Lithium Carbonate Market Size 2025-2029

The lithium carbonate market size is forecast to increase by USD 4.98 billion, at a CAGR of 14.1% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand for lithium-ion batteries in electric vehicle (EV) manufacturing and recycling initiatives. The global shift towards sustainable transportation solutions is fueling the demand for lithium carbonate, a key component in the production of lithium-ion batteries. However, the market faces a notable challenge: the shortage of EV charging stations. Despite the growing demand, the limited availability of charging infrastructure poses a significant obstacle to the widespread adoption of electric vehicles. This challenge is further compounded by the fact that the production and recycling of lithium-ion batteries require a substantial amount of energy, which in turn necessitates a reliable and efficient charging infrastructure.

- Companies seeking to capitalize on the opportunities presented by the market must address this challenge by investing in the development and expansion of EV charging networks. Additionally, exploring alternative methods of battery production and recycling, such as those with lower energy requirements, could help mitigate this challenge and ensure a steady supply of lithium carbonate.

What will be the Size of the Lithium Carbonate Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve as the demand for advanced energy storage solutions surges across various sectors. Lithium carbonate, a key component in the production of lithium-ion batteries, plays a crucial role in powering electric vehicles (EVs), renewable energy systems, and consumer electronics. Battery analytics and diagnostics are increasingly important as industry standards for fast charging and battery efficiency continue to rise. Lithium hydroxide, another lithium compound, is gaining attention for its potential use in next-generation batteries, such as lithium-sulfur and solid-state batteries. Environmental concerns and the need for sustainable mining practices are shaping the lithium industry. Lithium reserves are being explored and developed to meet the growing demand, while lithium-ion battery recycling is gaining traction as a solution for reducing the carbon footprint and minimizing the risk of battery fires.

Battery technology advancements, including improvements in battery performance, battery safety, and battery capacity, are driving innovation in the energy storage sector. Lithium-ion battery testing and monitoring are essential to ensure battery life and reliability. Government regulations and ethical sourcing are becoming increasingly important in the lithium industry. Renewable energy sources, such as wind and solar, are driving demand for energy storage systems, further fueling the need for lithium carbonate. The battery supply chain is undergoing significant changes as new players enter the market and existing players expand their operations. Battery management systems and battery charging technologies, including wireless charging, are also advancing to meet the evolving needs of the industry.

Power tools and consumer electronics are just a few of the many applications for lithium-ion batteries. The ongoing unfolding of market activities and evolving patterns in the market reflect the continuous dynamism and innovation in the battery industry.

How is this Lithium Carbonate Industry segmented?

The lithium carbonate industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Batteries

- Ceramics and glass

- Cement and aluminum

- Others

- Distribution Channel

- Direct sale

- Indirect sale

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

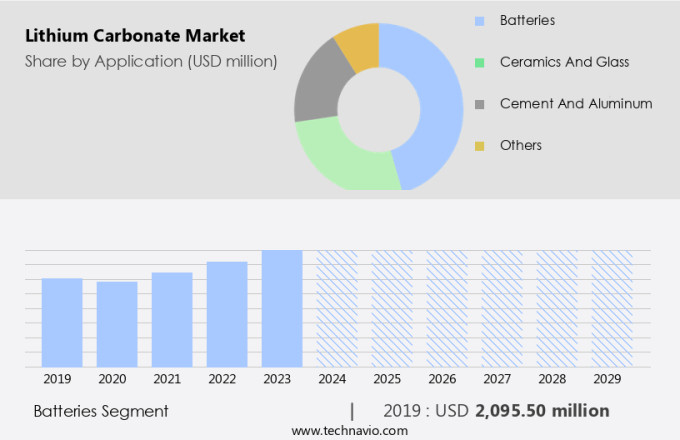

The batteries segment is estimated to witness significant growth during the forecast period.

Lithium carbonate is a crucial component in the production of cathode materials for lithium-ion batteries, specifically those used in electric vehicles (EVs), energy grid storage, and consumer electronics. The purity level of lithium carbonate determines its grade; EV-grade lithium carbonate contains 99.9% lithium, while standard battery-grade lithium carbonate has a purity of 99.5%. Lithium carbonate's excellent electrochemical inertness makes it ideal for manufacturing the protective layer of cathodes, ensuring battery efficiency and longevity. The lithium industry focuses on sustainable mining practices to meet the increasing demand for lithium carbonate. Lithium hydroxide, another derivative of lithium, is also gaining popularity due to its potential use in next-generation batteries like lithium-sulfur and solid-state batteries.

Battery certification and safety are paramount in the battery industry, with battery management systems and monitoring playing essential roles in maintaining battery performance and preventing thermal runaway. Battery degradation and environmental impact are significant concerns in the battery industry. Battery analytics and diagnostics help identify issues early, improving battery life and reducing the need for replacement. Lithium-ion battery recycling is another area of focus, as it reduces the carbon footprint and the demand for new lithium reserves. Lithium-ion batteries are integral to various industries, including wind and solar energy, power tools, and the evolving electric vehicle industry. Lithium-ion batteries' power density, energy density, and cycle life make them a preferred choice for these applications.

However, concerns regarding battery cost, battery charging, and battery safety, including the risk of fires, remain. Government regulations and ethical sourcing are essential considerations in the lithium industry. Lithium pricing and the battery supply chain's stability are also critical factors in the industry's growth. As the demand for renewable energy sources increases, the role of lithium carbonate and lithium-ion batteries becomes more significant.

The Batteries segment was valued at USD 2.1 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

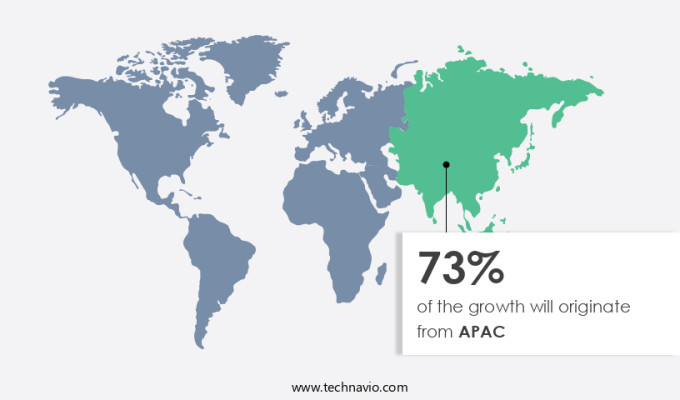

APAC is estimated to contribute 73% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Lithium carbonate plays a pivotal role in the production of lithium-ion batteries, which are essential for powering electric vehicles (EVs) and energy storage systems in renewable energy projects. The escalating adoption of EVs, particularly in countries like China and India, fuels the demand for lithium carbonate. Renewable energy sources, such as solar and wind, are increasingly popular in countries like Indonesia and India in the Asia Pacific (APAC) region. Lithium-ion batteries are integral to energy storage in renewable energy projects, thereby driving the demand for lithium carbonate. For instance, India's Ministry of New and Renewable Energy announced the installation of around 13.5 GW of renewable energy capacity with an investment of approximately USD10 billion in January 2024.

The country ranks fourth internationally in renewable energy installed capacity, fourth in wind power capacity, and fifth in solar power capacity. The battery industry focuses on enhancing battery efficiency, safety, and performance through advancements in battery technology, such as solid-state batteries and lithium-sulfur batteries. Sustainable mining practices and ethical sourcing are also crucial considerations in the lithium industry. Battery management systems, battery analytics, and battery diagnostics help monitor battery health and optimize battery life. Lithium hydroxide, another lithium compound, is used in battery electrolytes and cathodes, contributing to the overall battery industry growth. Government regulations and safety concerns, including battery degradation, thermal runaway, and battery fires, necessitate rigorous testing and certification processes.

The battery supply chain, from mining to manufacturing and recycling, is undergoing significant transformations to address these challenges and ensure a sustainable, cost-effective, and reliable battery ecosystem. Lithium pricing, battery cost, and battery capacity are key factors influencing the market dynamics. The evolving battery landscape encompasses next-generation batteries, such as lithium-air batteries and lithium-metal batteries, which promise higher energy density and longer battery life. The lithium industry's future lies in addressing these advancements while minimizing the environmental impact and ensuring a responsible, transparent, and ethical battery supply chain.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Lithium Carbonate Industry?

- The surging demand for lithium-ion batteries, driven primarily by the increasing adoption of electric vehicles (EVs), is the primary growth factor in the market.

- The global shift towards sustainable transportation and the widespread adoption of electric vehicles (EVs) have significantly increased the demand for lithium-ion batteries. Lithium carbonate is a crucial raw material in the production of cathode materials for these batteries. Given the high energy density and low weight of lithium-ion batteries, they are the preferred choice for hybrid electric vehicles, plug-in hybrid electric vehicles, and EVs. The fast-charging capabilities of these batteries and their ability to meet industry standards for battery efficiency have made them a popular choice in the battery industry. Lithium hydroxide, another derivative of lithium carbonate, is used in battery electrolytes and battery management systems.

- It plays a crucial role in improving battery performance and reducing battery degradation. The growing demand for grid-scale energy storage and the development of advanced battery technologies, such as lithium-sulfur batteries and lithium metal batteries, are expected to further boost the market for lithium carbonate. Battery certification and monitoring systems are essential to ensure the safety and reliability of lithium-ion batteries. Lithium carbonate is used in the production of battery anodes and battery electrolytes, making it a vital component in the battery manufacturing process. The increasing focus on improving battery efficiency and reducing battery degradation is expected to drive the demand for lithium carbonate in the battery industry.

What are the market trends shaping the Lithium Carbonate Industry?

- Battery recycling initiatives have gained significant traction as the market trend. It is essential for businesses and individuals to prioritize this practice due to its environmental benefits and potential financial rewards.

- Lithium carbonate is a crucial component in the production of batteries, particularly those used in solid-state technologies and energy storage systems. The demand for lithium carbonate is driven by the increasing adoption of these batteries in various applications, including battery separators for electric vehicles and renewable energy systems like wind energy. Sustainability is a significant factor in the lithium industry, and mining operations must prioritize environmentally responsible practices. Recycling spent batteries is a key initiative that helps conserve valuable resources and reduce the environmental impact of mining. By recovering and reusing lithium, as well as other metals such as cobalt, nickel, and copper, the need for extracting new lithium from raw materials is minimized.

- This approach promotes a more sustainable mining process and lowers the overall carbon footprint of the battery supply chain. Battery performance, battery safety, battery charging, and wireless charging are essential aspects of the battery market. Lithium carbonate plays a vital role in enhancing battery performance, ensuring efficient energy storage, and improving battery safety. As the demand for more cost-effective and efficient energy storage solutions continues to grow, the focus on reducing battery costs remains a critical market driver. In conclusion, the market is influenced by various factors, including technological advancements, sustainability initiatives, and the growing demand for energy storage systems.

- The recycling of spent batteries is a significant trend that contributes to the circular economy and reduces the environmental impact of mining operations. This approach not only benefits the lithium industry but also supports the development of more efficient, cost-effective, and sustainable energy storage solutions.

What challenges does the Lithium Carbonate Industry face during its growth?

- The insufficient availability of Electric Vehicle (EV) charging stations represents a significant barrier to the expansion and growth of the industry.

- The market is experiencing significant growth due to the increasing adoption of lithium-ion batteries in the Electric Vehicle (EV) industry. The environmental benefits of EVs, such as reduced carbon footprint and renewable energy integration, are driving this trend. However, challenges persist, including the need for improved battery analytics, diagnostics, and next-generation batteries with higher power density and longer cycle life. The environmental impact of battery production and disposal, including carbon footprint and battery fires, is also a concern. Lithium reserves are a critical factor in the market's growth, and there is a push for lithium-ion battery recycling to mitigate supply chain risks.

- Despite these challenges, the market is expected to continue growing, driven by the increasing demand for EVs and advancements in battery technology. However, the lack of standardized charging infrastructure remains a significant barrier to market growth, particularly in regions with low charging station density. Public awareness and investment in charging infrastructure are necessary to address this challenge and accelerate the transition to EVs.

Exclusive Customer Landscape

The lithium carbonate market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the lithium carbonate market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, lithium carbonate market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Albemarle Corp. - The company specializes in supplying lithium carbonate, a versatile raw material essential for various industries. In the realm of glass, ceramics, and enamel production, lithium carbonate serves as a critical component. Additionally, it functions as the foundation for the synthesis of various lithium compounds. Furthermore, it is utilized as a catalyst in the esterification process. By providing high-quality lithium carbonate, the company supports the manufacturing sectors that rely on its unique properties.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Albemarle Corp.

- Arcadium Lithium

- Ascend Elements Inc.

- Axiom Chemicals Pvt. Ltd.

- Basstech International

- Bisley and Co. Pty. Ltd.

- Celtic Chemicals Ltd.

- Eramet

- Ganfeng Lithium Group Co., Ltd

- GFS Chemicals Inc.

- HELM AG

- JIGCHEM UNIVERSAL

- Lakshita Chemicals

- Lepidico Ltd

- Merck KGaA

- Noah Chemicals

- Orocobre Ltd.

- SQM S.A.

- Stellantis NV

- Targray Technology International Inc.

- Tianqi Lithium Corp.

- ZIJIN MINING GROUP CO. LTD

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Lithium Carbonate Market

- In February 2023, Albemarle Corporation, a leading lithium producer, announced the expansion of its lithium hydroxide production capacity at its Silver Peak, Nevada facility. This expansion is expected to increase the company's total lithium hydroxide capacity by 50%, making Albemarle a major player in the lithium hydroxide market, which is increasingly preferred over lithium carbonate due to its higher energy density for batteries (Albemarle Corporation Press Release).

- In July 2024, Tesla, the electric vehicle giant, and POSCO, a leading South Korean steel producer, formed a strategic partnership to develop a lithium-ion battery recycling plant in the United States. This collaboration aims to reduce the environmental impact of battery production and secure a stable supply of critical raw materials, including lithium carbonate, for the rapidly growing electric vehicle industry (Tesla Inc. Press Release).

- In March 2025, SQM, a leading lithium producer, completed the acquisition of the Salar de Atacama lithium brine project from Sociedad Quimica y Minera de Chile S.A. This acquisition significantly increased SQM's lithium reserves and strengthened its position in the global lithium market (SQM Press Release).

- In October 2025, Ganfeng Lithium, a leading Chinese lithium producer, announced the commercialization of its innovative lithium-ion battery recycling technology. This technology recovers both lithium and cobalt from used batteries, reducing the reliance on primary raw materials and contributing to a more sustainable lithium carbonate supply chain (Ganfeng Lithium Press Release).

Research Analyst Overview

- The market is a critical component of the battery industry, fueling the research and development (R&D) and manufacturing sectors. With increasing battery industry consolidation, standards and regulations play a significant role in shaping market dynamics. Lithium market forecasts indicate continued growth, driven by the expanding battery industry and the demand for sustainable battery solutions. Lithium-ion battery patents and intellectual property are essential for innovation and market differentiation. Sustainability is a key trend, with a focus on battery processing techniques and recycling technologies. Lithium extraction technologies are also advancing to meet the growing demand for raw materials.

- Battery usage spans various applications, from consumer electronics to electric vehicles (EVs), necessitating testing equipment and safety standards. The battery industry associations and conferences serve as platforms for knowledge sharing and collaboration. Battery assembly and packaging require optimization for performance and life extension. Electrochemical processes are continually evolving to improve battery efficiency and reduce pricing volatility. The battery market size is projected to expand, driven by the increasing market share of EVs and renewable energy storage systems. Battery industry regulations are crucial in ensuring safety and environmental sustainability. The battery market trends reflect the ongoing efforts to address these challenges while maintaining competitiveness.

- Investment in battery manufacturing and R&D remains a priority for businesses seeking to stay ahead in this dynamic industry.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Lithium Carbonate Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.1% |

|

Market growth 2025-2029 |

USD 4980.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.3 |

|

Key countries |

China, South Korea, Japan, US, India, Germany, Canada, UK, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Lithium Carbonate Market Research and Growth Report?

- CAGR of the Lithium Carbonate industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the lithium carbonate market growth of industry companies

We can help! Our analysts can customize this lithium carbonate market research report to meet your requirements.