Industrial Lubricant Additives Market Size 2024-2028

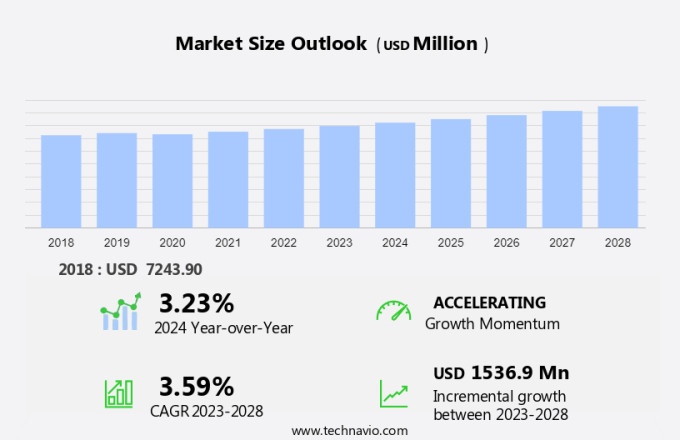

The industrial lubricant additives market size is forecast to increase by USD 1.54 billion, at a CAGR of 3.59% between 2023 and 2028. The market is experiencing significant growth due to various driving factors. Firstly, substantial investments in the energy industries are leading to increased demand for high-performance lubricants. Secondly, there is a growing adoption of industrial lubricant additives in processing and packaging machinery to enhance productivity and reduce downtime. Stricter environmental restrictions have also necessitated the formulation of industrial lubricant additives that meet stringent emission norms. Additionally, the increasing focus on energy efficiency and cost savings is driving the market for advanced additives that improve lubricant performance and extend the life of machinery components. Overall, these trends are expected to continue fueling the growth of the market in the coming years.

What will be the Size of the Market During the Forecast Period?

The market is a significant sector in the global industrial landscape, focusing on enhancing the performance of various types of lubricants used in manufacturing facilities and transportation industries. The market includes the production and supply of additives for Automation and Robotic equipment, such as Lubricating oils, Turbine oils, Metalworking fluids, General industrial oils, Greases, and various other types like Combustion engines' Additive usage. Key additives include Oil viscosity modifiers, Corrosion inhibitors, and Chemical components. The market caters to various industries, including Automotive lubricants, Engine oils, Brake fluids, Transmission oils, Coolants, and Electric vehicles. Infineum International is a notable player in this market, providing base oils and additives for Heavy-duty lubricants, Passenger car lubricants, Mechanical engine oils, Transmission fluids, Hydraulic fluids, Gear oils, and Marine transportation applications. Energy management, Emissions, and various other factors influence the market's growth.

The use of industrial lubricant additives is widespread across various manufacturing industries, including automotive, energy, and heavy machinery. In the automotive sector, they are used to enhance the performance and durability of engines, transmissions, and other components. In the energy sector, they are used to improve the efficiency and reliability of turbines, generators, and other power equipment. The manufacturing sector is a significant consumer of industrial lubricant additives. They are used to maintain the smooth operation of machinery, reduce downtime, and improve energy efficiency. In addition, they help to reduce emissions and improve overall environmental sustainability. Industrial lubricant additives are also gaining popularity in the electric vehicle market.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

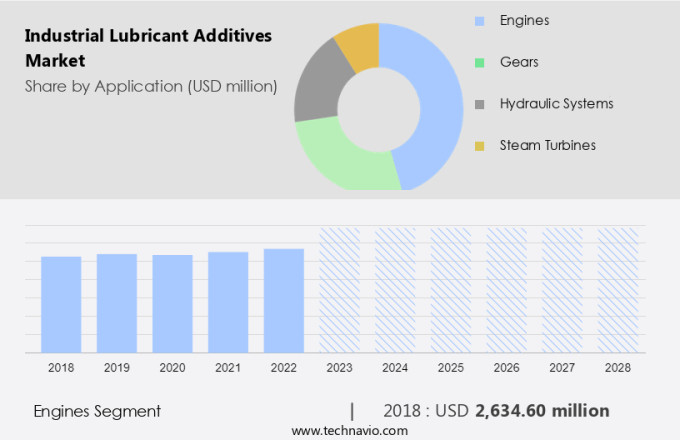

- Application

- Engines

- Gears

- Hydraulic systems

- Steam turbines

- Type

- Performance enhancing additives

- Surface protecting additives

- Lubricant protecting additives

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- North America

- US

- Middle East and Africa

- South America

- APAC

By Application Insights

The engines segment is estimated to witness significant growth during the forecast period. In the global market for industrial lubricant additives, the engines segment holds significant importance, particularly for industries beyond the automotive sector. Industrial engines, including those utilized in heavy machinery, marine applications, power generation, and other large-scale industrial equipment, heavily depend on high-performance lubricant additives to operate effectively under challenging conditions. These additives, which consist of anti-wear agents, corrosion inhibitors, dispersants, and antioxidants, play a vital role in minimizing friction, preventing wear and tear, and enhancing the longevity of engine components. In industries such as construction, mining, and power generation, where engines face extreme temperatures and heavy loads, these additives ensure optimal engine performance, minimize downtime, and lower maintenance expenses.

Environmental regulations and chemical initiatives have led to the development of eco-friendly and less toxic additives for various applications, including automotive lubricants like engine oils, brake fluids, transmission oils, and coolants. Additionally, the increasing adoption of electric vehicles and the transition towards internal combustion engine alternatives have created new opportunities for industrial lubricant additives in the transportation sector.

Get a glance at the market share of various segments Request Free Sample

The engines segment accounted for USD 2.63 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

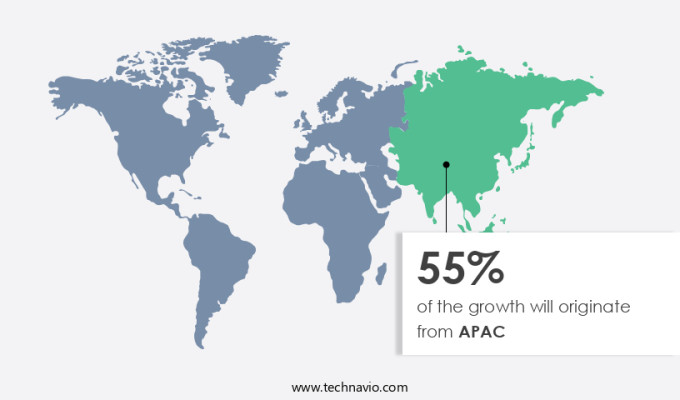

APAC is estimated to contribute 55% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Asia-Pacific (APAC) region plays a pivotal role in the market, fueled by industrialization, urbanization, and a thriving power generation sector. Key contributors to the demand in APAC include China, India, and Japan, with China being the largest consumer due to its extensive manufacturing sector and expanding transportation industry. The region's energy, mining, and construction sectors also contribute significantly, necessitating high-performance lubricants to optimize machinery efficiency and durability. For instance, China's fixed-asset investment experienced steady growth in February 2024, driven by government policies aimed at enhancing effective investment, with the National Bureau of Statistics (NBS) reporting a 4% increase.

Industrial lubricant additives, including anti-wear agents, antioxidants, and friction modifiers, are essential components in various industries. In the vehicle manufacturing sector, these additives improve engine performance and extend component life. In aviation transportation, they ensure engine efficiency and reduce emissions. In the automotive aftermarket, they cater to the demand for extended vehicle life and improved fuel economy. Domestic blending facilities also rely on these additives to produce mineral lubricants, compressor oils, and cutting fluids that meet industry standards. Future estimations indicate continued growth in the market, driven by increasing demand from the transportation, power generation, and manufacturing sectors.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Growth investments in energy industries is the key driver of the market. The market experiences growth due to increasing investments in various sectors, including textiles, power generation, chemicals, petrochemicals, agriculture, manufacturing, and more. In particular, the expansion and advancements in energy industries, such as renewable energy and power generation, fuel the demand for superior lubricant additives. These additives are essential for modern equipment to operate efficiently and reliably under demanding conditions.

According to recent reports, global energy investments are projected to surpass USD 3 trillion by 2024, with approximately USD 2 trillion allocated to clean energy technologies and infrastructure. This trend underscores the importance of specialized lubricants in sectors like textile finishing, metalworking fluids, hydraulic oils, chain oils, and high-temperature lubricants. By enhancing equipment performance and extending component life, these additives contribute significantly to the overall productivity and profitability of industries.

Market Trends

The growing adoption of industrial lubricant additives in processing and packaging machinery is the upcoming trend in the market. The market is experiencing significant growth due to the increasing utilization of these additives in processing and packaging machinery across various industries. With the expansion of sectors like food and beverage, pharmaceuticals, and consumer goods, there is a heightened demand for efficient machinery to meet consumer needs. These machines encounter demanding conditions, including high speeds, pressures, and temperatures, necessitating the use of advanced lubricants for dependable and seamless operation.

For instance, in the food and beverage sector, where cleanliness and equipment reliability are paramount, specialized lubricant additives ensure production consistency and prevent contamination. As industries transition to automated and high-speed machinery, the significance of advanced lubricants becomes increasingly apparent. Innovative technologies, such as nanotechnology-based additives, are gaining popularity in the market due to their ability to enhance lubricant performance and extend equipment life.

Market Challenge

Stricter environmental restrictions for formulation of industrial lubricant additives is a key challenge affecting the market growth. In the market, environmental regulations pose a substantial challenge. Stricter regulations are being enacted to address environmental concerns, such as emissions, waste, and ecological impact. These regulations often necessitate the development of eco-friendly additives that are biodegradable and adhere to global standards. Government agencies, such as the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) and the Occupational Safety and Health Administration (OSHA) in the US, play a vital role in ensuring the safe use and manufacturing of industrial additives and lubricants. Similarly, the European Union's Regulation No 1907/2006 and the Global Reporting Initiative (GRI) offer guidelines for the industry.

Adherence to these regulations is crucial for companies operating in the food processing sector, particularly those producing processed food products, as food-grade lubricants are essential for their production. In other industries, such as utility-scale electricity, automobile manufacturing, and diesel conditioning, gear oil treatments and additives like anti-wear additives, thickeners, and tackifiers remain vital. Key regulatory bodies continue to shape the market, ensuring its growth in a sustainable and responsible manner.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Afton Chemical - The company provides a diverse selection of industrial lubricant additives, suitable for various applications including wind turbines and industrial gears.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BASF SE

- BRB International BV

- Chevron Corp.

- Clariant AG

- DOG Deutsche Oelfabrik

- Dover Chemical Corp.

- Eni SpA

- Evonik Industries AG

- Exxon Mobil Corp.

- FUCHS PETROLUB SE

- Infineum International Ltd.

- Italmatch Chemicals Spa

- King Industries Inc.

- Lanxess AG

- Lucas Oil Products Inc.

- The Lubrizol Corp.

- Valvoline Inc.

- Wuxi Southern Petroleum Additives Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Industrial lubricant additives play a crucial role in enhancing the performance and longevity of various types of lubricants used in diverse industries. These additives offer benefits such as improved wear protection, oxidation resistance, and corrosion inhibition for lubricating oils, turbine oils, metalworking fluids, greases, and general industrial oils. Additive usage is prevalent in manufacturing facilities that house automation and robotic equipment, as well as in the automotive sector for combustion engines, automotive lubricants, and electric vehicles. The additives market is witnessing consolidation due to chemical initiatives and environmental regulations aimed at reducing toxicity and improving energy management. Key chemical components of industrial lubricant additives include viscosity index improvers, dispersants, detergent, and antioxidants.

Further, these additives are used in heavy-duty lubricants, passenger car lubricants, mechanical engine oils, transmission fluids, hydraulic fluids, gear oils, compressor oils, cutting fluids, and textile finishing. The market for industrial lubricant additives is expanding due to the growing demand for renewable energy sources and the need for emission controls in various sectors such as aviation transportation, marine transportation, power generation, and manufacturing. The future estimations suggest significant growth in the market due to the increasing demand for energy efficiency, economic growth, and the development of patented polymeric and nanotechnology-based additives.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.59% |

|

Market Growth 2024-2028 |

USD 1.54 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.23 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 55% |

|

Key countries |

China, US, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Afton Chemical, BASF SE, BRB International BV, Chevron Corp., Clariant AG, DOG Deutsche Oelfabrik, Dover Chemical Corp., Eni SpA, Evonik Industries AG, Exxon Mobil Corp., FUCHS PETROLUB SE, Infineum International Ltd., Italmatch Chemicals Spa, King Industries Inc., Lanxess AG, Lucas Oil Products Inc., The Lubrizol Corp., Valvoline Inc., and Wuxi Southern Petroleum Additives Co. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.