses to analyze and optimize their connected devices and operations in real-time.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture Plc

- Alphabet Inc.

- Amazon.com Inc.

- AT and T Inc.

- Axiros GmbH

- Cisco Systems Inc.

- Davra

- Echelon Solutions Group

- General Electric Co.

- Huawei Technologies Co. Ltd.

- Intel Corp.

- International Business Machines Corp.

- Microsoft Corp.

- Nokia Corp.

- PTC Inc.

- Salesforce Inc.

- Samsung Electronics Co. Ltd.

- SAP SE

- Siemens AG

- Wipro Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in IoT Platform Market

- In January 2024, IBM announced the acquisition of Sigfox's IoT services business, expanding its footprint in the low-power, wide-area network (LPWAN) segment (IBM Press Release).

- In March 2024, Microsoft and Amazon Web Services (AWS) formed a strategic partnership, allowing seamless integration of their respective IoT platforms, Azure IoT and AWS IoT, to cater to enterprise customers (Microsoft Blog).

- In April 2024, Siemens and Google Cloud entered into a collaboration to develop an IoT operating system, MindSphere Edge, aimed at enhancing industrial IoT applications with edge computing capabilities (Siemens Press Release).

- In May 2025, PTC secured a strategic investment of USD500 million from Koch Industries, further strengthening its position in the market (PTC Press Release). These developments underscore the ongoing consolidation, strategic partnerships, and investment in the market, driving innovation and growth.

Research Analyst Overview

- The Internet of Things (IoT) platform market is experiencing dynamic growth, driven by the increasing adoption of RESTful API services for seamless data exchange between devices and applications. Data quality assessment is paramount, with network security measures and data privacy compliance ensuring the protection of sensitive information. Predictive analytics deployment and system uptime monitoring enable proactive problem-solving, while MQTT protocol support and alerting and notification systems facilitate real-time communication. User interface design plays a crucial role in ensuring user-friendly experiences, with statistical data analysis and actuator control systems enabling data-driven decision making. Scalability architecture, sensor data processing, and websocket communication optimize system performance, reducing cloud infrastructure costs.

- Time series forecasting, hardware lifecycle management, and decision support systems further enhance operational efficiency. Security vulnerability testing, regression modeling techniques, software version control, clustering algorithms application, anomaly detection methods, and data modeling techniques are essential components of robust IoT platform solutions. System performance tuning and CoAP protocol usage ensure optimal network communication, enabling businesses to harness the full potential of IoT technologies.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled IoT Platform Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 26.06% |

|

Market growth 2024-2028 |

USD 20716.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

21.6 |

|

Key countries |

US, China, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this IoT Platform Market Research and Growth Report?

- CAGR of the IoT Platform industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the iot platform market growth of industry companies

We can help! Our analysts can customize this iot platform market research report to meet your requirements.