Land Surveying Equipment Market Size 2025-2029

The land surveying equipment market size is forecast to increase by USD 2.95 billion, at a CAGR of 6.3% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for accurate mapping and data analysis in various industries, including construction, engineering, and real estate. This trend is driving the adoption of advanced surveying technologies, such as robotic total stations and 3D scanners, which offer higher precision and efficiency compared to traditional methods. Robotic total stations, in particular, are gaining popularity due to their ability to automate the surveying process, reducing human error and increasing productivity. These devices use GPS technology and self-leveling mechanisms to capture data and generate accurate surveys. However, the market faces challenges in the form of regulatory and compliance requirements.

- As surveying data is critical for infrastructure projects, governments and regulatory bodies impose stringent regulations to ensure data accuracy and security. Compliance with these regulations can be time-consuming and costly, posing a significant challenge for market players. Moreover, the emergence of drone technology in surveying applications is another trend transforming the market landscape. Drones equipped with high-resolution cameras and LiDAR sensors are increasingly being used for topographic surveys, volumetric analysis, and infrastructure inspections. However, the use of drones in surveying raises concerns regarding data privacy, security, and safety, which need to be addressed through regulatory frameworks and technological solutions.

- In conclusion, the market is poised for growth due to the increasing demand for accurate mapping and data analysis. The adoption of advanced surveying technologies, such as robotic total stations and drones, is driving innovation and efficiency in the market. However, regulatory and compliance challenges, data privacy concerns, and safety issues pose significant obstacles that market players need to navigate effectively to capitalize on market opportunities and maintain a competitive edge.

What will be the Size of the Land Surveying Equipment Market during the forecast period?

The market is characterized by continuous evolution and dynamic market activities. Construction staking and cadastral surveying remain key applications, with data integrity and report generation playing essential roles in ensuring accuracy and reliability. Data processing, survey software, and RTK systems facilitate efficient data collection and analysis, while total stations and control surveys ensure alignment and precision. Alignment surveys and as-built surveys are crucial for infrastructure development, as are elevation surveys and field data collection in construction sites. Aerial surveying, site plans, and BIM integration are transforming the industry with advanced technologies such as laser scanning and drone surveying.

Mining surveying, land development, and engineering surveying require high levels of data analysis and GIS integration for effective planning and execution. Hydrographic surveying, ground control points, and coordinate systems ensure data accuracy in various applications. Emerging technologies like artificial intelligence, machine learning, and point cloud processing are revolutionizing the industry, offering new possibilities for data analysis and automation. The market's ongoing unfolding is marked by the integration of GPS mapping, infrastructure development, and environmental monitoring, among others. Construction surveying, site preparation, and boundary surveys are essential components of real estate development, with 3D modeling and GNSS receivers streamlining the process.

The market's continuous evolution underscores the importance of staying updated with the latest trends and technologies.

How is this Land Surveying Equipment Industry segmented?

The land surveying equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- TS and TL

- UAV

- GNSS system

- Pipe lasers

- Others

- End-user

- Construction

- Mining

- Oil and gas

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

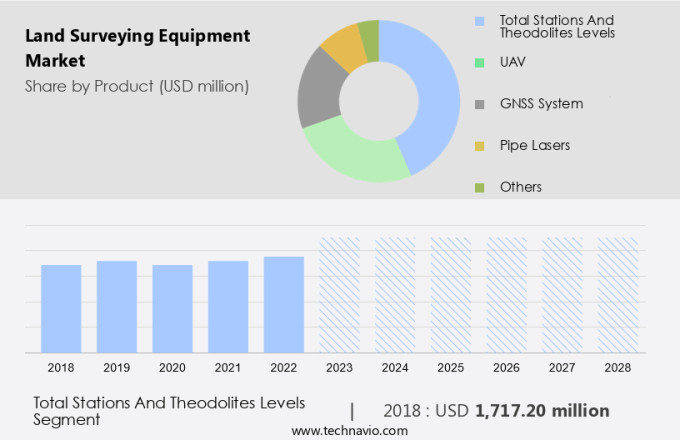

The ts and tl segment is estimated to witness significant growth during the forecast period.

The market experiences significant growth due to the increasing adoption of advanced technologies in surveying applications. Total stations and theodolites, such as TS and TL, play a pivotal role in this market. These instruments, which measure angles, distances, and elevations with high precision, are indispensable in construction, infrastructure development, topographic surveys, and boundary mapping. Total stations, which integrate the functions of a theodolite and an electronic distance measurement (EDM) system, offer enhanced capabilities. They enable the calculation of both horizontal and vertical angles, as well as distances, making them ideal for intricate surveying tasks. Modern total stations are equipped with features like integrated Global Navigation Satellite Systems (GNSS), automated tracking, and digital data recording, which boost survey efficiency and accuracy.

Additionally, the market is witnessing the adoption of various surveying technologies, including RTK systems, GPS mapping, drone surveying, and laser scanning. These technologies cater to diverse surveying requirements, such as data collection in challenging terrains, high-density point cloud processing, and infrastructure development projects. Data processing software, survey plans, and BIM integration are also essential components of the market, ensuring data integrity and facilitating seamless project workflows. Moreover, the integration of artificial intelligence, machine learning, and geographic information systems (GIS) is transforming the land surveying industry. These technologies enable automated data analysis, real-time monitoring, and enhanced data accuracy, making surveying processes more efficient and effective.

Furthermore, the use of coordinate systems, ground control points, and 3D modeling ensures precise data analysis and visualization, which is crucial for large-scale projects like land development, mining surveying, and environmental monitoring. In conclusion, the market is driven by the adoption of advanced technologies, such as total stations, RTK systems, GPS mapping, drone surveying, and laser scanning. These technologies cater to various surveying applications, ensuring data integrity, accuracy, and efficiency. The integration of artificial intelligence, machine learning, and geographic information systems further enhances the market's potential, making it a dynamic and evolving industry.

The TS and TL segment was valued at USD 1.8 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

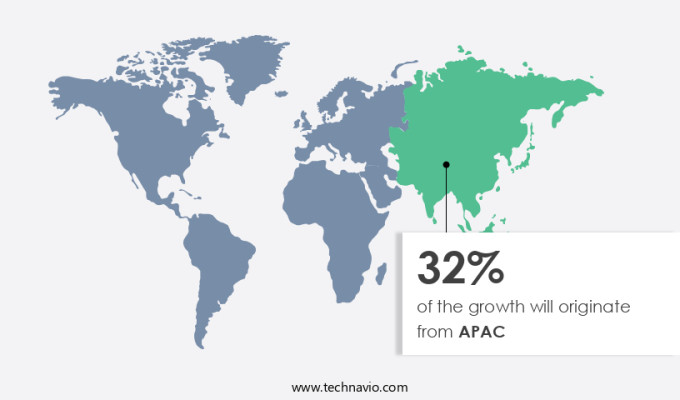

APAC is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia-Pacific (APAC) region is experiencing significant growth due to urbanization, infrastructure development, and government initiatives. China, India, and Japan are leading this expansion, with China's urbanization rate reaching 66.16% in 2023. This rapid urbanization, coupled with the digital economy's growth, has fueled new infrastructure demands. In the first half of 2023, China's infrastructure construction investment surged by 16.2% compared to the previous year. To support the planning and execution of these large-scale projects, advanced land surveying equipment is in high demand. This equipment includes total stations, RTK systems, data collectors, and GPS mapping tools for control, alignment, as-built, and topographic surveys.

Data processing software and BIM integration are essential for creating accurate site plans and 3D models. Geodetic surveying and ground control points ensure data integrity, while laser scanning and drone surveying offer immersive data collection methods. Hydrographic surveying and machine learning technologies enhance data analysis capabilities. Mining surveying, land development, and infrastructure development projects require precise coordinate systems and GIS integration. Construction surveying, site preparation, boundary surveys, and 3D modeling are crucial for real estate development. Environmental monitoring and point cloud processing are essential for assessing and mitigating potential risks. Advanced technologies like artificial intelligence, machine learning, and GPS mapping are transforming the land surveying industry, ensuring data accuracy and efficiency.

The market is expected to continue growing as infrastructure development and urbanization progress in the APAC region.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Land Surveying Equipment Industry?

- The increasing requirement for precise mapping and data analysis serves as the primary catalyst for market growth.

- The market is experiencing significant growth due to the increasing requirement for precise mapping and data analysis in various sectors, including agriculture, civil engineering, and land management. In agriculture, farmers utilize detailed geospatial data for precision farming practices, enabling them to monitor crop health, manage irrigation, and optimize planting and harvesting schedules. Advanced surveying tools, such as Unmanned Aerial Vehicles (UAVs) equipped with multispectral sensors and Global Navigation Satellite Systems (GNSS), provide the necessary data for informed decisions, thereby enhancing crop yields and resource management. Similarly, in civil engineering and land management, infrastructure development projects demand high-precision coordinate systems for 3D modeling, site preparation, boundary surveys, construction surveying, and GIS integration.

- The adoption of these technologies is emphasized to ensure accuracy, efficiency, and compliance with legal land title surveying requirements in real estate development. Overall, the market dynamics are driven by the need for advanced surveying solutions to meet the increasing demand for accurate and timely data analysis.

What are the market trends shaping the Land Surveying Equipment Industry?

- The emergence of robotic total stations represents a significant market trend in the surveying industry. These advanced technologies automate and streamline surveying processes, offering increased efficiency and accuracy.

- The market is experiencing notable growth due to the rising adoption of advanced technologies, particularly robotic total stations. This trend is driven by the increasing demand for remote surveying solutions, which significantly boosts productivity. Traditional total stations allow two surveyors to measure approximately 200 survey points per day. In contrast, the implementation of robotic total stations enables the same level of work to be completed with just one surveyor, doubling productivity.

- The efficiency gains offered by these sophisticated instruments are becoming increasingly attractive to surveying professionals. As remote surveying technology continues to evolve, the demand for robotic total stations is anticipated to increase further during the forecast period.

What challenges does the Land Surveying Equipment Industry face during its growth?

- The growth of the industry is significantly impacted by regulatory and compliance challenges, which necessitate rigorous adherence and adaption to ensure business continuity and maintain regulatory compliance.

- The market encounters intricate regulatory and compliance complexities due to varying standards and regulations internationally. For instance, the Federal Communications Commission (FCC) in the US imposes regulations on the utilization of Global Navigation Satellite Systems (GNSS) and specific communication frequencies employed in surveying equipment. Devices such as GNSS receivers, which depend on satellite data, must conform to these regulations to avoid interference with other crucial communication systems. The FCC's stringent standards ensure that devices meet specific technical and operational criteria, posing a challenge for manufacturers catering to diverse markets. Data integrity plays a pivotal role in land surveying, necessitating the use of advanced survey software, RTK systems, total stations, and other sophisticated technologies for control, alignment, and as-built surveys.

- Report generation and data processing are also critical aspects of the land surveying process, ensuring accuracy and efficiency. Cadastral and construction staking surveys require high precision and reliability, making the selection of appropriate equipment essential. In conclusion, navigating regulatory requirements and employing advanced technologies are key market dynamics in the land surveying equipment industry.

Exclusive Customer Landscape

The land surveying equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the land surveying equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, land surveying equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Beijing UniStrong Science and Technology Co. Ltd. - The company specializes in providing advanced land surveying solutions through innovative equipment. Our product line includes the eBase 20 Portable GNSS Base Receiver, eRTK10 AR Visual Stakeout GNSS Receiver, and eTS2 High-Efficiency Operation Total Station. These tools are designed to enhance accuracy and efficiency in land surveying projects. The eBase 20 serves as a reliable base station for real-time kinematic (RTK) surveying, while the eRTK10 offers augmented reality (AR) technology for enhanced stakeout. The eTS2 total station delivers high-precision measurements for various surveying applications. Our equipment is engineered to meet the evolving demands of the land surveying industry, ensuring optimal performance and productivity.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Beijing UniStrong Science and Technology Co. Ltd.

- Changzhou Dadi Surveying Science and Technology Co. Ltd.

- Eos Positioning Systems Inc.

- Geo Tech System

- GUANGDONG KOLIDA INSTRUMENT CO. LTD.

- Hexagon AB

- Hi Target

- Robert Bosch GmbH

- SAMAH AERIAL SURVEY CO. LTD.

- Satlab AS

- Shanghai Huace Navigation Technology Ltd.

- South Surveying and Mapping Instruments Co. Ltd.

- Stonex Srl

- Suzhou Foif Co. Ltd.

- Theis Feinwerktechnik GmbH

- TI Asahi Co. Ltd.

- Topcon Corp.

- Trimble Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Land Surveying Equipment Market

- In February 2023, Trimble, a leading provider of solutions for construction and geospatial industries, introduced its new Trimble SX12 scanning total station, which combines 3D scanning and surveying capabilities in a single instrument. This innovation allows for increased efficiency and accuracy in land surveying projects (Trimble Press Release).

- In July 2024, Topcon Positioning Group, another major player in the market, announced a strategic partnership with Esri, a geographic information system (GIS) software company. This collaboration aims to integrate Topcon's surveying equipment with Esri's ArcGIS platform, enhancing data processing and analysis capabilities for customers (Topcon Press Release).

- In October 2024, Hexagon AB, a global technology company, completed the acquisition of Intergraph Corporation's geospatial business from Hexagon's competitor, Harris Corporation. This acquisition expanded Hexagon's portfolio of geospatial solutions and strengthened its position in the market (Hexagon AB Press Release).

- In March 2025, Leica Geosystems, a leader in geospatial measurement technology, showcased its new BLK2GO, a handheld imaging laser scanner, at the International Construction and Real Estate Expo. This compact and cost-effective device offers high-speed data acquisition and real-time point cloud visualization, making it an attractive solution for small to medium-sized surveying projects (Leica Geosystems Press Release).

Research Analyst Overview

- The market is witnessing significant advancements, driven by the integration of digital technologies such as digital surface models (DSMs) and remote sensing. GIS software and BIM software are increasingly being adopted for terrain modeling and 3D point clouds generation. Digital level and laser theodolites are evolving with Bluetooth and Wifi connectivity for seamless data transfer. Software integration is a key trend, enabling the use of auto levels, differential GPS, and kinematic surveying for enhanced accuracy. Base stations and data logging are essential components for real-time kinematic (RTK) and precise point positioning (PPP) applications. Cloud storage and data management solutions facilitate efficient data access and collaboration.

- Surveying tools like electronic total stations, distance measurement devices, and height measurement instruments offer improved angle measurement capabilities and GNSS corrections. Image processing and data visualization are crucial for effective analysis and interpretation of survey data. CAD software and survey databases are integral for designing and planning projects, while levelling rods and static surveying techniques ensure high precision in traditional applications. The market is also witnessing the adoption of cellular connectivity and surface modeling techniques for increased productivity and efficiency. These trends are shaping the future of land surveying, providing valuable insights and solutions for US businesses.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Land Surveying Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.3% |

|

Market growth 2025-2029 |

USD 2950.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.8 |

|

Key countries |

US, China, India, Japan, Germany, UK, Canada, Australia, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Land Surveying Equipment Market Research and Growth Report?

- CAGR of the Land Surveying Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the land surveying equipment market growth of industry companies

We can help! Our analysts can customize this land surveying equipment market research report to meet your requirements.