Laminated Veneer Lumber Market Size 2024-2028

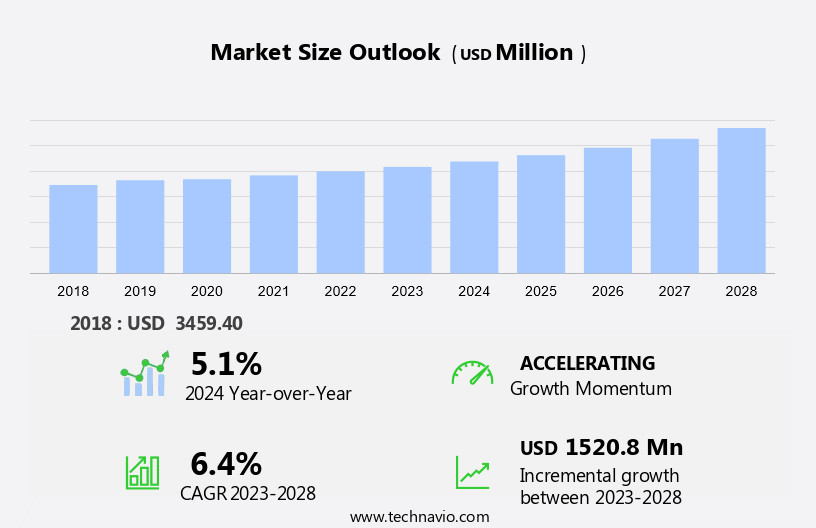

The laminated veneer lumber market size is forecast to increase by USD 1.52 billion at a CAGR of 6.4% between 2023 and 2028.

- The market is experiencing significant growth due to various factors. The construction industry, both commercial and industrial, is witnessing increased investments, driving the demand for engineered wood products like LVL. Additionally, the trend towards affordable housing and energy-efficient buildings is leading to the adoption of LVL in construction. Disruptions in supply chains have also created opportunities for LVL as a reliable alternative to traditional lumber. Cross-banded veneer lumber, a type of LVL, offers superior strength and dimensional stability, making it an attractive option for various applications. The demand for LVL is expected to continue growing as the focus on sustainable and cost-effective building solutions increases.

What will be the Size of the Market During the Forecast Period?

- Laminated veneer lumber (LVL), also known as engineered wood product, is a popular alternative to solid sawn lumber in various construction applications. This product is manufactured by bonding together multiple thin layers of wood veneers with industrial adhesives under heat and pressure. The resulting material offers improved strength, dimensional stability, and resistance to warping, splitting, and twisting. The construction industry's growing demand for lightweight and durable building materials has significantly contributed to the increasing popularity of LVL. This engineered wood product is widely used in residential and commercial buildings for headers, beams, rim board, and truck bed decking.

- Despite the numerous benefits, the production of LVL faces certain challenges. The primary concerns include the quality of raw materials, specifically softwood species such as spruce, pine, and fir. The selection and preparation of these raw materials are crucial to ensure the final product's uniformity and strength. Moreover, natural disasters like floods, storms, and fires can impact the availability and cost of raw materials, leading to potential supply chain disruptions. To mitigate these risks, manufacturers must maintain a diversified supply base and invest in disaster recovery plans. The real estate plays a significant role in the demand for LVL.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Cross-Banded LVL

- Structural LVL

- Others

- End-user

- Residential

- Commercial

- Industrial

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- Japan

- South America

- Brazil

- Middle East and Africa

- North America

By Type Insights

- The cross-banded LVL segment is estimated to witness significant growth during the forecast period.

The market is driven by its usage in both residential and commercial buildings. Cross-banded LVL, a type of engineered wood product, is gaining popularity due to its superior structural properties. This LVL is manufactured with veneers arranged in a cross-banded pattern, which enhances its strength, stability, and durability. These features make cross-banded LVL an excellent choice for construction applications that demand high performance. For instance, in the construction of public buildings and commercial structures, the need for a lightweight yet strong material is essential. Cross-banded LVL, such as Boxxa LVL from Nelson Pine, meets these requirements.

Get a glance at the market report of share of various segments Request Free Sample

The cross-banded LVL segment was valued at USD 1.72 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 32% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market for Laminated Veneer Lumber (LVL) is witnessing substantial expansion due to escalating investments in construction projects and eco-friendly initiatives. This rise in construction activity underscores the burgeoning demand for building materials, particularly LVL, which is renowned for its strength, durability, and sustainability. LVL, an engineered wood product, is manufactured using multiple thin layers of wood veneers bonded together with adhesives. This manufacturing process mitigates issues such as warping, splitting, and twisting commonly found in solid lumber. The use of softwood species in LVL production further enhances its strength and stability.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Laminated Veneer Lumber Market?

Increasing investments in the construction sector is the key driver of the market.

- The market in North America is experiencing notable expansion due to the increasing investments in the construction industry. These investments are essential for satisfying the escalating demand for eco-friendly and superior building materials. This substantial funding commitment underscores the United States' dedication to improving its infrastructure, which is projected to fuel the demand for LVL products, particularly in the manufacture of structural beams and fire-resistant applications.

- Similarly, spruce, pine, and fir are commonly used species for LVL production due to their strength and versatility. Rotary peeling and slicing techniques are employed to extract thin veneers from these trees, which are then laminated under high pressure and temperature to create strong, uniform beams. The use of LVL in construction offers numerous benefits, including improved structural performance, reduced material waste, and enhanced fire resistance. As the construction sector continues to prioritize sustainable building materials, the LVL market in North America is expected to thrive.

What are the market trends shaping the Laminated Veneer Lumber Market?

The adoption of recyclable wind blades is the upcoming trend in the market.

- The market is experiencing notable progress, particularly in the commercial and industrial sectors. This advancement is attributed to the increasing demand for affordable housing and energy-efficient buildings. In commercial construction, LVL is gaining popularity as an engineered wood product due to its strength and durability. Cross-banded veneer lumber, a type of LVL, is increasingly being used for its superior performance in high-load applications.

- Moreover, the introduction of LVL in various industries is driven by the need for sustainability and reduced environmental impact. For instance, in the renewable energy sector, LVL is being used to manufacture wind blades, offering a recyclable alternative to traditional fiberglass and carbon composite blades. This shift is expected to significantly contribute to the growth of the LVL market.

What challenges does Laminated Veneer Lumber Market face during the growth?

Disruptions in supply chain is a key challenge affecting the market growth.

- The market is currently experiencing challenges due to disruptions in the supply chain. These disruptions are primarily caused by geopolitical tensions and security concerns in major trade routes. The Red Sea, a vital trade corridor connecting Asia, Africa, and Europe, has been affected by security issues since 2023. These incidents have raised concerns within the transportation, logistics, and supply chain industries regarding potential disruptions, increased freight costs, extended shipping times, and the re-emergence of the bullwhip effect. The ongoing Israel-Hamas conflict intensifies these challenges, with threats from Iran-backed Houthi rebels of Yemen targeting Israeli vessels in the Red Sea, resulting in the seizure of a ship belonging to an Israeli businessman.

- Additionally, green building certifications continue to drive demand for LVL in the construction sector. Cross-bended LVL and laminated strand lumber are popular choices for headers, beams, rim board, truck bed decking, and other applications. However, the disruptions in the supply chain could impact the availability and affordability of these products, potentially hindering growth in the residential sector. To mitigate these challenges, industry players are exploring alternative transportation routes and collaborating with logistics providers to ensure timely delivery of goods. Additionally, some manufacturers are increasing their production capacity to meet demand and reduce reliance on imports.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anderson Lumbar Company

- Boise Cascade Co

- Brisco Manufacturing Ltd.

- Mayr Melnhof Holz Holding AG

- METSA GROUP

- Nelson Pine Industries Ltd.

- Pacific Woodtech Corp

- Pfeifer Holding GmbH

- Roseburg Forest Products Co.

- SmartLam

- Stora Enso Oyj

- Sunrise plywood

- UFP Industries Inc.

- West Fraser Timber Co. Ltd.

- Weyerhaeuser Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Engineered wood products, specifically laminated veneer lumber (LVL), have gained significant traction in the global construction industry due to their numerous benefits. These products are manufactured by bonding together multiple layers of wood veneers with advanced adhesives. LVL is known for its dimensional precision and superior strength, making it an ideal choice for structural applications such as beams, headers, joists, lintels, purlins, and scaffold boards. Softwood species like spruce, pine, and fir are commonly used in the production of LVL. The manufacturing process involves either rotary peeling or slicing of logs to obtain thin veneers. The veneers are then pressed and bonded under high pressure and temperature to form a solid, uniform piece of lumber.

Moreover, LVL offers several advantages over traditional solid lumber, including improved resistance to warping, splitting, and twisting. It is also a sustainable and eco-friendly building material, with many LVL products carrying green building certifications. LVL is used extensively in residential, commercial, and industrial construction, including affordable housing, energy-efficient buildings, commercial construction, public buildings, industrial warehouses, prefabricated buildings, and customized wooden houses. LVL's lightweight nature makes it an excellent choice for structural framing and cross-banded veneer lumber is used for truss chords and truck bed decking. Its fire resistance properties make it suitable for use in various applications, including heavy-duty glue applications and waterproofing.

In summary, despite its high initial cost, LVL's durability and longevity make it a cost-effective solution in the long run. Its superior strength, dimensional precision, and resistance to warping, splitting, and twisting make it an ideal choice for various structural applications. Additionally, its eco-friendly and sustainable properties make it a preferred choice for green building projects. LVL is used extensively in residential, commercial, and industrial construction, and its lightweight nature and fire resistance properties make it a cost-effective and durable solution for various applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.4% |

|

Market growth 2024-2028 |

USD 1.52 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.1 |

|

Key countries |

US, China, Germany, Japan, UK, France, Italy, Brazil, Australia, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch