Thailand Logistics Market Size and Trends

The Thailand logistics market size is forecast to increase by USD 14.87 billion at a CAGR of 4% between 2023 and 2028. The market is experiencing significant growth due to the increase in e-commerce and retail industries. Warehousing and distribution have become essential components of this market, as businesses strive to meet increasing consumer demands for faster delivery times. The use of advanced technologies, such as blockchain, is revolutionizing logistics by enhancing transparency and security. However, challenges persist, including longer lead times and supply-demand imbalances. In response, companies are turning to third-party logistics (3PL) and fourth-party logistics (4PL) providers for expertise in conventional logistics, e-commerce logistics, and both forward and reverse logistics. These facilities utilize advanced systems, such as conveyor belts, automated storage and retrieval systems (AS/RS), and robotic arms, to manage inventory and fulfill orders. Domestic and international logistics continue to be crucial areas of focus, with road transportation playing a significant role in ensuring the timely and efficient delivery of consumer electronics and other goods. As the market continues to evolve, staying informed about these trends and challenges is essential for businesses looking to succeed in the logistics industry.

Market Analysis

The market is undergoing significant transformations, driven by advancements in technology and shifting consumer preferences. These trends are shaping the way businesses manage their supply chains and deliver products to customers. Warehousing is a crucial aspect of logistics, and automation is becoming increasingly prevalent. Automated warehouses are being adopted to streamline operations, reduce labor costs, and improve efficiency. E-commerce is a major catalyst for change in the logistics industry. Online purchases have led to an increase in home delivery facilities and the need for last-mile delivery solutions. Drones and autonomous vehicles are being explored as potential solutions to address the challenges of delivering goods to consumers in an efficient and cost-effective manner. Electric vehicles are gaining popularity in logistics due to their environmental benefits and cost savings. Green logistics solutions are becoming essential as businesses strive to reduce their carbon footprint and meet sustainability goals. Supply chain services are being revolutionized by digital technologies, such as logistics monitoring systems and blockchain. These solutions provide real-time visibility into supply chain operations, enabling businesses to optimize their processes and improve customer satisfaction. The use of IoT-enabled devices and tech-driven logistics is also on the rise. These technologies enable real-time tracking and monitoring of inventory, transportation, and delivery, leading to improved efficiency and accuracy. Inbound and outbound logistics are being transformed by automation and digitalization. Second party logistics providers are leveraging these technologies to offer more value-added services to their clients.

Market Segmentation

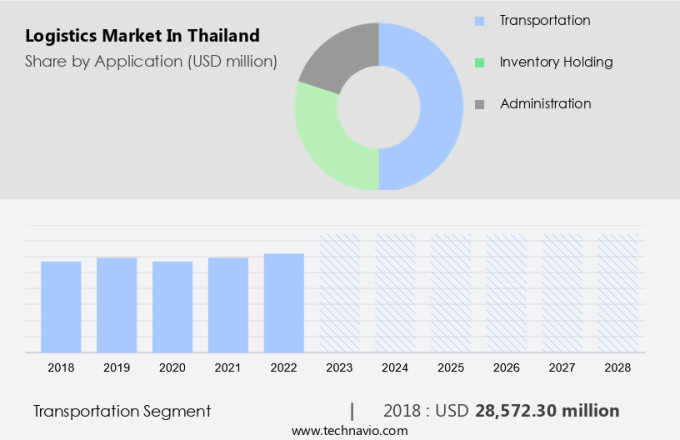

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Application

- Transportation

- Inventory holding

- Administration

- End-user

- Manufacturing

- Automotive

- Retail

- Healthcare

- Others

- Geography

- Thailand

By Application Insights

The transportation segment is estimated to witness significant growth during the forecast period. Logistics refers to the management of the flow of goods from the point of origin to the destination, encompassing the planning, execution, and control of procurement, transportation, and storage. This crucial aspect of supply chain management includes various services such as freight forwarding and multimodal transport via sea, road, air, and rail.

Get a glance at the market share of various segments Download the PDF Sample

The transportation segment was the largest segment and was valued at USD 28.57 billion in 2018. In the retail and e-commerce sectors, particularly for consumer electronics, effective logistics is essential to ensure timely delivery and customer satisfaction. Two primary types of logistics are conventional and e-commerce. Conventional logistics deals with the transportation and storage of goods for businesses with physical retail locations. E-commerce logistics, on the other hand, focuses on the delivery of products directly to consumers. Hence, such factors are fuelling the growth of this segment during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Thailand Logistics Market Driver

Growing e-commerce propels demand for logistics services is notably driving market growth. In Southeast Asia, particularly in Thailand, the expanding e-commerce sector and rising consumer spending have led to a significant evolution in logistics. This digital transformation has brought about an increase in demand for logistics space and revolutionized the supply chain.

Sensor technologies, such as IoT-enabled devices, are increasingly being adopted in healthcare and pharmaceutical logistics to ensure temperature control and real-time monitoring. Fourth-Party Logistics (4PL) providers are playing a crucial role in managing complex logistics operations for e-commerce companies, overseeing both inbound and outbound logistics. Thus, such factors are driving the growth of the market during the forecast period.

Thailand Logistics Market Trends

Use of blockchain with logistics is the key trend in the market. Blockchain technology, a secure and decentralized digital ledger, is revolutionizing the logistics industry by enhancing transparency and enabling efficient tracking of goods throughout the supply chain.

Each block in this technology contains encrypted information and a reference to the previous block, ensuring data integrity and security. In logistics, this innovation increases operational visibility and allows for effective product tracking. The records stored in the blocks detail the involved stakeholders and specific product information associated with each movement. Thus, such trends will shape the growth of the market during the forecast period.

Thailand Logistics Market Challenge

Increased lead time and supply-demand imbalance is the major challenge that affects the growth of the market. The pandemic's impact on global supply chains has led to increased pressure on transportation and logistics resources. Disruptions in last-mile fulfillment services, supply-demand imbalances, and labor shortages are major challenges facing the transport and logistics industry. Domestic transportation services have also been affected, with an imbalance between incoming and outgoing freight in restricted areas further complicating matters.

The limited workforce and reduced working hours have also restrained logistics activities. In the context of the market, logistics automation and multi-modal systems are becoming increasingly important for companies to ensure efficient last-mile deliveries. Telecommunication plays a crucial role in enabling omnichannel operations for trade and transportation, particularly in the media and entertainment industries. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

CMA CGM SA Group: The company offers a one-stop logistical shop that includes transportation, customs clearance, onsite handling, and storage.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- CJ Logistics Corp.

- Crane Worldwide Logistics

- DB Schenker

- DHL Express Ltd.

- DSV AS

- Expeditors International of Washington Inc.

- FedEx Corp.

- Gulf Agency Co. Ltd.

- iHub Solutions Pte Ltd.

- Kerry Logistics Network Ltd.

- Kintetsu World Express Inc.

- MON Logistics Group Co. Ltd.

- Nippon Express Holdings Inc.

- SCG Logistics Management Co. Ltd.

- Transpo Logistics Pvt. Ltd.

- Unithai Group

- WICE Logistics Public Co. Ltd.

- Yamato Unyu

- YUSEN LOGISTICS CO. LTD.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

The logistics industry is undergoing a significant transformation due to the increasing demand for faster and more efficient delivery services, particularly in the retail and e-commerce sectors. Warehousing and distribution play a crucial role in this evolution, with automation becoming a key trend. Automated warehouses, drones, and autonomous vehicles are being adopted to streamline operations and meet customer expectations. Electric vehicles and green logistics solutions are also gaining popularity as companies seek to reduce their carbon footprint. E-commerce logistics, including 3PL and 4PL, are driving innovation in the industry. Forward and reverse logistics, domestic and international, are being optimized through tech-driven solutions such as blockchain, artificial intelligence (AI), and augmented reality (AR). The logistics industry is embracing digitalization, with warehouse management systems, logistics monitoring systems, and IoT-enabled devices becoming standard. Trade networks and transportation infrastructure are also being modernized, with multi-modal systems and transportation services offering more efficient and cost-effective solutions. Industries such as industrial and manufacturing, healthcare, pharmaceuticals, and military logistics are also adopting these trends to improve their supply chain management and inventory management. Online purchases and home delivery facilities have led to an increase in last-mile deliveries, with logistics providers offering more flexible and convenient options. Omnichannel operations, hazardous materials handling, and vaccine distribution are also areas of focus for logistics service providers. Trade agreements and tech-driven logistics are key factors shaping the future of the logistics industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4% |

|

Market growth 2024-2028 |

USD 14.87 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.8 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

CJ Logistics Corp., CMA CGM SA Group, Crane Worldwide Logistics, DB Schenker, DHL Express Ltd., DSV AS, Expeditors International of Washington Inc., FedEx Corp., Gulf Agency Co. Ltd., iHub Solutions Pte Ltd., Kerry Logistics Network Ltd., Kintetsu World Express Inc., MON Logistics Group Co. Ltd., Nippon Express Holdings Inc., SCG Logistics Management Co. Ltd., Transpo Logistics Pvt. Ltd., Unithai Group, WICE Logistics Public Co. Ltd., Yamato Unyu, and YUSEN LOGISTICS CO. LTD. |

|

Market dynamics |

Parent market analysis, market report , market forecast , Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Thailand

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch