Media Asset Management (MAM) Solutions Market Size 2025-2029

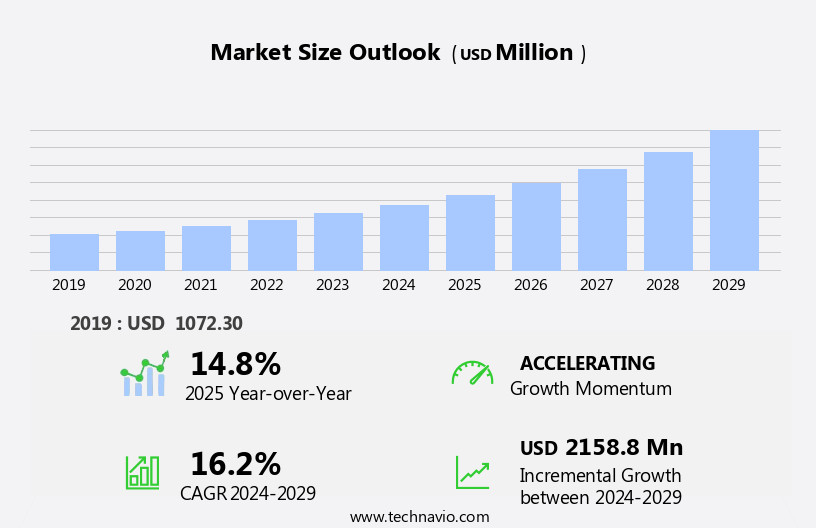

The media asset management (mam) solutions market size is forecast to increase by USD 2.16 billion, at a CAGR of 16.2% between 2024 and 2029.

- The market is experiencing significant shifts and trends, primarily driven by the gradual transition from on-premises to cloud-based solutions. This transition offers numerous benefits, including increased flexibility, scalability, and cost savings. Another key trend is the growing adoption of analytics in media asset management, enabling organizations to gain valuable insights from their media content and enhance operational efficiency. However, the market is not without challenges. Data privacy and security concerns remain a significant obstacle, as media assets often contain sensitive information that must be protected.

- Ensuring the confidentiality, integrity, and availability of these assets is crucial for companies seeking to mitigate risks and maintain customer trust. As the market evolves, it is essential for organizations to navigate these challenges and capitalize on opportunities to stay competitive and succeed in the dynamic media landscape.

What will be the Size of the Media Asset Management (MAM) Solutions Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the ever-increasing demand for efficient and effective content management across various sectors. These solutions enable seamless integration of APIs for improved production workflow, version control, and hybrid solutions that cater to both cloud and on-premise infrastructures. Deep learning technologies are increasingly being adopted to enhance user interface (UI) and archive management, enabling content reuse and cost optimization through metadata tagging and automated transcription services. Metadata management and AI-powered search are key components, ensuring user experience (UX) is optimized and content is easily discoverable. Workflow automation and disaster recovery are essential for business continuity, while regulatory compliance and access control ensure secure content organization.

Centralized storage and content lifecycle management facilitate content categorization and content delivery, with machine learning and content search enhancing brand consistency and content discovery. Marketing workflow and content repurposing are gaining traction, with distributed storage and content preservation ensuring long-term access to valuable assets. The ongoing unfolding of market activities reveals a dynamic landscape, with solutions continuously adapting to meet the evolving needs of media and entertainment industries.

How is this Media Asset Management (MAM) Solutions Industry segmented?

The media asset management (mam) solutions industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- On-premises

- Cloud

- Type

- Small and medium size enterprise

- Large enterprise

- End-user

- Media and entertainment

- Advertising and marketing

- Education and e-learning

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

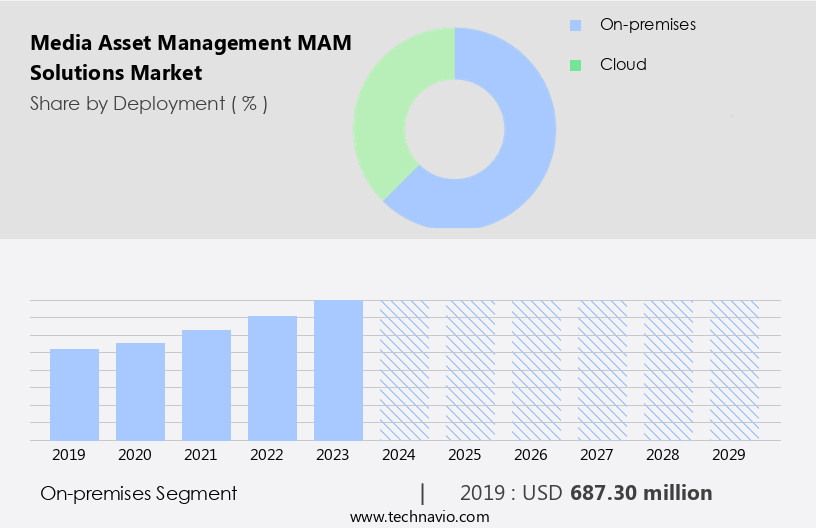

By Deployment Insights

The on-premises segment is estimated to witness significant growth during the forecast period.

Media Asset Management (MAM) solutions enable businesses to manage and optimize their multimedia content, from production to delivery. These solutions offer various features such as API integrations for seamless workflow, version control for tracking changes, and hybrid models for flexibility. Deep learning and AI-powered technologies enhance capabilities, including metadata tagging, facial recognition, and object recognition. User interface and experience are crucial, with metadata management and search optimization ensuring efficient content discovery. Cost optimization is a significant factor, with cloud storage and system integration offering scalability and reducing infrastructure costs. Regulatory compliance and access control ensure secure content management.

Disaster recovery and business continuity plans are essential for maintaining operations during unexpected events. Content lifecycle management, from ingestion to preservation, is streamlined through automated workflows, including advertising, editorial, post-production, and marketing. Metadata schema and content organization facilitate content reuse and repurposing, while centralized storage and distributed systems ensure scalability. Machine learning and transcription services automate processes, improving workflow efficiency and content collaboration. Brand consistency is maintained through automated captioning and metadata tagging, ensuring accurate and consistent metadata across all content. Rights management and access control ensure proper usage and monetization of content. Overall, MAM solutions continue to evolve, addressing the needs of businesses in various industries.

The On-premises segment was valued at USD 687.30 billion in 2019 and showed a gradual increase during the forecast period.

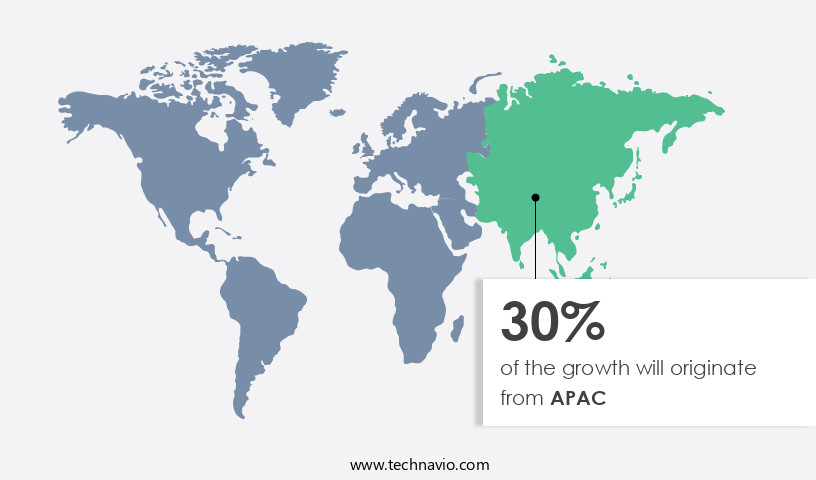

Regional Analysis

APAC is estimated to contribute 30% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Media Asset Management (MAM) solutions have witnessed significant growth in the North American market, with the US leading the charge. The transition from on-premises systems to cloud-based platforms has been a major trend, facilitating easier access and collaboration among geographically dispersed teams. This shift has been driven by increasing IT budgets for cloud-based solutions in enterprises across the region. Deep learning and AI technologies have become integral to MAM solutions, with companies like IBM and Microsoft leading the way. These advancements enhance automation in content management processes, from version control and metadata tagging to object recognition and automated captioning. Hybrid solutions that combine on-premises and cloud storage offer businesses the flexibility to manage their content according to their specific needs.

Cost optimization and search optimization are crucial aspects of MAM solutions, enabling businesses to reuse content and improve discovery. Regulatory compliance and access control are also essential features, ensuring secure and efficient management of media assets. Workflow automation and system integration are key to streamlining processes and improving overall workflow efficiency. Archive management and disaster recovery are essential components of business continuity, ensuring the preservation and accessibility of valuable content. Content lifecycle management, from ingestion to delivery, is another critical area where MAM solutions excel. Marketing workflows and content collaboration are also essential for businesses looking to maximize the value of their media assets.

In conclusion, the MAM solutions market is evolving rapidly, with a focus on AI-powered search, user experience, and cost optimization. The integration of deep learning, metadata management, and workflow automation is enhancing the capabilities of these solutions, making them indispensable tools for businesses looking to manage their media assets effectively and efficiently.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Global Cold Chain Logistics Market: Trends, Technologies, Sustainability, and Growth Prospects (2025-2030) The global cold chain logistics market is a critical segment of the supply chain industry, focusing on the transportation, storage, and handling of temperature-sensitive goods. This market is expected to experience significant growth between 2025 and 2030, driven by increasing consumer demand for fresh and perishable products, advancements in technology, and a growing focus on sustainability. Key Market Trends: 1. Rising Demand for Fresh and Perishable Goods: The increasing preference for fresh and healthy food options is driving the growth of the cold chain logistics market, particularly in the food and beverage sector. 2. Technological Advancements: The adoption of advanced technologies such as IoT, RFID, and GPS tracking is revolutionizing the cold chain logistics industry, improving efficiency, reducing costs, and enhancing supply chain visibility. 3. Sustainability Practices: The growing emphasis on reducing carbon footprints and minimizing waste is leading to the adoption of eco-friendly practices, such as the use of renewable energy sources and reusable packaging, in the cold chain logistics market. Industry Segments: 1. Temperature-Controlled Warehousing: This segment includes the storage of temperature-sensitive goods in refrigerated or frozen warehouses. 2. Cold Transportation: This segment involves the transportation of temperature-sensitive goods using refrigerated trucks, trains, or ships. 3. Cold Chain Equipment: This segment includes the sale and rental of equipment such as refrigerated containers, freezers, and cooling systems. Regional Context: 1. Asia-Pacific: The Asia-Pacific region is expected to dominate the global cold chain logistics market due to the growing demand for fresh and perishable goods, particularly in countries like China and India. 2. North America: The North American market is also expected to grow significantly due to the increasing demand for fresh and healthy food options and the adoption of advanced technologies. Challenges and Solutions: 1. High Energy Consumption: The energy consumption of cold chain logistics is a significant challenge, but the adoption of energy-efficient technologies and renewable energy sources is helping to mitigate this issue. 2. Complexity of Supply Chain: The cold chain logistics supply chain is complex, involving multiple stakeholders and requiring careful coordination. B2B and procurement strategies, such as collaborative partnerships and supply chain visibility tools, are helping to address these challenges. Media Asset Management (MAM) Solutions: Media asset management (MAM) solutions are increasingly being adopted in the cold chain logistics industry to manage the vast amounts of data generated by IoT devices and other technologies. MAM solutions enable the efficient storage, retrieval, and sharing of data, improving supply chain visibility and enabling more effective decision-making. In conclusion, the global cold chain logistics market is poised for significant growth in the coming years, driven by increasing consumer demand, technological advancements, and a growing focus on sustainability. The adoption of advanced technologies, such as MAM solutions, is helping to address the challenges of energy consumption and supply chain complexity. The Asia-Pacific and North American regions are expected to lead the market, with B2B and procurement strategies playing a crucial role in addressing the challenges of this complex and dynamic industry.

What are the key market drivers leading to the rise in the adoption of Media Asset Management (MAM) Solutions Industry?

- The transition from traditional on-premises media asset management solutions to cloud-based alternatives is the primary market trend, reflecting growing demand for flexibility, scalability, and cost savings in media management.

- Media asset management (MAM) solutions in the global market are transitioning from on-premises to cloud-based systems, providing businesses with more convenient and intuitive services. Cloud-based solutions offer benefits such as drag-and-drop functionality, mobile accessibility, and scalability, making them attractive to companies of all sizes. These solutions cater to various digital asset requirements at affordable costs and rapid deployment. A major advantage of cloud-based MAM solutions is the pay-per-use pricing model, enabling clients to pay only for the services they utilize. Flexibility is another key feature, with cloud-based services available in three deployment models: Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS).

- Workflow automation, transcription services, metadata management, and ai-powered search are essential features that enhance the user experience (UX) in MAM solutions. Content organization, asset tracking, regulatory compliance, search optimization, access control, content categorization, and centralized storage are other crucial components that contribute to the effectiveness of these systems. MAM solutions facilitate efficient management of media assets by automating workflows, ensuring regulatory compliance, and offering advanced search capabilities. These solutions enable businesses to streamline their content management processes, optimize their search capabilities, and maintain secure access to their media assets.

What are the market trends shaping the Media Asset Management (MAM) Solutions Industry?

- The increasing use of analytics to manage media assets is a significant market trend. This approach enables organizations to optimize their media resources effectively and efficiently.

- Media asset management solutions enable organizations to effectively manage their multimedia content using advanced analytical tools. These solutions facilitate the analysis of media assets to support critical business decision-making processes. Cloud-based content analytics and asset tracking solutions are popular choices for managing large data sets derived from mobile applications and smart devices. Content analytics is a crucial aspect of media asset management, involving the application of analytical services to unstructured enterprise data, such as text, images, and videos. Predictive analytical solutions are increasingly adopted by organizations to transform unstructured data into structured formats, enhancing the management of digital content.

- System integration is essential for media asset management solutions to function optimally within an organization's existing workflow. Integration with broadcast workflows, for instance, can streamline processes and improve workflow efficiency. Advanced features like object recognition, automated captioning, and facial recognition further enhance the capabilities of media asset management solutions. Moreover, cloud storage and on-premise solutions cater to different organizational needs. Cloud storage offers flexibility, while on-premise solutions provide greater control over data. Data migration and storage management are essential considerations for organizations transitioning to cloud-based solutions. Business continuity is another critical factor, ensuring uninterrupted access to media assets during system downtimes or disasters.

What challenges does the Media Asset Management (MAM) Solutions Industry face during its growth?

- Data privacy and security concerns represent a significant challenge to the industry's growth, as organizations must balance the need to collect and use data to drive innovation and business growth with the requirement to protect sensitive information from unauthorized access or misuse.

- Media Asset Management (MAM) solutions have become essential for organizations seeking to effectively manage their multimedia content throughout its entire lifecycle. These solutions facilitate content ingestion, marketing workflows, content delivery, and distributed storage, among other functions. Machine learning algorithms enhance content search capabilities, ensuring brand consistency and enabling content discovery. Content repurposing and preservation are also critical aspects of MAM solutions. As the volume of digital content grows, the ability to locate and repurpose existing assets becomes increasingly important. Moreover, content preservation ensures that valuable assets are not lost or degraded over time. Rights management is another key feature of MAM solutions.

- With the increasing complexity of content licensing and distribution, these systems help organizations manage and enforce their intellectual property rights. By automating the process, MAM solutions reduce the risk of errors and ensure that the correct licenses are applied to the appropriate content. Cloud security is a significant concern for organizations adopting MAM solutions. To mitigate risks, it is essential to encrypt client data and implement multi-factor authentication systems. By prioritizing security, organizations can protect their valuable content and maintain the trust of their customers.

Exclusive Customer Landscape

The media asset management (mam) solutions market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the media asset management (mam) solutions market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, media asset management (mam) solutions market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amazon.com Inc. - This company specializes in media asset management, providing innovative solutions including eMAM and CUBE365. These tools streamline media workflows, ensuring efficient organization, access, and delivery of digital content for businesses.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amazon.com Inc.

- Arvato Systems GmbH

- Bynder BV

- Cloudinary Ltd.

- Dalet SA

- Dell Technologies Inc.

- Etere Pte Ltd.

- Evolphin Software Inc.

- Imagen Ltd.

- International Business Machines Corp.

- MediaBeacon Inc.

- MediaValet Inc.

- MerlinOne Inc.

- Microsoft Corp.

- Open Text Corp.

- Prime Focus Ltd.

- Publitio doo

- Ross Video Ltd.

- Sony Group Corp.

- Video Stream Networks SL

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Media Asset Management (MAM) Solutions Market

- In January 2024, IBM announced the acquisition of Marzedo Media, a leading Media Asset Management (MAM) solutions provider for the media and entertainment industry. This acquisition was aimed at strengthening IBM's Cloud Pak for Media and Entertainment, enhancing its ability to manage, monetize, and distribute media content at scale (IBM Press Release).

- In March 2024, Adobe unveiled Adobe Experience Manager Assets 2024, an upgrade to its MAM solution. The new version introduced advanced AI-powered search capabilities and enhanced integration with Adobe's Creative Cloud suite (Adobe Press Release).

- In May 2024, Amazon Web Services (AWS) launched AWS Elemental MediaConnect, a new service that simplifies the process of transporting live video over the internet. This development was a significant step forward in AWS's media services portfolio, enabling broadcasters and content providers to distribute live video content to multiple destinations (AWS Press Release).

- In April 2025, Microsoft announced the integration of Azure Media Services with Adobe Experience Manager. This strategic partnership allowed Adobe customers to leverage Azure's advanced media processing capabilities, enhancing the functionality of Adobe's MAM solution (Microsoft Press Release).

Research Analyst Overview

- In the market, content syndication and multi-platform distribution are key trends, enabling businesses to expand their reach and monetize their media assets. Data redundancy and high availability are essential for ensuring business continuity planning and disaster recovery, while integration with ERP and CRM systems streamlines workflows and improves operational efficiency. Security audits and vulnerability assessments are crucial for safeguarding valuable media assets against potential threats. User training and support services ensure a smooth adoption of MAM solutions, while license management and usage tracking help optimize costs. Redundant storage, data backup, and long-term archiving are essential for preserving media assets, adhering to ISO standards and compliance certifications.

- Forensic watermarking and metadata enrichment facilitate asset publishing and custom development, while content scheduling and synchronization maintain consistency across platforms. Penetration testing and compliance certifications are vital for maintaining security and regulatory requirements. Mobile accessibility and compliance with ISO standards enable remote access and collaboration, making MAM solutions an indispensable tool for modern businesses.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Media Asset Management (MAM) Solutions Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 16.2% |

|

Market growth 2025-2029 |

USD 2158.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

14.8 |

|

Key countries |

US, China, Germany, UK, Canada, Japan, India, France, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Media Asset Management (MAM) Solutions Market Research and Growth Report?

- CAGR of the Media Asset Management (MAM) Solutions industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the media asset management (mam) solutions market growth of industry companies

We can help! Our analysts can customize this media asset management (mam) solutions market research report to meet your requirements.