K-12 Blended E-Learning Market Size 2025-2029

The k-12 blended e-learning market size is forecast to increase by USD 25.73 billion, at a CAGR of 15.2% between 2024 and 2029.

- The market is witnessing significant growth, driven by the increasing need for cost-effective teaching models and the emergence of learning via mobile devices. Schools and educational institutions are increasingly adopting blended e-learning to reduce operational costs and enhance student engagement. This approach combines traditional classroom teaching with digital content and interactive tools, offering flexibility and personalized learning experiences. Moreover, the availability of vast open-source learning content further fuels market growth. Educational institutions can access and utilize a wealth of free digital resources, supplementing their existing curriculum and catering to diverse student needs. However, challenges persist in the form of unequal access to technology and internet connectivity, particularly in underprivileged areas.

- Additionally, ensuring data security and privacy, as well as addressing the digital divide, remain critical issues that require effective solutions to ensure equitable access to quality education. Companies seeking to capitalize on market opportunities should focus on developing innovative, cost-effective, and secure blended e-learning solutions while addressing these challenges to cater to the evolving educational landscape.

What will be the Size of the K-12 Blended E-Learning Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, integrating various components to enhance educational experiences. Virtual classrooms, interactive simulations, and cloud-based solutions facilitate curriculum development and alignment. Collaborative learning tools and teacher resources enable effective instruction, while homework platforms and interactive whiteboards support student engagement. Personalized learning and video conferencing bridge the gap between K-12 education and higher education. Usability testing and student performance analytics ensure optimal learning outcomes. Implementation strategies, gamified learning, and privacy compliance address the unique needs of secondary education and special education. Data security and training and development programs ensure the effective use of digital curriculum. Technical support, software updates, and accessibility features maintain the functionality of blended learning platforms.

On-premise solutions and educational software cater to diverse technology infrastructure requirements. Assessment tools and simulation software provide valuable insights into student progress. Online tutoring, educational games, and student success initiatives foster engagement and promote academic achievement. Hybrid solutions and mobile learning cater to the evolving needs of modern education. Adaptive learning technologies and hardware requirements adapt to the individual learning styles of students. Bandwidth requirements and deployment models ensure seamless integration into various educational settings. Standards-based education and e-learning content creation maintain the focus on academic excellence.

How is this K-12 Blended E-Learning Industry segmented?

The k-12 blended e-learning industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Hardware

- Content

- Solutions

- Others

- Application

- Pre-primary school

- Primary school

- Middle school

- High school

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

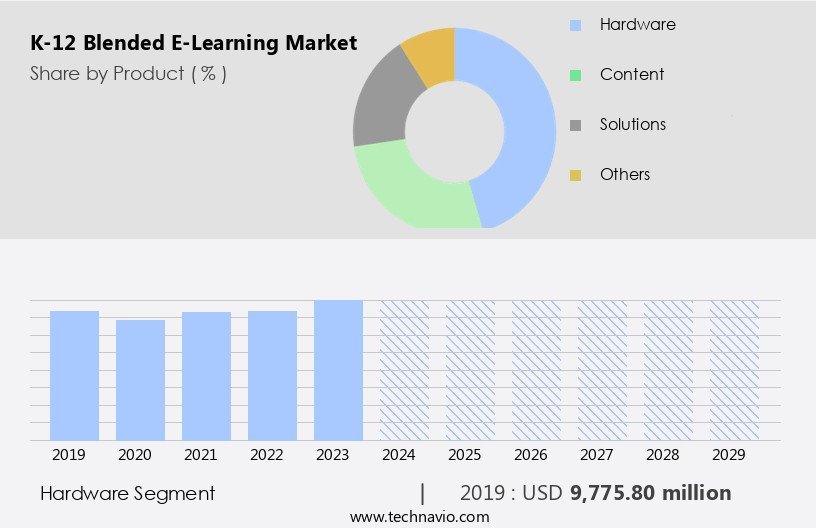

By Product Insights

The hardware segment is estimated to witness significant growth during the forecast period.

In the realm of K-12 education, the integration of technology has transformed traditional classroom learning into a more engaging and effective experience through blended e-learning. This approach combines virtual classrooms, interactive simulations, curriculum development, and cloud-based solutions to foster collaborative learning. Interactive whiteboards and personalized learning tools, such as video conferencing and homework platforms, enable real-time interaction and customized instruction. Professional development for teachers is crucial in this digital landscape, ensuring they are adequately trained to use these tools and resources effectively. Gamified learning and adaptive technologies cater to diverse learning styles and abilities, while privacy compliance and data security maintain student information protection.

Hardware requirements include laptops, tablets, and interactive whiteboards, with companies like Samsung, Educomp Solutions, and Accelerate Learning providing content for these devices. Schools must consider the quality, price, and reliability of hardware, along with service and replacement plans. Blended learning platforms, on-premise solutions, and educational software facilitate digital literacy and standards-based education. Simulation software, assessment tools, and support services ensure effective implementation and student engagement. Hybrid solutions and mobile learning cater to various deployment models and accessibility needs. In the higher education sector, blended learning has also gained traction, with e-learning content creation and online courses offering flexibility and convenience.

Teacher training programs, online tutoring, and educational games further enhance the learning experience. The technology infrastructure's evolution in K-12 education necessitates careful consideration of bandwidth requirements and implementation strategies. Accessibility features, such as closed captioning and screen readers, ensure equal opportunities for all students. Ultimately, the goal is to create a harmonious blend of technology and traditional teaching methods, prioritizing teacher effectiveness, student success, and learning outcomes.

The Hardware segment was valued at USD 9.78 billion in 2019 and showed a gradual increase during the forecast period.

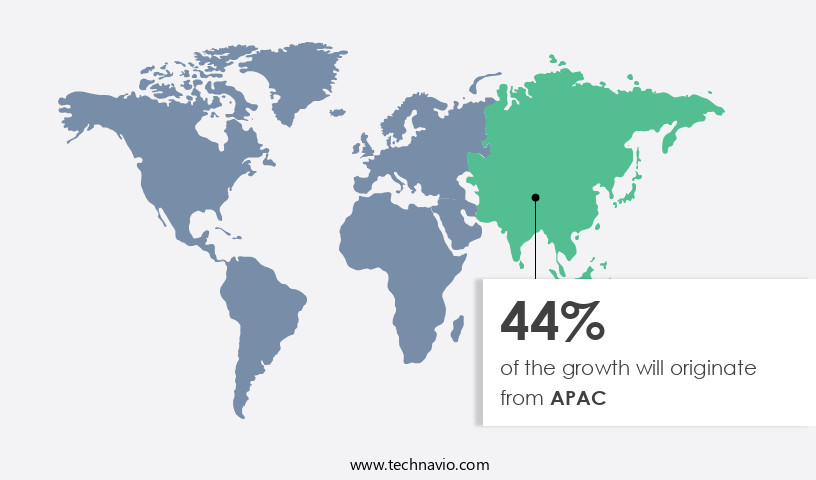

Regional Analysis

APAC is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the US, Canada, and Mexico, the market is experiencing significant growth. Virtual classrooms, interactive simulations, and cloud-based solutions are increasingly being adopted to complement traditional classroom teaching. Curriculum development, alignment, and teacher resources are essential components of this approach. Homework platforms, interactive whiteboards, and personalized learning tools enhance student engagement. Video conferencing and professional development opportunities foster teacher effectiveness. Learning outcomes are a primary focus, with higher education institutions integrating blended e-learning into their programs. Usability testing and student performance analytics help measure success. Implementation strategies, gamified learning, and privacy compliance are crucial considerations. Digital curriculum, secondary and special education, data security, and training and development are also integral parts of the market.

Technology infrastructure plays a significant role, with good bandwidth requirements and accessibility features ensuring seamless learning experiences. Assessment tools, simulation software, and support services are essential for effective implementation. Online courses, hybrid solutions, and mobile learning cater to diverse student needs. Standards-based education and e-learning content creation further strengthen the market's foundation. The increasing availability of gadgets and high Internet penetration in North America have fueled the adoption of e-learning and blended e-learning. The region's robust IT infrastructure enables schools to provide virtual classes, contributing to the steady growth of the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the ever-evolving educational landscape, the market continues to gain momentum. This market combines traditional classroom instruction with online learning, offering flexibility and personalized education. Digital tools, such as learning management systems, adaptive learning technologies, and multimedia resources, play pivotal roles in enhancing student engagement and performance. Interactive whiteboards, virtual labs, and gamification techniques further enrich the learning experience. Teachers act as facilitators, guiding students through the curriculum, while educational software and applications support individualized instruction. Parents appreciate the convenience and accessibility of blended learning, while administrators value its cost-effectiveness and scalability. The future of k-12 education lies in this innovative, technology-driven approach.

What are the key market drivers leading to the rise in the adoption of K-12 Blended E-Learning Industry?

- The market's primary motivation is the necessity for cost-effective teaching models. This requirement drives the education sector to continually seek innovative and efficient approaches to instruction.

- Blended e-learning in K-12 education is revolutionizing the way students learn and teachers teach, offering significant cost savings for both parties. Virtual classrooms and interactive simulations facilitate immersive learning experiences, while cloud-based solutions enable easy content access and management. Curriculum development and alignment are streamlined through collaborative learning tools, allowing for personalized learning plans. Interactive whiteboards and video conferencing foster engaging, real-time interactions. Homework platforms and teacher resources ensure continuous learning and progress tracking. Professional development opportunities for educators are also readily available, expanding their skillset and reach.

- The adoption of these technologies empowers educators to focus on their primary role: delivering quality education to students. By leveraging these tools, K-12 institutions can create a harmonious learning environment that strikes a balance between traditional and digital education.

What are the market trends shaping the K-12 Blended E-Learning Industry?

- The emergence of mobile learning is a significant market trend, with an increasing number of professionals and students utilizing mobile devices for education and skill development. This shift towards mobile education is mandatory for staying competitive in today's digital world.

- Blended e-learning, the fusion of traditional classroom instruction with digital technology, is revolutionizing K-12 education in the US and beyond. This approach leverages both online and offline learning to deliver personalized, flexible, and immersive educational experiences. The proliferation of mobile devices, such as smartphones and tablets, is a significant driver of this trend. These devices enable students to access digital curriculum, attend virtual lectures, receive performance analytics, and engage in gamified learning, all of which contribute to improved learning outcomes. Implementation strategies, including usability testing and teacher effectiveness training, ensure a harmonious blend of technology and traditional teaching methods.

- Student performance analytics provide valuable insights into individual student progress, allowing educators to tailor instruction to meet unique learning needs. Digital curriculum caters to diverse student populations, including those in secondary education, special education, and higher education. Data security and privacy compliance are essential considerations in the implementation of blended e-learning solutions. Training and development programs for teachers and administrators ensure proper use of technology and adherence to data security best practices. As technology continues to evolve, the education industry will continue to embrace blended e-learning as a powerful tool for enhancing student learning and teacher effectiveness.

What challenges does the K-12 Blended E-Learning Industry face during its growth?

- The expansion of open-source learning content poses a significant challenge to the industry's growth trajectory.

- Blended e-learning in K-12 education combines traditional classroom instruction with online components, necessitating technical support and software updates for seamless implementation. The market dynamics are influenced by the availability of open-source solutions, which pose a challenge to commercial providers. MOOCs, or Massive Open Online Courses, offer cost-effective alternatives with unlimited access and flexible scheduling, making them increasingly popular. Companies like Khan Academy and Byjus provide free courses in various subjects, including math, biology, and physics. Accessibility features, teacher training programs, online tutoring, educational games, and adaptive learning technologies are essential components of blended learning platforms.

- On-premise solutions and educational software require hardware requirements to ensure digital literacy and student success. In summary, the blended e-learning market is evolving, with open-source solutions and MOOCs influencing its growth trajectory. Companies must focus on providing high-quality services and support to remain competitive.

Exclusive Customer Landscape

The k-12 blended e-learning market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the k-12 blended e-learning market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, k-12 blended e-learning market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accelerate Learning - This company specializes in K-12 blended e-learning solutions, encompassing online courses, adaptive credit recovery programs, and independent study options. Designed to cater to diverse student needs, these offerings include resources for at-risk learners and those pursuing advanced classes. Through technology-enhanced instruction, students can access personalized learning experiences, fostering academic growth and success.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accelerate Learning

- Apollo Asset Management Inc.

- Articulate Global Inc.

- Cisco Systems Inc.

- Coursera Inc.

- D2L Inc.

- Docebo Inc.

- Educomp Solutions Ltd.

- edX LLC

- Ellucian Co.

- Houghton Mifflin Harcourt Co.

- Instructure Holdings Inc.

- Pearson Plc

- PowerSchool Holdings Inc.

- Promethean World Ltd.

- Samsung Electronics Co. Ltd.

- Scholastic Corp.

- Stride Inc.

- Toppr Technologies Pvt. Ltd.

- Vedantu Innovations Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in K-12 Blended E-Learning Market

- In January 2024, Microsoft Education announced the global expansion of its Microsoft Education Transformation Framework, aiming to reach an additional 100 million students and 10 million teachers by 2027 (Microsoft Press Release, 2024). This expansion represents a significant commitment to the market, combining technology solutions with teacher training and professional development.

- In March 2024, Google and Apple, two major tech companies, entered into a partnership to offer integrated learning solutions for schools, merging Google Classroom and Apple School Manager (Apple Newsroom, 2024). This collaboration marked a significant shift in the market, allowing schools to leverage the strengths of both platforms and providing a more comprehensive e-learning solution.

- In May 2024, Edmodo, a leading K-12 learning platform, raised USD100 million in a Series D funding round, bringing its total funding to USD225 million (Crunchbase, 2024). This investment will support the company's continued growth and expansion into new markets, positioning it as a major player in the K-12 blended e-learning sector.

- In April 2025, the US Department of Education launched the Ed-Fi Data Standard 3.0, enabling interoperability between various educational technology systems (Ed-Fi Alliance, 2025). This standardization initiative is expected to streamline data sharing and improve the effectiveness of K-12 blended learning programs, making it easier for educators to access and analyze student data across multiple platforms.

Research Analyst Overview

- The market is experiencing significant growth, driven by the integration of technology into classrooms. Interactive exercises and educational apps are becoming essential tools for delivering engaging and effective instruction. STEM education is a key focus area, with differentiated instruction and progress tracking enabling personalized learning experiences. Project-based learning and inquiry-based approaches foster critical thinking and problem-solving skills. Accessibility standards ensure equal access to education for all students, while formative assessments provide real-time feedback. Parent communication tools keep families informed, and reporting tools offer insights into student achievement.

- Teacher collaboration tools facilitate professional development and enhance instruction. Digital citizenship, data visualization, and automated grading streamline administrative tasks. Social-emotional learning (SEL) addresses students' emotional needs, and virtual field trips broaden horizons. Learning analytics dashboards provide valuable insights, enabling schools to make data-driven decisions. The market is evolving, with trends including project-based learning, personalized feedback, and collaboration skills.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled K-12 Blended E-Learning Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.2% |

|

Market growth 2025-2029 |

USD 25734.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.9 |

|

Key countries |

US, Canada, China, Germany, UK, India, Japan, Italy, South Korea, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this K-12 Blended E-Learning Market Research and Growth Report?

- CAGR of the K-12 Blended E-Learning industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the k-12 blended e-learning market growth of industry companies

We can help! Our analysts can customize this k-12 blended e-learning market research report to meet your requirements.