Lithium Hexafluorophosphate Market Size 2024-2028

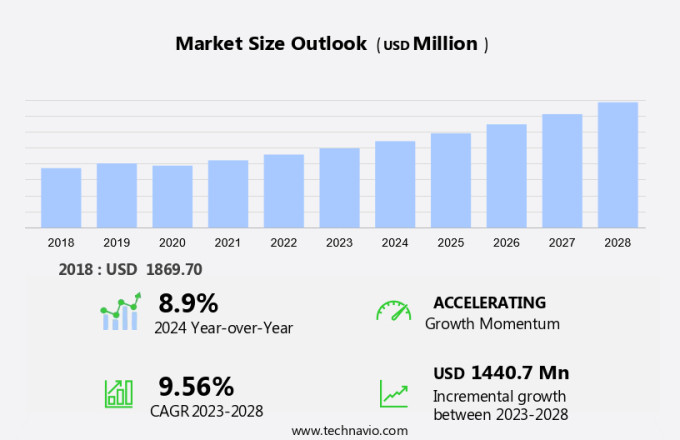

The lithium hexafluorophosphate market size is forecast to increase by USD 1.44 billion at a CAGR of 9.56% between 2023 and 2028. The lithium hexafluorophosphate (LiPF6) market is experiencing significant growth due to the increasing demand for lithium-ion batteries in electric vehicles (EVs) and renewable energy storage applications. The Indian government's Production-Linked Incentive (PLI) scheme for advanced chemistry cell (ACC) batteries is expected to boost the market's expansion. The electric vehicle segment is a major driver, as the shift toward sustainable transportation solutions continues to gain momentum. Furthermore, the integration of renewable energy sources, such as solar and wind power with battery storage systems is increasing the demand for LiPF6. However, the high production cost of hexafluorophosphate remains a challenge for market growth.

What will be the Size of the Market During the Forecast Period?

The lithium hexafluorophosphate (LiPF6) market is witnessing significant growth, driven by its crucial role in lithium-ion batteries used in smartphones, laptops, tablets, and electric vehicles (EVs). Direct lithium extraction (DLE) technologies are enhancing the efficiency of lithium production, supporting the increasing demand for high-performance battery cells. FPC (functionalized phosphate chemicals) are integral in improving battery performance by optimizing ion transfer within the battery. As the shift towards renewable sources of energy accelerates, particularly with electric cars and EV batteries, LiPF6 plays a key role in enabling long-lasting, high-purity battery solutions. Verified Market Reports indicate that the demand for LiPF6 will continue to rise, driven by the growing need for purity perfection in lithium-ion batteries, ensuring the reliability and safety of modern electronic devices and electric vehicles.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Application

- Automotive

- Industrial energy storage solutions

- Consumer electronics

- Others

- Geography

- APAC

- China

- North America

- US

- Europe

- Germany

- UK

- France

- Norway

- South America

- Middle East and Africa

- APAC

By Distribution Channel Insights

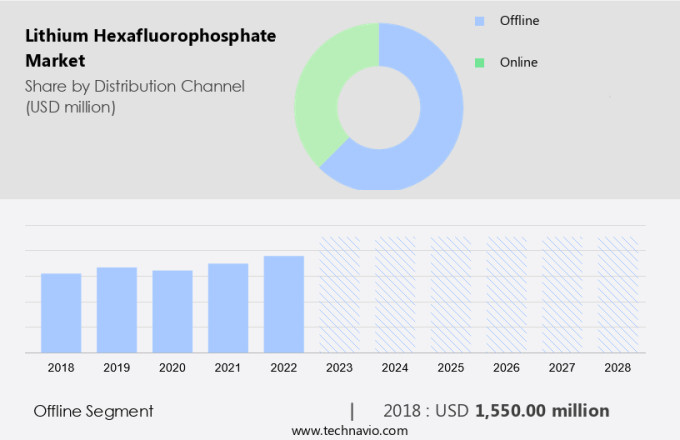

The offline segment is estimated to witness significant growth during the forecast period. The traditional sales and distribution channels for lithium hexafluorophosphate (LiPF6), a crucial electrolyte component in lithium-ion batteries, are referred to as the offline segment in the global market. In this segment, transactions occur directly between suppliers and manufacturers, enabling better communication and customized supply agreements. This arrangement is particularly beneficial for industries with substantial demands for lithium hexafluorophosphate, such as the automotive and aerospace sectors. North America and Asia Pacific (APAC) are experiencing a wave in manufacturing capabilities, particularly in the electric vehicle (EV) and battery technology sectors. As more manufacturing plants are set up in these regions, the demand for raw materials like lithium hexafluorophosphate increases, leading to the expansion of offline distribution channels in the global market.

Lanxess, a leading specialty chemicals producer, is one of the key suppliers of LiPF6. The offline distribution model allows for direct relationships between manufacturers and suppliers, ensuring a steady supply of high-quality materials for their production processes.

Get a glance at the market share of various segments Request Free Sample

The Offline segment accounted for USD 1.55 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

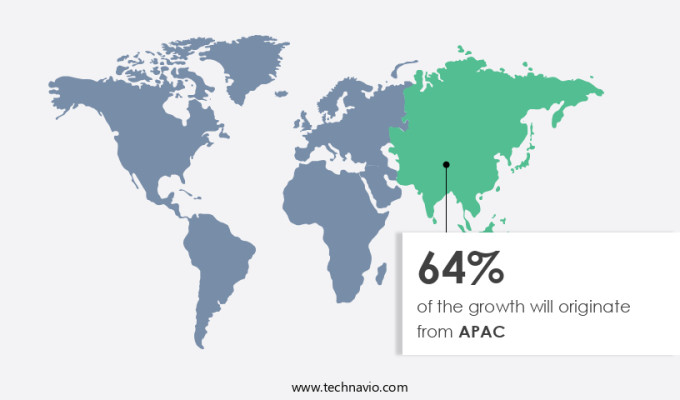

APAC is estimated to contribute 64% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The demand for lithium hexafluorophosphate (LHFP) has experienced significant growth in the Asia Pacific region due to the increasing adoption of renewable energy sources, electric vehicles (EVs), and consumer electronics in 2023. LHFP plays a crucial role in the production of lithium iron phosphate (LFP) cathodes, which are widely used in batteries for these applications. Energy storage is a critical component of modern infrastructure, particularly in the development of smart cities. These urban areas require reliable and continuous power supplies to function effectively. For instance, the Indian government's initiative to create 100 smart cities has boosted the smart energy market, leading to increased demand for battery storage solutions. The market is expected to witness steady growth, with key players focusing on expanding their production capacities and developing new technologies to meet the evolving demands of their customers.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing demand for lithium-ion batteries is notably driving market growth. Lithium Hexafluorophosphate (LiPF6) is a critical electrolytic material used in the production of lithium-ion batteries. Do-fluoride Chemicals, Tianjin Jinni, Jiujiujiu, MORITA, Central Glass, Formosa Plastics, and other leading chemical manufacturers produce this compound.

Moreover, in the realm of electronic materials and medical devices, LiPF6 finds extensive applications. Pacemakers and defibrillators are prime examples of medical devices that utilize LiPF6. Moreover, LiPF6 plays a pivotal role in powering portable electronic devices such as smartphones, laptops, and tablets. The burgeoning electric vehicle (EV) segment, driven by renewable sources like solar and wind, is another significant market for lithium hexafluorophosphate. Thus, such factors are driving the growth of the market during the forecast period.

Market Trends

Growing focus on environmental sustainability is the key trend in the market. Lithium Hexafluorophosphate (LiPF6) is a critical electrolytic material used in the production of lithium-ion batteries. Do-fluoride Chemicals, Tianjin Jinni, Jiujiujiu, MORITA, Central Glass, Formosa Plastics, and other leading manufacturers produce this compound.

Moreover, Lithium hexafluorophosphate plays a significant role in the electrochemical process of lithium-ion batteries, facilitating ion transfer between the cathode and anode. The demand for LiPF6 is driven by the increasing usage in various electronic materials, including lithium-ion batteries for portable electronic devices such as smartphones, laptops, and tablets, as well as electric vehicles (EVs) and renewable energy storage systems. Thus, such trends will shape the growth of the market during the forecast period.

Market Challenge

High production cost of hexafluorophosphate is the major challenge that affects the growth of the market. Lithium Hexafluorophosphate (LiPF6) is a critical electrolytic material used in the production of Lithium-ion batteries. Do-fluoride Chemicals, Tianjin Jinni, Jiujiujiu, MORITA, Central Glass, Formosa Plastics, and other leading chemical manufacturers produce this compound. Lithium hexafluorophosphate plays a pivotal role in the ion transfer process between battery cells, enhancing energy density and improving the performance of electric vehicles (EVs) and portable electronic devices such as smartphones, laptops, tablets, and electric cars.

Moreover, the electric vehicle segment, driven by the PLI scheme and the growing adoption of renewable sources like solar and wind, is expected to dominate the market. Lanxess, a leading specialty chemicals company, and Lithium-ion battery manufacturers like LG Chem, CATL, and Panasonic are significant consumers of this electrolyte component. Hence, the above factors will impede the growth of the market during the forecast period.

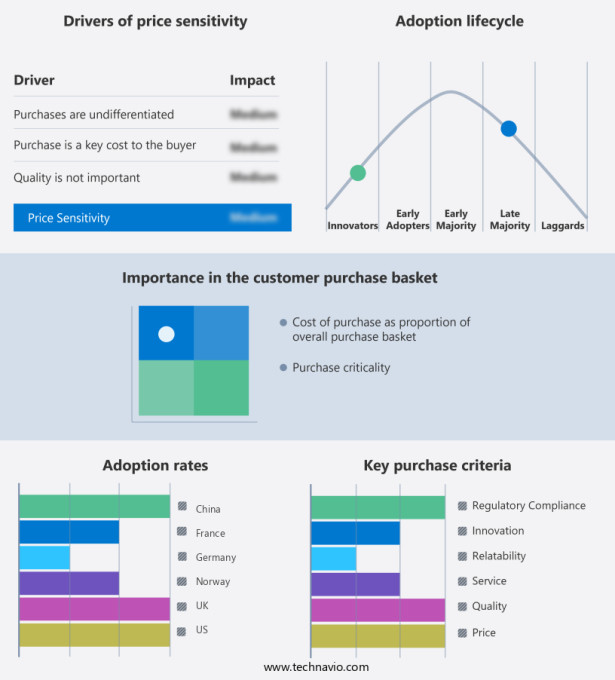

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

American Elements: The company offers Lithium Hexafluorophosphate products and solutions such as Battery Grade LiPF6 Electrolyte Solutions.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ANHUI MEISENBAO TECHNOLOGY CO., LTD.

- Buss ChemTech AG

- Central Glass Co. Ltd.

- CheMondis GmbH

- FUJIFILM Wako Pure Chemical Corporation

- Glentham Life Sciences Ltd.

- Guangzhou Tinci Advanced Materials Co. Ltd.

- Hexa Fluor Chem Inc.

- Kanto Denka Kogyo Co. Ltd.

- Lanxess AG

- Merck and Co. Inc.

- Mitsubishi Chemical Group Corp.

- Morita Chemical Industries Co. Ltd.

- NANOGRAFI Co. Inc.

- Stella Chemifa Corp.

- Thermo Fisher Scientific Inc.

- Tianqi Lithium Corp.

- Tokyo Chemical Industry Co. Ltd.

- Zhenjiang Poworks Co., Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Lithium hexafluorophosphate (Lithium Hexahydrogen Phosphate, LiF-HP), a critical electrolytic material, plays a significant role in the production of lithium-ion batteries. This inorganic compound, with the formula LiPF6, is widely used as an electrolyte component in various electronic materials, including lithium-ion batteries for portable electronic devices, electric vehicles (EVs), and medical devices such as pacemakers and defibrillators. The demand for Lithium Hexafluorophosphate is driven by the growing adoption of renewable energy sources, particularly solar and wind, and the increasing popularity of electric vehicles. Major manufacturers of Lithium Hexafluorophosphate include Do-Fluoride Chemicals, Tianjin Jinni, Jiujiujiu, Morita, Central Glass, Formosa Plastics, and Lanxess.

Further, lithium Hexafluorophosphate is also used in the production of solid-state batteries, which offer higher energy density and longer battery life compared to traditional lithium-ion batteries. The increasing focus on battery technology and clean energy programs is expected to boost the demand for Lithium Hexafluorophosphate in the coming years. Geopolitical considerations and regulatory frameworks, such as REACH rules and the ACE matrix, also influence the market dynamics. The PLi Scheme and Acc Battery Storage are other applications of Lithium Hexafluorophosphate, further expanding its market potential.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.56% |

|

Market growth 2024-2028 |

USD 1.44 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.9 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 64% |

|

Key countries |

China, US, Germany, UK, France, and Norway |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

American Elements, ANHUI MEISENBAO TECHNOLOGY CO., LTD., Buss ChemTech AG, Central Glass Co. Ltd., CheMondis GmbH, FUJIFILM Wako Pure Chemical Corporation, Glentham Life Sciences Ltd., Guangzhou Tinci Advanced Materials Co. Ltd., Hexa Fluor Chem Inc., Kanto Denka Kogyo Co. Ltd., Lanxess AG, Merck and Co. Inc., Mitsubishi Chemical Group Corp., Morita Chemical Industries Co. Ltd., NANOGRAFI Co. Inc., Stella Chemifa Corp., Thermo Fisher Scientific Inc., Tianqi Lithium Corp., Tokyo Chemical Industry Co. Ltd., and Zhenjiang Poworks Co., Ltd |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch