Laser Projector Market Size 2024-2028

The laser projector market size is forecast to increase by USD 8.34 billion at a CAGR of 21.7% between 2023 and 2028.

- The market is experiencing significant growth due to the adoption of laser-based projection systems in various industries. These systems offer high brightness and vivid colors, enhancing the visual experience in entertainment, enterprise, healthcare, and other sectors. The technology behind laser projection is continuously evolving, leading to advancements in image quality and longevity. However, the maintenance requirements of laser projectors remain a challenge for some users, as these systems typically require specialized expertise and resources. Despite this, the benefits of laser projection, including its ability to produce large-scale visuals with exceptional clarity and accuracy, make it a valuable investment for organizations seeking to deliver great experiences to their audiences.

What will be the Size of the Market During the Forecast Period?

- Laser projection technology has gained significant traction in various industries due to its ability to produce high brightness and vivid colors. Unlike traditional bulb projectors, laser-based projection systems leverage the power of laser technology to provide a superior visual experience. High brightness is a critical factor in delivering impressive visuals, especially for large-scale applications such as digital signage, geographic mapping, and public places. Laser projectors offer unmatched brightness levels, making them ideal for these applications. Furthermore, they produce high-quality images with high-resolution capabilities, ensuring a clear and detailed visual experience. The entertainment industry is one of the primary adopters of laser projection technology. Laser projectors are increasingly being used in movie theaters and cinemas to deliver a great cinematic experience. They offer advantages such as longer lamp life, reduced maintenance, and lower total cost of ownership. Laser projection technology is also finding significant applications in enterprise settings, including meeting spaces, boardrooms, and healthcare facilities. In healthcare, laser projectors are being used for medical imaging, providing high-quality, detailed images for diagnosis and treatment planning. In enterprise settings, laser projectors offer a more engaging and effective way to present data and information.

- In addition, defense and security applications are another area where laser projection technology is gaining popularity. Laser projectors are being used for projection mapping and other applications requiring high-brightness, high-resolution visuals. Laser projectors come in various types, including hybrid laser, RGB laser, and laser diode projectors. These projectors offer different benefits depending on the specific application requirements. For instance, RGB laser projectors offer the most vibrant colors, while laser diode projectors offer high brightness and long lamp life. Laser phosphor technology is another advancement in laser projection technology. It combines the benefits of laser and phosphor technologies, providing high brightness, vivid colors, and long lamp life.

How is this market segmented and which is the largest segment?

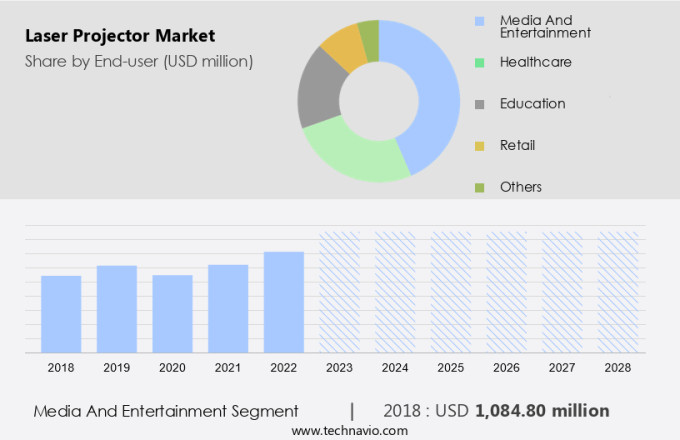

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Media and entertainment

- Healthcare

- Education

- Retail

- Others

- Geography

- APAC

- China

- Japan

- South Korea

- North America

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By End-user Insights

- The media and entertainment segment is estimated to witness significant growth during the forecast period.

The market is witnessing notable expansion, primarily due to the evolution of laser-based projection systems and the escalating demand for superior visual experiences in various sectors. This trend is particularly noticeable in the media and entertainment industry, where laser projectors are increasingly being adopted for their capacity to produce vibrant colors, exceptional brightness, and crisp image definition.

Furthermore, the entertainment sector, including cinemas and live events, is benefiting significantly from this technology, as laser projectors provide unparalleled contrast ratios and uniform illumination, making them optimal for grand-scale visuals. This shift from conventional lamp-projectors to laser systems is revolutionizing the cinema industry, with the APAC region leading the charge, as countries such as India and China embrace laser technology in their theaters and entertainment venues.

Get a glance at the market report of share of various segments Request Free Sample

The media and entertainment segment was valued at USD 1.08 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 41% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in the Asia Pacific region is experiencing notable expansion due to the surging demand for laser projectors from key industries such as defense, automotive, and medical sectors. China, as a significant global manufacturer (accounting for over 30% of global automotive production), plays a pivotal role in fueling the growth of the market in this region. The escalating investments in autonomous vehicles in the Asia Pacific are a major catalyst for the market's expansion.

In addition, the increasing adoption of laser projectors for great experiences in meeting spaces and interactive installations, as well as for high-quality and high-resolution images in geographic mapping applications, is further propelling market growth. The defense sector also utilizes laser projectors for training simulations and surveillance systems, adding to the market's momentum.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Laser Projector Market?

Better color and accuracy of laser projectors is the key driver of the market.

- The market is experiencing significant growth due to the importance of superior color accuracy and illumination in various applications, including boardrooms and theaters. Laser projectors employ individual red, green, and blue lasers, enabling them to generate vivid and precise colors, reaching up to 98% of the Rec. 2020 color gamut. This surpasses the color capabilities of conventional lamp-based projectors, which may struggle with color fidelity and saturation.

- Moreover, RGB laser technology maintains consistent image brightness and clarity, making it an excellent choice for applications where dependable performance is essential, such as cinemas and live events. Additionally, laser projectors eliminate the need for filters, thereby reducing energy consumption and enhancing overall efficiency. Laser phosphor and hybrid projectors, which combine laser and lamp technology, are also gaining popularity due to their cost-effectiveness and versatility.

What are the market trends shaping the Laser Projector Market?

Rapid technological advancements in laser projectors is the key trend in the market.

- The market is experiencing significant growth due to advancements in Laser Technology, particularly in RGB Laser solutions. These innovations are making a significant impact in various sectors, including Media and Entertainment, Public Places, and Industrial applications. HighBrightness Solutions are becoming increasingly popular, enabling digital displays to deliver superior image quality and longer operational hours. The IoT (Internet of Things) is revolutionizing various industries by connecting devices to the Internet, enabling data transfer over wireless networks.

- Moreover, the laser projectors are essential components in this technology, contributing to mobile sensing and efficient performance. The IoT integrates technologies such as data communication, hardware design, and data storage and mining. Smart homes, workplaces, and buildings are prime areas of application for the IoT. Automated control of light intensity is a crucial feature in these environments, and laser projectors play a pivotal role in delivering optimal lighting solutions. Thus, such trends will shape the growth of the market during the forecast period.

What challenges does Laser Projector Market face during the growth?

Maintenance of laser projectors is a key challenge affecting the market growth.

- The market experiences significant growth, particularly in sectors such as media and entertainment, public spaces, and aerospace defense, due to the 4K resolution and 3D viewing experience offered by RGB laser projectors. However, maintenance remains a crucial factor impacting both user experience and operational efficiency. Laser projectors boast impressive lifespans of up to 30,000 hours, but proper upkeep is essential to maintain optimal performance.

- Moreover, neglected maintenance tasks, such as filter and lens cleaning, can lead to decreased image quality, including reduced brightness and color accuracy. This, in turn, negatively affects the overall viewing experience. The complexity of maintaining laser projectors may deter potential users, especially in sectors with limited technical expertise. Therefore, it is imperative to prioritize routine maintenance to ensure the longevity and effectiveness of these advanced projectors.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Barco NV

- BenQ Corp.

- Canon Inc.

- CASIO Computer Co. Ltd.

- Christie Digital Systems Canada Inc.

- Dell Technologies Inc.

- Delta Electronics Inc.

- Digital Projection Ltd.

- Hitachi Ltd.

- LG Electronics Inc.

- Panasonic Holdings Corp.

- Ricoh Co. Ltd.

- Samsung Electronics Co. Ltd.

- Seiko Epson Corp.

- Sharp Corp.

- Sony Group Corp.

- ViewSonic Corp.

- Xiaomi Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Laser projection technology has revolutionized the world of visual displays, offering high brightness and vivid colors that surpass the capabilities of traditional lamp-based projectors. Laser-based projection systems, utilizing laser diodes, provide illumination with minimal power consumption and superior thermal management. This technology is making waves in various industries, including entertainment and enterprise, where high-quality images and large-scale visuals are essential. In entertainment, laser projectors deliver great experiences through their ability to produce high-resolution, 3D viewing experiences. In healthcare, they are used for medical imaging and interactive installations. The defense sector leverages laser projectors for geographic mapping and simulation training.

Furthermore, laser projectors have also found a home in digital signage, AR/VR devices, and pico projectors, providing a visual impact that captivates audiences in public spaces such as stadiums, amusement parks, and aerospace defense. With advancements in laser technology, these high-brightness solutions are increasingly being adopted for industrial applications and meeting spaces, including boardrooms, theaters, and cinemas. Hybrid laser phosphor and RGB laser projectors offer even more possibilities, delivering HD and 4K images for media and entertainment, as well as for public places and industrial applications. The future of visual experiences lies in the hands of these advanced laser projectors, offering unparalleled visual impact and energy efficiency.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 21.7% |

|

Market Growth 2024-2028 |

USD 8.34 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

17.5 |

|

Key countries |

US, China, Japan, Germany, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch