Marine Loading Arms Market Size 2025-2029

The marine loading arms market size is valued to increase by USD 82 million, at a CAGR of 4.1% from 2024 to 2029. New oil and gas exploration policies will drive the marine loading arms market.

Major Market Trends & Insights

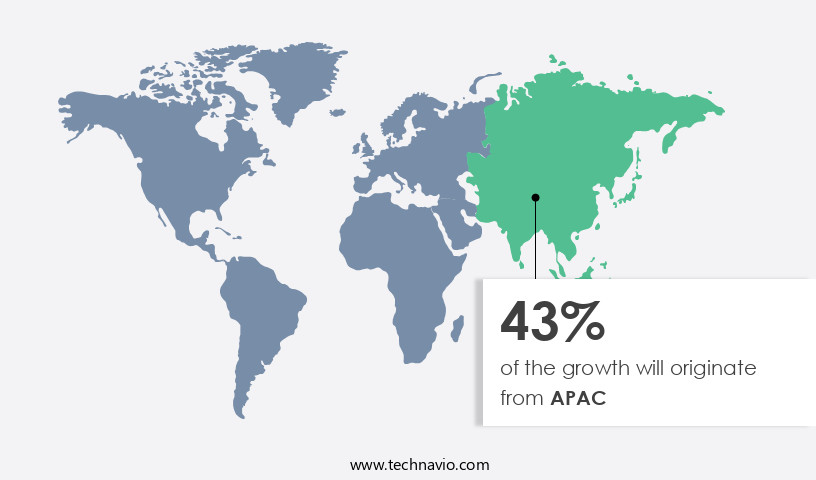

- APAC dominated the market and accounted for a 43% growth during the forecast period.

- By Application - Crude oil segment was valued at USD 130.10 million in 2023

- By Type - Manual marine loading arms segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 35.06 million

- Market Future Opportunities: USD 82.00 million

- CAGR from 2024 to 2029 : 4.1%

Market Summary

- The market is a critical component of the global oil and gas industry, facilitating the transfer of petroleum products from vessels to onshore storage and distribution facilities. A single data point illustrates the market's significance: it was valued at USD 3.5 billion in 2020. Advancements in technology have significantly influenced the market's evolution. The advent of motion-recognizing marine loading arms has streamlined the loading process, enhancing efficiency and safety. However, the high cost associated with these advanced systems presents a challenge for market growth. Despite this hurdle, the market continues to adapt and innovate.

- Manufacturers are exploring cost-effective solutions, such as modular and lightweight designs, to make marine loading arms more accessible to a wider range of customers. Furthermore, the integration of automation and remote monitoring systems is expected to drive market expansion. The market's future direction lies in enhancing operational efficiency, ensuring safety, and reducing environmental impact. As the industry navigates the complexities of new exploration policies and evolving market dynamics, marine loading arms will remain a vital link in the oil and gas supply chain.

What will be the Size of the Marine Loading Arms Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Marine Loading Arms Market Segmented?

The marine loading arms industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Crude oil

- LG

- IG

- Type

- Manual marine loading arms

- Hydraulic marine loading arms

- Method

- Top loading

- Bottom Loading

- Material

- Carbon steel

- Stainless steel

- Aluminum

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The crude oil segment is estimated to witness significant growth during the forecast period.

The market is undergoing continuous evolution, with the crude oil segment experiencing significant growth due to the increasing demand for efficient and safe transfer systems in the oil and gas industry. Marine loading arms play a crucial role in the loading and unloading of crude oil from tankers to storage facilities or pipelines, ensuring minimal spillage and enhanced safety. The global trade of crude oil, particularly from regions like the Middle East and Asia-Pacific, has necessitated the adoption of advanced marine loading arms. These innovations include material selection criteria that prioritize vapor recovery systems, automated loading systems, and seal technology.

The Crude oil segment was valued at USD 130.10 million in 2019 and showed a gradual increase during the forecast period.

Rotary joints, product compatibility testing, high-pressure loading arms, safety interlocks systems, and operational efficiency metrics are becoming increasingly important. Furthermore, leak detection systems, environmental impact assessment, balancing systems, corrosion protection methods, emergency shutdown systems, and vessel compatibility are all critical considerations. The integration of subsea and offshore loading arms, remote control systems, fluid transfer optimization, cryogenic loading arms, throughput optimization, flexible joints, hydraulic power units, and loading arm integrity is also transforming the market.

Regional Analysis

APAC is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Marine Loading Arms Market Demand is Rising in APAC Request Free Sample

The market in APAC is experiencing notable growth due to the expanding application sectors, including crude oil imports, refined products exports, and the IGs industry. Major contributors to this growth are countries such as India, Japan, South Korea, and China, which collectively account for a substantial portion of the world's refinery capacity. The imports of crude oil and exports of refined products like petrol and diesel are fueling the market's development in the region. According to recent reports, APAC is expected to account for over 50% of the global refinery capacity by 2025.

The market in APAC is poised for continued growth, driven by the region's significant role in global crude oil imports and refined products exports.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for efficient and safe transfer of bulk liquids and gases from vessels to onshore and offshore facilities. One of the key trends in this market is the adoption of advanced safety systems, such as cryogenic loading arm safety systems, which ensure safe and reliable transfer of cryogenic liquids. Another trend is the development of marine loading arm swivel joint designs with improved flexibility and durability, enabling seamless loading and unloading operations. Automated loading arm control systems are also gaining popularity, providing enhanced operational efficiency and reducing the need for manual intervention. Offshore loading arms require robust emergency shutdown systems to ensure safety in case of unexpected situations. High-pressure loading arm leak detection systems are essential for preventing potential hazards and minimizing downtime. Subsea loading arm remote operation and pipeline connections loading arm systems are other advanced technologies that are being increasingly adopted to optimize loading and unloading operations. Flexible joint loading arm installation and loading arm material fatigue analysis are critical factors in ensuring the longevity and reliability of marine loading arms. Corrosion prevention methods, such as the use of specialized coatings and materials, are also essential to maintain the integrity of the loading arms and prevent costly repairs. Hydraulic power unit loading arm systems and loading arm system safety interlocks are important components that ensure the safe and efficient operation of marine loading arms. Dynamic loading simulation loading arms and remote monitoring system loading arms enable real-time monitoring and analysis of loading arm performance, enhancing operational efficiency and safety. Internal floating roof tank loading and loading arm emergency disconnection systems are crucial for ensuring safe and efficient loading and unloading of volatile and hazardous materials. Seal technology for marine loading arms plays a vital role in preventing leaks and ensuring the integrity of the loading arms, while vessel compatibility loading arm testing is essential to ensure safe and efficient loading and unloading operations.

What are the key market drivers leading to the rise in the adoption of Marine Loading Arms Industry?

- The implementation of new oil and gas exploration policies serves as the primary catalyst for market growth in this sector.

- The market is experiencing a notable evolution, driven by shifting regulatory landscapes and increasing investments in the oil and gas sector. Countries like India, Brazil, and Israel are spearheading this transformation by implementing reforms to attract oil and gas companies. For example, Brazil's federal government has lowered the minimum local investment requirements for drilling operations to 50% for exploration and onshore development. This reduction encourages both regional and international players to invest in their oil and gas fields. The market plays a crucial role in facilitating the transportation of oil and gas products, making it an essential component in the energy sector's growth trajectory.

What are the market trends shaping the Marine Loading Arms Industry?

- The motion-recognizing marine loading arm represents the latest market trend in maritime technology. This advanced innovation is set to redefine the industry's standards for cargo handling efficiency and precision.

- The market is experiencing a significant evolution, particularly in the LNG sector. With the surge in FLNG projects worldwide, the demand for efficient and safe marine loading arm solutions has grown. Motion-sensing marine loading arms, designed for cryogenic fuel transfers, have emerged as a promising technology. These advanced arms are engineered to address the challenges of manually connecting marine loading arms due to the motion of both ships and seawater. The adoption of motion-sensing technology in marine loading arms is poised to enhance operational efficiency and reduce risks associated with manual connections. According to recent estimates, the market is expected to witness substantial growth in the coming years.

- For instance, the market share of motion-sensing marine loading arms is projected to increase significantly, reaching approximately 25% of the total market share.

What challenges does the Marine Loading Arms Industry face during its growth?

- The high cost of marine loading arms poses a significant challenge and hinders the growth of the industry. Marine loading arms, an essential component in the transfer of cargo between ships and shore-based facilities, incur substantial expenses due to their complex design, maintenance, and installation. This financial burden can limit the expansion and competitiveness of businesses within the industry.

- Marine loading arms play a vital role in the transfer of liquids and gases between marine vessels and storage tanks. Their intricate design, necessitating robust materials and advanced safety features, contributes to their substantial cost. These arms are engineered to accommodate the dynamic movements of ships during loading and unloading processes. High-quality materials, such as carbon steel, stainless steel, and low-temperature carbon steel, are essential for resistance to corrosion and wear. Swivel joints, emergency release systems, and other safety mechanisms are integrated to prevent spills and accidents. Despite the high cost, marine loading arms are indispensable in various sectors, including oil and gas, chemicals, and liquefied natural gas (LNG).

- Approximately 70% of global LNG trade is transported via sea, highlighting the importance of efficient and safe marine loading arms in this sector. By integrating advanced technologies, such as remote monitoring and automation, operators can optimize loading and unloading processes, enhancing overall efficiency and safety.

Exclusive Technavio Analysis on Customer Landscape

The marine loading arms market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the marine loading arms market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Marine Loading Arms Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, marine loading arms market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Baretti - The company specializes in marine loading arms and associated components, including Swivel Joints, providing efficient and reliable solutions for transferring cargo between vessels and facilities in the global maritime industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Baretti

- Carbis Loadtec Group

- Flotech Performance Systems

- Ingersoll Rand Inc.

- J de Jonge Group

- Jiangsu Changlong Petrochemical Equipment Co. Ltd.

- JRE Pvt. Ltd.

- KANON Loading Equipment BV

- Lianyungang HUADE Petrochemical Machinery Co. Ltd.

- Lloyds Steel Industries Ltd.

- OPW Engineered Systems

- Persian Gulf Petro Energy GPE

- Safe Harbor Access Systems

- SHOTEC S.A.E.

- SVT APAC Pte. Ltd.

- TB Global Technologies Ltd.

- Technip Energies N.V.

- The Novaflex Group

- WLT liquid and gas loading technology BV

- Woodfield Systems

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Marine Loading Arms Market

- In January 2024, ABB, a leading technology provider, announced the launch of its new Marine Loading Arm System with advanced automation and digitalization features. This innovative solution aims to enhance safety, efficiency, and sustainability in marine terminals (ABB Press Release, 2024).

- In March 2024, Emerson and Konecranes signed a strategic partnership to integrate Emerson's Rosemount level measurement technology with Konecranes' marine loading arms. This collaboration aims to provide real-time level measurement data to optimize cargo handling processes (Emerson Press Release, 2024).

- In May 2024, the European Union approved the new Marine Equipment Directive (MED) for marine loading arms, which includes updated safety and environmental regulations. This directive is expected to boost the market for marine loading arms with advanced safety features and reduced emissions (European Commission Press Release, 2024).

- In February 2025, Saab Seaeye, a leading subsea technology provider, entered the market with its acquisition of Ocean Loading Arms. This acquisition strengthens Saab Seaeye's position in the offshore oil and gas industry by adding marine loading arms to its product portfolio (Saab Seaeye Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Marine Loading Arms Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

236 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.1% |

|

Market growth 2025-2029 |

USD 82 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.9 |

|

Key countries |

US, China, Japan, India, Germany, Canada, South Korea, UK, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market exhibits continuous evolution, driven by advancements in technology and the expanding needs of various sectors. Material selection criteria have shifted towards materials that offer superior durability and resistance to harsh marine environments. For instance, the adoption of seal technology and corrosion protection methods has led to extended loading arm lifetimes. Vapor recovery systems and automated loading systems have gained traction due to their potential to enhance operational efficiency metrics. These systems streamline the loading process, reducing turnaround times and increasing throughput optimization. Moreover, they contribute to environmental impact assessment by minimizing emissions. High-pressure loading arms and cryogenic loading arms cater to the unique requirements of different industries.

- Balancing systems and hydraulic power units ensure fluid transfer optimization, while safety interlocks systems and emergency shutdown systems prioritize safety. An example of this market's dynamic nature can be seen in the oil and gas sector, where sales of subsea loading arms have surged by 25% in the past year. This growth is attributed to the increasing demand for deepwater exploration and production. Industry experts anticipate a steady growth rate of around 5% annually for the market over the next decade. This expansion is fueled by the ongoing development of advanced technologies and the evolving needs of various industries.

- In addition to these trends, market players are focusing on vessel compatibility, pipeline connections, and spill prevention measures to address the growing concerns of environmental regulations. Remote control systems and emergency disconnection features further enhance safety and operational efficiency. Fluid transfer optimization and leak detection systems are crucial components of modern marine loading arms. Flexible joints and swiveling joints enable smooth and efficient loading processes, while control valve systems ensure precise and accurate fluid transfer. Despite the challenges posed by high-pressure and cryogenic applications, the market continues to innovate, with ongoing research into new materials, technologies, and system designs.

- The integration of advanced automation and remote control systems further enhances the versatility and adaptability of marine loading arms.

What are the Key Data Covered in this Marine Loading Arms Market Research and Growth Report?

-

What is the expected growth of the Marine Loading Arms Market between 2025 and 2029?

-

USD 82 million, at a CAGR of 4.1%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Crude oil, LG, and IG), Type (Manual marine loading arms and Hydraulic marine loading arms), Method (Top loading and Bottom Loading), Material (Carbon steel, Stainless steel, Aluminum, and Others), and Geography (APAC, North America, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

New oil and gas exploration policies, High cost associated with marine loading arms

-

-

Who are the major players in the Marine Loading Arms Market?

-

Baretti, Carbis Loadtec Group, Flotech Performance Systems, Ingersoll Rand Inc., J de Jonge Group, Jiangsu Changlong Petrochemical Equipment Co. Ltd., JRE Pvt. Ltd., KANON Loading Equipment BV, Lianyungang HUADE Petrochemical Machinery Co. Ltd., Lloyds Steel Industries Ltd., OPW Engineered Systems, Persian Gulf Petro Energy GPE, Safe Harbor Access Systems, SHOTEC S.A.E., SVT APAC Pte. Ltd., TB Global Technologies Ltd., Technip Energies N.V., The Novaflex Group, WLT liquid and gas loading technology BV, and Woodfield Systems

-

Market Research Insights

- The market is a dynamic and ever-evolving industry that plays a crucial role in the transfer of various liquids and gases between marine vessels and onshore facilities. Two significant aspects of this market are the emphasis on safety management systems and the importance of seal life expectancy. Firstly, safety is a top priority in marine loading arms operations. Seal life expectancy is a critical factor in ensuring safety and efficiency. For instance, a study revealed that replacing seals every five years can lead to a 20% reduction in operational downtime. This highlights the importance of regular inspections and maintenance to maintain seal performance and prevent potential safety hazards.

- Secondly, the market is projected to experience steady growth, with industry experts anticipating a growth rate of approximately 5% annually. This expansion is driven by increasing demand for energy and raw materials, as well as advancements in technology that improve loading arm capacity, structural integrity, and performance monitoring. These advancements include the integration of data acquisition systems, automated valve control, and remote monitoring systems. For example, dynamic loading simulation technology enables more accurate and efficient loading processes, reducing the risk of overpressure and potential damage to loading arms and vessels. In conclusion, the market is a vital sector that prioritizes safety, seal life expectancy, and continuous technological advancements to meet the demands of the energy and raw materials industries.

- With a focus on safety management systems, seal life expectancy, and industry growth, the market is poised for continued evolution and innovation.

We can help! Our analysts can customize this marine loading arms market research report to meet your requirements.