Lubricant Viscosity Grade Improvers Market Size 2024-2028

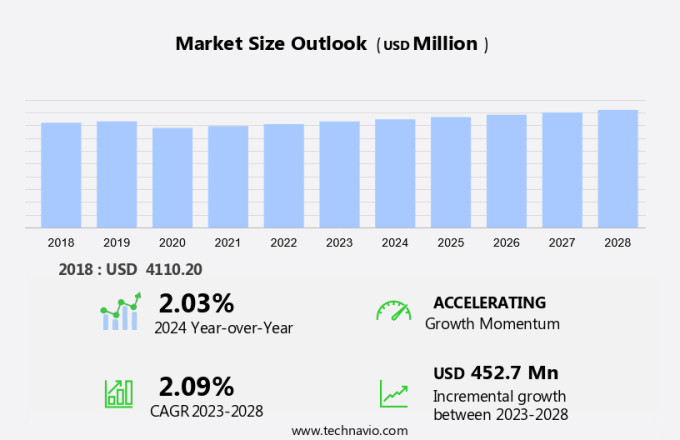

The lubricant viscosity grade improvers market size is forecast to increase by USD 452.7 million at a CAGR of 2.09% between 2023 and 2028. The growth of the market depends on several factors, including increasing demand from end-user industries, the rising need for reliable machinery and effective maintenance, and growing investment in the infrastructure sector in APAC. These elements collectively drive market expansion by addressing industrial needs, ensuring operational efficiency, and capitalizing on regional development. The increasing demand from end-user industries highlights the diverse applications and reliance on market products.

Simultaneously, the rising need for reliable machinery and effective maintenance underscores the importance of minimizing downtime and enhancing productivity. Additionally, growing investment in the infrastructure sector in APAC reflects significant regional growth opportunities and development projects.

Market Analysis

The market is experiencing significant growth in various industries, including the Automotive and Industrial sectors. This market expansion is driven by the increasing demand for high-performance lubricants in applications such as Automobiles, Braking fluids, Transmission lubricants, and Engine lubricants. Olefin Copolymer, a key additive used in the production of viscosity index improvers, plays a crucial role in enhancing the performance of lubricants. The Automotive Industry's growth, fueled by rising automobile output and the pursuit of improved fuel economy, is a significant factor driving the demand for lubricants with improved viscosity properties. Operating temperatures in machinery and the energy sector also necessitate the use of lubricants with optimal viscosity to ensure efficient performance and prolonged equipment life.

Industrial applications, including the use of lubricants in Drilling fluids, Metalworking fluids, and Quenching oils, further expand the market potential for viscosity grade improvers. The development and adoption of advanced industrial additives and technologies to enhance the viscosity properties of lubricants are expected to fuel market growth in the coming years.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Vehicle lubricants

- Industrial lubricants

- Product

- Polymethacrylate (PMA)

- Hydrostyrene diene copolymer (HSD)

- Polyisobutylene (PIB) and others

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- Middle East and Africa

- South America

- APAC

By Application Insights

The vehicle lubricants segment is estimated to witness significant growth during the forecast period. The market encompasses specialty chemical companies that produce additives to enhance the performance and compatibility of lubricants. These additives, primarily petroleum-based, contribute significantly to energy efficiency and regulatory compliance in various sectors. In the automotive industry, they improve engine performance, protection, and fuel efficiency, while in the marine and aerospace sectors, they ensure equipment performance and sustainability under harsh conditions. In the energy sector, high-lube additives extend service life and ensure temperature resistance, shear stability, and pour point performance in industrial lubricants, drilling and completion fluids, and metalworking fluids. Regulatory standards, such as those related to emissions, necessitate the use of innovative products that offer benefits like friction reduction, film strength, and lubricant formulation requirements.

Polymethacrylate Viscosity Index and other advanced technologies enable these companies to meet the evolving demands for sustainable lubricant solutions in diverse industries. Environmental regulations continue to shape the market, driving the need for lubricants that offer superior performance and environmental sustainability. As awareness of these benefits grows, the demand for viscosity grade improvers is expected to increase, ensuring a strong future for this market.

Get a glance at the market share of various segments Request Free Sample

The vehicle lubricants segment accounted for USD 2.87 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market encompasses specialty chemical companies that produce additives to enhance the performance and compatibility of lubricants. These additives, primarily petroleum-based, contribute significantly to energy efficiency and regulatory compliance in various sectors. In the automotive industry, they improve engine performance, protection, and fuel efficiency, while in the marine and aerospace sectors, they ensure equipment performance and sustainability under harsh conditions. In the energy sector, high-lube additives extend service life and ensure temperature resistance, shear stability, and pour point performance in industrial lubricants, drilling fluids, and metalworking fluids. Regulatory standards, such as those related to emissions, necessitate the use of innovative products that offer benefits like friction reduction, film strength, and lubricant formulation requirements.

Key players in this market, including Oronite, Infineum, Afton, Evonik, Sanyo Chemical, and BPT Chemical, have demonstrated financial performance through sales revenue growth and successful product development. Polymethacrylate Viscosity Index and other advanced technologies enable these companies to meet the evolving demands for sustainable lubricant solutions in diverse industries. Environmental regulations continue to shape the market, driving the need for lubricants that offer superior performance and environmental sustainability. As awareness of these benefits grows, the demand for viscosity grade improvers is expected to increase, ensuring a strong future for this market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing demand from end-user industries is the key driver of the market. The market experiences significant demand from various industries beyond automotive, including construction, steel and cement, mining, and oil drilling, and marine. In the construction sector, lubricants are indispensable in construction equipment due to their anti-wear properties, resistance to corrosion, superior lubricity, water tolerance, and filterability. These characteristics enable efficient energy transmission in equipment such as crawler excavators, mini excavators, wheeled excavators, wheeled dozers, and skid-steer loaders. In the steel and cement industry, lubricants play a crucial role in enhancing the performance and longevity of machinery. They extend drain intervals, boost lubrication efficiency, fortify wear resistance of friction pairs, and ultimately, extend the lifespan of the equipment.

The demand for lubricant viscosity grade improvers is also driven by the need for quenching oils in the steel industry, which require viscosity modifiers to maintain their optimal performance and ensure consistent fuel economy in automobile output.

Market Trends

The rise in adoption of nanotechnology in viscosity grade improvers is the upcoming trend in the market. Nanotechnology significantly enhances the performance of lubricant viscosity grade improvers in the automotive industry. These additives play a crucial role in improving the flow properties of quenching oils and extending engine life by minimizing friction. Conventional viscosity grade improvers, which are based on large polymer molecules, have a drawback of degrading rapidly, leading to altered viscosity and reduced lubricant efficiency. In contrast, nanotechnology-driven viscosity improvers, incorporating nanoparticles, offer enhanced benefits. By optimizing fuel economy and contributing to increased automobile output, these advanced additives represent a promising development in the lubricant market.

Market Challenge

Fluctuation in crude oil prices is a key challenge affecting the market growth. The market experiences significant challenges due to the volatile pricing of essential raw materials, including quenching oils derived from thermoplastic polymers. These materials have seen price instability since 2015. Furthermore, as lubricant viscosity grade improvers are derived from petroleum and natural gas, their prices are subject to the market fluctuations of these resources. Unpredictable price swings in crude oil and its derivatives can significantly impact the market. In the automotive sector, the use of these quenching oils plays a crucial role in enhancing fuel economy and optimizing automobile output. Consequently, market stability relies heavily on the consistent pricing of these raw materials.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

BPT Chemicals Co. Ltd.: The company offers lubricant viscosity grade improvers such as BPT Viscotech EPC-100, BPT Viscotech OCP-100, and BPT Viscotech SIS-100. Also, the company specializes in the manufacturing of viscosity index improvers.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Hitech Petroleum and Chemicals Inc.

- Asian Oil Co.

- BASF SE

- CHETAS BIOCHEM

- Chevron Corp.

- Croda International Plc

- Eni SpA

- Evonik Industries AG

- Goodway Chemicals Pvt. Ltd.

- Innov Oil Pte Ltd.

- Jinzhou Kangtai Lubricant Additives Co. Ltd.

- Lanxess AG

- Mitsui Chemicals Inc.

- NewMarket Corp.

- PETRONAS Chemicals Group Berhad

- Sanyo Chemical Industries Ltd.

- Shanghai Minglan Chemical Co. Ltd.

- Shell plc

- The Lubrizol Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market plays a crucial role in enhancing the performance of lubricants by adjusting their viscosity properties. These improvers are essential in various industries such as automotive, industrial, and power generation. The demand for lubricant viscosity grade improvers is driven by factors like increasing machinery usage, rising fuel efficiency requirements, and the need for extended oil drain intervals. Lubricant viscosity grade improvers are available in different types, including organic and inorganic. Organic improvers are derived from natural sources, while inorganic improvers are synthetic. The choice of improver type depends on the specific application requirements and the desired viscosity properties.

The market for lubricant viscosity grade improvers is expected to grow significantly due to the increasing demand for high-performance lubricants in various end-use industries. Additionally, the ongoing research and development activities aimed at improving the efficiency and effectiveness of lubricant viscosity grade improvers are expected to further fuel market growth. The key players in the market focus on expanding their product portfolios, enhancing their production capabilities, and exploring new markets to meet the growing demand for these products. Some of the common applications of lubricant viscosity grade improvers include engine oils, gear oils, hydraulic fluids, and turbine oils.

In conclusion, the market is a significant and growing market, driven by the increasing demand for high-performance lubricants in various industries. The market is expected to continue growing due to ongoing research and development activities and the expanding application scope of these products.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.09% |

|

Market growth 2024-2028 |

USD 452.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.03 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 33% |

|

Key countries |

China, US, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

American Hitech Petroleum and Chemicals Inc., Asian Oil Co., BASF SE, BPT Chemicals Co. Ltd., CHETAS BIOCHEM, Chevron Corp., Croda International Plc, Eni SpA, Evonik Industries AG, Goodway Chemicals Pvt. Ltd., Innov Oil Pte Ltd., Jinzhou Kangtai Lubricant Additives Co. Ltd., Lanxess AG, Mitsui Chemicals Inc., NewMarket Corp., PETRONAS Chemicals Group Berhad, Sanyo Chemical Industries Ltd., Shanghai Minglan Chemical Co. Ltd., Shell plc, and The Lubrizol Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch