Hemp Fiber Market Size 2024-2028

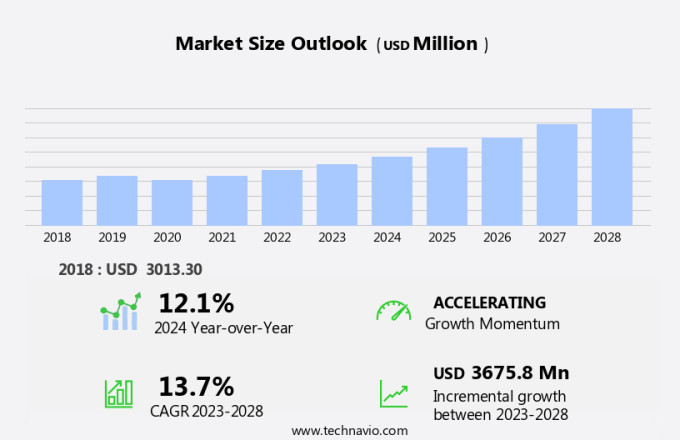

The hemp fiber market size is forecast to increase by USD 3.68 billion at a CAGR of 13.7% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing use of hemp in various industries, particularly In the clothing sector and pulp industry. The clothing industry is embracing hemp as an eco-friendly alternative to synthetic fibers, leading to a surge in demand. Similarly, the pulp industry is utilizing hemp for paper production, further boosting market growth. However, challenges persist In the production of hemp, including regulatory issues, limited availability of arable land, and competition from other fiber sources. Despite these challenges, the market is expected to continue expanding, driven by the growing awareness of sustainable and eco-friendly practices. The increasing adoption of hemp in diverse applications, coupled with its environmental benefits, presents significant opportunities for market participants.

What will be the Size of the Hemp Fiber Market During the Forecast Period?

- The market In the United States is experiencing significant growth due to the increasing demand for sustainable materials in various industries. Hemp fibers, a natural and renewable resource, offer advantages in textiles, construction, and other sectors. In textiles, hemp fibers are known for their strength, durability, and ability to breathe, making them an attractive substitute for traditional fibers. In construction, hemp fibers can be used as insulation, composite materials, and even as a replacement for concrete in certain applications. Additionally, hemp biomass is utilized In the production of fuels, chemicals, and bioenergy. Beyond textiles and construction, hemp fibers have applications in pulp and paper, animal bedding, and even as an antimicrobial agent.

- Hemp cultivation is also gaining traction due to its environmental benefits and potential to reduce the carbon footprint of various industries. Online retailing has made it easier for consumers to access hemp fiber products, further fueling market growth. Overall, the market is poised for continued expansion as more industries recognize the versatility and sustainability of this natural resource.

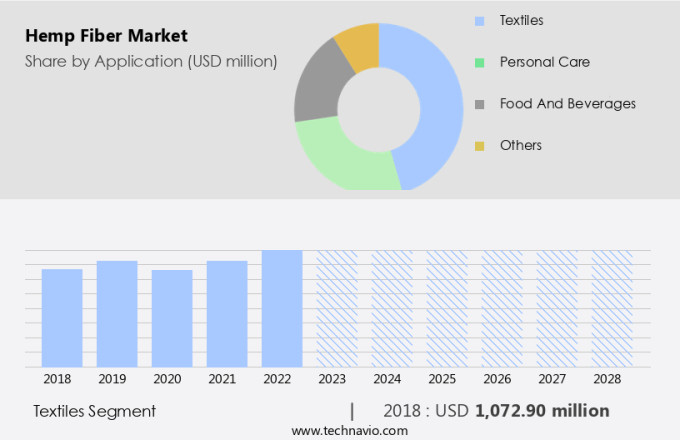

How is this Hemp Fiber Industry segmented and which is the largest segment?

The hemp fiber industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Textiles

- Personal care

- Food and beverages

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- UK

- France

- Italy

- North America

- Canada

- US

- Middle East and Africa

- South America

- APAC

By Application Insights

- The textiles segment is estimated to witness significant growth during the forecast period.

Hemp fibers have gained significant attention in various industries due to their eco-friendly and durable properties. In the textiles sector, hemp is used to produce yarns, spun fibers, and textiles such as rope, net, canvas bags, carpets, and geotextiles. Hemp cultivation does not require pesticides, making it an environmentally friendly choice. Its tensile strength, which is nearly eight times that of cotton fiber, increases its demand. Hemp fabrics are hypoallergenic, non-irritating, and highly resistant to rotting, mildew, and saltwater. The market is driven by the increasing demand for biodegradable materials and the need to reduce textile pollution and water shortage issues.

Hemp cultivation also aids in soil erosion control. With its numerous benefits, the market for hemp fibers is expected to grow steadily.

Get a glance at the Hemp Fiber Industry report of share of various segments Request Free Sample

The Textiles segment was valued at USD 1.07 billion in 2018 and showed a gradual increase during the forecast period.

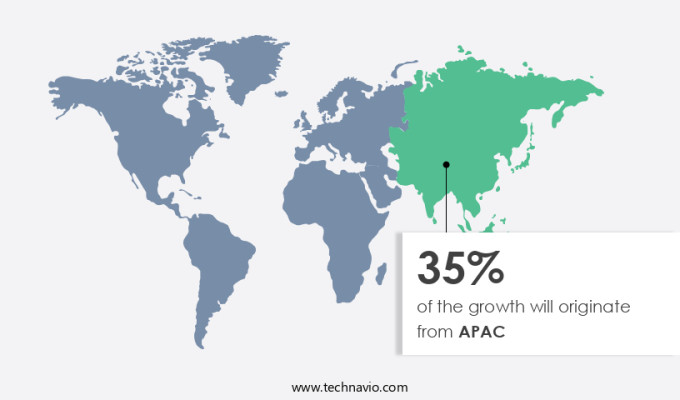

Regional Analysis

- APAC is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific (APAC) region is experiencing significant growth In the market due to favorable climatic conditions, government support, and increasing demand for eco-friendly materials. The region's optimal weather and soil conditions enable large-scale hemp cultivation, which is crucial for supplying the expanding markets in textiles, construction, and automotive components. Governments In the APAC region are recognizing hemp's economic potential as a sustainable crop and are promoting its cultivation through incentives such as grants, subsidies, and relaxed regulations. This encouragement fosters the growth of a thriving domestic hemp fiber sector. Hemp fiber is a biodegradable and sustainable alternative to traditional materials, making it an attractive option for green building materials, such as hempcrete, and bioplastics.

Online retailing further expands its reach, making it easily accessible to consumers seeking eco-friendly solutions. The APAC region's strategic position In the global market is set to continue its growth trajectory, contributing significantly to the demand for hemp fiber.

Market Dynamics

Our hemp fiber market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Hemp Fiber Industry?

Increasing use in clothing industry is the key driver of the market.

- Hemp fibre has been a sustainable material of choice for various industries, including textiles and construction, for centuries. Unlike conventional fibres, hemp is a fast-growing plant that requires minimal water and no chemical fertilizers or insecticides. Hemp fibre is more durable than its counterparts, offering superior strength and longevity. The natural fibre has been used to create textiles and fabrics, including hemp fabric for clothing, ropes, and even paper. Hemp biomass is also used to produce fuels, chemicals, bioenergy, and bioplastics. Hemp seeds are a valuable source of protein and are used as meat and dairy replacements. Hemp cultivation has gained popularity due to its eco-friendly properties and its ability to provide a range of sustainable products.

- In the textile industry, hemp fibre is being used to create biodegradable materials that address textile pollution and water shortage issues. Hemp fibre is also used in composite materials for insulation, animal bedding, and In the production of fiberboard, cement, and bio-composite materials. Hemp's antimicrobial properties make it an ideal material for construction activities. Hemp oil is extracted from the stalks and seeds and is used in various applications, including as a thermal insulator, electrical conductor, and In the production of paints and coatings. Hemp fibre's high absorbency, thermal properties, and electrical properties make it a versatile material for various industries.

- In conclusion, hemp fibre is a natural, sustainable, and versatile material that offers numerous benefits for various industries. Its use in textiles, construction, fuels, chemicals, and bioenergy makes it an essential component of a green economy. Hemp fibre's biodegradable properties and eco-friendly production methods make it a preferred choice for companies and consumers seeking sustainable alternatives to conventional fibres.

What are the market trends shaping the Hemp Fiber Industry?

Increasing demand from pulp industry is the upcoming market trend.

- Hemp fiber, derived from the plant Cannabis sativa, is gaining popularity as a sustainable material in various industries, including textiles and construction. The hemp fibre market is experiencing growth due to the increasing demand for eco-friendly and biodegradable materials. Hemp fibers are used to create fabrics for clothing and ropes, while hemp biomass is utilized to produce fuels, chemicals, bioenergy, and bioplastics. Hemp seeds are also used as meat and dairy replacements. Hemp cultivation, whether conventional or organic, provides several benefits, including the production of biodegradable materials. In the textile industry, hemp fiber is a natural, hypoallergenic, and high-absorbency alternative to synthetic fibers.

- In construction activities, hemp fiber is used to create insulation, composite materials, and green building materials such as hempcrete. Hemp oil is extracted from the stalks and seeds for use In thermal and electrical properties. The use of hemp fiber in pulp and paper production offers a solution to the water shortage issues and textile pollution caused by conventional methods. Hemp fiber is also used In the production of fiberboard, cement, and bio-composite materials, making it a versatile and sustainable choice for automotive products and other industries. With its antimicrobial properties, hemp fiber is a preferred choice for animal bedding and other applications.

- Online retailing has made it easier for consumers to access and purchase hemp fiber products, further increasing its demand.

What challenges does Hemp Fiber Industry face during the growth?

Challenges associated with production of hemp is a key challenge affecting the industry growth.

- Hemp fibre, a natural and sustainable material, is gaining popularity in various industries, including textiles, construction, and bioplastics. The hemp fibre market is witnessing significant growth due to the versatility of hemp fibre, which can be used to produce fibres for clothes and ropes, insulation materials, composite materials for building and automotive products, and biodegradable plastics. Hemp biomass can also be converted into fuels, chemicals, and bioenergy, making it an attractive alternative to conventional fossil fuels. Hemp cultivation requires specific climatic conditions and well-drained soils, making it a challenge for farmers in some regions. Regulatory challenges also exist due to the close relationship between hemp and marijuana, which are chemically similar but differ in THC content.

- Hemp contains only 0.3% THC, while marijuana contains 3-15% THC. The legality of hemp farming depends on THC content, making it essential to ensure strict compliance with regulations. Hemp fibre is biodegradable and offers several advantages over conventional materials. It has antimicrobial properties, high absorbency, thermal properties, electrical properties, and hypoallergenic qualities. Hemp textiles are also UV radiation resistant, making them an attractive alternative to synthetic fibres. In the construction industry, hemp fibre is used to produce green building materials such as hempcrete, which has excellent insulation properties. The hemp fibre market is expected to grow further due to increasing demand for sustainable textiles and green building materials.

- Online retailing has also made it easier for consumers to access hemp fibre products, including hemp fabric, fibreboard, cement, and bio-composite materials. As the world moves towards sustainable and eco-friendly solutions, hemp fibre is poised to become a significant player in various industries.

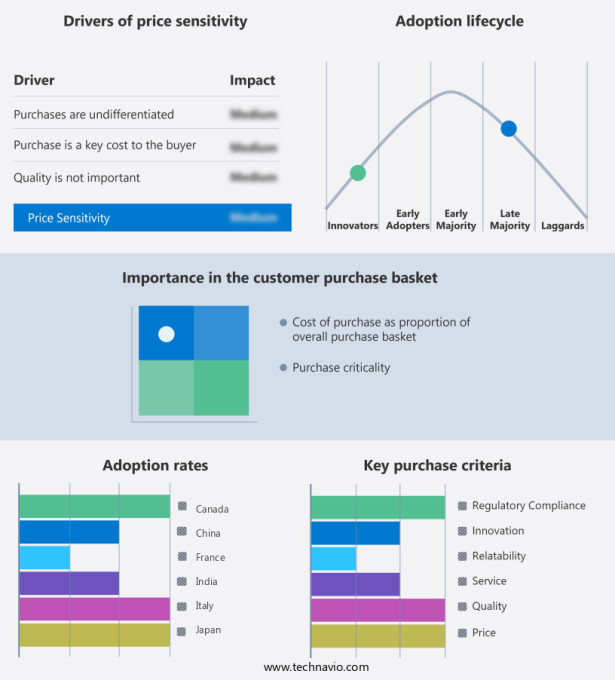

Exclusive Customer Landscape

The hemp fiber market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hemp fiber market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hemp fiber market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

CanvaLoop Fibre Pvt. Ltd. - Our company provides a range of high-quality hemp fiber products for the US market. These offerings include Cottonized Hemp Fibers, Hemp Yarns, HempLoop, and Blended Yarns. Our Cottonized Hemp Fibers are processed to resemble the feel and texture of cotton, making them an excellent alternative for textile manufacturers. Hemp Yarns are strong and durable, ideal for use in industrial applications. HempLoop is a sustainable and eco-friendly fabric made entirely from hemp fibers. Lastly, our Blended Yarns combine hemp with other natural fibers to create unique textures and properties. Our commitment to quality and sustainability sets us apart In the market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- CanvaLoop Fibre Pvt. Ltd.

- Dun Agro Hemp Group

- Ecofibre Ltd.

- Forever Green

- Hemp Fortex Industries Ltd.

- Hemp INC.

- Hemp Oil Canada

- HempAge AG

- HempFlax Group BV

- HemPoland Sp zoo

- Hempro Int. GmbH

- HempSense Inc.

- Hempys

- Ind Hemp LLC

- Konoplex LLC

- Margaret River HempCo.

- Naturalus pluostas UAB

- Shanxi Greenland Textile Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Hemp fiber, a natural and sustainable material derived from the plant Cannabis sativa, has gained significant attention in various industries due to its versatility and eco-friendly properties. This fibrous substance can be utilized in textiles, construction, fuels, chemicals, bioenergy, and numerous other applications. Textile production is a primary market for hemp fiber. The natural fiber possesses desirable qualities such as high tensile strength, low moisture absorption, and excellent breathability. Hemp fabric is known for its durability and softness, making it an attractive alternative to synthetic fibers. In the textile industry, hemp fibers can be used to produce clothes, ropes, and other textile products.

Hemp fibers also play a crucial role In the construction sector. Hemp biomass can be converted into composite materials, insulation, and even building materials like hempcrete. These materials offer numerous advantages, including their biodegradability, thermal properties, and resistance to pests and moisture. Hemp fibers can also be used as animal bedding and possess antimicrobial properties, making them an excellent choice for various applications. The pulp and paper industry is another sector that benefits from hemp fiber. Hemp pulp can be used to produce paper and paper products, offering a more sustainable alternative to traditional wood pulp. The use of hemp pulp in paper production reduces the demand for wood, which can help mitigate deforestation and its associated environmental impacts.

Bioenergy and biofuels are another growing market for hemp fiber. The plant's biomass can be converted into bioenergy, providing a renewable and sustainable energy source. Hemp fibers can also be used to produce biofuels, offering a more eco-friendly alternative to traditional fossil fuels. The chemical industry also utilizes hemp fibers for various applications. Hemp fibers can be used to produce bioplastics, which offer a more sustainable alternative to traditional plastics. These bioplastics are biodegradable and can help reduce the amount of plastic waste In the environment. In the automotive industry, hemp fibers are used to produce bio-composite materials.

These materials offer numerous advantages, including their lightweight nature, high strength, and biodegradability. Hemp fibers can also be used to produce fiberboard and cement, offering more sustainable alternatives to traditional materials. Online retailing has made it easier for consumers to access hemp fiber products. These products include hemp fibers, hemp fabric, hemp insulation, and other hemp-derived materials. Consumers can now easily purchase these products from the comfort of their own homes, making them more accessible than ever before. As the demand for sustainable materials continues to grow, the market is expected to expand. Hemp fibers offer numerous advantages over conventional materials, including their biodegradability, renewability, and eco-friendly production methods.

Additionally, hemp fibers can be used as substitute fibers in various industries, offering a more sustainable alternative to traditional materials. In conclusion, hemp fiber is a versatile and sustainable material that offers numerous advantages over conventional materials. Its use in textiles, construction, fuels, chemicals, bioenergy, and various other applications makes it an attractive alternative for industries seeking to reduce their environmental impact. As the demand for sustainable materials continues to grow, the market is expected to expand, offering new opportunities for innovation and growth.

|

Hemp Fiber Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.7% |

|

Market growth 2024-2028 |

USD 3675.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.1 |

|

Key countries |

China, Russia, France, Japan, Canada, India, South Korea, UK, Italy, and US |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hemp Fiber Market Research and Growth Report?

- CAGR of the Hemp Fiber industry during the forecast period

- Detailed information on factors that will drive the Hemp Fiber growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hemp fiber market growth of industry companies

We can help! Our analysts can customize this hemp fiber market research report to meet your requirements.