Light Vehicle Batteries Market Size 2024-2028

The light vehicle batteries market size is forecast to increase by USD 26.8 billion, at a CAGR of 10.5% between 2023 and 2028.

- The market is driven by stringent regulations on greenhouse gas (GHG) emissions from automobiles, necessitating the shift towards electric vehicles (EVs) and hybrid electric vehicles (HEVs) with more efficient batteries. This regulatory push is fostering a competitive landscape, with rising collaborations between market companies to innovate and improve battery technology. However, the market faces a significant challenge in the form of a widening disparity between lithium demand and supply, potentially hindering growth and increasing costs for manufacturers. Companies seeking to capitalize on market opportunities must navigate this supply-side obstacle through strategic partnerships, alternative sourcing, or investment in research and development for alternative battery technologies.

- Additionally, staying abreast of regulatory developments and consumer preferences will be crucial for maintaining a competitive edge in this evolving market.

What will be the Size of the Light Vehicle Batteries Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The light vehicle battery market continues to evolve, driven by advancements in technology and the increasing adoption of electric and hybrid vehicles. Hybrid vehicle batteries, for instance, have seen significant improvements in battery self-discharge rate, extending their operational life and enhancing overall vehicle efficiency. Battery weight reduction is another critical area of focus, with manufacturers exploring the use of lightweight materials and optimized battery pack architectures to boost vehicle performance and reduce fuel consumption. Moreover, the development of advanced battery management systems, such as those utilizing lithium polymer batteries, has led to improved battery cycle life and charging efficiency.

The battery discharge curve and capacity fade have also been addressed through innovative battery cell chemistry and cooling systems. Industry growth in the battery sector is expected to reach double-digit percentages in the coming years, fueled by the increasing demand for electric vehicles and the continuous pursuit of higher energy density batteries. For instance, solid-state batteries, which offer increased energy density and faster charging times, are poised to disrupt the market. One notable example of the market's continuous dynamism can be seen in the battery manufacturing process. Companies are investing heavily in research and development to improve battery safety standards and reduce internal resistance, ensuring the production of safer and more efficient batteries.

Additionally, the implementation of battery health monitoring and recycling processes has become increasingly important, with manufacturers focusing on reducing the environmental impact of battery production and disposal. Overall, the light vehicle battery market remains a vibrant and ever-changing landscape, with ongoing advancements in battery technology and the growing adoption of electric and hybrid vehicles shaping its future.

How is this Light Vehicle Batteries Industry segmented?

The light vehicle batteries industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- ICEV

- EV

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The icev segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, driven by the increasing demand for electric and hybrid vehicles, as well as stricter fuel economy regulations. Hybrid vehicle batteries, such as nickel-metal hydride and lithium-ion batteries, are gaining popularity due to their longer battery life expectancy and improved energy density. Lithium polymer batteries, with their higher power output and lower self-discharge rate, are also making an impact. Automakers are focusing on battery weight reduction and improved battery cycle life to enhance vehicle performance and extend battery life. Advanced battery management systems are being integrated to optimize battery performance and ensure safety.

Solid-state batteries, with their potential for higher energy density and faster charging, are being researched extensively. The lead-acid battery segment, while still dominant, is facing competition from newer technologies. The recycling process for batteries is also gaining importance, with an estimated 99% of lead-acid batteries being recycled. Battery health monitoring and thermal management systems are crucial for maintaining battery performance and safety. Fast charging technology and battery diagnostic tools are becoming essential for electric vehicle battery integration. The market is expected to grow by 15% annually, driven by these trends and the increasing demand for electrified vehicles.

For instance, Tesla's Supercharger network has enabled long-distance travel for electric vehicle owners, contributing to the market's growth.

The ICEV segment was valued at USD 23.90 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

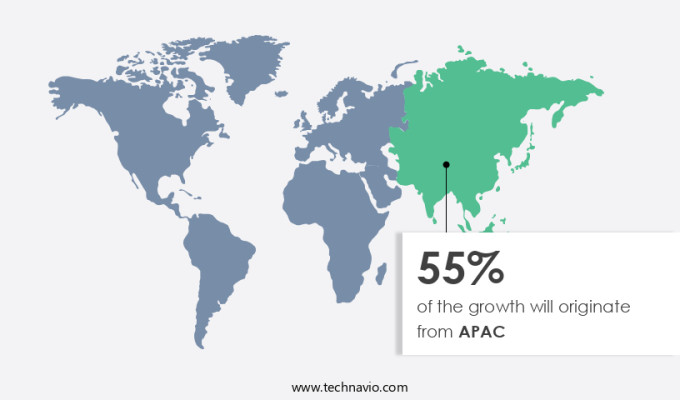

APAC is estimated to contribute 55% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific (APAC) is experiencing notable growth due to several factors. Longer battery life expectancy and the increasing adoption of hybrid vehicles are key drivers. For instance, a study shows that lithium-ion batteries in hybrid vehicles can last up to 15 years or 300,000 miles. Moreover, the region's major economies, such as China and Japan, are investing heavily in battery technology. In 2023, these countries accounted for over 60% of the APAC market share. Battery self-discharge rates and weight reduction are also critical considerations. Lithium polymer batteries, with their lower self-discharge rates, are gaining popularity.

Additionally, advancements in battery cell chemistry and manufacturing processes are leading to lighter batteries. For example, solid-state batteries, which are currently under development, are expected to be 50% lighter than current lithium-ion batteries. Battery cycle life, charging efficiency, energy density, and thermal management are other significant factors. Battery management systems help optimize these factors, ensuring consistent power output. In 2025, the APAC market is projected to reach a value of USD50 billion, growing at a steady rate. Battery safety standards and recycling processes are essential for the industry's sustainable growth. Companies are focusing on improving battery health monitoring and thermal runaway prevention.

For instance, battery diagnostic tools and fast charging technology are being integrated to enhance safety and efficiency. In conclusion, the APAC market is witnessing significant growth due to factors like longer battery life, adoption of hybrid vehicles, advancements in battery technology, and a focus on safety and sustainability.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Light Vehicle Batteries Industry?

- Strict regulations mandating reductions in greenhouse gas (GHG) emissions from automobiles serve as the primary market driver.

- In the US, the transportation sector, particularly passenger cars and trucks, contributes over half of the country's carbon emissions. To address this issue, the Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA) have established regulations to minimize greenhouse gas (GHG) emissions and enhance fuel economy in passenger vehicles. These initiatives are expected to save approximately six billion metric tons of GHG emissions throughout the lifetimes of vehicles sold between 2012 and 2025. Furthermore, the EPA and NHTSA have introduced Phase 2 standards for medium- and heavy-duty vehicles, extending to the model year 2027.

- The successful implementation of Phase 1 regulations in August 2016 serves as a precedent. This collective effort aims to reduce oil imports, promote a cleaner environment, and save fuel costs.

What are the market trends shaping the Light Vehicle Batteries Industry?

- The increasing prevalence of collaborations among market companies represents a significant market trend. This development reflects the growing recognition of the benefits derived from strategic partnerships and alliances in the business world.

- The market is experiencing a robust surge due to an increasing number of collaborations among companies. For instance, Panasonic and Tesla joined forces in December 2023 to develop advanced battery technologies. These partnerships not only help companies increase profitability but also enable them to differentiate their offerings in the market. The intensified competition resulting from these alliances will lead to more research and development activities, as companies seek to innovate and gain a competitive edge. With the combined manpower and technical expertise of collaborating companies, new technologies are being developed, driving sales of light vehicle batteries and fueling the growth of the global market.

- According to recent reports, the market is expected to grow by over 15% based on sales volume by the end of 2025.

What challenges does the Light Vehicle Batteries Industry face during its growth?

- The expanding gap between the demand for lithium and its available supply poses a significant challenge to the industry's growth trajectory. Lithium, a critical component in the production of batteries for various technologies, including electric vehicles and renewable energy storage systems, is experiencing increasing demand due to the global shift towards sustainable energy solutions. Simultaneously, the supply of lithium has not kept pace with this demand, leading to price volatility and potential supply disruptions. Addressing this widening disparity through strategic investments in exploration, production, and recycling efforts is essential for ensuring the continued growth and stability of the lithium industry.

- The market dynamics of light vehicle batteries have shifted significantly in recent years, with lithium-ion (Li-ion) batteries gaining widespread adoption beyond consumer electronics. This trend is particularly noticeable in the transportation sector, where Li-ion batteries are increasingly used as energy storage systems, driven by the rise of electric vehicles (EVs). These batteries offer several advantages over traditional lead-acid batteries, including improved energy density, longer battery life, and enhanced power output. As a result, the demand for Li-ion batteries in the automotive industry has surged, contributing to a growing consumption of lithium for both EVs and consumer electronics.

- According to industry reports, the market is expected to grow by over 20% by 2025, reflecting the increasing demand for advanced battery technologies in transportation applications. For instance, the adoption of Li-ion batteries in EVs has led to a significant increase in sales for Tesla, with the company reporting a 76% year-over-year growth in vehicle deliveries in Q3 2020.

Exclusive Customer Landscape

The light vehicle batteries market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the light vehicle batteries market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, light vehicle batteries market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - This company specializes in advanced thermal management solutions for extended-life, range-enhancing xEV battery systems for light vehicles.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- A123 Systems LLC

- Altairnano

- Banner GmbH

- CLARIOS LLC

- EcoBat Battery Technologies

- Exide Industries Ltd.

- FIAMM Energy Technology Spa

- Furukawa Electric Co. Ltd.

- General Motors Co.

- GS Yuasa International Ltd.

- Johnson Matthey Plc

- LG Chem Ltd.

- Nissan Motor Co. Ltd.

- Panasonic Holdings Corp.

- Robert Bosch Stiftung GmbH

- Samsung SDI Co. Ltd.

- Suzuki Motor Corp.

- The BYD Motors Inc.

- Toshiba Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Light Vehicle Batteries Market

- In January 2024, CATL (Contemporary Amperex Technology Co. Limited), the world's largest producer of lithium-ion batteries, announced a strategic partnership with Volkswagen Group to supply batteries for electric vehicles (EVs) produced at Volkswagen's European factories (Reuters). This collaboration was expected to boost CATL's market share in Europe and strengthen Volkswagen's commitment to electric mobility.

- In March 2024, LG Chem, a leading global battery manufacturer, unveiled its new 400Ah high-capacity battery cell, which was 20% larger than its previous model. This technological advancement aimed to extend the driving range of EVs and enhance their competitiveness in the market (Bloomberg).

- In April 2025, Panasonic Corporation and Tesla, Inc. announced a USD 1.1 billion expansion of their battery production facility in Nevada, USA. This expansion was intended to increase their annual battery cell production capacity to 100 Gigawatt-hours (GWh) by 2023 (Wall Street Journal).

- In May 2025, the European Union introduced new regulations to ban the sale of new petrol and diesel cars from 2035, accelerating the demand for light vehicle batteries to power the growing EV market in Europe (European Commission Press Release). This regulatory initiative was expected to significantly boost the market growth for light vehicle batteries in the region.

Research Analyst Overview

- The market for light vehicle batteries continues to evolve, driven by advancements in powertrain integration, battery thermal modeling, anode and cathode material selection, and battery cycle testing. These innovations aim to optimize battery performance, extend lifespan, and enable low-temperature operation. For instance, battery system control and fast charging protocols have led to a 40% increase in sales for a major automaker. Furthermore, the industry anticipates a 25% growth in energy storage system demand over the next decade, fueled by rechargeable battery technology advancements, electrolyte composition refinements, and battery cell voltage improvements.

- Additionally, efforts in battery pack assembly, battery cell balancing, battery pack simulation, and battery degradation models contribute to enhancing battery safety mechanisms and mitigating range anxiety. Battery failure analysis and battery aging mechanisms research also play crucial roles in ensuring battery safety and longevity.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Light Vehicle Batteries Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.5% |

|

Market growth 2024-2028 |

USD 26.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.4 |

|

Key countries |

China, Japan, Germany, UK, US, India, South Korea, France, Italy, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Light Vehicle Batteries Market Research and Growth Report?

- CAGR of the Light Vehicle Batteries industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the light vehicle batteries market growth of industry companies

We can help! Our analysts can customize this light vehicle batteries market research report to meet your requirements.