Knowledge Management Software Market Size 2025-2029

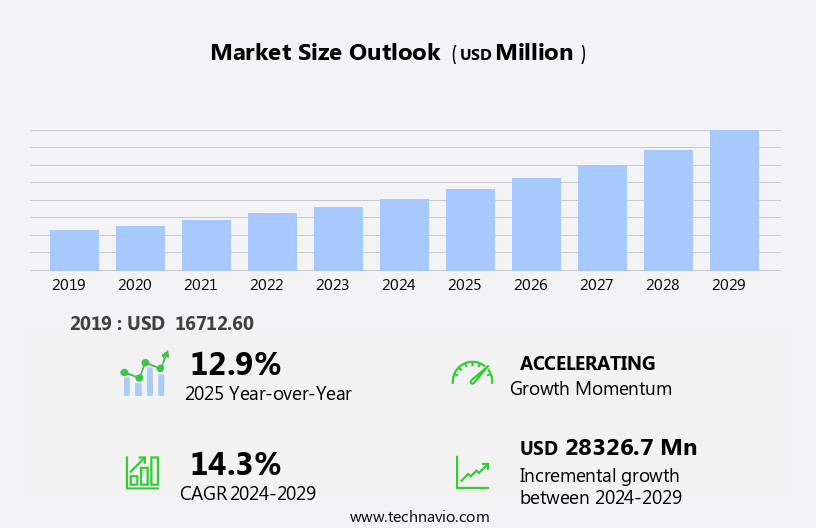

The knowledge management software market size is forecast to increase by USD 28.33 billion, at a CAGR of 14.3% between 2024 and 2029.

- The market is witnessing significant growth, driven by the increasing emphasis on skill development and employment. As digital education gains prominence, the role of knowledge management systems in facilitating easy access to information and fostering continuous learning is becoming increasingly important. Furthermore, the rising influence of data analytics in education is fueling the demand for advanced knowledge management solutions. However, the operational challenges associated with implementing and managing these software solutions pose a significant hurdle for organizations. Integrating new systems, ensuring data security, and maintaining user adoption are some of the key challenges that need to be addressed for successful implementation.

- To capitalize on the market opportunities and navigate these challenges effectively, companies must focus on providing user-friendly, secure, and customizable solutions that cater to the unique needs of various industries and educational institutions. By doing so, they can help their clients streamline processes, enhance productivity, and foster a culture of continuous learning and improvement.

What will be the Size of the Knowledge Management Software Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. Seamlessly integrated solutions enable entities to evaluate and collaborate on knowledge in real-time. Knowledge modeling, version control, and transfer facilitate effective communication and streamline workflows. Data integration and metadata management ensure accessibility to comprehensive information. Business intelligence and knowledge asset management systems provide valuable insights, while knowledge capture and knowledge graphs enable efficient data organization. Learning management systems and content management systems foster continuous learning and development.

Artificial intelligence, data governance, and data analytics enhance decision-making capabilities. Knowledge retention and management maturity are crucial for long-term success. Taxonomy development, content moderation, and information security maintain data accuracy and integrity. Usability testing and document management systems optimize user experience. Expert systems and customer support automation offer personalized solutions. Semantic search and information architecture improve search efficiency. Workflow automation and natural language processing streamline processes and enhance productivity.

How is this Knowledge Management Software Industry segmented?

The knowledge management software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- On-premises

- Cloud-based

- End-user

- Large enterprises

- SMEs

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Deployment Insights

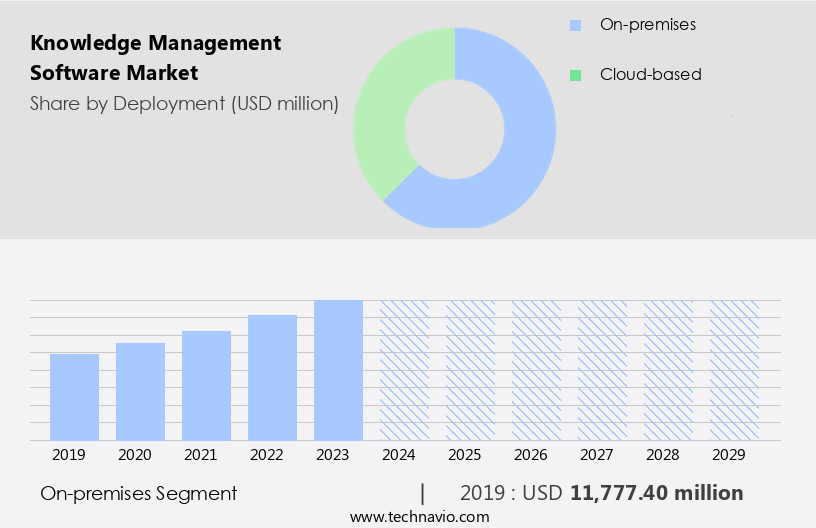

The on-premises segment is estimated to witness significant growth during the forecast period.

On-premises knowledge management software continues to be a preferred choice for businesses in sectors such as banking, financial services, and insurance (BFSI) and healthcare due to its high security and customization capabilities. Enterprises maintain complete control over their on-premises solutions with monitored and restricted access. The software's user interface is designed to facilitate knowledge sharing, training, and development, as well as knowledge mapping, validation, representation, and management. Business intelligence, knowledge asset management, and data integration are integral components, enabling data governance, data analytics, and knowledge retention. Collaborative workspaces and version control support knowledge transfer and data accessibility, while metadata management ensures effective knowledge management strategy and ontology development.

Learning management systems and content management systems are integrated for efficient content curation and usability testing. Artificial intelligence, machine learning, and natural language processing enhance search optimization and decision support. Despite the advantages, the on-premises deployment model requires organizations to invest in software licenses, IT staff, regular upgrades, and data protection solutions. The market share for on-premises knowledge management software is projected to decrease as cloud-based solutions gain popularity for their flexibility and cost-effectiveness. However, information security remains a significant concern for cloud adoption, making on-premises a viable option for businesses prioritizing data security.

The On-premises segment was valued at USD 11.78 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

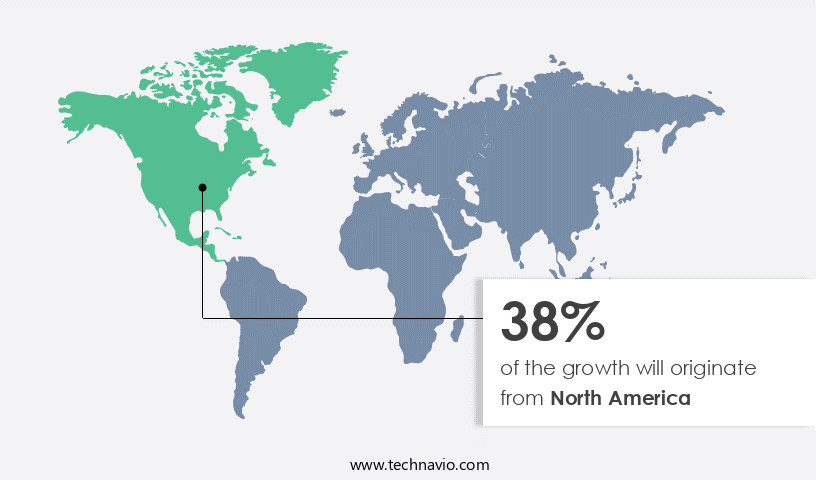

North America is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market is poised for growth due to the region's technological advancements and enterprise adoption of these platforms. The US, in particular, leads the way with a high penetration of internet-enabled devices and a strong focus on digital communication with customers. companies in the US are responding by launching new solutions to enhance customer experience and provide specific, product-focused navigation. Knowledge sharing, training and development, and knowledge mapping are key features driving the market, along with knowledge validation, representation, and base management. Business intelligence and knowledge asset management are also critical components, as is data integration and metadata management.

Collaborative workspaces and version control facilitate knowledge transfer, while data governance, data analytics, and knowledge retention ensure data security and accuracy. Learning management systems and content management systems support knowledge acquisition and taxonomy development, while artificial intelligence, machine learning, and natural language processing enable advanced search capabilities. Information security, content curation, usability testing, and document management systems further bolster the market's offerings. Overall, the North American market's growth is fueled by the increasing importance of knowledge management platforms in business communication and customer experience.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Knowledge Management Software Industry?

- The primary catalyst for market growth is the continuous development of skills and employment opportunities.

- The market is experiencing significant growth due to the increasing focus on skill development and knowledge sharing among working professionals. In today's rapidly evolving business landscape, staying updated with the latest technologies and trends is crucial for career advancement and adding value to one's knowledge base. This trend is observed across all age groups and industries, particularly in IT companies. To meet the demands of this digital age, professionals are turning to online certification programs and digitized courses. These platforms offer flexibility and convenience, allowing learners to access content from anywhere at any time.

- This shift towards digitized learning is expected to fuel the growth of the market during the forecast period. Moreover, knowledge management software solutions offer various features such as user interface design, knowledge mapping, knowledge validation, knowledge representation, business intelligence, and knowledge base management. These features enable organizations to effectively manage and utilize their knowledge assets, leading to improved productivity and better decision-making. Additionally, knowledge capture and knowledge graphs are essential components of knowledge management software. They help in organizing and analyzing data, making it easier for professionals to access and apply relevant information to their work.

- With the increasing emphasis on data-driven decision-making, the demand for knowledge management software is expected to continue growing. In conclusion, the market is poised for growth due to the changing learning preferences of working professionals and the need for effective knowledge sharing and management in organizations. The software's ability to provide a flexible, convenient, and comprehensive solution for knowledge asset management is making it an essential tool for businesses in the digital age.

What are the market trends shaping the Knowledge Management Software Industry?

- The increasing importance of data analytics in the field of digital education represents a significant market trend. This development reflects the growing recognition of the value that data analysis can bring to enhancing educational outcomes and optimizing learning experiences.

- The integration of data analytics software and technologies, including big data, in digital educational publishing has experienced substantial growth in recent years. companies are increasingly offering data analytics as part of their educational content packages to allow learners to monitor their engagement in learning activities in real-time. For instance, Comaround, a solution by BMC Software, is a cloud-based platform for higher education institutions. It facilitates personalizing learners' campus experience through mobile engagement and online communities using built-in content management tools, analytics, and automation software. Collaborative workspaces and knowledge modeling are essential components of knowledge management strategies.

- Version control and metadata management ensure the accuracy and accessibility of knowledge bases. Knowledge transfer is streamlined through data integration and learning management systems. Ontology development enables the creation of a formal representation of knowledge, enhancing its accessibility and usability. Effective knowledge management strategies emphasize the importance of knowledge evaluation and version control to maintain the quality and relevance of knowledge. By leveraging these technologies, organizations can improve their overall knowledge management capabilities and foster a more harmonious and immersive learning environment. In conclusion, recent research indicates that the adoption of advanced technologies in knowledge management is on the rise.

- Institutions and learners alike are benefiting from the integration of data analytics, collaborative workspaces, and learning management systems to enhance their knowledge management strategies. By focusing on knowledge modeling, version control, metadata management, and ontology development, organizations can ensure the accuracy, accessibility, and relevance of their knowledge bases, ultimately driving better decision-making and improved performance.

What challenges does the Knowledge Management Software Industry face during its growth?

- The growth of the software industry is significantly impacted by operational challenges inherent to the software sector.

- Knowledge management software is essential for organizations to effectively manage and utilize their intellectual assets. However, implementing such solutions comes with operational challenges that can hinder market growth. Personalized customer service interactions necessitate quick and efficient support solutions, which can be challenging for companies to provide. Operational issues, such as version discrepancies and computer problems leading to the need for access databases, difficulty in personalizing certificates and reports, lack of editing capabilities, and the requirement for strong local IT infrastructure instead of a basic plug-and-play option, necessitate constant training of operators for customization of reports generated by the software.

- These operational challenges are expected to hamper the expansion of the market during the forecast period. Additionally, advanced features like content management systems, artificial intelligence, data governance, data analytics, knowledge retention, knowledge acquisition, machine learning, taxonomy development, content moderation, and decision support systems play a crucial role in enhancing the functionality and value of knowledge management software. Despite these challenges, the market's growth is driven by the increasing need to manage and leverage organizational knowledge effectively.

Exclusive Customer Landscape

The knowledge management software market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the knowledge management software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, knowledge management software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Atlassian Corp Plc - This company provides knowledge management solutions, including Confluence software, empowering teams to effectively generate, structure, and disseminate information. By streamlining information creation and organization, this software fosters enhanced collaboration and knowledge sharing among organizations.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Atlassian Corp Plc

- Bitrix Inc.

- Bloomfire Inc.

- BMC Software Inc.

- eGain Corp.

- eXo Platform SAS

- Freshworks Inc.

- HCL Technologies Ltd.

- Igloo Inc.

- International Business Machines Corp.

- MangoApps Inc.

- Notion Labs Inc.

- Oracle Corp.

- ProProfs

- SAP SE

- SkyPrep Inc.

- Tata Sons Pvt. Ltd.

- Upland Software Inc.

- Zendesk Inc.

- Zoho Corp. Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Knowledge Management Software Market

- In January 2024, IBM announced the launch of its new AI-powered Knowledge Management System, Watson Discovery, which integrates machine learning and natural language processing capabilities to help organizations identify insights from unstructured data (IBM Press Release). In March 2024, Microsoft entered into a strategic partnership with Google Cloud to offer integrated knowledge management solutions, combining Microsoft's SharePoint and Google's Search and Knowledge Graph technologies (Microsoft News Center).

- In April 2024, OpenText Corporation completed the acquisition of MetaStar Corporation, a leading provider of knowledge management solutions for professional services firms, expanding OpenText's market reach and enhancing its product portfolio (OpenText Corporation Press Release). In May 2025, Salesforce signed a definitive agreement to acquire Slack Technologies, Inc., aiming to integrate Slack's collaboration and communication platform with Salesforce's Customer 360 and Knowledge articles to create a more comprehensive customer engagement solution (Salesforce Press Release).

- These developments demonstrate significant strategic moves in the market, including new product launches, partnerships, acquisitions, and market expansions, as companies strive to enhance their offerings and better serve their customers.

Research Analyst Overview

- In today's data-driven business landscape, effective knowledge management has become a critical success factor. The market for knowledge management software is dynamic, with various trends shaping its evolution. Community management solutions foster collaboration and information sharing among teams, while data visualization tools enable businesses to gain insights from complex data sets. Voice search optimization and sentiment analysis enhance user experience, making it easier for users to access and interpret data. The knowledge transfer process is streamlined through content syndication and API integration, ensuring consistent information dissemination. Predictive analytics and knowledge maturity models help organizations anticipate future needs and assess their current knowledge management capabilities.

- Cloud-based solutions offer mobile accessibility, enabling employees to access critical information from anywhere. Enterprise content management systems provide a centralized repository for managing and preserving knowledge, while knowledge discovery tools help uncover hidden insights. Knowledge audits and gap analysis identify areas for improvement, and knowledge lifecycle management ensures the ongoing relevance and accuracy of information. Virtual assistants and knowledge graph integration further enhance the functionality of knowledge management platforms, providing personalized recommendations and contextual insights. Social learning and on-premises solutions complement cloud-based offerings, catering to specific business needs. Overall, the market is characterized by continuous innovation and adaptation to meet the evolving demands of businesses.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Knowledge Management Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.3% |

|

Market growth 2025-2029 |

USD 28.33 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.9 |

|

Key countries |

US, China, Germany, Canada, UK, Japan, Brazil, India, Australia, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Knowledge Management Software Market Research and Growth Report?

- CAGR of the Knowledge Management Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the knowledge management software market growth of industry companies

We can help! Our analysts can customize this knowledge management software market research report to meet your requirements.