Isostearic Acid Market Size 2024-2028

The isostearic acid market size is forecast to increase by USD 120.28 million at a CAGR of 7.06% between 2023 and 2028. Isostearic acid, a type of chemical ester, is gaining significant traction in various industries, particularly in the cosmetics and personal care sector. The increasing use of isostearic acid derivatives such as Isostearyl Isostearate and Isopropyl Isostearate in hair care and skincare products is driving the market growth. Additionally, the rising demand for bio-based products aligns with the production of isostearic acid from renewable sources, further boosting market expansion. However, concerns regarding the production and utilization of isostearic acid, including its potential environmental impact and safety concerns, may pose challenges to market growth. The cosmetics industry's reliance on isostearic acid in sin-protection creams, lipsticks, and other skin care applications underscores its importance as a key ingredient.

Isostearic acid is a type of saturated fatty acid that is gaining popularity in various industries due to its unique properties. This organic compound is a colorless, odorless solid with a melting point of 68-70°C. It is derived from sustainable raw materials, primarily oilseeds such as rapeseed oil, soybean oil, safflower oil, sunflower oil, palm oil, and beef tallow. The cosmetics industry is a significant consumer of isostearic acid. It is used in the production of chemical esters, including isostearyl isostearate and isopropyl isostearate. These esters are essential ingredients in various cosmetic products, such as hair care, skincare, sun-protection creams, and lipsticks.

Additionally, they provide excellent emollient properties, making them ideal for formulating creams and lotions. In the industrial sector, isostearic acid is used in the production of industrial cleaners and coatings. It acts as a thickener and emulsifier in these applications, enhancing the performance and stability of the final product. A stainless steel reactor, operated under controlled water pressure, is used to produce isostearic acid on a large scale. These companies have established a strong foothold in the market due to their commitment to innovation and sustainability.

In addition, isostearic acid is a versatile compound that offers numerous benefits. Its unique properties make it an ideal choice for various applications, from cosmetics to industrial cleaning and coatings. As the global population expands, the demand for sustainable raw materials is increasing, making isostearic acid a valuable commodity in the chemical industry. In conclusion, isostearic acid is a vital organic compound with a wide range of applications in various industries. Its use in cosmetics, industrial cleaners, and coatings is growing due to its excellent emollient properties and sustainability.

Market Segmentation

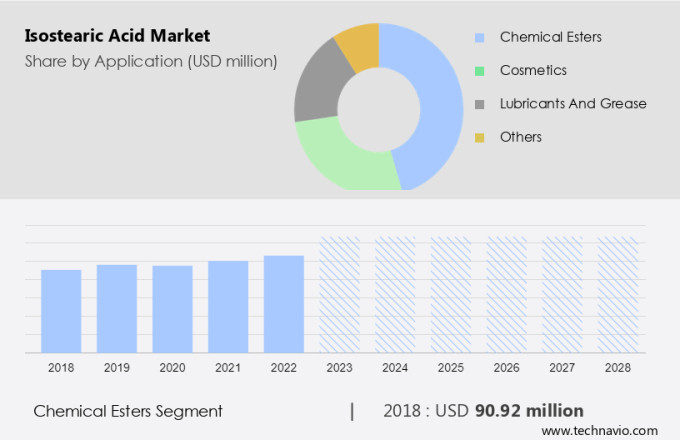

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Chemical esters

- Cosmetics

- Lubricants and grease

- Others

- End-user

- Personal care

- Home care

- Food and beverages

- Others

- Geography

- Europe

- Germany

- UK

- APAC

- China

- Japan

- North America

- US

- Middle East and Africa

- South America

- Europe

By Application Insights

The chemical esters segment is estimated to witness significant growth during the forecast period. Isostearic acid plays a significant role in the cosmetics industry, particularly in the production of cosmetic esters. These esters are essential components of various personal care and cosmetic products, serving functions such as emollients, moisturizers, and texture enhancers in skincare and haircare formulations. The population expansion and the rise in middle-class disposable income have fueled the demand for high-quality cosmetics, leading to an increased use of isostearic acid esters. Isostearic acid-based esters are known for their ability to provide a soft, smooth, and non-greasy feel to the skin. They are effective in enhancing the texture and appearance of cosmetic and skincare products.

Furthermore, these esters act as solvents for various active ingredients and chemicals, ensuring their even distribution and stability within the formulations. In addition, isostearic acid esters offer advantages such as quick absorption rates, low residual amount, and enhanced dispersion. They function as pigment adhesion promoters and plasticizers, making them indispensable in various cosmetic applications. Polyhydric alcohols are often used in combination with isostearic acid esters to improve their performance and versatility. In conclusion, the demand for isostearic acid esters in the cosmetics industry is driven by their unique properties and the increasing consumer preference for high-quality personal care products.

Get a glance at the market share of various segments Request Free Sample

The chemical esters segment was valued at USD 90.92 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

Europe is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Isostearic acid is a valuable commodity in various industries, particularly in Europe, where it finds extensive applications in pigment stabilization, lubricants, and greases. The European market for isostearic acid is projected to expand due to the region's thriving industries, such as cosmetics and personal care. This market growth can be attributed to the emollient properties of isostearic acid, making it a preferred ingredient in skincare products, lipsticks, and hair care formulations. Moreover, the European market's shift towards renewable materials and sustainability is driving the demand for isostearic acid. This acid can be derived from sustainable and renewable sources, making it an attractive alternative to fossil fuel-based materials.

Additionally, the clean beauty movement in Europe, which focuses on the use of eco-friendly ingredients, is further fueling the demand for isostearic acid. Isostearic acid is also widely used in the production of gasoline detergent and monoamide. The automotive industry's increasing focus on reducing emissions and improving fuel efficiency is expected to boost the demand for isostearic acid in the production of gasoline detergent. Additionally, isostearic acid's excellent lubricating properties make it a popular choice in the production of monoamide, which is used in various industrial applications. In conclusion, the European market for isostearic acid is poised for growth due to its diverse applications in various industries, including cosmetics, lubricants, greases, and fuel additives. The region's emphasis on sustainability and renewable materials is further driving the demand for isostearic acid as a viable alternative to fossil fuel-based materials. As a result, the market for isostearic acid in Europe is expected to experience steady growth during the forecast period.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The increasing use of isostearic acid in cosmetics and personal care products is the key driver of the market. Isostearic acid is a valuable ingredient in various industries, including cosmetics, industrial cleaners, and coatings. In the cosmetics sector, this versatile compound plays a crucial role due to its multiple functions. It acts as an emollient, stabilizing agent, and thickener, making it indispensable in the production of a wide array of personal care products. These include lipsticks, foundations, moisturizers, and sunscreens. The cosmetics industry's focus on enhancing appearance, hygiene, and skincare has driven the demand for isostearic acid. Its ability to improve texture, spreadability, and stability in cosmetic formulations is a significant factor in maintaining product quality and consistency.

Manufacturing processes involve the hydrolysis of oleic acid in a stainless steel reactor, followed by esterification to produce isostearic acid. The global market for isostearic acid is expected to grow steadily, driven by the increasing demand for personal care products and the expanding industrial applications of this versatile compound.

Market Trends

The rising demand for bio-based products is the upcoming trend in the market. Isostearic acid, a type of chemical ester, is derived from natural sources such as vegetable oils as an eco-friendly alternative to petrochemical feedstocks. The chemical industry's focus on green chemistry and sustainability principles has fueled growing interest in bio-based products. Isostearic acid derived from natural sources is favored by companies and consumers who prioritize environmental friendliness.

Also, consumers are increasingly aware of the environmental and health implications of the products they use, making bio-based ingredients like isostearic acid popular choices in cosmetics, personal care products, and other applications. Additionally, the demand for sustainable packaging materials has accelerated the use of bio-based products, with isostearic acid serving as a key component in the production of eco-friendly packaging solutions.

Market Challenge

The concerns associated with production and use of isostearic acid is a key challenge affecting the market growth. Isostearic acid is derived from different sources, such as petrochemicals and vegetable oils, including rapeseed oil, soybean oil, safflower oil, sunflower oil, palm oil, and beef tallow. The selection of feedstock raises environmental concerns. The utilization of fossil fuels for production raises carbon emission issues. On the other hand, large-scale monoculture farming for vegetable oils can lead to deforestation and habitat destruction. The production process of isostearic acid is energy-intensive, which can result in significant greenhouse gas emissions if the energy source is non-renewable. Therefore, reducing energy consumption and transitioning to cleaner energy sources is essential for minimizing environmental impact.

Furthermore, chemical reactions during the production of isostearic acid generate hazardous byproducts and waste, which necessitates proper disposal methods. Adhering to sustainable practices and implementing eco-friendly production methods are crucial considerations for the isostearic acid industry.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ATAMAN Kimya AS: The company offers products such as 16 Methylheptadecanoic acid, 16 Methylmargaric acid, and Isooctadecanoic acid.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AVRIL SCA

- BASF SE

- CREMER OLEO GmbH and Co. KG

- Croda International Plc

- DL Chemical

- Emery Oleochemicals Group

- Kokyu Alcohol Kogyo Co. Ltd.

- Kuala Lumpur Kepong Berhad

- Merck KGaA

- Nippon Fine Chemical Co. Ltd.

- Nissan Chemical Corp.

- Santa Cruz Biotechnology Inc.

- SpecialChem S.A.

- SysKem Chemie GmbH

- The Procter and Gamble Co.

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry Co. Ltd.

- Vantage Specialty Chemicals

- Kao Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Isostearic acid, a long-chain saturated fatty acid, is a valuable ingredient in various industries, including cosmetics, industrial cleaners, and coatings. Isostearic acid is used in cosmetics for hair care and skincare applications, such as sin-protection creams, lipsticks, and sun protection creams, due to its enhanced dispersion, quick absorption rates, and low residual amount. In industrial cleaners, it functions as a pigment adhesion promoter and ingredient solubilizer, while in coatings, it acts as a plasticizer and emulsifier.

In conclusion, isostearic acid is derived from various oilseeds, including rapeseed oil, soybean oil, safflower oil, sunflower oil, palm oil, and beef tallow. Its branching structure provides dispersing power, pigment stabilization, and lubrication properties. The increasing population expansion and middle-class disposable income have fueled the demand for isostearic acid in various industries. Additionally, its use in confections as an oil-in-water type emulsifier and in synthetic greases as a lubricant further expands its applications. The shift towards renewable materials and the depletion of fossil fuel reserves has also boosted the demand for isostearic acid as a sustainable alternative to monoamide and other fossil fuel-based chemicals in industries such as gasoline detergent.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.06% |

|

Market growth 2024-2028 |

USD 120.28 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.29 |

|

Regional analysis |

Europe, APAC, North America, Middle East and Africa, and South America |

|

Performing market contribution |

Europe at 34% |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ATAMAN Kimya AS, AVRIL SCA, BASF SE, CREMER OLEO GmbH and Co. KG, Croda International Plc, DL Chemical, Emery Oleochemicals Group, Kokyu Alcohol Kogyo Co. Ltd., Kuala Lumpur Kepong Berhad, Merck KGaA, Nippon Fine Chemical Co. Ltd., Nissan Chemical Corp., Santa Cruz Biotechnology Inc., SpecialChem S.A., SysKem Chemie GmbH, The Procter and Gamble Co., Thermo Fisher Scientific Inc., Tokyo Chemical Industry Co. Ltd., Vantage Specialty Chemicals, and Kao Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch