Level Sensors And Switches Market Size 2025-2029

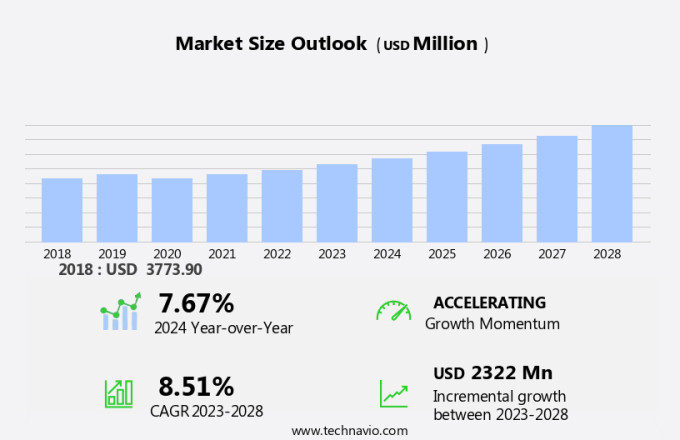

The level sensors and switches market size is forecast to increase by USD 2.62 billion, at a CAGR of 8.9% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing demand in the oil and gas industry for efficient and accurate level measurement solutions. This sector's reliance on level sensors and switches for process optimization and safety is on the rise, as companies seek to maximize production and minimize operational costs. Another trend shaping the market is the growing preference for wireless level sensors. Boiler control relies on level sensors to prevent overheating and ensure efficient energy usage. The flexibility and ease of installation offered by these sensors make them an attractive option for various industries, including water and wastewater treatment, food and beverage, and chemical processing. However, the challenge of selecting the right level sensor for specific applications remains a significant obstacle.

- Factors such as temperature, pressure, and liquid properties must be considered to ensure the chosen sensor delivers accurate and reliable readings. Despite these opportunities, the market faces challenges. Selecting the appropriate level sensor for various applications can be a complex process, as each sensor type has its unique advantages and limitations. For instance, ultrasonic sensors are suitable for measuring liquids with varying densities, while radar sensors are ideal for applications with high levels of interference. Companies must carefully evaluate their specific requirements to make informed decisions and optimize their operations effectively.

What will be the Size of the Level Sensors And Switches Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- In the market, system integration plays a crucial role in optimizing industrial processes. Sensor life cycles are extended through advanced calibration procedures and temperature compensation, ensuring sensor accuracy. Solid state switches and piezoelectric sensors offer reliability and sensitivity, while data analytics and machine learning enable predictive maintenance and process optimization. Remote diagnostics and sensor troubleshooting improve uptime, and fail-safe design ensures safety systems function effectively. Deep learning and artificial intelligence enhance sensor configuration and data logging capabilities. Cloud platform integration and software integration streamline control systems, while pressure compensation and electromagnetic switches cater to various applications.

- Zero-point drift and sensor resolution are critical factors in selecting the right sensors for specific industrial needs. Predictive analytics and emergency shutdown systems ensure safety and efficiency in harsh environments. Overall, the market continues to evolve, driven by technological advancements and the demand for optimized industrial processes. However, the challenge of selecting the right sensor for specific applications necessitates a thorough understanding of the unique requirements and capabilities of each sensor type. Companies seeking to capitalize on these opportunities must invest in research and development to offer innovative solutions that cater to diverse application needs.

How is this Level Sensors And Switches Industry segmented?

The level sensors and switches industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Oil and gas

- Water and wastewater treatment

- Chemical

- Food and beverage

- Others

- Technology

- Hydrostatic pressure

- Microwave and radar

- Ultrasonic

- Vibratory probe

- Others

- Type

- MEMS

- Optical sensors

- Capacitive sensors

- Piezoelectric sensors

- Others

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

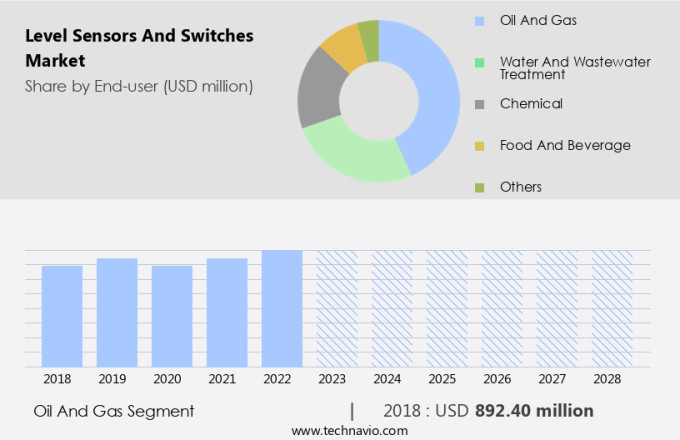

The oil and gas segment is estimated to witness significant growth during the forecast period. Level sensors and switches play a crucial role in process industries, particularly in the oil and gas sector. These sensors, known for their simple designs and high efficiency, enable complex functions. Given the industry's requirement to operate in harsh environmental conditions, level sensors and switches offer comprehensive solutions to prevent leaks and spills of hazardous substances. The expanding exploration in African oil fields and escalating investments in the oil and gas industries across the Middle East and Asia-Pacific are propelling market growth. In the realm of technology, level sensors incorporate various advancements, such as Devicenet protocol, Ethernet connectivity, Wi-Fi, and Profibus protocol, to facilitate seamless integration with industrial automation systems.

Sensor calibration and maintenance are essential aspects of level sensor and switch performance. Capacitive sensors, conductive sensors, and magnetic sensors are some of the types that require regular calibration to maintain accuracy. Proximity switches, float switches, and pressure switches are among the switch types that facilitate efficient switch actuation and control. In summary, the market is driven by the oil and gas industry's need for efficient and reliable level sensing and control solutions. The market is characterized by technological advancements, diverse applications, and stringent industry requirements.

The Oil and gas segment was valued at USD 942.70 billion in 2019 and showed a gradual increase during the forecast period.

Pressure sensors, optical sensors, and ultrasonic sensors are among the popular types, catering to diverse applications in industries like water treatment, power generation, and food & beverage. Moreover, level sensors and switches are engineered to meet stringent industry requirements, including shock resistance, vibration resistance, operating temperature, and hazardous area certification. They are also designed for easy integration with OEM applications, PLCs, SCADA systems, and other industrial control systems. In the context of the Internet of Things (IoT), level sensors and switches are increasingly being used for remote monitoring, data acquisition, and switch actuation. They support various communication protocols, such as Modbus, CAN bus, and HART, to ensure seamless data exchange and control.

The Level Sensors and Switches Market is growing rapidly, driven by advancements in strain gauge sensors that enhance precision and performance. A crucial factor in industry adoption is the sensor life cycle, ensuring longevity and cost efficiency. Improved sensor reliability guarantees accurate measurement and reduced maintenance needs. Enhanced sensor sensitivity allows for more precise detection of liquid and solid levels in various industrial applications. Proper sensor installation is essential for optimizing functionality and achieving consistent performance.

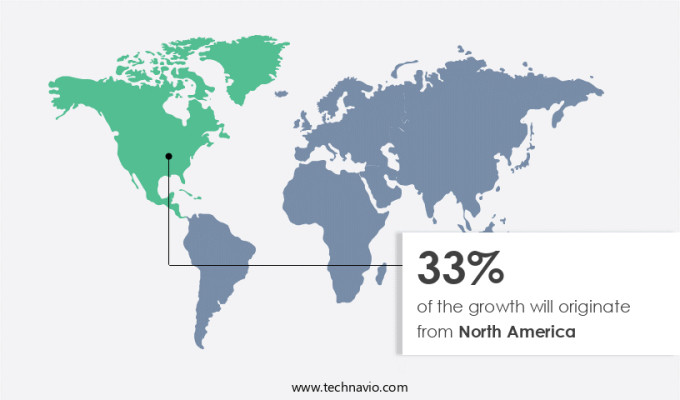

Regional Analysis

APAC is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the industrial automation sector, level sensors and switches are essential components, particularly in the oil and gas industry. The demand for these devices is surging due to increased investments in this sector, especially in greenfield projects across APAC. Notably, state-owned oil companies in China, such as CNOOC Ltd., PetroChina Co. Ltd., and China Petroleum and Chemical Corp., have significantly boosted their investments in traditional and renewable energy projects. In 2024, they collectively invested over RMB 130 billion and increased oil production by 7% year-on-year. This trend is driving the market for level sensors and switches, which play a crucial role in process control, fluid level detection, and reservoir monitoring.

These devices come in various types, including pressure sensors, capacitive sensors, ultrasonic sensors, and magnetic sensors. They offer features like wifi connectivity, ethernet connectivity, and Bluetooth connectivity for remote monitoring and data acquisition. Other essential features include shock resistance, vibration resistance, and hazardous area certification. Level sensors and switches are used in diverse applications, such as food & beverage, water treatment, power generation, and chemical processing. They are integrated with various protocols like DeviceNet, Modbus, Profibus, and CAN bus for seamless communication with other industrial automation systems. They also offer different output options, such as analog output, digital output, and Hart protocol, catering to the specific requirements of various applications.

Moreover, level sensors and switches are integral to various industrial automation systems, including conveyor systems, pipeline monitoring, and tank monitoring. They ensure efficient process control, reduce downtime, and enhance overall productivity. Maintenance requirements for these devices are essential, and sensor calibration is a critical aspect to maintain their accuracy and reliability. In summary, the market for level sensors and switches is experiencing significant growth due to increased investments in the oil and gas industry and the need for efficient process control and automation across various industries. The devices offer various features and come in different types, catering to diverse applications and integration requirements.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Level Sensors And Switches market drivers leading to the rise in the adoption of Industry?

- The oil and gas industry's growing requirement for level sensors and switches serves as the primary market driver. Level sensors and switches play a crucial role in process control and industrial automation, particularly in the chemical processing industry. These devices are essential for fluid level detection in various applications, including reservoir monitoring and hazardous area certification. Two common communication protocols, RS-485 and CAN bus, facilitate the integration of level sensors into larger control systems. Inductive sensors and magnetic sensors are popular technologies for level detection due to their reliability and immunity to harsh environments. Float switches are another option for applications where a simple on/off switch is sufficient. Analog output and digital output are common output types, providing flexibility for system integration.

- The oil and gas industry in the Middle East and Africa continues to drive demand for level sensors and switches due to their extensive oil reserves. Despite reduced oil and gas prices, Latin American countries have not seen a significant decrease in production, ensuring ongoing demand for new plant equipment and machinery. Ingress protection rating is an essential consideration for level sensors and switches, ensuring they can withstand the harsh conditions often encountered in industrial applications. The HART protocol and ISA-100 communication protocols provide additional features for process monitoring and diagnostics.

What are the Level Sensors and Switches market trends shaping the Industry?

- The growing demand for wireless level sensors represents a significant market trend in the industrial automation sector. These sensors offer numerous advantages, including increased flexibility, easier installation, and improved data access, making them an essential component of modern industrial systems. Level sensors and switches play a crucial role in industrial automation and process control by monitoring and maintaining the accurate level of fluids or materials in tanks and pipelines. These sensors convert physical quantities into electrical signals, which are then processed through an automation system to indicate physical variations or error signals. Wireless level sensors, in particular, have gained popularity due to their ability to transmit data in real-time, enabling remote monitoring and control. Pressure sensors, optical sensors, and proximity switches are common types of level sensors used in various industries, including food & beverage, oil & gas, and manufacturing.

- These sensors offer features such as high precision, reliability, range, and sensitivity, making them suitable for applications like flow control, pipeline monitoring, and OEM integrations with PLCs. Signal conditioning is an essential aspect of level sensing, ensuring the accuracy and quality of the electrical signals produced by the sensors. The integration of wireless connectivity technologies, such as Wi-Fi and DeviceNet protocol, further enhances the functionality of level sensors by enabling seamless data transfer and remote monitoring. These sensors offer advanced features, such as pressure sensing, optical detection, and proximity switching, making them indispensable in various industries and applications.

How does Level Sensors and Switches market face challenges during its growth?

- The inability to choose appropriate level sensors poses a significant challenge to industry expansion. This issue, which requires the expertise and knowledge of professionals, hinders growth in the sector. Level sensors and switches play a crucial role in various industries, including water treatment, power generation, and oil & gas, for level control and switch actuation. These devices come in different types, such as capacitive sensors, which use the property of capacitance to detect the level of a medium. Digital output, ethernet connectivity, Bluetooth connectivity, and IoT applications are some advanced features increasingly adopted in level sensors and switches. However, choosing the right type of level sensor can be challenging due to the complexity involved in capturing and measuring distinct phases, such as vapor and liquid or liquid and solid.

- Customized solutions are often sought after, but their high cost can be a significant barrier for industrial buyers, potentially impacting business operations and overall costs. Data acquisition and sensor calibration are essential aspects of maintaining accurate level measurements. Industrial communication protocols, such as Profibus, facilitate seamless integration of level sensors and switches into industrial systems.

Exclusive Customer Landscape

The level sensors and switches market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the level sensors and switches market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, level sensors and switches market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - The company specializes in level sensors and switches and introduces its advanced LLT 100 laser level transmitters, engineered for precise measurement of dry bulk solids and liquids within silos.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- AMETEK Inc.

- Berthold Technologies GmbH and Co.KG

- Danfoss AS

- Dwyer Instruments LLC

- Emerson Electric Co.

- Endress Hauser Group Services AG

- Gems Sensors Inc.

- Honeywell International Inc.

- JUMO Instrument Co. Ltd.

- KROHNE Messtechnik GmbH

- NOHKEN Inc

- Pepperl and Fuchs SE

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- SST Sensing Ltd.

- TE Connectivity Ltd.

- Trafag AG

- VEGA Grieshaber KG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Level Sensors And Switches Market

- In February 2023, Honeywell International Inc. announced the launch of its new level sensor, the MicroSwitch Level Sensor, designed for harsh environments. This innovative product offers a higher temperature rating and improved reliability, making it suitable for applications in the oil and gas industry (Honeywell, 2023).

- In March 2024, Emerson Electric and Sensirion AG, a Swiss sensor manufacturer, entered into a strategic partnership to develop advanced level sensors for various industries. The collaboration aims to combine Emerson's automation expertise with Sensirion's sensor technology, creating more efficient and accurate level sensing solutions (Emerson Electric, 2024).

- In May 2024, Endress+Hauser, a leading process automation company, acquired Sensico Instruments, a Swiss manufacturer of ultrasonic level measurement sensors. This acquisition strengthened Endress+Hauser's position in the level sensor market and expanded its product portfolio (Endress+Hauser, 2024).

Research Analyst Overview

The market continues to evolve, driven by the diverse requirements of various sectors such as water treatment, power generation, food & beverage, oil & gas, and chemical processing. Tank monitoring and pipeline monitoring are crucial applications, ensuring efficient flow control and maintaining optimal operating pressure. Devicenet protocol and Profibus protocol facilitate seamless integration with PLCs and SCADA systems, while signal conditioning and sensor calibration ensure accurate level sensing. Optical sensors and ultrasonic sensors are increasingly used for non-contact level measurement, offering advantages in harsh environments and challenging applications. Wifi connectivity and Bluetooth connectivity enable remote monitoring and data acquisition, enhancing operational efficiency and reducing maintenance requirements.

Proximity switches and float switches are essential components in material handling and industrial automation, ensuring switch actuation and response time in various applications. Capacitive sensors and conductive sensors offer versatility in sensing different media and temperatures, while shock resistance and vibration resistance ensure reliable performance in demanding environments. The ongoing integration of IoT applications and wireless communication in level sensors and switches is revolutionizing process control and industrial automation, enabling smart manufacturing and real-time data analysis. The market's continuous dynamism is reflected in the emergence of new technologies and evolving patterns, ensuring a vibrant and innovative landscape for level sensing solutions.

Technologies like inductive sensors, magnetic sensors, and float switches offer reliable level detection in various applications. The oil and gas industries in the Middle East and Africa, along with ongoing production in Latin America, ensure consistent demand for these devices. Ingress protection rating and communication protocols like RS-485, CAN bus, HART, and ISA-100 further enhance their functionality and versatility. The Level Sensors and Switches Market is advancing with innovative switch technology, ensuring accurate fluid level detection. Enhanced sensor integration improves monitoring precision across industries.

Efficient PLC integration optimizes automation, while SCADA integration enables seamless real-time data acquisition. Communication protocols like Modbus protocol, RS protocol, and Profinet protocol facilitate reliable data exchange in industrial systems. These advancements contribute to improved operational efficiency and safety in sectors such as manufacturing, wastewater management, and oil & gas. The integration of these technologies allows for smarter, adaptive sensing solutions, ensuring better process control and reducing maintenance costs. As industries embrace automation, the demand for intelligent level sensors and switches continues to grow, driving further innovation and market expansion.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Level Sensors And Switches Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

247 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.9% |

|

Market growth 2025-2029 |

USD 2.62 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Key countries |

US, China, Canada, Germany, Japan, Mexico, UK, France, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Level Sensors And Switches Market Research and Growth Report?

- CAGR of the Level Sensors And Switches industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the level sensors and switches market growth of industry companies

We can help! Our analysts can customize this level sensors and switches market research report to meet your requirements.