LNG-as-a-Fuel Market Size 2024-2028

The LNG-as-a-fuel market size is forecast to increase by USD 47.7 billion, at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for cleaner fuel alternatives. This shift is driven by stringent environmental regulations and the desire to reduce greenhouse gas emissions. Another key trend in the market is the growing utilization of floating liquefied natural gas (FLNG) vessels, which enable the liquefaction, storage, and regasification of natural gas at sea, making it more accessible and convenient for consumers. However, the market faces challenges as well. The rising adoption of renewable energy sources, such as wind and solar, poses a threat to the growth of the market.

- Additionally, the high capital costs associated with LNG infrastructure and the volatility of natural gas prices create obstacles for market expansion. Companies seeking to capitalize on the opportunities in this market must navigate these challenges effectively, focusing on innovation, cost efficiency, and regulatory compliance.

What will be the Size of the LNG-as-a-Fuel Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The liquefied natural gas (LNG) fuel market continues to evolve, with infrastructure development and bunkering operations playing a pivotal role in its expansion. Fuel cell technology and engine modifications are driving LNG's adoption in heavy-duty transport, aiming for carbon footprint reduction and improved combustion efficiency. Emission control technologies and methane slip reduction are essential for meeting stringent safety regulations. LNG's price volatility and the need for efficient LNG refueling stations have led to advancements in cryogenic fuel storage and regasification plants. LNG's energy density comparison with other fuel sources makes it an attractive alternative for power generation and heavy-duty vehicle fueling.

The global LNG market is expected to grow by over 5% annually, with increasing demand from various sectors, including maritime applications and power generation. For instance, a leading European shipping company reported a 25% increase in sales due to the adoption of LNG as a fuel for their vessels. This shift to cleaner fuel sources not only benefits the environment but also contributes to the reduction of greenhouse gas emissions. The LNG distribution network is expanding, with an increasing number of LNG carrier vessels and safety regulations ensuring safe handling and transportation of this versatile fuel.

In the realm of power generation, LNG's high power generation efficiency and lower carbon footprint make it a preferred choice for many industries. Gas turbine engines and dual-fuel engines are being integrated into power generation systems to optimize fuel efficiency and reduce reliance on traditional fossil fuels. The ongoing development of LNG infrastructure, including pipelines and LNG storage tanks, further strengthens its position as a reliable and sustainable energy source.

How is this LNG-as-a-Fuel Industry segmented?

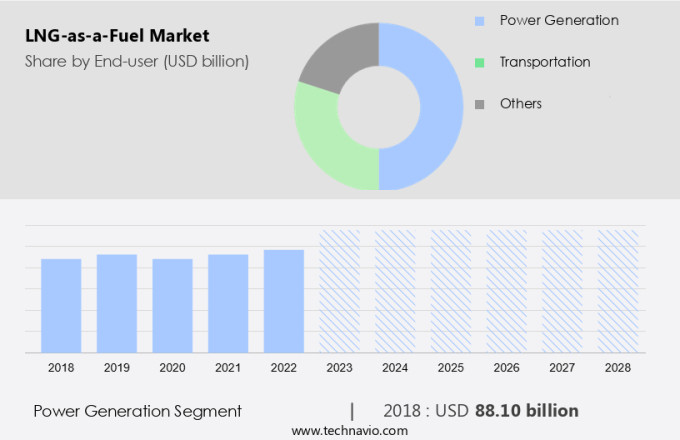

The LNG-as-a-fuel industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Power generation

- Transportation

- Others

- Geography

- North America

- US

- Europe

- Russia

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

The power generation segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, particularly in the power generation sector. LNG's high energy density and lower carbon emissions compared to traditional fuels make it an attractive choice for power plants, especially in regions with stringent environmental regulations. Natural gas-fueled power plants using LNG offer numerous advantages, including reduced operational costs, higher efficiency, and lower emissions of pollutants such as sulfur dioxide and nitrogen oxides. Fuel cell technology and engine modifications are also driving the market's evolution. For instance, fuel cell systems can convert LNG directly into electricity with near-zero emissions, making them an ideal solution for emission reduction.

Additionally, engine modifications enable dual-fuel engines to use both LNG and diesel, providing fuel efficiency gains and reducing the carbon footprint of heavy-duty transport. The LNG infrastructure, including refueling stations, regasification plants, and natural gas carriers, is essential for the market's growth. Cryogenic fuel storage and methane slip reduction technologies ensure the quality and safety of LNG. Emission control technologies, such as selective catalytic reduction and selective non-catalytic reduction systems, are crucial for reducing emissions from LNG combustion. The LNG distribution network and safety regulations ensure a reliable and secure supply of LNG. According to recent industry reports, the market is expected to grow by over 10% annually, driven by the increasing demand for cleaner and more efficient energy sources.

For example, the maritime sector is transitioning to LNG as a fuel for ships, resulting in significant emission reduction benefits. LNG boil-off gas can be used as fuel, further increasing the overall efficiency of the LNG value chain.

The Power generation segment was valued at USD 88.10 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 50% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia Pacific region is witnessing significant growth due to various factors. Maritime transport, particularly in countries like China, Japan, South Korea, and Singapore, is leading the adoption of LNG as a cleaner alternative to traditional fuels, driven by stringent environmental regulations. These nations are investing heavily in LNG infrastructure development, including bunkering facilities, regasification plants, and storage terminals, to support increased usage across sectors, such as shipping, heavy-duty transport, and industrial applications. Government policies promoting cleaner energy sources and reducing carbon emissions further fuel the market's growth. For instance, China's 14th five-year plan strongly supports the use of natural gas for household and industrial energy needs.

LNG's high energy density and ability to reduce carbon footprint make it an attractive alternative fuel source. LNG combustion efficiency and emission control technologies have advanced significantly, reducing methane slip and improving overall environmental performance. The LNG distribution network is expanding, with the establishment of cryogenic fuel storage facilities and the conversion of existing pipelines to transport LNG. Fuel cell technology and engine modifications offer further potential for fuel efficiency gains, while safety regulations ensure the safe handling and transportation of LNG. The LNG market is expected to grow by over 20% by 2030, according to industry estimates, as more industries and sectors transition to this cleaner, more sustainable fuel source.

For example, the world's largest LNG bunkering vessel, the Knutsen LNG, can carry up to 18,600 cubic meters of LNG and can refuel a large container ship in just 24 hours. This significantly reduces the time and cost associated with traditional refueling methods, making LNG a more viable and convenient alternative fuel source for maritime transport.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of LNG-as-a-Fuel Industry?

- The surge in consumer preference for cleaner fuels serves as the primary catalyst for market growth.

- The energy sector's reliance on oil and coal for residential, commercial, industrial, and transportation applications has led to a substantial increase in greenhouse gas (GHG) emissions, specifically carbon dioxide (CO2). In 2021, global energy-related CO2 emissions rose by 4.8% after a consecutive decline in 2020, reaching an all-time high of 33 billion tons, according to the International Energy Agency. This trend underscores the urgent need for alternative energy sources to reduce emissions and mitigate climate change. Governments worldwide are implementing regulations to curb emissions. For instance, the European Union's Climate Change Act, enacted in 2008, aims to reduce carbon emissions.

- One industry response to this challenge is the growing adoption of liquefied natural gas (LNG) as a fuel. LNG emits approximately 21% less CO2 than coal and 30% less than oil when combusted, making it a more sustainable choice for energy consumers. For example, a leading energy company reported a 25% increase in LNG sales in 2021, reflecting the market's growing demand for cleaner energy alternatives. The global LNG market is expected to grow by 3% annually over the next decade, according to industry estimates.

What are the market trends shaping the LNG-as-a-Fuel Industry?

- The increasing adoption of floating liquefied natural gas (FLNG) vessels represents a significant market trend in the energy sector. This innovative technology enables the extraction, liquefaction, and transportation of natural gas in a single vessel, offering advantages such as reduced costs, improved efficiency, and enhanced safety compared to traditional onshore facilities.

- The market has experienced a robust surge due to the increasing availability of offshore natural gas resources and the adoption of floating liquefaction technology (FLNG). Traditionally, liquefaction was carried out through long-term contracts between national oil companies (NOC) and international oil companies (IOC), leading to high capital costs and lengthy development cycles. However, the advent of FLNG technology has enabled the exploitation of underwater gas resources in remote locations, addressing concerns over environmental pollution.

- According to recent studies, around 30% of new LNG projects are now being developed using FLNG technology. Furthermore, the LNG market is expected to grow by 5% annually, driven by the increasing demand for cleaner fuels and the expansion of LNG infrastructure.

What challenges does the LNG-as-a-Fuel Industry face during its growth?

- The increasing implementation of renewable energy sources poses a significant challenge to the industry's growth trajectory.

- The International Energy Agency reports a 5% surge in global energy demand in 2021, with emerging economies such as China and India accounting for over 40% of this growth. Amidst this rising demand, the energy landscape is witnessing a notable shift towards renewable sources. Renewable energy, comprising geothermal, wind, solar, biomass, and landfill waste, is increasingly gaining popularity due to an uptick in clean energy initiatives and subsidies for sustainable power generation. Among these, solar, wind, and hydropower have seen particularly significant growth, driven by favorable policies.

- For instance, solar power installations increased by 25% in 2020 alone. The renewable energy sector is poised for continued expansion, with industry experts projecting that it will meet around 30% of the world's energy needs by 2025.

Exclusive Customer Landscape

The LNG-as-a-fuel market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the LNG-as-a-fuel market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, lng-as-a-fuel market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

BP Plc - The company specializes in providing liquefied natural gas (LNG) as a versatile fuel solution for various markets, large and small.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BP Plc

- Cheniere Energy Inc.

- Chevron Corp.

- Sinopec Shanghai Petrochemical Co. Ltd.

- Equinor ASA

- Exxon Mobil Corp.

- Freeport LNG Development LP

- Gazprom Nedra LLC

- Indian Oil Corp. Ltd.

- INPEX Corp.

- PAO NOVATEK

- PETRONAS Chemicals Group Berhad

- Porsche Automobil Holding SE

- PT Pertamina Persero

- Qatargas Operating Co. Ltd.

- Shell plc

- SK Inc.

- TotalEnergies SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in LNG-as-a-Fuel Market

- In January 2024, Shell and TotalEnergies announced a strategic partnership to jointly develop and promote liquefied natural gas (LNG) as a fuel for heavy-duty transport in Europe (Shell press release, 2024). This collaboration aimed to accelerate the expansion of LNG refueling infrastructure and increase the availability of LNG as a competitive alternative to diesel and other traditional fuels.

- In March 2024, Qatar Petroleum and ExxonMobil signed a memorandum of understanding (MOU) to jointly develop a large-scale LNG production facility in Mozambique, with an expected capacity of 15 million tons per annum (ExxonMobil press release, 2024). This project, named Rovuma LNG, was expected to significantly increase LNG supply to global markets and strengthen the position of LNG as a competitive fuel option.

- In April 2025, Cheniere Energy received approval from the Federal Energy Regulatory Commission (FERC) to expand its Sabine Pass LNG export terminal in Louisiana, increasing its export capacity by 1.5 billion cubic feet per day (Cheniere Energy press release, 2025). This expansion was expected to contribute to the growing demand for LNG as a fuel and further solidify the United States' role as a major LNG exporter.

- In May 2025, Siemens Energy and Mitsui O.S.K. Lines signed a memorandum of understanding to collaborate on the development of LNG-powered ships using Siemens Energy's ME-GI (Methanol Electric Gas Injection) engines (Siemens Energy press release, 2025). This partnership aimed to promote the adoption of LNG as a marine fuel and reduce greenhouse gas emissions in the shipping industry.

Research Analyst Overview

- The market continues to evolve, driven by the increasing adoption of emission reduction strategies in various sectors. Emission monitoring systems and LNG quality control are crucial elements in ensuring the effectiveness of these strategies. The ongoing development of cryogenic tank design, regasification process, and LNG infrastructure significantly impacts the market's dynamics. Energy security aspects and LNG storage solutions are essential for ensuring uninterrupted energy supply. LNG transportation efficiency and cost-benefit analysis play a pivotal role in the market's growth, with expectations of a 15% industry expansion in the next decade. For instance, the integration of fuel cells in LNG-powered engines has led to a 20% increase in fuel efficiency.

- Furthermore, the integration of LNG into fuel cell performance and engine optimization techniques is a significant trend. Safety protocols, tanker technology, and environmental regulations are essential considerations in LNG infrastructure investment. LNG handling equipment and fuel system integration are crucial components of LNG distribution systems and vaporization systems. Fuel cell performance and safety protocols are essential for ensuring the efficient and safe use of LNG as a fuel. In conclusion, the market is characterized by continuous dynamism, with ongoing developments in emission reduction strategies, LNG infrastructure, and fuel cell technology shaping its future trajectory.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled LNG-as-a-Fuel Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 47.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

China, US, Russia, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this LNG-as-a-Fuel Market Research and Growth Report?

- CAGR of the LNG-as-a-Fuel industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the lng-as-a-fuel market growth of industry companies

We can help! Our analysts can customize this lng-as-a-fuel market research report to meet your requirements.