Kiteboarding Equipment Market Size 2025-2029

The kiteboarding equipment market size is forecast to increase by USD 336.9 million, at a CAGR of 7.6% between 2024 and 2029.

- The market is experiencing significant growth, driven by the inclusion of kiteboarding as an Olympic sport and innovative product launches that prioritize user safety. These trends are propelling the market forward, attracting both new and experienced kiteboarders. Key product categories include kites made from various materials such as wood, plastic, and carbon fiber masts. However, the risk of accidents remains a challenge, potentially limiting interest in the sport. Manufacturers must address safety concerns through advanced technology and education to maintain market growth. Overall, the market is poised for continued expansion, with a focus on enhancing the user experience and ensuring safety.

What will be the Size of the Kiteboarding Equipment Market During the Forecast Period?

- The market encompasses the production and distribution of kites, boards, harnesses, and accessories used in this dynamic water sport. This market has experienced significant growth due to the increase in popularity of kiteboarding as a recreational activity and the desire for adventure and leisure experiences. Kiteboards in diverse sizes and materials like wood, plastic, and carbon fiber; harnesses for optimal rider support; and a range of accessories including control bars, pumps, and repair kits. Expert analysis reveals that production and consumption patterns indicate a thriving industry, with key players continually innovating to meet the evolving needs of kiteboarders worldwide. Import/export dynamics further contribute to the market's expansion, enabling global access to high-quality kiteboarding equipment.

How is this Kiteboarding Equipment Industry segmented and which is the largest segment?

The kiteboarding equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Retail

- Others

- Product

- Kites

- Accessories

- Boards

- End-user

- Recreational users

- Professional athletes

- Geography

- Europe

- Germany

- UK

- France

- Italy

- North America

- Canada

- Mexico

- US

- APAC

- China

- Japan

- South America

- Middle East and Africa

- Europe

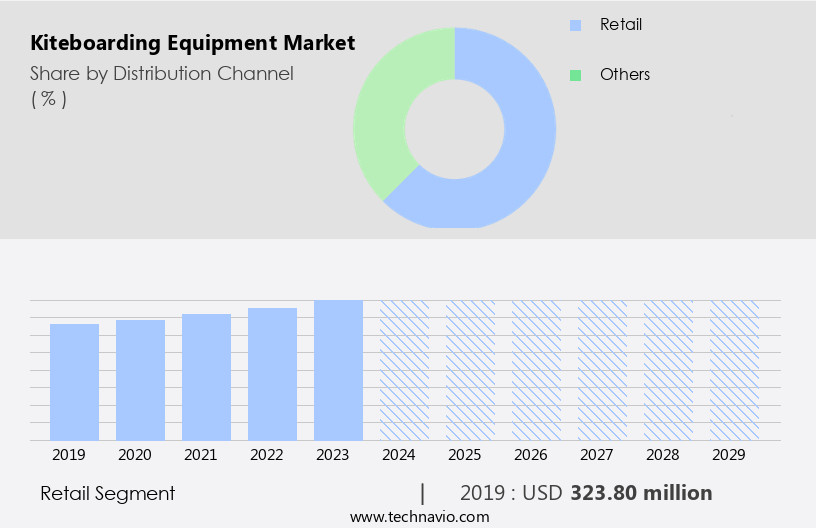

By Distribution Channel Insights

- The retail segment is estimated to witness significant growth during the forecast period. Kiteboarding equipment is primarily distributed through retail channels, encompassing specialty stores and online retailers. Specialty stores, the leading segment in terms of revenue, offer a diverse range of sports equipment, including kiteboarding gear. Notable examples include MACkite Boardsports Center, REAL Watersports, Jupiter Kiteboarding, and Versusshop. By managing their own retail operations, manufacturers and distributors can allocate resources for marketing, advertising, promotions, brand development, training, and IT infrastructure. This strategic approach enables them to engage directly with consumers, reducing reliance on independent retailers for sales.

- Kiteboarding equipment comprises various components, such as kites, boards, harnesses, accessories, and protective gear. Key accessories include leashes, bars, pumps, and click-in functions, enhancing rider safety and convenience. The market is influenced by factors such as consumer confidence, stock market inefficiencies, financial imbalances, and end-user safety concerns. Kiteboarding is a popular recreational activity and adventure sport, with a growing presence in global tourism, social media channels, and Olympic events. The sport offers numerous health advantages and attracts young people and athletes. The kiteboard and surfboard markets are closely related, with kiteboarding requiring both types of boards.

Get a glance at the market report of the share of various segments Request Free Sample

The retail segment was valued at USD 323.80 million in 2019 and showed a gradual increase during the forecast period.

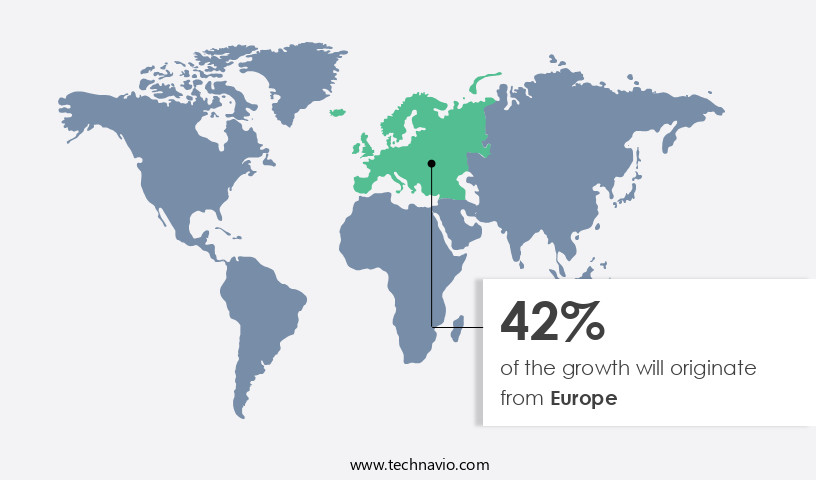

Regional Analysis

- Europe is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. Europe is a leading market, with prominent brands such as F-ONE and Switch Kiteboarding based in the region. The continent boasts numerous destinations suitable for both professional and novice riders, making it a hub for recreational kiteboarding. Spain, Italy, Greece, and the Netherlands are among the European countries with a high affinity for this sport.

For more insights on the market size of various regions, Request Free Sample

The European market encompasses kites, boards, harnesses, accessories, kiteboards, surfboards, and various other gear. Key components include wooden, plastic, and carbon fiber masts, as well as leashes, bars, pumps, and protective gear. The industry is influenced by consumer confidence, stock market inefficiencies, and financial imbalances, impacting business operations and enterprises. Safety is paramount, with seat belt locks, Click-In functions, and other safety features ensuring rider protection. Kiteboarding offers fun and adventure, attracting young people, athletes, and surfers alike. It is an essential component of the water sports equipment market and the adventure tourism industry. The sport's health advantages, connection to beach culture, and social media channels contribute to its increasing popularity. The Olympic and Youth Olympic Games have further boosted its visibility and appeal.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Kiteboarding Equipment Industry?

- Inclusion of kiteboarding in the Olympics is the key driver of the market. The kiteboarding equipment industry has experienced significant growth in recent years due to the rising popularity of this extreme sport among surfers and adventure seekers. The market consists of various types of equipment including kites, boards, harnesses, and accessories. Kites come in different sizes and materials such as wood, plastic, and carbon fiber masts. Boards can be kiteboards or surfboards. Harnesses provide riders with better control and comfort, while accessories include leashes, bars, pumps, and seat belt locks with Click-In functions for enhanced safety.

- The industry is driven by various factors such as the increasing number of kiteboarding events, including the Paris 2024 Olympics, and the desire for adventure and leisure activities. The sport's inclusion in the Olympics and the Youth Olympic Games has further boosted its popularity. The market is experiencing a rise in demand due to the health advantages associated with the sport and the growing urban population's interest in water sports.

What are the market trends shaping the Kiteboarding Equipment Industry?

- Innovative product launches heightening user safety is the upcoming market trend. The market continues to evolve, with companies introducing advanced and user-friendly gear. Innovations include ergonomically designed harnesses, boards, kites, and accessories that prioritize end-user safety. For example, Ozone's new Click-In Loop system is modeled after car seat belt locks, ensuring a simple and intuitive release mechanism. This feature, which activates and reloads easily, has become a game-changer in the industry, providing a flag out in most situations and potentially preventing accidents. As riders become accustomed to this technology, it underscores the importance of safety in the sport. Kiteboarding equipment accessories, such as leashes, bars, and pumps, also continue to advance, enhancing the overall experience for surfers on rivers and other bodies of water.

- The kiteboarding industry's growth is driven by an increase in popularity, desire for adventure, and leisure activities. Adventure tourism, beach culture, and social media channels further fuel the sport's expansion. Despite unstable markets and financial imbalances, consumer confidence and stock market inefficiencies have not significantly impacted business operations for enterprises in the kiteboarding equipment sector. Companies continue to innovate and expand their production capacities to meet the growing demand for kiteboarding equipment.

What challenges does the Kiteboarding Equipment Industry face during its growth?

- Risk of accidents limiting interest in kiteboarding is a key challenge affecting the industry growth. The market encompasses various components such as kites, boards, harnesses, and accessories. Kites come in various sizes and materials, including wood, plastic, and carbon fiber masts. Boards can be kiteboards or surfboards, while harnesses provide riders with support and control. Accessories include leashes, bars, pumps, and seat belt locks with Click-In functions for end-user safety. Despite the fun and excitement that kiteboarding offers as a sport and adventure activity, it is essential to acknowledge the potential risks involved. The high degree of risks associated with water sports, including kiteboarding, can hinder market growth. Unstable markets, consumer confidence, and financial imbalances can impact business operations for enterprises involved in this industry.

- Common injuries during kiteboarding include abrasions, contusions, lacerations, joint sprains, fractures, anterior cruciate ligament (ACL) injuries, posterior cruciate ligament (PCL) injuries, polytrauma, and others. The foot/ankle, skull, knee, and chest are the body parts most susceptible to injuries. As the popularity of kiteboarding increases, there is a growing demand for protective gear and sporting goods retailers, both online and offline. Adventure tourism, beach culture, and social media channels have contributed to the increase in popularity of this sport. The health advantages of kiteboarding, such as cardiovascular fitness and core strength, attract young people and athletes to this recreational activity.

Exclusive Customer Landscape

The kiteboarding equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the kiteboarding equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AXIS Foils - The company offers kiteboarding equipment such as foilboards and wings.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Best Kiteboarding

- BOARDS and MORE GmbH

- Cabrinhakites Inc.

- Crazy Fly s.r.o

- Epic Kites LLC

- Equipe Trading BV

- F ONE

- Go Foil Inc.

- Good Breeze Kiteboarding Inc.

- Litewave Kiteboards

- Motion Sports LLC

- Naish International

- North Actionsports B.V.

- RICCI INTERNATIONAL SRL

- SHQ Boardsports

- Skywalk GmbH and Co. KG

- Slingshot Sports LLC

- Switch Kiteboarding

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of products, including kites, boards, harnesses, and accessories. These items are essential for riders to experience the thrill of kiteboarding, a dynamic and exhilarating water sport. Kites come in various sizes and shapes, with some made of wood, plastic, or carbon fiber masts. Boards, meanwhile, can be made of similar materials, with some featuring advanced designs for improved performance. Harnesses are a crucial component of kiteboarding equipment, providing riders with the necessary support and connection to the kite. Accessories such as leashes, bars, and pumps are also essential, ensuring the proper functioning and safety of the kiteboarding setup.

Further, the market has seen fluctuations in recent years due to various market dynamics. Unstable markets, consumer confidence, and financial imbalances have impacted business operations for enterprises in this industry. End-user safety remains a top priority, with seat belt locks and click-in functions becoming increasingly popular features in kiteboarding equipment. Despite these challenges, the demand for kiteboarding equipment continues to grow due to the fun and excitement the sport provides. The sporting goods retail sector has seen an increase in sales of kiteboarding gear, with both online retail and brick-and-mortar stores benefiting from the trend. Adventure tourism and beach culture have played a significant role In the popularity of kiteboarding.

In addition, social media channels have also contributed to the sport's growth, allowing riders to share their experiences and showcase their skills to a global audience. The kiteboarding industry is not limited to specific regions and caters to a diverse range of consumers. Young people and athletes are among the primary demographics, drawn to the health advantages and desire for adventure that the sport offers. The market is closely related to the surfboard market, with both sports sharing similarities in terms of equipment and consumer demographics. However, kiteboarding requires more specialized equipment, making it a distinct market with unique characteristics.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.6% |

|

Market growth 2025-2029 |

USD 336.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.6 |

|

Key countries |

Germany, US, France, Canada, Australia, Italy, China, UK, Japan, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Kiteboarding Equipment Market Research and Growth Report?

- CAGR of the Kiteboarding Equipment industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the kiteboarding equipment market growth of industry companies

We can help! Our analysts can customize this kiteboarding equipment market research report to meet your requirements.