Laser Sensor Market Size 2024-2028

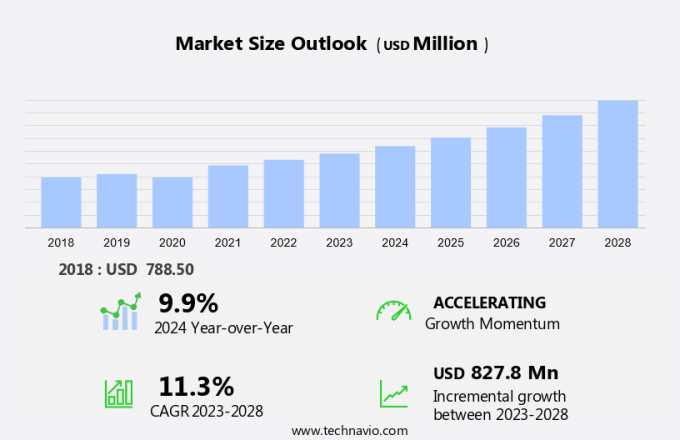

The laser sensor market size is forecast to increase by USD 827.8 million at a CAGR of 11.3% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing adoption of laser sensors in various industries, particularly in automation and Industry 4.0. These sensors, which include laser light curtains, laser photoelectric sensors, and positioning lasers, are utilized for distance measurements and level measurements, among other applications. The Time-Of-Flight (ToF) principle, which relies on reflection, is a key technology driving the market's growth.

- Moreover, this principle enables accurate and efficient distance measurements, leading to flow optimization in industries such as manufacturing, logistics, and transportation. Furthermore, the use of laser sensors is expanding to new sectors, such as mooring of ships and level measurements in hazardous areas with the availability of ATEX versions. Despite the market's growth, the high cost of LiDAR sensors remains a challenge. However, sensor partners are collaborating to develop more cost-effective solutions, ensuring the market's continued expansion.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing significant growth due to the increasing demand for precise measurements and positioning in various industries. These sensors employ the use of laser light to detect and measure various parameters, including distance, level, thickness, and flow. Laser sensors are integral to industrial automation applications, enabling accurate measurement and optimization of processes. The technology behind these sensors relies on principles such as reflection, time-of-flight (TOF), and light intensity to provide reliable and efficient solutions. Distance measurements are a primary application for laser sensors, with these sensors offering high measurement speed and accuracy.

- Moreover, laser distance sensors are commonly used in applications such as mooring of ships, conveyor belt monitoring, and steel plate measurement. Laser displacement sensors are another type of laser sensor, used for measuring linear displacement or position. These sensors are essential in industries such as automotive manufacturing, where precise positioning is critical for assembly processes. Laser projectors and laser light curtains are also important applications of laser sensors. Laser projectors are used for marking and coding applications, while laser light curtains provide safety functions in manufacturing processes. Laser photoelectric sensors and positioning lasers are other types of laser sensors that offer unique advantages.

- Additionally, laser photoelectric sensors provide high-speed detection and are ideal for applications where fast response times are necessary. Positioning lasers, on the other hand, offer high accuracy and are used for precise alignment and positioning applications. The market is also driven by the need for level measurements in various industries. These sensors offer advantages such as high accuracy, long-term stability, and immunity to electromagnetic interference. Moreover, laser sensors play a crucial role in flow optimization, enabling industries to improve their production efficiency and reduce costs. The use of laser sensors in industries such as oil and gas, chemical processing, and food and beverage processing is becoming increasingly common.

- In summary, despite the numerous benefits of laser sensors, there are challenges that need to be addressed. These include the risk of explosion in hazardous environments and the need for sensor partners to provide customized solutions for specific applications. In conclusion, the market is experiencing steady growth due to the increasing demand for precise measurements and positioning in various industries. The technology offers numerous advantages, including high accuracy, measurement speed, and immunity to electromagnetic interference. However, challenges such as explosion risk and the need for customized solutions present opportunities for sensor manufacturers to innovate and provide solutions that meet the unique needs of their customers.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Industrial

- Aerospace defense

- Automotive

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By End-user Insights

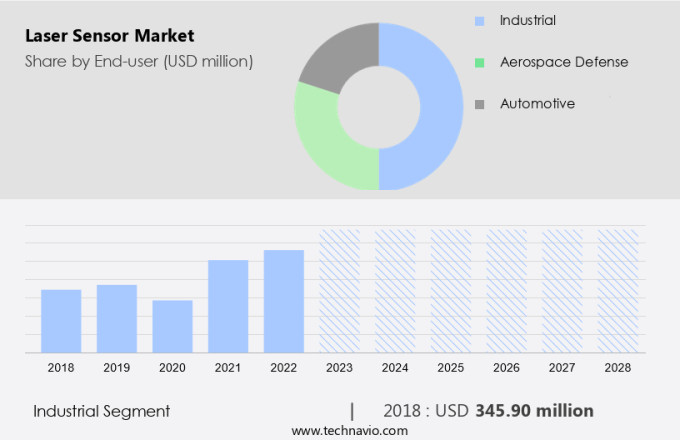

- The industrial segment is estimated to witness significant growth during the forecast period.

The industrial sector's growth in adopting automation technologies, such as machine vision systems, robots, and collaborative robots (cobots), is driving the demand for laser sensors in various applications. These sensors, including laser light curtains, laser photoelectric sensors, and positioning lasers, are integral to automation systems for tasks like distance measurements, level measurements, and flow optimization. According to the International Federation of Robotics (IFR), the global sales of industrial robots reached 0.37 million units in 2023, with APAC being the leading region for adoption. In industries dealing with flammable materials, laser sensors play a vital role in safety systems, such as flame detection.

Moreover, the Time-Of-Flight (ToF) principle is commonly used in these sensors for reflection-based distance measurements. Sensor Partners, along with other key players, offer ATEX versions of these sensors, ensuring safety in potentially explosive atmospheres. Laser sensors' applications extend beyond industrial safety, with uses in mooring of ships and various other industries.

Get a glance at the market report of share of various segments Request Free Sample

The industrial segment was valued at USD 345.90 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 59% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in Asia Pacific is experiencing notable expansion due to the escalating demand for laser sensors from the region's industrial, automotive, and aerospace defense sectors. China, as a leading manufacturer of over 30% of global automotive production, plays a pivotal role in fueling the growth of the market in Asia Pacific. The burgeoning investments in autonomous vehicles in this region are propelling the market for laser sensors. Consequently, the integration of advanced features, including advanced driver-assistance systems (ADAS), anti-intrusion and anti-theft systems, backup cameras, telematics, and adaptive cruise control (ACC), into vehicles will increase, driven by the growing investments in autonomous cars.

Moreover, laser sensors offer stable and accurate measurements, ensuring reliable product values and error-free production. These sensors are effective in detecting reflective surfaces, making them suitable for various applications, including materials and color recognition. The independent housing design of laser sensors enhances their durability and flexibility, making them an ideal choice for diverse industries. Linear imager technology further enhances their capabilities, enabling precise measurements and improved performance. The market in Asia Pacific is poised for substantial growth, fueled by the increasing demand for quality control and advanced technology in various sectors.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Laser Sensor Market?

The adoption of laser sensors in smart cities is the key driver of the market.

- In the realm of advanced technology integration, numerous nations are investing in the creation of intelligent urban environments, referred to as smart cities. A smart city is an urban development strategy that incorporates technology and communication systems into a city's infrastructure. Key indicators of a smart city include the implementation of smart grid technologies, the utilization of IT to enhance traffic management, the availability of Wi-Fi zones, and a strong mobile application ecosystem. Notable examples of smart cities are Singapore, London, and Barcelona. Major corporations like IBM, Microsoft, Cisco, and Schneider Electric are contributing to this transformation by launching initiatives and engineering IT solutions.

- Moreover, a crucial component of smart city infrastructure is the utilization of precise positioning systems, such as those employing a pinpoint laser emitter. These systems enable minute objects to be located with great accuracy, employing a light beam and visible ray. External controllers are used to configure and make adjustments to these systems, while software tools facilitate seamless integration and operation. As electrical devices, these systems are essential for managing various aspects of a smart city, from traffic control to waste management. By harnessing the power of light waves, these technologies contribute significantly to the efficient and effective functioning of smart cities.

What are the market trends shaping the Laser Sensor Market?

The rapid technological advancements in automation and industry 4.0 is the upcoming trend in the market.

- In the realm of IoT technology, laser sensors hold significant importance due to their application in various sectors, including industrial automation. These sensors utilize laser light for detections, measurements, and positioning, offering accurate measurement and measurement speed. Laser distance sensors and displacement sensors are prime examples of such sensors. IoT integrates laser sensors to facilitate mobile sensing, ensuring optimal performance.

- Moreover, IoT encompasses data communication, hardware design, data storage, and mining technologies. Its applications extend to wearables, smart homes, smart workplaces, smart buildings, and automated cars. In industrial automation, laser sensors are crucial for automated control of light intensity, enhancing efficiency and productivity. IoT's integration of laser sensors is a key driver in the development of advanced technologies and applications.

What challenges does Laser Sensor Market face during the growth?

The high cost of LiDAR sensors is a key challenge affecting the market growth.

- The implementation of laser sensors in various industries has been hindered by their high cost, which remains a significant barrier to their widespread adoption. For instance, the price of Velodyne's HDL-64 LiDAR sensor was approximately USD 75,000 in 2015. However, the company offers more affordable alternatives, such as the 32 and 16 laser LiDAR models, priced at around USD 7,000 to USD 8,000. Despite these reductions in price, the cost of laser sensors remains prohibitive for many industries, posing a challenge for The market. Laser sensors are essential components in various applications, including autonomous vehicles, industrial automation, and robotics.

- Additionally, they provide accurate information transmission through the parallel direction of laser beams. These sensors come in various pin configurations, including power pins, voltage supply pins, and a Not Connected (NC) pin. It is crucial to understand the pin configuration to ensure proper installation and functionality. However, the high cost of laser sensors, particularly hazardous ones, can pose a risk to human eyes and potential loss of sight. Therefore, it is essential to prioritize safety measures when handling and installing these sensors.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Banner Engineering Corp.

- Baumer Holding AG

- Ekspla

- ifm electronic gmbh

- Jenoptik AG

- Keyence India Pvt. Ltd.

- LAP GmbH Laser Applikationen

- Laser Technology Inc.

- Micro Epsilon Messtechnik GmbH and Co. KG

- OMRON Corp.

- OPTEX GROUP CO. LTD.

- Panasonic Holdings Corp.

- Rockwell Automation Inc.

- Schmitt Industries Inc.

- SmartRay GmbH

- Technos Instruments

- TRUMPF SE Co. KG

- WayCon Positionsmesstechnik GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for accurate and reliable measurement solutions in various industries. Laser sensors are widely used for detections and measurements in industrial automation applications such as positioning, level measurements, flow optimization, mooring of ships, and thickness measurements. These sensors utilize laser light and its intensity to provide precise measurements, ensuring stable and error-free production. Laser sensors come in various configurations, including laser distance sensors, displacement sensors, laser projectors, laser light curtains, laser photoelectric sensors, and positioning lasers. The time-of-flight (TOF) principle is commonly used in laser sensors for distance measurements, while reflection is used for presence and absence detection of objects.

In summary, laser sensors are suitable for measuring materials with reflective surfaces, such as steel plates and conveyor belts, and can detect minute objects with precise positions. They offer reliable product values and are available in independent housing configurations, making them suitable for hazardous environments. Laser sensors use an external controller for adjustments and configurations, and software tools are available for information transmission and error-free production. These sensors have a pin configuration with power pins, voltage supply pins, and an NC pin for not connected applications. They are available in various sizes and can be used for measuring distances, thicknesses, and profiles, making them a versatile solution for various industrial applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

135 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.3% |

|

Market growth 2024-2028 |

USD 827.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.9 |

|

Key countries |

US, China, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch