Luxury Whiskey Market Size 2025-2029

The luxury whiskey market size is forecast to increase by USD 814.9 million at a CAGR of 5.5% between 2024 and 2029.

- The market witnesses significant growth, driven by the burgeoning whiskey-based tourism industry and the continuous innovation in product development. Luxury whiskey brands are capitalizing on the increasing popularity of whiskey tourism by offering unique experiences and exclusive tastings, attracting a global consumer base. Moreover, the launch of high-end, limited-edition whiskeys caters to the growing demand for premium spirits. However, the market faces challenges, including stringent regulations and high taxes on spirits.

- Moreover, the market encompasses a range of premium alcoholic beverages, including Irish whiskey, Scotch whisky, American whiskey, Canadian whisky, Japanese whisky, rye whiskey, and others. Compliance with these regulations adds to the production costs, making it essential for manufacturers to maintain efficient supply chains and optimize operations. Effective navigation of these challenges and continued innovation will enable companies to capitalize on the market's growth potential and maintain a competitive edge.

What will be the Size of the Luxury Whiskey Market during the forecast period?

- In the market, whisky aging plays a crucial role in shaping the whisky's flavor profile and aroma. Whisky tasting notes reveal intricacies of Irish pot still and single pot still varieties, while whisky pairing enhances the drinking experience. Ex-bourbon casks and oak casks impart distinct flavors, with whisky notes ranging from fruity to smoky. Whisky investment opportunities attract collectors, driven by the scarcity and authenticity of whiskies. Whisky regions, such as Scotland and Japan, offer unique whisky flavor profiles and finishing notes. Japanese blended and single malt whiskies have gained popularity, with whisky food pairing adding an extra layer of enjoyment. The production of whiskey involves the mashing of grains such as barley, corn, rye, and wheat, followed by fermentation with yeast. Premium and craft spirits continue to gain market share, driven by consumer preferences for unique flavor profiles and the growing trend of mixology and cocktail culture.

- Whisky oxidation and reduction impact the whisky's taste, while cask strength and natural color add to its allure. Whisky certification ensures authenticity, with whisky counterfeit posing a threat to the industry. Whisky education resources help enthusiasts deepen their understanding of whisky aroma, whisky wood, and whisky cooperage. Single-grain and grain whiskey offer diverse flavor profiles, catering to various palates. Whisky community engagement fosters a shared appreciation for the craft, with whisky authenticity and certification playing essential roles in maintaining trust and value. Whisky collecting remains a significant aspect of the market, with port casks, sherry casks, and non-chill filtered varieties highly sought after.

How is this Luxury Whiskey Industry segmented?

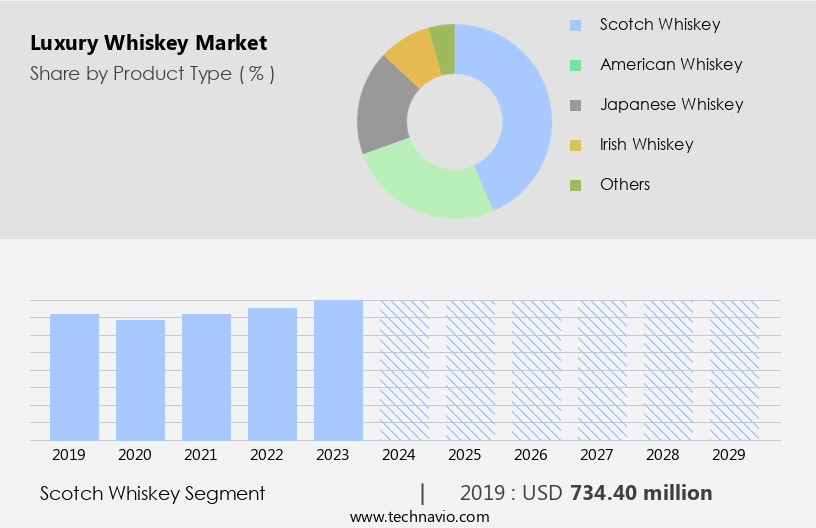

The luxury whiskey industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product Type

- Scotch whiskey

- American whiskey

- Japanese whiskey

- Irish whiskey

- Others

- Distribution Channel

- Off-trade

- On-trade

- Price Range

- Premium

- High-end premium

- Super-premium

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Spain

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Type Insights

The scotch whiskey segment is estimated to witness significant growth during the forecast period.

The market is fueled by the allure of whisky distillation, with Scotch whiskey being a significant player due to its stringent production standards and storied history. This market encompasses various types, including Single Malt, Single Grain, Blended Malt, Blended Grain, and Blended Scotch Whiskey. Single Malt whiskey, crafted at a single distillery using only malted barley and aged for a minimum of three years, is highly valued for its distinct flavor profile. Single Grain whiskey, which includes grains like wheat or corn, adds diversity to the market. Blended Malt whiskey, a combination of single malts from different distilleries, and Blended Grain whiskey, a blend of single grain whiskies, cater to whisky connoisseurs seeking unique experiences.

Blended Scotch Whiskey, the most popular type, merges single malt and single grain whiskies, appealing to a broader audience. Whisky festivals, brand storytelling, and distillery tours attract affluent consumers, while whisky masterclasses, blending, and awards foster a sense of exclusivity. Independent bottlers, sustainable distilling, and whisky finishing add depth to the market, with whisky cocktails, clubs, and cocktail culture further expanding its reach. Whisky auctions, limited edition releases, and whisky investment opportunities cater to collectors, while luxury branding, bottling, retail, and packaging enhance the overall whisky lifestyle experience. Craft distilling, whisky appreciation, and organic whiskey add to the market's diversity, with whisky education, history, and maturation maintaining its rich heritage. E-commerce, digital marketing, and offline sales channels cater to the diverse consumer lifestyles.

Japanese whiskey, Irish whiskey, and whisky bars contribute to the global whisky culture, with whisky experiences, social media marketing, and online sales further engaging consumers.

The Scotch whiskey segment was valued at USD 734.40 million in 2019 and showed a gradual increase during the forecast period.

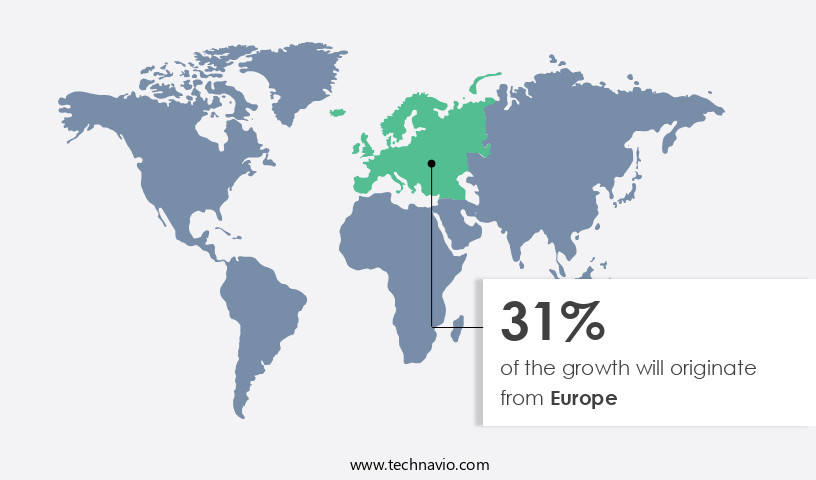

Regional Analysis

Europe is estimated to contribute 31% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European whiskey market is marked by its historic significance and continued innovation in whiskey production. Scotland and Ireland remain key players, but France and Germany are emerging as significant contributors. The European region experiences a rising demand for premiumization and authenticity in the beverage industry, with consumers seeking high-quality, artisanal products. This trend is prominent in the whiskey market, where there is a growing preference for premium and aged expressions from brands with deep heritage and provenance. Whisky festivals, distillery tours, and masterclasses cater to whisky connoisseurs, while independent bottlers and sustainable distilling practices add to the market's allure.

Brand storytelling and luxury lifestyle associations further enhance the market's appeal. Whisky auctions, cocktail culture, and whisky clubs create unique experiences for consumers. Single malt, craft whiskey, and blended whiskey continue to capture the attention of consumers, with aged whiskey and limited edition releases generating significant buzz. Whisky ratings, reviews, and influencer marketing contribute to the market's growth. Sustainable distilling, organic whiskey, and whisky appreciation courses reflect the market's commitment to education and innovation. Whisky bars, whisky experiences, and whisky tourism offer consumers and pleasant encounters with the spirit. Whisky casks, whisky packaging, and high-end retail channels add to the market's luxury appeal.

Whisky education, history, and maturation are integral to the market's richness and diversity. Japanese whiskey and Irish whiskey also hold a prominent position in the European whiskey market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Luxury Whiskey market drivers leading to the rise in the adoption of Industry?

- Whiskey tourism's growth is the primary factor fueling market expansion. This sector's increasing popularity, driven by the rising number of distillery visits and tastings, significantly contributes to the industry's advancement. The market is experiencing significant growth, with a focus on whisky distillery tours becoming a major trend. Distilleries in Scotland and Ireland have recognized the potential of tourism and are attracting affluent consumers by offering experiences. In Scotland, distilleries are popular tourist attractions, and Ireland is seeing an increase in visitors, with numbers expected to double by 2025. In the US, Kentucky distilleries have reported a triple-digit growth rate in tourist footfall over the last decade. This trend extends beyond traditional whiskey-producing regions, as Amrut Distilleries in Bangalore, India, now offers consumers the opportunity to tour their distillery and learn about the single-malt whiskey distillation process firsthand.

- The market is not only about production but also about brand storytelling and creating a whisky lifestyle. Premium and ultra-premium whiskies, small batch productions, whisky festivals, and masterclasses are all part of this luxury experience. Consumers are building collections and seeking authentic, unique experiences, making this a dynamic and engaging market for all involved.

What are the Luxury Whiskey market trends shaping the Industry?

- The market is witnessing significant advancements in product innovation and the introduction of luxury whiskey, setting a notable trend for the upcoming industry developments. This growing trend reflects the increasing demand for premium and unique spirits in the market. The market is witnessing innovation and new product launches as distilleries aim to captivate discerning consumers and differentiate their offerings. These innovations encompass various aspects, such as unique maturation techniques, experimental cask finishes, and rare or limited-edition releases. For example, in April 2024, Diageo India introduced the McDowells and Co Distillers Batch Indian Single Malt, a 750 ml bottle with 46% ABV that combines tradition and innovation. This trend towards heritage and craftsmanship in new product introductions offers consumers an authentic and premium whiskey experience. Whisky awards, independent bottlers, and sustainable distilling also contribute to the market's growth.

- Cocktail culture and whisky clubs further fuel the demand for whiskey cocktails and unique flavor profiles. Whisky auctions and ratings add to the market's dynamics, providing consumers with a means to discover and acquire rare and highly-rated whiskeys. Overall, the market is driven by the desire for exceptional quality, authenticity, and innovation among whiskey connoisseurs.

How does Luxury Whiskey market faces challenges face during its growth?

- The spirits industry faces significant challenges due to stringent regulations and high taxes, which impede its growth. The market faces substantial challenges due to stringent regulations and high taxes. Governments worldwide enforce rigorous regulatory frameworks on whiskey production, distribution, and sale. For example, in the US, distilleries must secure permits from the Alcohol and Tobacco Tax and Trade Bureau (TTB) to produce and sell spirits, and licenses from individual states for distribution and sales within their jurisdictions. Moreover, federal and state governments impose excise taxes on spirits, which include luxury whiskey sales, based on alcohol content and volume. Whisky enthusiasts seek authentic experiences, driving the market towards whisky reviews, tastings, and cultural experiences.

- Influencer marketing plays a crucial role in promoting whisky brands and experiences. Aged whiskey, craft distilling, and organic whiskey continue to gain popularity. Japanese whiskey and whisky bars offer unique and exclusive experiences. Social media marketing and whisky tourism are essential channels for experiential marketing. Whisky casks and whisky appreciation societies cater to the growing demand for high-end whiskey experiences.

Exclusive Customer Landscape

The luxury whiskey market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the luxury whiskey market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, luxury whiskey market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allied Blenders and Distillers Ltd - The company offers luxury whiskey such as Sterling Reserve Blend 7 Whisky and others.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allied Blenders and Distillers Ltd

- Asahi Group Holdings Ltd.

- Bacardi and Co. Ltd.

- Brown Forman Corp.

- Campari Group

- Constellation Brands Inc.

- Diageo

- John Distilleries Pvt. Ltd.

- KAIYO JAPANESE MIZUNARA OAK WHISKY

- Kirin Holdings Co. Ltd.

- La Martiniquaise-Bardinet

- Luxco Inc.

- LVMH Moet Hennessy Louis Vuitton SE

- Pernod Ricard SA

- Piccadily Distilleries

- Suntory Beverage and Food Ltd.

- The Edrington Group Ltd.

- Whyte and Mackay Ltd

- William Grant and Sons Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Luxury Whiskey Market

- In February 2024, Diageo, a leading player in the market, unveiled a new expression, Johnnie Walker Blue Label Ghost and Rare, marking a significant new product launch (Diageo, 2024). This exclusive whiskey was aged in ice-cooled cellars and finished in rare casks, adding to the brand's prestigious portfolio.

- In March 2025, Chivas Brothers, a subsidiary of Pernod Ricard, announced a strategic partnership with Moët Hennessy, the luxury wines and spirits division of LVMH Moët Hennessy Louis Vuitton, to co-develop a luxury whisky brand (Chivas Brothers, 2025). This collaboration aimed to capitalize on the growing demand for luxury spirits and expand their market presence.

- In July 2024, Brown-Forman, another major player, acquired Woodford Reserve, a premium bourbon brand, for USD750 million, marking a significant acquisition (Brown-Forman, 2024). This move strengthened Brown-Forman's position in the luxury whiskey segment and expanded its bourbon offerings.

- In November 2025, the European Union (EU) introduced new regulations on the labeling and marketing of alcoholic beverages, including whiskey, to promote responsible drinking and consumer protection (European Commission, 2025). These regulations set new standards for alcohol content, ingredient labeling, and health warnings, impacting the market significantly.

Research Analyst Overview

The market continues to evolve, with dynamic market activities unfolding across various sectors. Whisky blending, a long-standing practice, persists as a key driver, with brands continually refining their mash bills to create unique flavor profiles. Independent bottlers challenge established brands with their exclusive offerings, while whisky awards celebrate exceptional quality and innovation. Whisky finishing, the art of aging whiskey in different types of casks, adds another layer of complexity to the category. Cocktail culture and whisky clubs further expand the market, offering consumers new ways to explore and appreciate these luxury spirits. Whiskey auctions and sustainable distilling are shaping the industry, with consumers increasingly valuing the provenance and sustainability of their whiskey.

Single malt and craft whiskey continue to attract connoisseurs, while luxury branding and experiential marketing strategies cater to affluent consumers. Luxury spirits, including ultra-premium and limited edition releases, fuel the market's growth. Whisky masterclasses and tastings provide educational experiences, while online sales and social media marketing broaden access to these coveted products. The whisky lifestyle, encompassing cocktail culture, bars, and tourism, continues to flourish. Organic and craft distilling, as well as whisky appreciation and education, add depth to the market. Japanese and Irish whiskeys capture the attention of consumers, with their distinct flavors and rich histories.

Whisky ratings and reviews influence consumer preferences, while influencer marketing and high-end retail further amplify the category's reach. The ongoing evolution of the market ensures a diverse and exciting landscape for consumers and producers alike.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Luxury Whiskey Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

224 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market growth 2025-2029 |

USD 814.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.1 |

|

Key countries |

US, UK, China, Germany, Brazil, Japan, France, Canada, India, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Luxury Whiskey Market Research and Growth Report?

- CAGR of the Luxury Whiskey industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the luxury whiskey market growth and forecasting

We can help! Our analysts can customize this luxury whiskey market research report to meet your requirements.