Mead Beverages Market Size 2025-2029

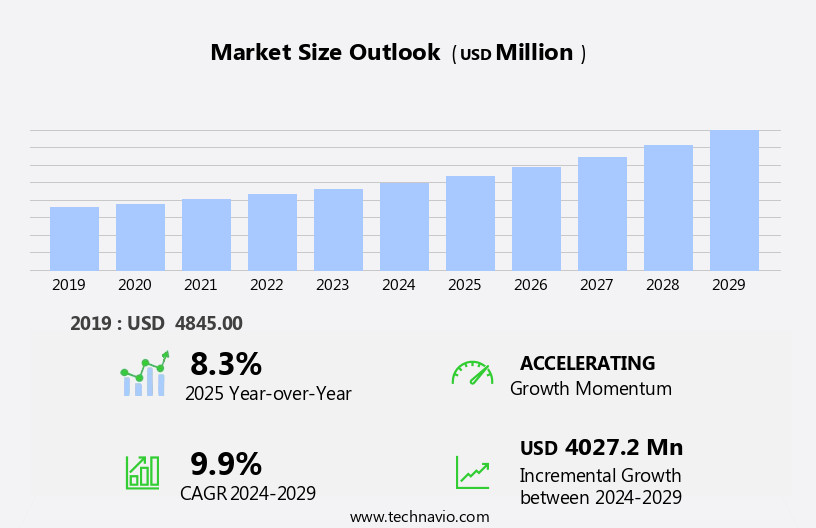

The mead beverages market size is forecast to increase by USD 4.03 billion, at a CAGR of 9.9% between 2024 and 2029.

- The market exhibits significant growth potential due to the emergence of numerous untapped markets and continuous product innovations. Honey, a key ingredient in mead production, experiences price fluctuations, which can impact the market's cost structure and profitability. These trends present both opportunities and challenges for market participants. Untapped markets, particularly in emerging economies, offer substantial growth opportunities for mead beverage companies. As consumer preferences shift towards locally produced and natural beverages, mead, with its rich history and unique flavors, is gaining popularity. Product innovations, such as infusions with various fruits and herbs, are attracting a younger demographic and expanding the market's reach.

- However, the market faces challenges due to the price volatility of honey. As a primary ingredient, the cost fluctuations can significantly impact the production costs and, consequently, the final product's price. Companies must navigate this challenge by exploring alternative sweeteners or implementing price strategies to mitigate the impact on their profitability. Effective supply chain management and strategic sourcing of honey can also help mitigate the risks associated with price fluctuations. In conclusion, the market presents both opportunities and challenges for participants. The emergence of untapped markets and continuous product innovations offer growth opportunities, while the price volatility of honey poses a challenge.

- Companies seeking to capitalize on market opportunities and navigate challenges effectively must stay informed of market trends and implement strategies to mitigate the impact of honey price fluctuations.

What will be the Size of the Mead Beverages Market during the forecast period?

- The mead market continues to evolve, with dynamic shifts in consumer preferences, production methods, and industry trends. Commercial mead producers are constantly innovating, from refining mead making processes in fermentation tanks to exploring new flavor profiles through the use of diverse honey sources and yeast strains. Mead kits enable homebrewing enthusiasts to join the movement, contributing to the growing popularity of this ancient beverage. Mead heritage is being celebrated through educational initiatives, festivals, and competitions, showcasing the rich history and cultural significance of this honey wine. Traditional mead styles are being reimagined with modern twists, while new mead varieties emerge, catering to evolving consumer tastes.

- Mead packaging is a critical focus, with sustainable and eco-friendly options gaining traction. Branding strategies are evolving to reflect the unique stories behind each mead, while retailers and bars are expanding their offerings to meet the growing demand. Mead innovation is driving the industry forward, with advancements in mead equipment, labeling, and safety standards ensuring consistent quality. Regulations and sustainability concerns are also shaping the market, with mead tourism and marketing efforts further fueling growth. Mead consumers are increasingly knowledgeable, seeking out unique flavors and experiences. Mead competitions and awards provide a platform for recognition, while mead recipes and education resources enable enthusiasts to deepen their understanding of this complex and versatile beverage.

How is this Mead Beverages Industry segmented?

The mead beverages industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Melomel mead

- Traditional mead

- Sparkling mead

- Others

- Distribution Channel

- Online

- Offline

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

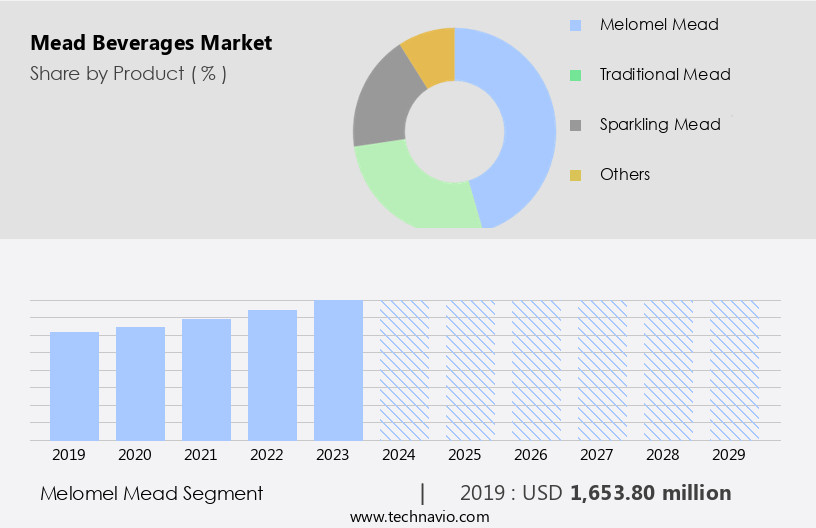

The melomel mead segment is estimated to witness significant growth during the forecast period.

Mead, a traditional honey wine, continues to captivate consumers with its rich history and diverse offerings. Mead production involves fermenting honey with water and sometimes adding fruits, spices, or herbs. Mead culture thrives on innovation, with craft meadmakers experimenting with various mead styles and flavors. Mead fermentation tanks play a crucial role in the mead-making process, ensuring optimal conditions for the yeast strains to convert sugars into alcohol. Mead competitions showcase the best of this ancient beverage, highlighting the creativity and skill of meadmakers. Retailers and bars catering to the growing demand for mead offer a wide range of commercial meads and mead kits for homebrewing enthusiasts.

Mead's heritage and traditions are celebrated through education and festivals, attracting both new and seasoned consumers. Sustainability is a priority in mead production, with an emphasis on local honey sources and eco-friendly practices. Mead labels reflect the unique characteristics of each mead, from traditional styles to modern innovations. Mead regulations ensure quality and safety, allowing consumers to enjoy this delicious beverage with peace of mind. Mead varieties cater to diverse tastes, from dry and sessionable to sweet and dessert-like. Mead recipes often include mead making techniques passed down through generations. The mead market continues to evolve, driven by consumer preferences, mead trends, and the passion of mead enthusiasts.

The Melomel mead segment was valued at USD 1.65 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

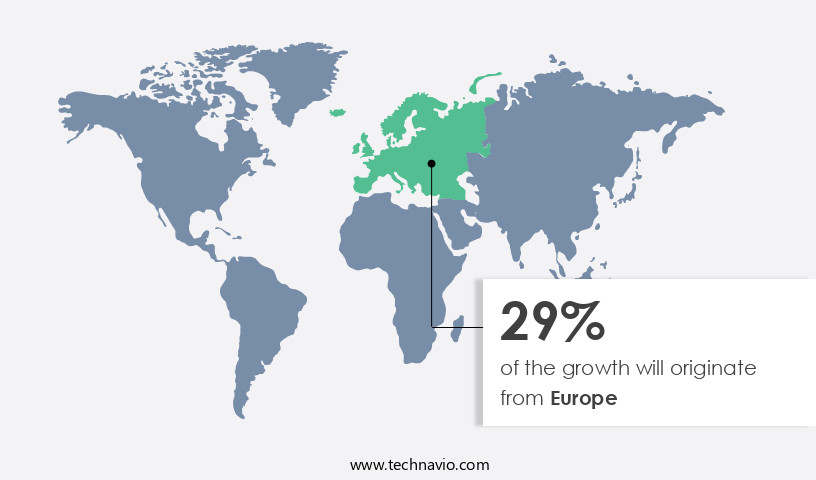

Europe is estimated to contribute 29% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European mead market is experiencing a notable growth trend, with Germany being a significant contributor in 2024. This expansion can be attributed to the increasing consumption of alcoholic beverages, particularly among women, and the rising popularity among millennials. These younger consumers are eager to explore high-end alcohol options and innovative blends, such as spiced and fruit-infused meads. Mead culture is thriving, with an increase in the number of dedicated lounges and bars. The traditional mead-making process continues to evolve, with advancements in mead production, branding, and packaging.

Mead competitions and festivals showcase the diversity of mead styles and flavors, fostering a sense of community and education. Sustainability and safety are key concerns, leading to innovations in mead equipment and regulations. The mead market encompasses commercial production, homebrewing, and craft mead, catering to a wide range of consumer preferences and tastes.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Mead Beverages Industry?

- The presence of numerous untapped markets serves as the primary catalyst for market growth.

- The market is experiencing growth due to the emergence of new markets in Asia Pacific (APAC) and the Middle East and Africa (MEA). Mead, an ancient alcoholic beverage, is gradually gaining popularity in these regions, attracting new players to enter the market. India and China, in particular, offer significant growth opportunities for companies due to their large populations and increasing consumer acceptance of mead. Mead safety and regulations are crucial factors in the market. Producers must adhere to strict guidelines to ensure the quality and purity of mead. Mead varieties continue to evolve, with new recipes and yeast strains being developed to cater to diverse consumer preferences.

- Mead festivals are an essential part of the mead community, providing opportunities for enthusiasts to sample different mead varieties and learn about the brewing process. These events help to promote the beverage and increase its visibility, contributing to its growing popularity. In conclusion, the market is poised for growth, driven by the untapped potential in APAC and MEA. Producers must focus on maintaining high standards of safety and quality while continuously innovating to meet the evolving preferences of consumers. Mead festivals provide a platform to showcase new products and engage with consumers, further fueling the market's growth.

What are the market trends shaping the Mead Beverages Industry?

- Mead beverages are experiencing a surge in product innovations, which represents an emerging market trend. This trend signifies a significant focus on enhancing the flavor profiles and expanding the variety of mead offerings.

- The market is witnessing significant growth due to continuous product innovation. companies are introducing new flavors and gluten-free options to cater to diverse consumer preferences. Mead, an ancient alcoholic beverage made from fermented honey and water, is gaining popularity among consumers. Mead aging in oak barrels adds complexity to the beverage's taste, making it a desirable choice for connoisseurs. Mead consumers appreciate the unique flavors and cultural significance of this beverage. To promote mead and recognize excellence in mead production, various mead competitions are held annually. Mead fermentation tanks are essential equipment used in mead production, ensuring proper fermentation and aging of the beverage.

- Mead culture is gaining traction, leading to an increase in the number of mead retailers and bars. These establishments offer a wide range of mead flavors, providing consumers with a diverse tasting experience. The market's growth is further driven by the increasing number of awards and recognition for mead beverages, which enhances brand value and consumer trust. Continuous product innovation and the introduction of new flavors are expected to boost the demand for mead beverages. As the market evolves, mead is poised to become a popular choice for consumers seeking unique and authentic alcoholic beverages.

What challenges does the Mead Beverages Industry face during its growth?

- The honey industry faces significant growth challenges due to price fluctuations.

- The market faces a significant challenge due to the rising cost of honey, which is a crucial ingredient in the production of commercial mead. The increasing demand for honey and the short supply have led to a surge in honey prices, making it more expensive for mead producers. This trend poses a significant hurdle for the growth of the mead industry. Moreover, beekeepers are not receiving proportionate compensation for the honey they sell, further exacerbating the issue. Despite these challenges, the mead market continues to innovate, with new mead styles and flavors gaining popularity.

- Mead equipment and packaging are also evolving to cater to changing consumer preferences. The mead heritage and traditions continue to inspire new trends in the market, making it an exciting space for innovation. Overall, the mead industry is poised for growth, despite the challenges posed by the rising cost of honey.

Exclusive Customer Landscape

The mead beverages market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the mead beverages market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, mead beverages market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

B. Nektar Meadery - The company specializes in producing unique mead beverages, featuring an assortment of flavors such as Optimism, Cherry Chipotle, and Honey Wine with Cherry Juice and Chipotle Peppers. Each mead offering showcases distinct flavor profiles, enhancing consumer choice and satisfaction. The Optimism mead boasts a bright and refreshing taste, while Cherry Chipotle infuses a delightful balance of sweet cherry and smoky chipotle undertones. The Honey Wine with Cherry Juice and Chipotle Peppers presents a harmonious blend of sweet honey, tart cherry, and spicy chipotle, creating a complex and intriguing tasting experience. By continually innovating and expanding its mead selection, the company caters to diverse palates and elevates the mead category within the beverage market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- B. Nektar Meadery

- Bunratty Mead and Liqueur Co. Ltd.

- Charm City Meadworks LLC

- Cornish Mead Co.

- Kuhnhenn Brewing

- Lyme Bay Cider Co Ltd.

- Medovina

- Moond Dog Meadery

- Moonlight Meadery

- Moonshine Meadery

- Pasieka Jaros Sp. z o.o.

- Redstone Meadery

- Sap House Meadery

- Schramms Mead

- Spirit Hills Ltd.

- Starlight Mead

- Superstition Meadery

- The Lancashire Mead Co.

- Wild Blossom Meadery.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Mead Beverages Market

- In February 2023, Mead Beverages, a leading player in the functional beverage market, introduced a new line of plant-based protein beverages. This expansion aims to cater to the growing demand for healthier and sustainable beverage options (BusinessWire).

- In May 2024, Mead Beverages announced a strategic partnership with a leading agricultural cooperative to secure a consistent supply of raw materials for their beverage production. This collaboration is expected to strengthen Mead's supply chain and improve operational efficiency (Reuters).

- In August 2024, Mead Beverages completed the acquisition of a major competitor, expanding its product portfolio and increasing its market share in the functional beverage sector. The deal was valued at approximately USD300 million (Wall Street Journal).

- In November 2025, Mead Beverages secured a key regulatory approval from the Food and Drug Administration (FDA) for its new line of functional beverages infused with adaptogens. This approval marks a significant milestone in the company's efforts to innovate and differentiate its offerings in the competitive beverage market (FDA press release).

Research Analyst Overview

In the dynamic the market, innovation continues to shape the landscape with new flavor profiles and blends emerging. Mead's acidity and sweetness levels are subject to exploration, leading to diverse tasting experiences. Mead's pairing potential with various dishes and its health benefits, including antioxidants and anti-inflammatory properties, are gaining recognition. Mead's production techniques have evolved, focusing on quality control, sensory analysis, and preservation methods such as filtration and pasteurization. Carbonation and bitterness are also being experimented with to expand the beverage's appeal. Mead research is ongoing to optimize mead development and understand the effects of oxidation and aging on mead's aroma, flavor profile, and finish.

The market's focus on mead's sensory attributes and tasting notes highlights the beverage's complexity and sophistication, making it an intriguing alternative to traditional alcoholic beverages. Mead's versatility extends beyond traditional serving methods, with cocktails and desserts showcasing the beverage's potential. As mead continues to evolve, its unique characteristics and health benefits are driving its popularity among consumers.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Mead Beverages Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.9% |

|

Market growth 2025-2029 |

USD 4027.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.3 |

|

Key countries |

US, Germany, China, Canada, France, UK, Japan, Italy, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Mead Beverages Market Research and Growth Report?

- CAGR of the Mead Beverages industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the mead beverages market growth of industry companies

We can help! Our analysts can customize this mead beverages market research report to meet your requirements.