Medical Plastics Market Size 2024-2028

The medical plastics market size is forecast to increase by USD 11.13 billion at a CAGR of 7.08% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for advanced materials in medical components, such as plastic composites and advanced plastics like polyethylene and polypropylene. The aging population and resulting reforms towards value-based care are key drivers, as medical devices and packaging require lightweight, durable, and cost-effective solutions. Trends include the use of advanced plastics in catheters, surgical instrument handles, syringes, and medical device packaging. However, concerns related to the use of medical plastics, including potential toxicity and environmental impact, necessitate ongoing research and development to address these challenges and ensure the safety and sustainability of medical plastics applications.

The market is witnessing significant growth due to the increasing adoption of advanced medical technologies in healthcare systems. The market is driven by the demand for customized devices, such as 3D printed implants, and the need for medical components made from advanced plastics, including engineering plastics and plastic composites. Polymer types, such as polyethylene, polypropylene, and polycarbonate, are widely used in the production of medical components, including catheters, surgical instrument handles, syringes, medical device packaging, IV tubes, surgical instruments, diagnostic devices, and home healthcare products. The use of medical-grade plastics ensures patient safety and improves the overall performance of medical technology.

Furthermore, the medical research sector is also contributing to the growth of the market, with the development of new medical technologies and the increasing use of plastics in medical applications. Hospitals are major consumers of medical plastics, with a significant demand for standard plastics in the production of disposable medical items.

Market Segmentation

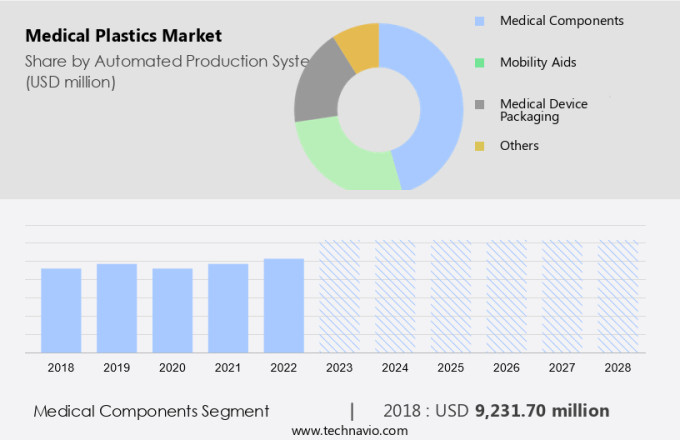

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Automated Production System

- Medical components

- Mobility aids

- Medical device packaging

- Others

- Geography

- North America

- Canada

- US

- Europe

- UK

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Automated Production System Insights

The medical components segment is estimated to witness significant growth during the forecast period. Medical plastics play a significant role in the healthcare industry, particularly in the manufacturing of various medical components. These components, which include instruments, apparatus, and machines, are essential for the prevention, diagnosis, treatment, and rehabilitation of illnesses and diseases. The use of medical plastics in this context is prevalent due to their ability to reduce friction and provide toughness, making them suitable for applications in robotic assistance and AI-driven procedures. Moreover, medical plastics are extensively used in producing implants and prosthetics, medical disposables, and surgical and procedural applications. Polymers derived from glycolic acid, polylactic acid (PLA), polydioxanone, and poly(trimethylene carbonate) are commonly utilized in the fabrication of these medical components.

Furthermore, the global population is aging, and the number of individuals suffering from chronic diseases is increasing. As a result, there is a growing demand for medical components, especially in middle-income countries. Local governments and healthcare providers are investing in IT integration and advanced technologies to improve healthcare delivery, further fueling the demand for medical plastics. In summary, medical plastics are crucial in the healthcare sector, with applications ranging from implants and prosthetics to medical disposables and surgical instruments. The aging population and the increasing prevalence of chronic diseases are driving the demand for these medical components, making the market a promising and growing industry.

Get a glance at the market share of various segments Request Free Sample

The Medical components segment accounted for USD 9.23 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market is projected to expand at a consistent rate over the upcoming years. The United States is the major contributor to this growth due to escalating healthcare expenditures and the availability of advanced hospitals and healthcare facilities. The medical plastics industry in this region is significantly influenced by the emergence of professional pharmacy chains and government initiatives, enabling consumer stores to sell over-the-counter (OTC) medicines. In the healthcare sector, medical plastics play a crucial role in friction reduction, enhancing robotic assistance, and facilitating AI-driven procedures. They are extensively used in implants and prosthetics, medical disposables, surgical applications, and procedural applications.

Furthermore, the aging population and the increasing prevalence of chronic diseases in the middle-income group further fuel the demand for medical plastics in North America. Local governments are also integrating IT systems into healthcare services, which is anticipated to create new opportunities for the market in this region.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The growth in geriatric population is the key driver of the market. The market is witnessing significant growth due to the increasing population of elderly individuals in healthcare systems around the world. The demographic shift is driving demand for advanced medical technologies, including customized devices and 3D-printed implants, which are often made from engineering plastics and standard plastics.

Furthermore, these polymers offer desirable properties such as malleability, impact resistance, flame resistance, shock resistance, and chemical resistance, making them ideal for medical applications. The market for medical plastics is expected to continue expanding as healthcare systems seek to improve patient outcomes and reduce costs through the use of innovative and efficient medical devices.

Market Trends

The growing recycling techniques is the upcoming trend in the market. The market plays a significant role in healthcare systems, particularly in the development and production of advanced medical technologies. Polymer types, including engineering plastics and standard plastics, are extensively utilized in creating customized devices such as 3D-printed implants due to their malleability, impact resistance, flame resistance, shock resistance, and chemical resistance. However, the environmental impact of medical plastics has become a growing concern.

Furthermore, to mitigate the environmental harm caused by medical plastics, manufacturers are focusing on producing recyclable products. Recycling medical plastics, however, poses challenges due to the complexity of sorting and cleaning these materials. Collaboration between healthcare systems and recycling industries is essential to effectively manage medical plastic waste and promote sustainable manufacturing practices. This approach not only reduces the environmental impact but also ensures the continued availability of high-quality, cost-effective medical plastics for the healthcare sector.

Market Challenge

The concerns related to use of medical plastics is a key challenge affecting the market growth. The global healthcare sector's reliance on medical plastics has significantly increased due to the adoption of advanced medical technologies. This trend is driven by the production of customized devices and 3D-printed implants, which require the use of various polymer types, including engineering plastics and standard plastics. The properties of these plastics, such as malleability, impact resistance, flame resistance, shock resistance, and chemical resistance, make them ideal for medical applications. However, the mass production and disposal of these plastics in healthcare systems pose environmental concerns.

Furthermore, a million goggles and 76 million gloves are used monthly in healthcare facilities. Unfortunately, only a small percentage of these plastics are recycled, with the rest being disposed of in landfills or inadequately incinerated. These practices not only harm the environment but also pose potential health risks and contribute to long-term pollution. It is crucial to find sustainable solutions to manage medical plastic waste and reduce its environmental impact while maintaining the benefits it provides to the healthcare sector.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Celanese Corp: The company offers plastic materials that enhance performance in packaging, film, and printing in the medical industry.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Avantor Inc.

- BASF SE

- Celanese Corp.

- Compagnie de Saint Gobain

- Covestro AG

- Dow Inc.

- Eastman Chemical Co.

- Evonik Industries AG

- HMC Polymers Co Ltd.

- Koninklijke DSM NV

- Nolato AB

- Orthoplastics Ltd.

- Rochling SE and Co. KG

- Saudi Basic Industries Corp.

- Solvay SA

- Tekni Plex Inc.

- Trelleborg AB

- Trinseo PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to the increasing adoption of advanced medical technologies in healthcare systems. The market is driven by the demand for customized devices, such as 3D-printed implants, and the use of engineering plastics and standard plastics in medical components. The polymer types used in medical plastics include polyethylene, polypropylene, polycarbonate, and thermoplastic polyurethane, among others. Advanced plastics and plastic composites are increasingly being used in medical applications due to their superior properties, such as malleability, impact resistance, flame resistance, shock resistance, and chemical resistance. These materials are used in various medical applications, including implants and prosthetics, medical disposables, surgical applications, procedural applications, and home healthcare.

Moreover, the aging population, chronic diseases, and the middle-income group are key factors driving the growth of the market. The market is also influenced by reforms in healthcare systems, value-based care, and IT integration. Medical technology, medical research, and personalized medicine are also contributing to the growth of the market. The market for medical plastics is diverse and includes applications in hospitals, patient safety, infection control, medical waste, and telemedicine. Medical components, such as catheters, surgical instrument handles, syringes, medical device packaging, and IV tubes, are major consumers of medical plastics. Personal protective equipment, such as face masks, gloves, and gowns, are also significant contributors to the market.

Furthermore, orthopedic implant packaging, cross-linked polyethylene, and polyphenylsulfone resin are some of the emerging trends in the market. The market is also witnessing growth in the areas of robotic assistance, AI-driven procedures, and minimally invasive procedures. The plastic compounding market and biocompatible polymers market is expected to grow in tandem with the market. Medical tourism is another area where medical plastics are gaining popularity due to their cost-effectiveness and superior properties.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

142 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.08% |

|

Market growth 2024-2028 |

USD 11.13 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.49 |

|

Regional analysis |

North America, Europe, APAC, and Rest of World (ROW) |

|

Performing market contribution |

North America at 36% |

|

Key countries |

US, UK, China, Canada, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Avantor Inc., BASF SE, Celanese Corp., Compagnie de Saint Gobain, Covestro AG, Dow Inc., Eastman Chemical Co., Evonik Industries AG, HMC Polymers Co Ltd., Koninklijke DSM NV, Nolato AB, Orthoplastics Ltd., Rochling SE and Co. KG, Saudi Basic Industries Corp., Solvay SA, Tekni Plex Inc., Trelleborg AB, and Trinseo PLC |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch