Medical Disposable Gloves Market Size 2024-2028

The medical disposable gloves market size is forecast to increase by USD 5.76 billion, at a CAGR of 7.08% between 2023 and 2028.

- The market is driven by the growing emphasis on hygiene and safety measures to prevent Healthcare-Associated Infections (HAIs). The increasing preference for powder-free gloves in the healthcare industry is another significant factor fueling market growth. This shift towards powder-free gloves is due to their advantages, such as reducing the risk of allergic reactions and contamination. However, the market faces challenges, including intense competition leading to pricing pressure among key players.

- This competition necessitates continuous innovation and cost reduction strategies to maintain market position. Companies must navigate these challenges by focusing on product differentiation and enhancing their value proposition to meet evolving customer needs. Additionally, staying updated with regulatory requirements and adhering to stringent quality standards are crucial for market success.

What will be the Size of the Medical Disposable Gloves Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the dynamic interplay of various factors. Nitrile glove durability and glove barrier protection remain key considerations, with ongoing advancements in material science leading to enhanced product offerings. Vinyl gloves, meanwhile, exhibit unique properties that cater to specific applications, such as chemical resistance and affordability. Glove perforation testing and glove manufacturing processes are continually refined to ensure the highest levels of quality and reliability. Surgical glove material and glove color options cater to diverse user preferences and regulatory requirements. Glove tensile strength and glove elongation rate are essential factors in determining glove performance and suitability for various tasks.

Glove biocompatibility testing, glove bacterial barrier, and medical glove sterilization are crucial aspects of glove production, ensuring the safety and efficacy of gloves in healthcare settings. Glove material degradation and glove surface treatment are areas of ongoing research, with the goal of improving glove longevity and enhancing user experience. Glove puncture resistance and latex allergy concerns continue to shape market trends, with the rise of powder-free glove options and glove manufacturing processes that minimize the risk of allergic reactions. Glove regulatory compliance and glove quality control are essential for maintaining market competitiveness and ensuring customer satisfaction. Examination glove types and disposable glove disposal are important considerations for end-users, with a focus on glove packaging integrity and sterile glove packaging to maintain glove quality and prevent contamination.

Glove comfort features, glove tactile sensitivity, and glove comfort features are increasingly prioritized to improve user experience and productivity. The market is a complex and ever-evolving landscape, with ongoing research and development driving innovation and growth. From glove manufacturing processes to glove material properties, the market dynamics are shaped by a multitude of interconnected factors that require a nuanced understanding to navigate effectively.

How is this Medical Disposable Gloves Industry segmented?

The medical disposable gloves industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Synthetic gloves

- Natural rubber gloves

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Product Insights

The synthetic gloves segment is estimated to witness significant growth during the forecast period.

Synthetic gloves, including nitrile and vinyl options, are essential in various industries for their enhanced protection and performance. Nitrile gloves, made from synthetic latex like nitrile butadiene rubber (NBR), are a popular choice due to their affordability, strength, puncture resistance, and chemical resistance, particularly against petroleum-based products. Nitrile gloves offer a secure fit and are suitable for examination purposes, although they are less elastic and tactile sensitive compared to natural rubber gloves. Nitrile gloves are available in powdered, sterile, and non-sterile versions, and various sizes. Vinyl gloves, on the other hand, are known for their flexibility, affordability, and resistance to water, oil, and non-oil-based chemicals.

They are often used in food handling, laboratory work, and other non-medical applications. Vinyl gloves come in various thicknesses to cater to different industry requirements. Both nitrile and vinyl gloves undergo rigorous testing for properties like tensile strength, elongation rate, puncture resistance, bacterial barrier, and material degradation. Glove manufacturing processes ensure the highest quality through techniques like glove donning simulations, perforation testing, and surface treatment. Sterilization methods, such as ethylene oxide, gamma radiation, and autoclaving, maintain the gloves' integrity and biocompatibility. Latex allergy concerns have led to the rise of alternatives like nitrile and vinyl gloves. Powder-free glove options and glove quality control measures, such as AQL standards, further enhance the gloves' safety and reliability.

Examination gloves, disposable gloves, and sterile gloves are essential types in the medical industry, each catering to specific needs. Regulatory compliance is crucial in glove manufacturing, with guidelines like FDA and ISO ensuring the highest standards for glove material, manufacturing process, and packaging integrity. Innovations in glove technology, such as nitrile glove manufacturing techniques and glove viral penetration studies, continue to evolve the market. Despite the differences in properties and applications, both nitrile and vinyl gloves remain integral to various industries, offering unparalleled protection and performance.

The Synthetic gloves segment was valued at USD 7.73 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

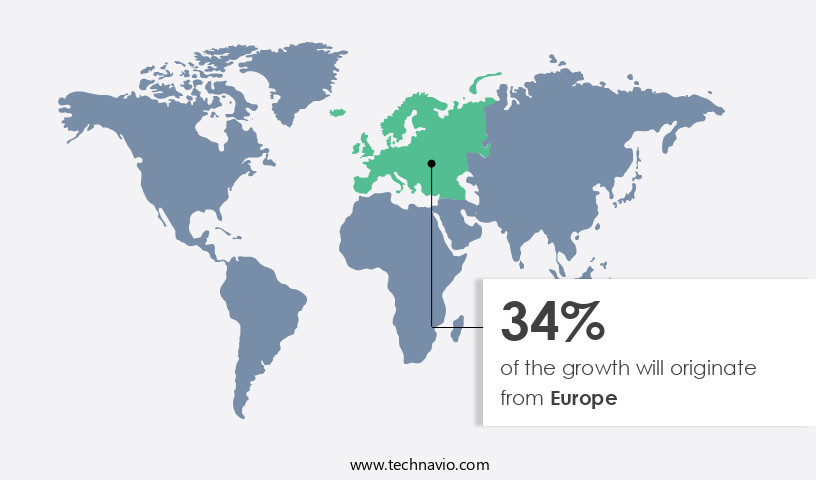

Europe is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is currently the largest segment globally, driven by the presence of advanced healthcare facilities, increasing safety and hygiene practices, and rising healthcare expenditures in the US and Canada. Nitrile gloves, known for their durability and superior barrier protection, dominate the market. Vinyl gloves, with their flexibility and affordability, remain popular for non-clinical applications. Glove manufacturers ensure product quality through rigorous testing for perforation, biocompatibility, and viral penetration. Surgical gloves are typically made of natural rubber latex or synthetic materials like nitrile, with latex gloves requiring additional considerations due to potential allergic reactions. Glove sizes cater to various user needs, and donning techniques ensure proper fit and comfort.

Tensile strength and elongation rate are essential properties, while bacterial barrier and sterilization methods ensure safety. Glove packaging integrity and powder-free options maintain sterility and reduce contamination risks. Comfort features like tactile sensitivity and color options cater to user preferences. Regulatory compliance is crucial, with standards like AQL and ISO guiding manufacturing processes. Nitrile glove manufacturing techniques have advanced, improving overall glove quality.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a critical segment in the healthcare industry, with a constant demand for high-quality, cost-effective gloves that meet stringent regulatory requirements. The production process of medical disposable gloves involves several stages, including nitrile glove production process optimization, latex glove manufacturing cost reduction strategies, vinyl glove barrier properties and performance, powder-free glove surface modification techniques, and surgical glove sterilization validation methods. Nitrile gloves, known for their superior resistance to chemicals and punctures, require optimized production processes to maintain consistency and efficiency. Latex gloves, on the other hand, have been subject to cost reduction strategies due to their high production costs and sensitivity to allergens. Vinyl gloves offer cost advantages but may compromise on barrier properties and performance. Sterilization validation methods and sterile glove packaging integrity verification testing are crucial to ensure safety and efficacy. Examination gloves require material selection criteria that balance cost, durability, and biocompatibility. Disposable glove environmental impact assessment and regulatory compliance requirements are essential considerations for manufacturers. Glove tensile strength and elongation testing protocols, puncture resistance, and barrier performance testing help ensure product quality. Biocompatibility testing methods and standards are necessary to assess the safety of glove materials. Glove material degradation under different conditions and glove packaging design's effect on sterility are essential factors in glove manufacturing. Glove quality control measures and inspection techniques, glove manufacturing automation and efficiency gains, glove supply chain management and logistics optimization, and glove sterilization method efficacy and validation are all critical aspects of the market. Additionally, glove user experience and ergonomics are essential to ensure comfort and ease of use. In conclusion, the market is a complex and dynamic industry that requires a holistic approach to optimize production, reduce costs, ensure safety and efficacy, and meet regulatory requirements. By focusing on process optimization, material selection, sterilization, packaging, and user experience, manufacturers can produce high-quality gloves that meet the evolving needs of the healthcare industry.

What are the key market drivers leading to the rise in the adoption of Medical Disposable Gloves Industry?

- Concerns regarding hygiene and safety from healthcare-associated infections (HAIs) serve as the primary market driver, necessitating continuous innovation and investment in products and solutions to mitigate these risks.

- In the healthcare sector, the prevention of Healthcare-Associated Infections (HAIs) is a critical priority. HAIs, which can occur in hospitals, long-term care facilities, home care settings, and ambulatory care, are caused by various factors such as the increasing prevalence of morbidities and mortality rates, drug-resistant bacteria transmission, prolonged hospital stays, disease outbreaks, and poor infection-control practices. According to the CDC, approximately 1 in 31 patients in the US are susceptible to HAIs every day. To minimize HAIs, infection-control programs and practices are essential in healthcare settings. Additionally, Personal Protective Equipment (PPE), including gloves, gowns, face masks, protective eyewear, and face shields, is crucial for healthcare professionals to reduce occupational infection transmission.

- Regarding examination gloves, there are various types, including powdered and powder-free options. Powder-free gloves have gained popularity due to their benefits, such as improved glove packaging integrity and reduced risk of allergic reactions. Glove quality control and adherence to glove AQL (Acceptable Quality Limit) standards are essential to ensure that glove viral penetration is minimized. Nitrile glove manufacturing is a significant contributor to the glove industry due to its durability and resistance to chemicals. It is vital to ensure the gloves' integrity and quality to maintain a clean and safe environment in healthcare facilities.

What are the market trends shaping the Medical Disposable Gloves Industry?

- The preference for powder-free gloves is gaining momentum in the market. This trend reflects a growing awareness of the health risks associated with powdered gloves and the availability of effective alternatives.

- The market is driven by the increasing preference for powder-free gloves among healthcare institutions due to the associated health risks of using powdered gloves. Powdered gloves can lead to exposure to starch powder, resulting in granulomas, pleuritis, myocarditis, irritation of the central nervous system, carcinoma, or tuberculosis misdiagnosis. After use, healthcare workers are required to wash their hands instead of using an alcohol-based hand rub, which can hinder hand hygiene compliance. In response, manufacturers are focusing on developing powder-free gloves by eliminating the residual powder. Nitrile gloves, known for their durability and superior barrier protection, are gaining popularity due to their powder-free feature.

- Vinyl gloves, although less expensive, have limitations in terms of glove perforation resistance and tensile strength. Glove manufacturers employ rigorous testing methods, such as glove perforation testing, to ensure the gloves meet the required standards for barrier protection. Surgical gloves are typically made from latex, nitrile, or vinyl, and come in various color options to cater to different applications. The glove manufacturing process involves several stages, including compounding, calendaring, dipping, curing, and finishing. The choice of glove material and manufacturing process plays a crucial role in determining the glove's overall performance and cost.

What challenges does the Medical Disposable Gloves Industry face during its growth?

- The intense competition among key companies, resulting in significant pricing pressure, poses a significant challenge to the industry's growth trajectory.

- The market is a dynamic and competitive industry, with various established and small companies. Key players in this market include Thermo Fisher Scientific, Semperit AG Holding, Cardinal Health, Top Glove, Owens and Minor, and Molnlycke Health Care. These companies offer medical disposable gloves at competitive prices to maintain brand loyalty and increase profit margins. Latex glove production is a significant aspect of the market, with glove size distribution and donning techniques influencing consumer preference. Glove elongation rate, bacterial barrier, and glove material degradation are essential factors impacting the market's growth. Glove biocompatibility testing is crucial to ensure the safety and effectiveness of medical disposable gloves.

- Medical glove sterilization is another critical factor, with various methods, including autoclaving, ethylene oxide, and gamma irradiation, used to sterilize gloves. Maintaining glove quality while minimizing material degradation is a significant challenge for manufacturers. Ensuring glove biocompatibility and bacterial barrier properties while maintaining affordability is a delicate balance that companies must strike. In conclusion, the market is a competitive industry, with various established and small companies offering products at competitive prices. Latex glove production, glove size distribution, donning techniques, glove elongation rate, bacterial barrier, glove material degradation, and glove sterilization are essential factors impacting the market's growth. Ensuring glove biocompatibility and maintaining affordability while minimizing material degradation are ongoing challenges for companies.

Exclusive Customer Landscape

The medical disposable gloves market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the medical disposable gloves market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, medical disposable gloves market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adenna LLC - This company specializes in providing a range of medical disposable products, encompassing Micro Touch, surgical, and examination gloves, healthcare safety devices, and active infection prevention tools.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adenna LLC

- Ansell Ltd.

- B.Braun SE

- Cardinal Health Inc.

- Dynarex Corp.

- Elite Surgical Pty Ltd.

- Hartalega Holdings Berhad

- Kanam Latex Industries Pvt. Ltd

- Kossan Rubber Industries Bhd

- McKesson Corp.

- Molnlycke Health Care AB

- Owens and Minor Inc.

- Romsons Medsource

- Rubberex Corp. M Berhad

- Semperit AG Holding

- Smith and Nephew plc

- Supermax Corporation Berhad.

- Thermo Fisher Scientific Inc.

- Top Glove Corp. Bhd

- Unigloves UK Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Medical Disposable Gloves Market

- In January 2024, Ansell Healthcare, a leading global provider of protective solutions, announced the launch of its new nitrile-free, powder-free examination gloves, named 'Protective Reliance EnVision'. This innovative product catered to latex-sensitive healthcare professionals and patients, addressing a growing demand for hypoallergenic gloves (Ansell Press Release).

- In March 2024, Top Glove Corporation, the world's largest rubber glove manufacturer, entered into a strategic partnership with the University of Malaya, Malaysia, to collaborate on the research and development of eco-friendly and sustainable disposable gloves (Top Glove Press Release).

- In May 2024, Trelleborg AB, a Swedish engineering group, completed the acquisition of American-based glove manufacturer H.B. Fuller Company's Healthcare & Hygiene business. This acquisition expanded Trelleborg's presence in the market and strengthened its global production capacity (Trelleborg Press Release).

- In February 2025, the European Union's Single Use Plastics Directive came into effect, banning the use of single-use plastic medical gloves in most healthcare settings, except for specific exemptions. This regulatory change is expected to drive demand for alternative, eco-friendly disposable gloves (European Parliament Press Release).

Research Analyst Overview

- The market is characterized by continuous innovation and improvement, with key focus areas including glove additive composition, packaging design, tear resistance, allergen reduction, and user experience. Glove manufacturers prioritize safety standards, ensuring chemical resistance, sterilization methods, and ergonomics design to meet the demands of various end-user applications. Quality assurance and performance testing are crucial aspects of the production process, with glove sustainability practices gaining increasing importance. Glove sustainability practices encompass waste management, recycling potential, and material sourcing, as businesses strive to minimize their environmental footprint. Regulatory approvals and manufacturing automation are essential components of the industry, ensuring compliance and efficiency.

- Antimicrobial properties and cost optimization are also significant factors, as glove manufacturers seek to address the evolving needs of healthcare professionals and patients. Innovation continues to drive the market, with advancements in glove tear resistance, safety standards, and handling procedures. Glove polymer selection plays a vital role in determining glove performance, while glove sterilization methods ensure the highest level of protection against infectious agents. The focus on glove sustainability practices and user experience underscores the industry's commitment to delivering high-quality, cost-effective, and eco-friendly solutions for the healthcare sector.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Medical Disposable Gloves Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.08% |

|

Market growth 2024-2028 |

USD 5762.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.49 |

|

Key countries |

US, Germany, UK, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Medical Disposable Gloves Market Research and Growth Report?

- CAGR of the Medical Disposable Gloves industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the medical disposable gloves market growth of industry companies

We can help! Our analysts can customize this medical disposable gloves market research report to meet your requirements.