Scotch Whisky Market Size 2025-2029

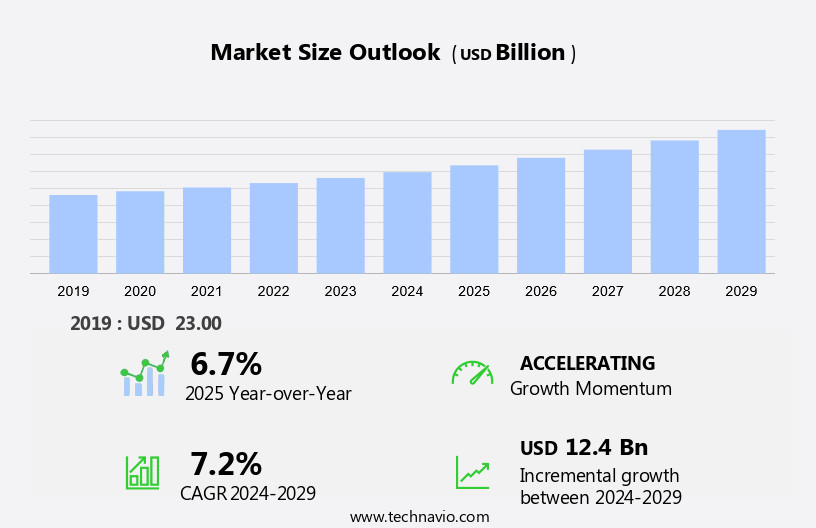

The scotch whisky market size is forecast to increase by USD 12.4 billion at a CAGR of 7.2% between 2024 and 2029.

- The market is experiencing significant growth driven by the increasing international demand, particularly in emerging markets such as Asia Pacific and the Americas. This trend is fueled by the growing appreciation for premium and luxury Scotch Whiskies, which are perceived as status symbols and symbols of sophistication. However, this market faces intense competition from other alcoholic beverages, including wine, beer, and other spirits. To capitalize on this market opportunity, companies must focus on innovation, product differentiation, and targeted marketing efforts to attract and retain consumers. Additionally, collaborations and partnerships with key players in the hospitality industry, such as luxury hotels and restaurants, can help expand market reach and build brand reputation. Navigating these challenges requires a deep knowledge of consumer preferences, market trends, and competitive dynamics. Companies must stay agile and adapt to changing market conditions to remain competitive and profitable in the market.

What will be the Size of the Market during the forecast period?

- The market, rooted in Scotland's rich distilling heritage, continues to thrive globally. This market is fueled by the production of Scotch whisky using traditional methods, involving cereals such as malted barley, water from Scottish sources, and yeast. The Scotch whisky industry encompasses various categories, including single-grain, blended grain, blended malt, and single malt Scotch whiskies. Premium Scotch whiskies, particularly those with a royal pedigree, remain popular among consumers. Millennials and health and wellness conscious drinkers are also driving growth in the market, with a preference for organic whisky made from organic barley and free from artificial additives. The industry's focus on transparency and authenticity has led to a rise in demand for whiskies with natural colors and no added flavors or colors.

- Online platforms have become essential for marketing and sales, enabling consumers to explore and purchase a diverse range of Scotch whiskies, as well as compare prices and read reviews. The market is expanding its reach beyond traditional markets, with increasing competition from other alcoholic beverages, such as wine, and from other whisky-producing regions. However, the market's size and direction remain positive, with continued innovation and consumer interest driving growth.

How is this Industry segmented?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Off-trade

- On-trade

- Product

- Blended

- Bulk blended

- Others

- Geography

- Europe

- France

- North America

- US

- Canada

- APAC

- China

- India

- Middle East and Africa

- South America

- Europe

By Distribution Channel Insights

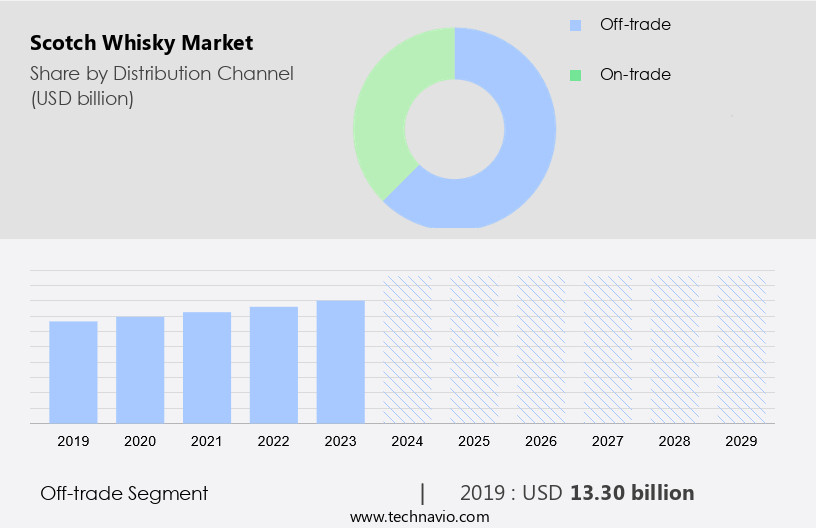

The off-trade segment is estimated to witness significant growth during the forecast period. Scotch whisky is a distinguished alcoholic beverage with a rich history and production process rooted in Scotland. Key components include cereals, water, and yeast, resulting in various types such as single-grain, blended grain, blended malt, and single malt. Blended scotch, a popular choice, is a mix of malt and grain whiskies. Export sales are significant due to its global appeal, particularly in regions like the US and Europe. The millennial demographic and health-conscious drinkers are increasingly preferring organic whisky made from organic barley and malt grains, free from artificial additives and colors. The aging process in old barrels adds unique taste and antioxidant properties, beneficial for heart disease prevention and reducing risks of blood clots and strokes.

Get a glance at the market report of share of various segments Request Free Sample

The off-trade segment was valued at USD 13.30 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

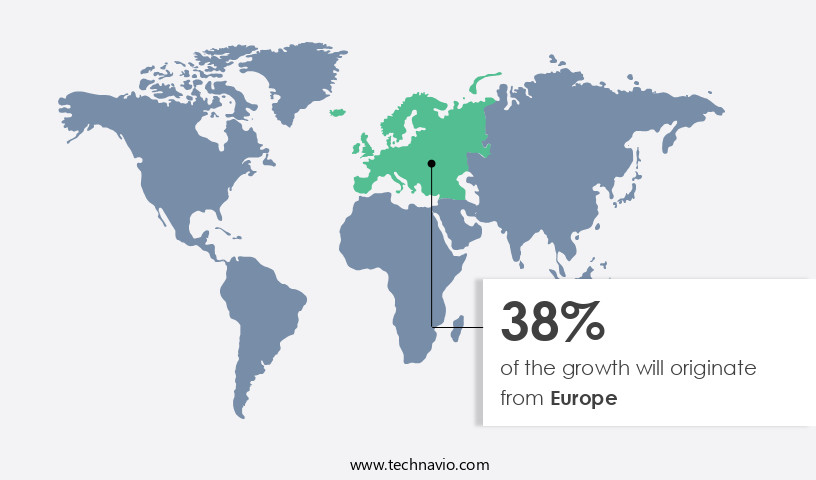

Europe is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The European market is experiencing significant growth due to the rising preference for alcoholic beverages. With Scotland as its birthplace, scotch whisky holds a rich cultural and historical significance in Europe. The whisky-making process, passed down through generations, contributes to the diverse range of scotch whisky styles, such as single malt, blended malt, single grain, and blended grain. These variations cater to various consumer preferences and price points. Moreover, scotch whisky is deeply intertwined with European traditions and celebrations. The market offers organic whisky for health-conscious drinkers, using organic barley and natural ingredients, free from artificial additives and colors.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Scotch Whisky Industry?

- Rising international demand for scotch whisky is the key driver of the market. The market expansion is driven by the increasing economic growth and rising middle-class populations in emerging markets, primarily in Asia, Latin America, and Africa. Consumers in these regions are developing a taste for premium and luxury products, including scotch whisky. The international demand for this beverage introduces it to a diverse range of consumers with varying flavor preferences.

- Whisky enthusiasts seek out different profiles, from peaty and smoky to sweet and fruity, expanding the market for various scotch whisky styles. Furthermore, the tourism industry's growth fosters cultural exchange, allowing consumers to connect with the origins of scotch whisky and encouraging purchases. This broad consumer base, combined with the increasing popularity of scotch whisky, creates a dynamic market with significant potential for growth.

What are the market trends shaping the Scotch Whisky Industry?

- Presence of premiumization and luxury scotch whiskies is the upcoming market trend. The market witnesses a significant consumer preference for premium and luxury expressions, which command higher prices than standard offerings. Consumers value exceptional quality, craftsmanship, and exclusivity, leading them to invest in aged expressions with complex flavor profiles.

- Distilleries cater to this demand by releasing limited-edition whiskies with unique cask finishes and packaging, enhancing their perceived value. Single malt scotch whiskies, renowned for their distinct regional characteristics and flavors, are a staple in the luxury whisky market. Distilleries showcase their single malt offerings to attract discerning consumers. Luxury scotch whiskies are presented in exquisite packaging, including ornate bottles, wooden boxes, and detailed labels, adding to their allure.

What challenges does the Scotch Whisky Industry face during its growth?

- Increasing competition from other alcoholic beverages is a key challenge affecting the industry growth. The market faces challenges from the rising popularity of other alcoholic beverages, including vodka, rum, and brandy. In the US and other American countries, the increasing demand for spirits like mezcal, vodka, rum, and tequila has negatively impacted Scotch whisky sales.

- European markets, such as Germany, France, Italy, Russia, Belgium, and Sweden, are witnessing a similar trend, with consumers shifting towards various spirits. In contrast, China, the largest market for alcoholic beverages in APAC, presents an opportunity for growth. However, the competition remains intense, necessitating strategic marketing and product innovation to maintain market share.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aceo Ltd.

- Allied Blenders and Distillers Ltd

- Arran Distillers Ltd.

- Asahi Group Holdings Ltd.

- Bacardi and Co Ltd

- Brown Forman Corp.

- Constellation Brands Inc.

- Davide Campari-Milano N.V.

- Diageo PLC

- Heaven Hill Distillery Inc.

- LVMH Moet Hennessy Louis Vuitton SE

- Paul John Whisky

- Pernod Ricard SA

- Quintessential Brands Group

- Sazerac Co. Inc.

- Speymalt Whisky Distributors Ltd.

- Suntory Holdings Ltd.

- Thai Beverage Public Co. Ltd.

- The Edrington Group Ltd.

- William Grant and Sons Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Scotch whisky, a distinguished alcoholic beverage hailing from Scotland, continues to captivate consumers worldwide with its rich heritage and unique taste. The production process of this amber elixir is deeply rooted in tradition, involving the use of cereals, water, and yeast. Cereals, primarily malted barley, form the foundation of Scotch whisky. The quality of these grains significantly influences the final product's flavor profile. The water sourced from Scotland's pristine springs plays a crucial role in the distillation process, contributing to the whisky's distinct character. The fermentation stage is another essential aspect of Scotch whisky production. Yeast converts the sugars in the mash into alcohol, setting the stage for the distillation process.

In addition, scotch whisky encompasses various categories, including single-grain, blended grain, blended malt, and single malt. Single-grain and blended grain whiskies are produced using a single type of grain, while blended malt and single malt whiskies are made from a combination of malted barley and water. Export sales of Scotch whisky have seen remarkable growth, driven by increasing consumer preferences for this luxurious beverage. The royal status associated with Scotch whisky, stemming from its long history and association with Scotland's rich culture, adds to its allure. Consumer demographics have evolved, with millennials and health-conscious drinkers embracing Scotch whisky. The trend towards organic and natural ingredients has led to the emergence of organic whisky, produced using organic barley and free from artificial additives, colors, or other chemical enhancements.

Furthermore, online platforms and e-commerce have revolutionized the way Scotch whisky is bought and sold. Consumers can now access a wide range of whiskies from various regions and distilleries, making it more accessible than ever before. Scotch whisky's unique taste and potential health benefits have contributed to its growing popularity. Antioxidants present in whisky have been linked to heart disease prevention, blood clot reduction, and stroke risk mitigation. The aging process plays a significant role in Scotch whisky's development, with the whisky maturing in old barrels, absorbing the flavors and aromas of the wood. This process imparts a complex and nuanced taste to the whisky, making each bottle a unique experience.

Moreover, the middle class population's growing purchasing power and increasing consciousness towards lifestyle and preventive measures have fueled the demand for Scotch whisky. As consumers become more aware of the benefits of this beverage, its market is poised for continued growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.2% |

|

Market growth 2025-2029 |

USD 12.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.7 |

|

Key countries |

US, India, China, Canada, and France |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Scotch Whisky industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.