Marine Radar Market Size 2024-2028

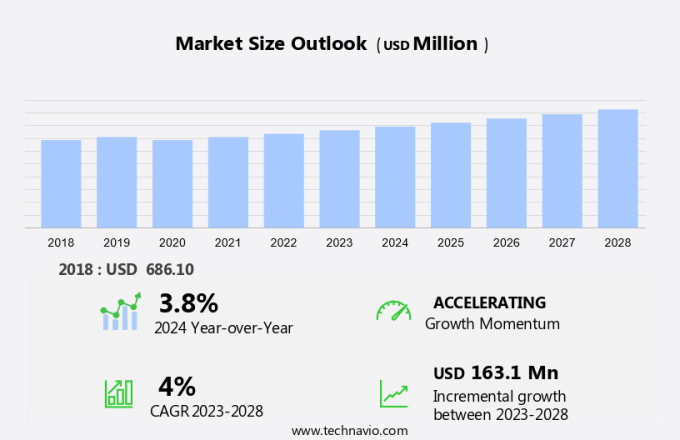

The marine radar market size is forecast to increase by USD 163.1 million at a CAGR of 4% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing need for advanced maritime safety and security. One of the key trends driving market expansion is the rising adoption of solid-state radar systems, which offer superior performance and reliability compared to traditional magnetron-based systems. Frequency ranges, including X-Band and S-Band, are commonly used in marine radar systems due to their ability to provide high-resolution imaging and long-range detection. Border security and anti-terrorist activities are major applications of marine radar systems, particularly for military radar applications. However, input limitations, such as sea clutter and rain interference, can pose challenges to accurate radar detection. The integration of Global Positioning System (GPS) technology can help mitigate these challenges by providing additional location data and improving target identification. Marine radar systems are essential for ensuring the safety and security of naval forces, submarine, commercial vessels, and coastal communities. As the demand for enhanced maritime surveillance and defense continues to grow, the market for marine radar systems is expected to experience continued expansion.

What will be the Size of the Market During the Forecast Period?

- The market encompasses the use of radar technology in various marine applications. Radar, an acronym for Radio Detection and Ranging, is a vital detection device used for identifying and locating objects, both stationary and moving, in the maritime environment. Navigation is a primary application of marine radar. It aids seafarers in determining their position and course, ensuring safe and efficient navigation. Marine radar systems employ different frequency ranges, including X-band and S-band, to provide accurate and reliable navigation data. Collision avoidance is another significant application of marine radar.

- Moreover, these systems help detect other vessels, obstacles, and moving objects in the vicinity, enabling mariners to take evasive action and prevent potential collisions. Marine radar finds extensive usage in military applications, including weapon guidance and surveillance. Radar systems are essential for military vessels to detect enemy ships, submarines, and aircraft, ensuring national security. Marine radar is also employed in commercial shipping for efficient cargo transportation. Radar systems help monitor the position and movement of commercial ships, ensuring safe and timely delivery of goods. Fishing vessels and pleasure boats also utilize marine radar for navigation and collision avoidance.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Fishing vessel

- Merchant vessel

- Naval vessel

- Recreational vessel

- Geography

- North America

- US

- Europe

- Sweden

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Application Insights

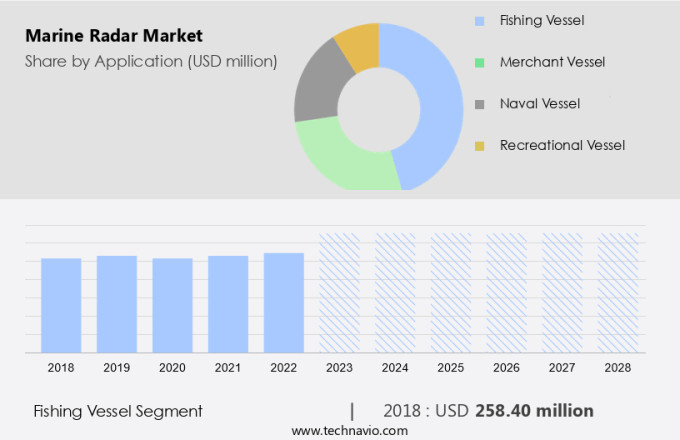

- The fishing vessel segment is estimated to witness significant growth during the forecast period.

Marine radar systems are indispensable for fishing vessels in ensuring safe and efficient navigation and fish locating. These systems provide real-time information on the surrounding environment, enabling fishermen to identify other boats, stationary objects, and moving marine life, as well as monitor climatic conditions. Advanced radar technologies are increasingly adopted to improve catch rates and streamline operations. Modern marine radar systems integrate with other navigation tools, such as GPS and electronic chart displays, providing enhanced situational awareness and precise route planning. However, there are certain challenges in the market. These include the harsh climatic conditions at sea, which can impact the performance of radar systems, and the high cost of manufacturing and maintaining these systems.

Furthermore, military expenditure on weapon guidance systems using radar technology can also impact the market dynamics. Despite these obstacles, the market for marine radar systems is expected to grow due to the increasing demand for safety and operational efficiency in the fishing industry.

Get a glance at the market report of share of various segments Request Free Sample

The fishing vessel segment was valued at USD 258.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

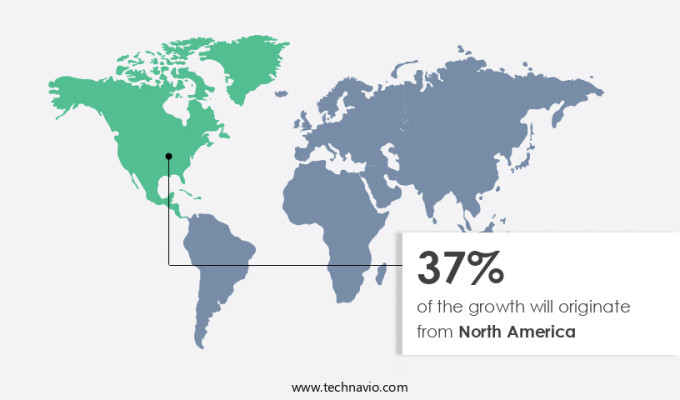

- North America is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is witnessing notable expansion due to the rise in maritime activities, technological advancements, and stringent safety regulations. With an extensive coastline and bustling ports, North America is a significant hub for commercial shipping, fishing, and recreational boating, resulting in a burgeoning demand for dependable marine radar systems. In the commercial sector, the shipping and logistics industries are driving the need for marine radar, as they prioritize precise navigation and collision avoidance systems to optimize operational efficiency and ensure safety. Fishing vessels, be they commercial or recreational, are incorporating advanced radar technologies to boost catch rates and navigate safely in crowded waters.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Marine Radar Market?

Increasing demand for enhanced maritime safety and security is the key driver of the market.

- The market is experiencing significant growth due to the heightened need for maritime safety and security. With increasing maritime traffic from trade, tourism, and offshore activities, the importance of dependable navigation and surveillance systems is becoming increasingly evident. Marine radar is a vital component in ensuring the safety of vessels by identifying potential hazards, such as nearby ships, floating debris, and land obstacles, particularly in challenging visibility conditions or congested waterways. Security concerns also fuel the adoption of radar technology, particularly in sensitive zones where unauthorized vessel movement can pose risks. Governments and regulatory bodies are investing substantially in advanced radar systems to safeguard coastlines, ports, and strategic areas.

- In addition, these investments reduce the likelihood of collisions, illegal fishing, piracy, and smuggling, making marine radar an indispensable tool for both commercial and military applications, including navigation, collision avoidance, military applications such as weapon guidance, marine tourism, pleasure boats, and commercial ships, as well as fishing vessels.

What are the market trends shaping the Marine Radar Market?

Rising adoption of advanced solid-state radar systems is the upcoming trend in the market.

- The market is witnessing significant growth due to the increasing adoption of solid-state radar systems. These systems, which operate on digital technology, offer several advantages over traditional magnetron-based systems. One of the primary reasons for their popularity is their enhanced performance and reliability in various maritime conditions. Solid-state radar systems eliminate the need for high-voltage components, resulting in reduced maintenance costs and improved durability. These advanced radar systems provide clearer imaging and more precise target tracking, even in challenging weather conditions or congested maritime environments. Frequency ranges used in marine radar systems include X-Band and S-Band. X-Band radar systems offer higher resolution and shorter wavelengths, making them ideal for detecting small targets, while S-Band systems provide a longer range and are suitable for detecting larger targets.

- In addition, solid-state radar systems also have environmental benefits, as they consume less power and emit minimal electromagnetic radiation. This makes them an attractive choice for both commercial and recreational marine users. Furthermore, these radar systems play a crucial role in enhancing border security and countering terrorist activities by providing real-time surveillance and detection capabilities. Military radar systems also rely on solid-state radar technology for improved situational awareness and threat detection. In conclusion, the market is experiencing a shift towards solid-state radar systems due to their superior performance, reliability, and environmental benefits. These systems offer enhanced detection capabilities, making them an essential tool for maritime safety and security applications.

What challenges does Marine Radar Market face during the growth?

Adverse climatic condition is a key challenge affecting the market growth.

- Radar technology plays a crucial role in maritime surveillance, particularly in the context of shipbuilding and the merchant marine. In the defense sector, military spending on radar systems is significant for both naval and airborne applications. Atmospheric conditions, such as precipitation and temperature inversions, can affect radar performance. Rain and other forms of precipitation can create echo signals that obscure the desired target echoes. At higher altitudes, the Earth's atmosphere reduces in density, causing radar waves to bend and extend the detection range at low angles. Ducts, which are formed by temperature inversions, can capture and channel radar energy around the Earth's curvature, enabling detection beyond the normal horizon.

- Furthermore, these phenomena are more common in tropical climates and can extend the range of airborne radar, but they can also cause radar energy to be deflected and miss areas beneath the ducts. Research and development activities in the maritime industry continue to focus on improving radar technology to overcome these challenges and enhance surveillance capabilities.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alphatron Marine B.V.

- BAE Systems Plc

- Brunswick Corp.

- Dassault Systemes SE

- Furuno Electric Co. Ltd.

- Garmin Ltd.

- GEM elettronica

- General Dynamics Corp.

- Honeywell International Inc.

- Koden Electronics Co. Ltd.

- L3Harris Technologies Inc.

- Lockheed Martin Corp.

- Nisshinbo Holdings Inc.

- Northrop Grumman Corp.

- RTX Corp.

- Saab AB

- Teledyne FLIR LLC

- Thales Group

- Wartsila Corp.

- WMJ Marine Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses advanced detection devices used for navigation and collision avoidance in various maritime applications. These systems employ radar technology to identify and track moving and stationary objects, including ships, obstacles, and weather phenomena. The market caters to diverse sectors such as commercial shipping, fishing vessels, pleasure boats, and the military. Military applications include collision avoidance, weapon guidance, and surveillance. Radar systems play a crucial role in border security, terrorist activities detection, and defense sector intelligence. In the commercial sector, radar technology is integral to merchant marine activities, shipbuilding, and trade. Frequency ranges, such as X band and S band, are essential in marine radar systems, providing high-resolution target detection and long-range weather detection.

In addition, modern radar systems incorporate digital signal processing, advanced detection systems, and data triangulation for improved performance. Climatic conditions and input limitations, like the Global Positioning System, influence radar system design and functionality. Hydrometeorological applications, offshore installations, and ship traffic control are additional areas where marine radar is employed. Military expenditure and defense sector spending significantly impact the market, driving the manufacturing of high-tech weapons and advanced radar systems. The intended audience for these systems includes defense organizations and maritime industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4% |

|

Market growth 2024-2028 |

USD 163.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.8 |

|

Key countries |

US, Japan, Sweden, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch