Medical Marijuana Market Size 2024-2028

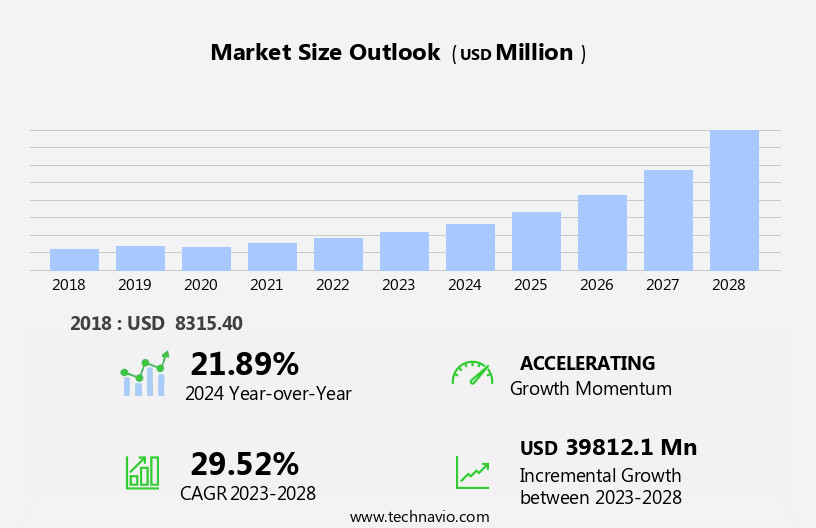

The medical marijuana market size is forecast to increase by USD 39.81 billion at a CAGR of 29.52% between 2023 and 2028.

- The market is experiencing significant growth, driven by several key factors. The rising number of product launches, as innovators introduce new strains and delivery methods, is expanding the market's reach and appeal. B2B enterprises focus on supplying cannabis biomass and processing it into various medical marijuana functional food products for authorized dispensaries and retail & pharmacy stores. The production process involves extracting cannabinoids and other beneficial compounds using solvents, followed by purification and standardization. Furthermore, increasing awareness campaigns aimed at educating the public about the potential benefits of medical marijuana for various conditions are fueling demand. However, the market also faces challenges, including the side effects associated with inappropriate use and the ongoing legal and regulatory hurdles that limit access in certain jurisdictions. As the industry continues to evolve, stakeholders must navigate these trends and challenges to capitalize on the market's potential.

What will be the Size of the Market During the Forecast Period?

- The market encompasses the production, distribution, and consumption of cannabis and cannabinoid-based medications for medical purposes. This burgeoning industry has gained significant momentum in various countries, driven by the growing recognition of cannabis as an effective treatment for a range of ailments and symptoms, including chronic pain, nausea, seizures, and more.

- Moreover, the market comprises both B2B and B2C enterprises, with the former focusing on the supply of raw marijuana plants or extracted cannabinoids to manufacturers of cannabis-derived pharmaceuticals, such as Epidiolex, Marinol, Syndros, Cesamet, and Sativex. The production process involves careful cultivation, thorough testing, and adherence to regulatory requirements. The market's size and direction reflect the increasing demand for alternative treatments and the potential of cannabinoid-based medications to address unmet medical needs.

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Oil and tinctures

- Flower

- Product

- Chronic pain

- Nausea

- Others

- Geography

- North America

- Canada

- US

- Europe

- UK

- France

- APAC

- South America

- Middle East and Africa

- North America

By Type Insights

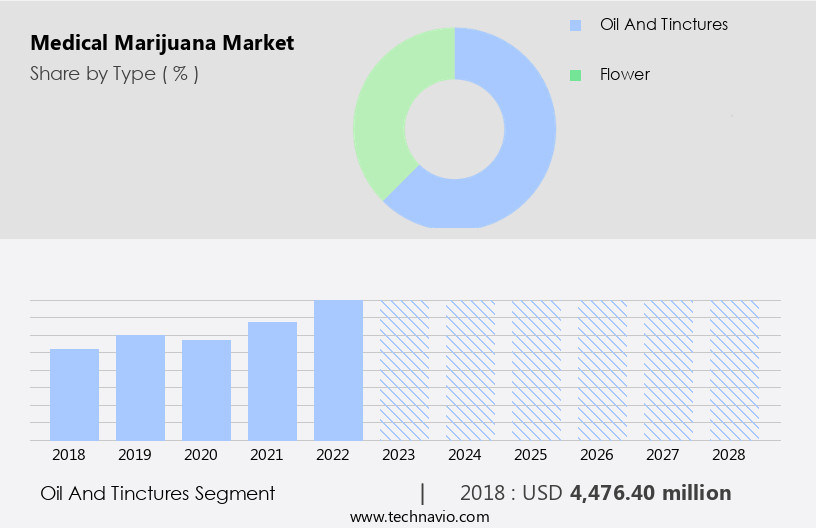

- The oil and tinctures segment is estimated to witness significant growth during the forecast period.

Medical marijuana oil and tinctures are concentrated extracts derived from the Cannabis Sativa and Cannabis Indica plants. These extracts can be consumed orally, topically, or inhaled. Medical marijuana oils, also known as cannabis concentrates, are more potent than traditional marijuana due to their higher cannabinoid content. Tinctures, made by soaking plant material in solvents like alcohol or glycerin, offer a more discreet and versatile consumption method. Cannabinoid-based medications, such as Epidiolex, Marinol, Syndros, Cesamet, and Sativex, are FDA-approved for medical purposes. Chronic pain, ALS, Parkinson's, Alzheimer's, cancer, and neurological disorders are among the conditions for which medical marijuana is used.

Get a glance at the market report of share of various segments Request Free Sample

The oil and tinctures segment was valued at USD 4.48 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

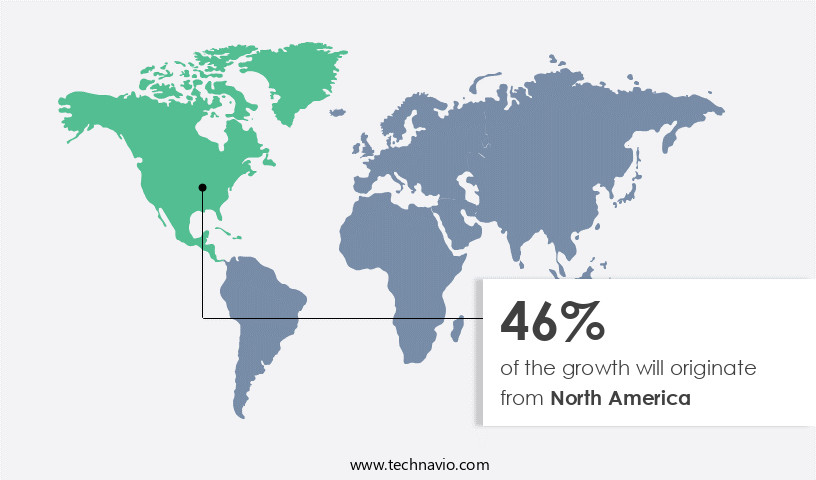

- North America is estimated to contribute 46% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The markets in North America are experiencing significant growth due to legalization efforts In the US and Canada. The Supreme Court in Mexico has also ordered the Health Ministry to issue regulations on medical marijuana use within six months, primarily for epilepsy treatment. Key players In the region include Cannabis Sativa and Medical Marijuana, with Canadian companies legally exporting medical marijuana to the US for clinical trials. Cannabinoid-based medications, such as Epidiolex, Marinol, Syndros, Cesamet, and Sativex, are gaining popularity for treating various ailments and symptoms, including chronic pain, ALS, Parkinson's, Alzheimer's, cancer, and neurological disorders. Consumer spending on medical marijuana is expected to follow an S-Curve function, with an initial slow growth phase, followed by rapid expansion and eventual maturity.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Medical Marijuana Industry?

Rising number of product launches is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for cannabis-derived products for various medical purposes. Two primary types of cannabis, Cannabis Sativa and Cannabis Indica, contain therapeutic compounds such as CBD and THC, which are effective in managing symptoms of chronic pain, neurological disorders like ALS, Parkinson's, and Alzheimer's, cancer, and seizures. Companies like Canopy Growth, Avicanna, and Pharmacological organizations are conducting extensive research work to develop cannabinoid-based medications for these ailments. New product launches, such as Epidiolex, Marinol, Syndros, Cesamet, Sativex, and Cannabis oil, are addressing the needs of B2B and B2C enterprises. These products cater to a wide range of medical conditions, including nausea, vomiting from chemotherapy, sleep disorders, anxiety, and appetite loss.

- The reimbursement environment and functional food trends, such as edible cannabis products, are also driving market growth. Safety concerns, including thorough testing and production, are crucial In the medical marijuana industry. The market dynamics are influenced by the legalization of marijuana for medical use, decriminalizing cannabis, and therapeutic uses for pain management, ocular strain, and HIV/AIDS. Clinical trial initiatives are ongoing to explore the potential of terpenes, minor cannabinoids, and their role in inflammation and chronic diseases like osteoarthritis. The market is expected to follow an S-Curve function or exponential curve function, with increasing consumer spending and the growing acceptance of medical marijuana.

What are the market trends shaping the Medical Marijuana Industry?

Increasing number of awareness campaigns is the upcoming market trend.

- The market is witnessing significant growth as companies launch educational campaigns to promote safe and responsible use. For instance, Leaf411, the first cannabis nurse guidance call service In the US, collaborated with Healer.Com in July 2022 to provide online medical cannabis training to patients, healthcare providers, and dispensaries. Similarly, House of Wise, a CBD and personal wellness brand, and Last Prisoner Project, a nonprofit advocating for criminal justice reform, announced their campaign, "Justice for all," in April 2022, to review and process clemency petitions from individuals with federal cannabis-related convictions. Cannabis Sativa and Cannabis Indica are the primary strains used in medical marijuana.

- The market for cannabinoid-based medications, such as Epidiolex, Marinol, Syndros, Cesamet, and Sativex, is expanding due to their therapeutic uses in treating various ailments like chronic pain, ALS, Parkinson's, Alzheimer's, cancer, and neurological disorders. Consumer spending on medical marijuana is following an S-Curve function, with an exponential curve function expected due to the increasing number of clinical trial initiatives for safety and efficacy. The market dynamics include the decriminalizing of cannabis for medical purposes, therapeutic uses in pain management, hunger stimulation, ocular strain relief, and the development of edible cannabis products for vomiting and nausea in patients undergoing chemotherapy.

What challenges does the Medical Marijuana Industry face during its growth?

Side effects associated with inappropriate use of medical marijuana is a key challenge affecting the industry growth.

- Medical marijuana, derived from the Cannabis Sativa and Indica plants, contains active ingredients called cannabinoids, primarily THC and CBD. THC is known for its psychoactive effects, while CBD does not produce these effects. The concentration of THC in medical marijuana can vary, influenced by cultivation methods, preparation, and storage. Other chemicals, including terpenes and minor cannabinoids, also impact the medical efficacy and patient experience. Medical marijuana is used to alleviate various symptoms and ailments, such as chronic pain, nausea and vomiting from chemotherapy, seizures in conditions like Epilepsy, and neurological disorders like ALS, Parkinson's, and Alzheimer's. Companies like Canopy Growth, Avicanna, and Pharmacological organizations are engaged in drug discovery and production of cannabinoid-based medications.

- The market for medical marijuana is growing, with increasing consumer spending and clinical trial initiatives focusing on safety and efficacy. This growth can be modeled using an S-Curve or Exponential Curve function. The market includes B2B and B2C enterprises, retail and pharmacy stores, online platforms, and authorized dispensaries. Products range from cannabis oil and solid forms to gas and dissolvable/powders, catering to diverse patient needs. Psychoactive compounds like THC are used for pain management, appetite loss, and ocular strain, while CBD is used for sleep disorders, anxiety, and inflammation. As the reimbursement environment evolves, functional food products like Kale, Turmeric, and Kombucha infused with cannabis are gaining popularity.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aurora Cannabis Inc.

- Canopy Growth Corp.

- Cresco Labs LLC

- Cronos Group Inc.

- CV Sciences Inc.

- Etain LLC

- HEXO Corp.

- Isodiol International Inc.

- Jazz Pharmaceuticals Plc

- Khiron Life Sciences Corp.

- Maricann Group Inc

- Medical Marijuana Inc.

- MediPharm Labs Inc.

- Organigram Holdings Inc.

- Phoena Holdings Inc

- Skye Bioscience Inc.

- Tikun Olam

- Tilray Brands Inc.

- Trevena Inc

- Verano Holdings LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the production, processing, and distribution of cannabis and cannabinoid-based medications for therapeutic uses. This burgeoning industry has gained significant momentum in various countries due to the growing recognition of cannabis as an effective treatment for a range of ailments and symptoms. Cannabis Sativa and Cannabis Indica are two primary species of the marijuana plant, each offering unique therapeutic benefits. The former is known to stimulate and uplift, while the latter is renowned for its calming and relaxing effects. Both species contain various cannabinoids, including THC and CBD, which have been shown to provide relief for chronic pain, neurological disorders such as ALS, Parkinson's, and Alzheimer's, and cancer.

In addition, the market for medical marijuana is experiencing exponential growth, driven by consumer spending and clinical trial initiatives. The S-curve function best describes this growth pattern, as the industry moves from an embryonic stage to a more mature and established one. This expansion is influenced by the decriminalizing of cannabis in several regions and the increasing social acceptance of its therapeutic uses. Medical marijuana is used to treat various conditions, including chronic pain, nausea and vomiting associated with chemotherapy, and sleep disorders. It also holds the potential for treating neurological diseases like epilepsy and anxiety. The production of medical marijuana involves thorough testing and adherence to strict quality standards to ensure safety and efficacy.

Furthermore, B2B and B2C enterprises play a crucial role In the market. B2C enterprises, on the other hand, sell these products directly to consumers through online platforms and high-end retail locations. Funding values in the market have been on the rise, fueled by the potential of cannabinoid-based medications and the increasing demand for functional food products, such as edible cannabis, kale, turmeric, and kombucha. The reimbursement environment for medical marijuana is evolving, with pharmacological organizations and insurance companies recognizing its therapeutic benefits.

Moreover, cannabis oil, a popular form of medical marijuana, is produced through various methods, including extraction and distillation. Psychoactive compounds like hemp fiber, THC and CBD are extracted from the plant and used to create a range of products, including solid, gas, and dissolvable/powders. The market for medical marijuana is not without challenges, however. Production concerns, such as cultivation, processing, and manufacturing, require significant resources and expertise. Additionally, the regulatory landscape varies from country to country, which can impact the growth and development of the industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 29.52% |

|

Market growth 2024-2028 |

USD 39.81 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

21.89 |

|

Key countries |

US, Canada, UK, and France |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Medical Marijuana industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.