Magnesium Fluoride Market Size 2024-2028

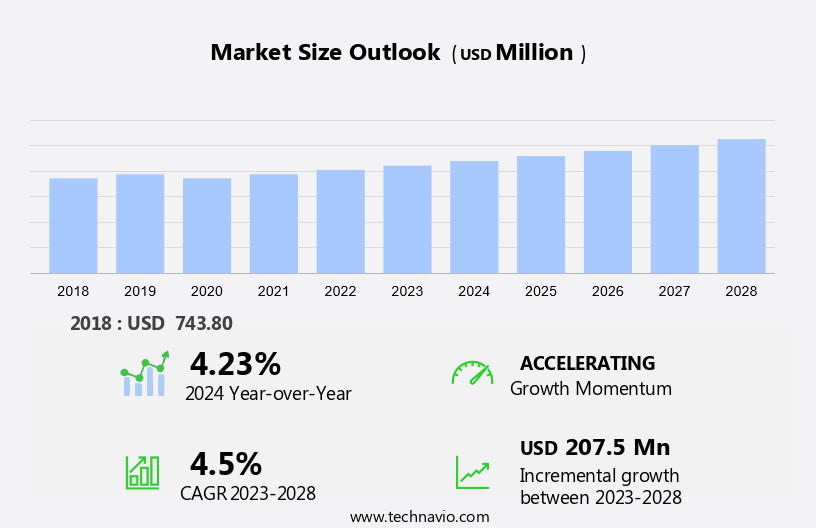

The magnesium fluoride market size is forecast to increase by USD 207.5 million at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. One of the primary drivers is the increasing use of biomaterials in various industries, including dentistry and pharmaceuticals, where magnesium fluoride is employed as a crucial ingredient. Additionally, the demand for magnesium fluoride is surging in emerging economies due to their growing economies and increasing healthcare expenditures. However, there are challenges associated with the market, including potential health side-effects, such as fluorosis, which can occur with excessive intake of fluoride. Producers must ensure stringent regulations and safety measures to mitigate these risks and maintain consumer trust. Overall, the market is poised for steady growth, driven by these trends and challenges.

What will be the Size of the Market During the Forecast Period?

- The market encompasses the production and application of this inorganic chemical, primarily used in various industries for its unique properties. Magnesium Fluoride, a white crystalline salt, is renowned for its role in specialty glass formulations, optical coatings, and photonics. In the realm of advanced ceramics, it is employed for nuclear reactors, electrical insulation, and biomaterials. Additionally, it finds applications in dental hygiene, temporary transplants, and fracture injuries. Magnesium Fluoride is also a critical component In the production of rare mineral sellaite, which is used In the pharmaceutical industry for drug replacement therapies, treating magnesium deficiency and related conditions such as hypomagnesemia, osteoporosis, heart problems, and magnesium-based alloys.

- The market for Magnesium Fluoride is driven by the increasing demand for advanced materials in various industries and the growing awareness of its health and wellness benefits. The market is expected to grow steadily, with ongoing research and development efforts expanding its applications.

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- High purity

- Ultra-high purity

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Product Insights

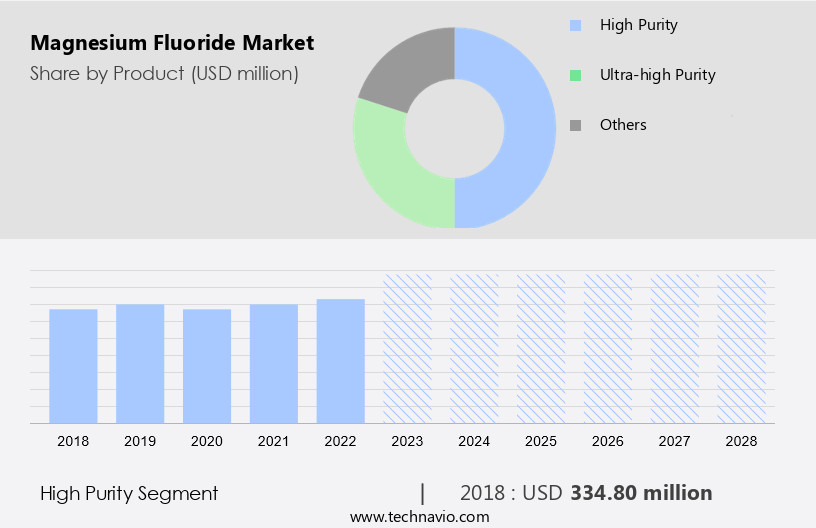

- The high purity segment is estimated to witness significant growth during the forecast period. Magnesium fluoride, a high purity inorganic compound with a molecular structure that binds easily to water molecules, is essential in various industries due to its superior chemical activity and stability with inorganic materials. With a purity level of 99.99%, this rare mineral sellaite is widely utilized in electronics, pharmaceuticals, and food and beverage sectors. In electronics, high purity magnesium fluoride is employed In the manufacturing of optical windows for deep ultraviolet (DUV), ultra-violet (UV), visible light (Vis), and infrared (IR) protection. Its applications extend to telescope lenses and liquid-crystal display (LCD) displays, driving the growth of the high purity market.

Get a glance at the market report of share of various segments Request Free Sample

The high purity segment was valued at USD 334.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

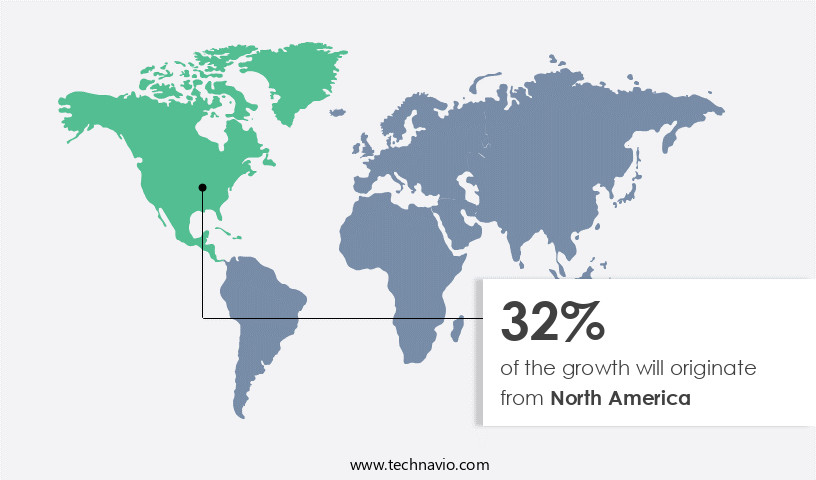

- North America is estimated to contribute 32% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The US market for magnesium fluoride is projected to experience significant growth in North America due to increasing demand from the pharmaceutical and food industries. Key contributors to this market In the region include the US, Canada, and Mexico. However, the limited availability of magnesium fluoride reserves in North America necessitates imports from countries such as China. The adoption of optic fiber cables and the establishment of numerous optical manufacturing units, coupled with substantial investments in research and development, are driving the market growth in North America. Applications of magnesium fluoride span across various industries, including photonics, ceramics, and optical coatings, among others.

For more insights on the market size of various regions, Request Free Sample

Moreover, in the pharmaceutical sector, magnesium fluoride is used as a catalyst support material, hydrofluorinating agent, and taste-masking agent in drug delivery systems. In the food industry, it is employed as an additive for improving the quality and shelf life of food products. Additionally, magnesium fluoride is used In the production of ultra-high purity and high purity magnesium fluoride for various applications, including semiconductor manufacturing, microelectromechanical systems, and sustainable manufacturing processes. The market's growth is further supported by advancements in distillation, filtration processes, real-time monitoring, data analytics, and automation systems, as well as recycling and circular economy initiatives.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Magnesium Fluoride Industry?

- Increasing use of biomaterials is the key driver of the market. Magnesium fluoride, a white crystalline compound, is an inorganic material gaining significance in various industries. In the realm of materials science and optical technology, magnesium fluoride is utilized in specialty glass formulations for producing optical coatings, photonics, and ceramics. The semiconductor manufacturing sector relies on magnesium fluoride as a fluorinating agent for hydrogenation, oxidation, and polymerization reactions. In the healthcare sector, magnesium fluoride is used in dental hygiene products and drug delivery systems as a taste-masking agent and catalyst support material. In the pharmaceutical industry, it is used In the production of solid dosages, such as tablets and capsules, for magnesium-based alloys and as a replacement therapy for magnesium fluoride deficiency or hypomagnesemia.

- Magnesium fluoride is also employed In the production of temporary transplants, such as biomaterials for fracture injuries, osteoporosis, heart problems, and other medical conditions prevalent In the aging population. The global market for magnesium fluoride is experiencing growth due to the increasing number of severe accidents requiring medical attention and the rising healthcare standards, leading to a longer life expectancy. The total medical costs for fatal and non-fatal accidents In the US alone exceed USD 50 billion annually. In addition to healthcare applications, magnesium fluoride is used in various industries, including aerospace, defense, and semiconductor industries, for its anti-reflection properties as a low index material and protective coating in various optics.

What are the market trends shaping the Magnesium Fluoride Industry?

- Increasing demand from emerging economies is the upcoming market trend. The global market for magnesium fluoride is experiencing notable growth due to escalating demand from specialty glass formulations, optical coatings in photonics and optical technology, and various industries such as ceramics, dental hygiene, nuclear reactors, electrical insulation, and drug delivery systems. In the medical sector, magnesium fluoride is utilized as a taste-masking agent, catalyst support material, and fluorinating agent in hydrogenation, oxidation, and polymerization reactions. Moreover, its application as a catalyst in semiconductor manufacturing, microelectromechanical systems, and sustainable manufacturing processes further bolsters market expansion. Magnesium fluoride's versatility extends to various industries, including the aerospace, defense, and semiconductor industries, which require ultra-high purity and high purity magnesium fluoride for their production facilities, research institutions, universities, and laboratories.

- The material's use in materials science and optical technology, as a white crystalline compound and rare mineral sellaite, has significant implications for biomaterials, temporary transplants, and the treatment of fracture injuries, osteoporosis, heart problems, and other health conditions in an aging population. Magnesium fluoride's applications are not limited to industrial and medical uses. It is also employed in various environmental applications, such as In the treatment of water resources, including groundwater, municipal wastewater, acid mine drainage, and soil contamination. To ensure long-term health and sustainability, magnesium fluoride is a valuable resource in mitigating the effects of carbon pollution levels and contributing to a circular economy through recycling and real-time monitoring, data analytics, and automation systems.

What challenges does the Magnesium Fluoride Industry face during its growth?

- Side-effects on health is a key challenge affecting the industry growth. Magnesium fluoride is a significant inorganic compound with various applications in specialized industries, including specialty glass formulations for optical coatings in photonics and the semiconductor industry. In ceramics, it serves as a catalyst support material for hydrogenation, oxidation, and polymerization reactions. In the dental hygiene sector, it functions as a fluorinating agent and taste-masking agent in solid dosages like tablets and capsules for drug delivery systems. Magnesium fluoride's role extends to the nuclear reactor industry as an electrical insulation material. In materials science, it is used In the production of ultra-high purity and high purity magnesium fluoride for optics, aerospace, defense, and semiconductor industries.

- Despite its benefits, magnesium fluoride's use comes with health concerns. Exposure to magnesium fluoride can lead to skin irritation, eye irritation, and respiratory problems. Ingestion may result in irritation of the throat, mouth, and gastrointestinal tract, causing vomiting and diarrhea. Magnesium fluoride can also cause painful and rigid muscle contractions of the limbs. To mitigate potential health risks, sustainable manufacturing processes, such as distillation and filtration, are employed. Real-time monitoring, data analytics, and automation systems are essential in ensuring the safe handling and production of magnesium fluoride. Additionally, recycling and circular economy initiatives contribute to minimizing the environmental impact of magnesium fluoride production.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Elements

- DERIVADOS DEL FLUOR SAU

- FAIRSKY INDUSTRIAL CO. LTD.

- Harshil Industries

- Henan Kingway Chemicals Co. Ltd.

- Honeywell International Inc.

- International Crystal Laboratories

- MaTecK GmbH

- Materion Corp.

- Merck KGaA

- Morita Chemical Industries Co. Ltd.

- Nanoshel LLC

- Noah Chemicals

- Oxford Lab Fine Chem LLP

- Powder Pack Chem

- Reade International Corp.

- Solvay SA

- Stella Chemifa Corp.

- Thermo Fisher Scientific Inc.

- Wuxi Ruiyuan Chemical Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Magnesium fluoride, a specialty inorganic compound, plays a significant role in various industries due to its unique properties. This white crystalline material, which can be found in nature as the mineral sellaite, exhibits high transparency across various wavelengths, making it an essential component in optical coatings and photonics. In the realm of ceramics, magnesium fluoride serves as a catalyst support material in hydrogenation, oxidation, and polymerization reactions. It is also used as a fluorinating agent in semiconductor manufacturing and microelectromechanical systems. The demand for magnesium fluoride In these applications is driven by the continuous advancements in materials science and optical technology.

In addition, beyond ceramics, magnesium fluoride finds applications in diverse sectors such as optical coatings for specialty glass formulations in aerospace and defense industries. In the field of dental hygiene, it is used as a taste-masking agent in solid dosages like tablets and capsules for drug delivery systems. Magnesium fluoride is also used as a protective coating in various industries, including nuclear reactors and electrical insulation. In the pharmaceutical sector, it is used in drug replacement therapy for magnesium fluoride deficiency, such as hypomagnesemia. The production of magnesium fluoride involves processes like distillation and filtration, which require high levels of purity.

Furthermore, ultra-high and high-purity magnesium fluoride are in high demand due to their superior properties. The production facilities for magnesium fluoride are typically located in research institutions, universities, and laboratories, where rigorous research and development are carried out. The market dynamics for magnesium fluoride are influenced by various factors, including the increasing demand for sustainable manufacturing processes and the circular economy. Real-time monitoring, data analytics, and automation systems are increasingly being adopted to optimize the production and usage of magnesium fluoride. Recycling and the reduction of carbon pollution levels are also crucial factors driving the market for magnesium fluoride.

In addition, its unique properties make it an essential component in various industries, and the demand for magnesium fluoride is expected to grow as new applications are discovered. Despite its numerous benefits, magnesium fluoride also presents challenges. Its production and usage involve potential health risks, such as skin and eye irritation, respiratory problems, and long-term health concerns. Therefore, it is essential to ensure the safe handling and disposal of magnesium fluoride. The market for magnesium fluoride is expected to grow as new applications are discovered and the demand for sustainable manufacturing processes and the circular economy increases. However, it is crucial to ensure the safe handling and disposal of magnesium fluoride to mitigate potential health risks.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 207.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, China, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Magnesium Fluoride industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.