Medical Transcription Market Size 2024-2028

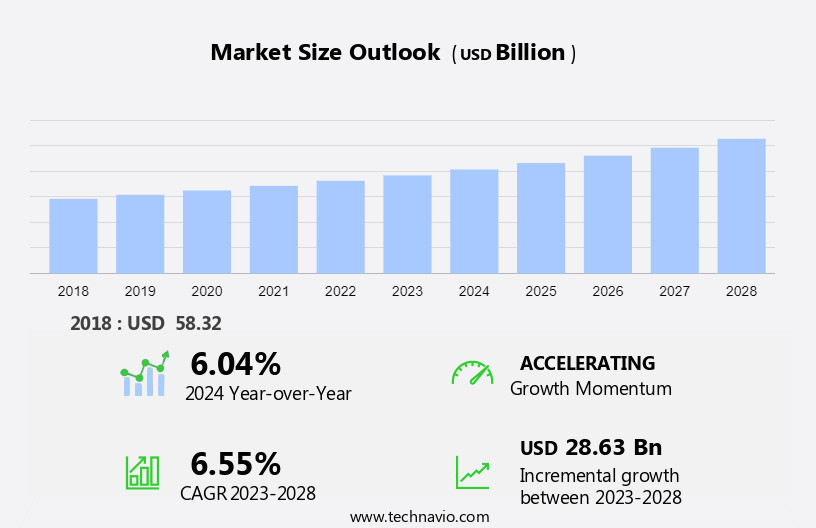

The medical transcription market size is forecast to increase by USD 28.63 billion at a CAGR of 6.55% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The increasing demand for automated transcripts is driving market growth, as healthcare providers seek to streamline their workflows and reduce turnaround times. Additionally, the emergence of advanced voice recognition technologies is enabling more accurate and efficient transcription, further fueling market expansion. However, concerns for medical data privacy remain a challenge, as the handling of sensitive patient information requires stringent security measures. Adherence to regulatory compliance and data protection standards is crucial for market participants to maintain trust and credibility with their clients. Moreover, AI, machine learning, and data-driven technologies have revolutionized clinical documentation, enabling healthcare professionals, including radiologists, clinicians, and surgeons, to access patient information more efficiently. Urbanization and the increasing adoption of telemedicine services and telehealth have further expanded the market's reach. Overall, the market is poised for continued growth, driven by these trends and the need for efficient, accurate, and secure transcription solutions.

What will be the Size of the Medical Transcription Market During the Forecast Period?

- The medical transcription (MT) market encompasses the conversion of spoken or handwritten medical documentation into text format, serving a vital role in healthcare facilities, clinics, and physicians' offices worldwide. This market is driven by the increasing volume of patient data generated from chronic illnesses such as melanoma, cardiovascular problems, and diabetes. The growing reliance on electronic health records (EHRs) and the need for ADT normalization and audio identification have fueled market expansion. Urbanization and the adoption of encryption technologies have increased the security of patient information, enabling the use of over-the-counter drugs and telemedicine services in MT processes. Telehealth and AI technologies, including machine learning, have revolutionized medical examination findings analysis and treatment plan development, reducing staff burden and streamlining patient forms and discharge summaries.

- These trends are expected to continue shaping the dynamic and growing the market.

How is this Medical Transcription Industry segmented and which is the largest segment?

The medical transcription industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Hospitals

- Physician groups and clinics

- Type

- Services

- Software

- Geography

- North America

- Canada

- US

- APAC

- Japan

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

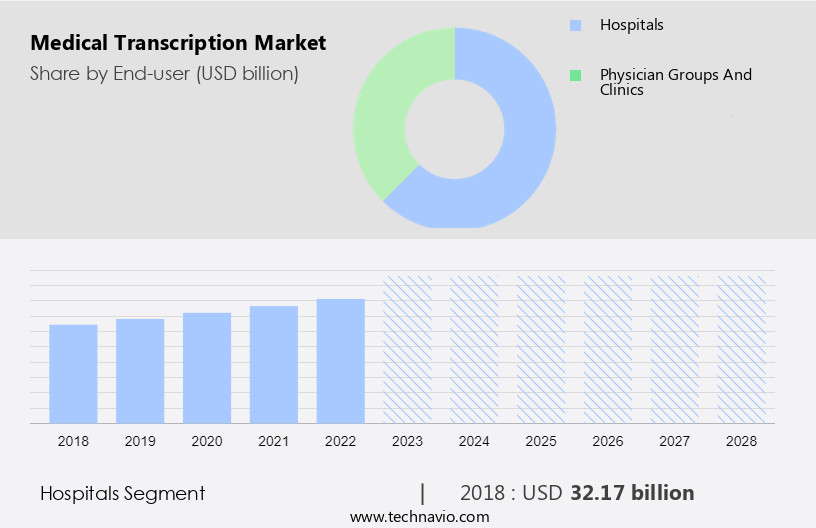

By End-user Insights

- The hospitals segment is estimated to witness significant growth during the forecast period.

Medical transcription (MT) plays a crucial role In the efficient management of healthcare documentation for hospitals, healthcare facilities, clinics, and physicians. With the rise of chronic illnesses such as melanoma, cardiovascular problems, and diabetes, the need for accurate and timely clinical documentation has become increasingly important. MT enables the conversion of spoken words into written records, facilitating the creation of treatment records, medical examination findings, and treatment plans. Advancements in technology, including audio identification, voice capture, and voice recognition, have streamlined the MT process.

Data security mechanisms, such as encryption technologies and regulatory requirements, ensure the protection of confidential patient information from data breaches and ransomware attacks. EHR manufacturers continue to invest in MT solutions, integrating them with cloud/web-based and on-premises/installed systems. Capital expenditures on healthcare IT are projected to grow, driving the market's expansion. Operational efficiency, patient care, and treatment plans are key benefits of MT, which is essential for healthcare providers to meet the demands of an increasing patient population and staff burden.

Patient forms, discharge summaries, and patient history are some of the critical documents that can be processed through MT, ensuring accurate and timely documentation. The market is expected to grow steadily due to these factors and the increasing prevalence of chronic diseases, including cancer, diabetes, and cardiovascular diseases.

Get a glance at the Medical Transcription Industry report of share of various segments Request Free Sample

The Hospitals segment was valued at USD 32.17 billion in 2018 and showed a gradual increase during the forecast period.

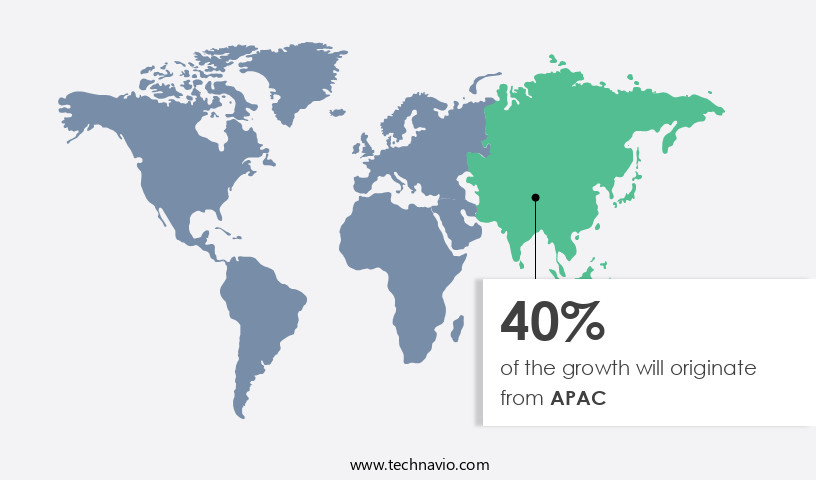

Regional Analysis

- APAC is estimated to contribute 40% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The medical transcription (MT) market is driven by the increasing demand for accurate and efficient healthcare documentation. This includes clinical documentation from hospitals, healthcare facilities, clinics, and physicians, as well as patient information related to chronic illnesses such as melanoma, cardiovascular problems, and diabetes. Advanced technologies like audio identification, voice capture, and voice recognition are utilized to streamline the MT process. Urbanization and the adoption of encryption technologies have increased the need for secure data handling In the healthcare sector. Over-the-counter drugs and telemedicine services, including telehealth and artificial intelligence (AI) and machine learning, are also contributing factors to the growth of the MT market.

Regulatory requirements, such as the need for ADT normalization, and the offerings of EHR manufacturers, have led to increased capital expenditure for healthcare providers. Data security mechanisms, including data breaches and confidential information protection from ransomware attacks, are crucial considerations for MT service providers. Healthcare professionals, including radiologists, clinicians, and surgeons, rely on MT services for operational efficiency and accurate clinical data. Patient care and treatment records, medical examination findings, and treatment plans are all essential components of healthcare documentation. The MT market is expected to grow significantly due to the increasing burden on healthcare providers to manage patient forms, discharge summaries, patient history, and doctors' physical condition reports for chronic diseases like cancer, diabetes, and cardiovascular diseases.

The market is segmented into cloud/web-based and on-premises/installed solutions, with the former gaining popularity due to their cost-effectiveness and ease of use.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Medical Transcription Industry?

Increase in need for automated transcripts is the key driver of the market.

- The global medical transcription (MT) market is driven by the growing volume of healthcare data, particularly in hospitals, healthcare facilities, clinics, and physicians' offices. Manual transcription processes are prone to errors, which can lead to misdiagnosis and incorrect treatments, especially in chronic illnesses such as melanoma, diabetes, and cardiovascular problems. To mitigate these risks, healthcare professionals are increasingly adopting automated MT solutions that leverage speech recognition systems, audio identification, and data-driven technologies like artificial intelligence (AI) and machine learning. These technologies enable the normalization of Admission, Discharge, and Transfer (ADT) data, streamline clinical documentation, and enhance operational efficiency. Additionally, encryption technologies and data security mechanisms protect patient information from breaches and cyber attacks, including ransomware.

- Telemedicine services, telehealth, and cloud/web-based solutions are also fueling the growth of the MT market. The market caters to various healthcare providers, including radiologists, clinicians, surgeons, and healthcare professionals, who rely on accurate and timely clinical data for effective patient care and treatment planning. Capital expenditure on MT solutions is a worthwhile investment for healthcare centers seeking to improve patient care, reduce staff burden, and maintain regulatory requirements.

What are the market trends shaping the Medical Transcription Industry?

Emergence of voice recognition technologies is the upcoming market trend.

- Medical transcription (MT) involves converting voice recordings from healthcare professionals into written documents. This process is essential for maintaining accurate and comprehensive patient records in hospitals, healthcare facilities, clinics, and physicians' offices. Chronic illnesses such as melanoma, cardiovascular problems, and diabetes require detailed documentation. Advanced technologies like audio identification, voice capture, and voice recognition facilitate MT, reducing the time and effort required for transcription. However, the increasing prevalence of chronic diseases necessitates the need for more efficient and secure MT solutions. The market is driven by the growing need for clinical documentation, regulatory requirements, and the integration of MT with electronic health records (EHR) and telemedicine services.

- Data security mechanisms, such as encryption technologies and data-driven technologies like artificial intelligence (AI) and machine learning, are crucial in safeguarding patient information from data breaches and ransomware attacks. Cloud/web-based and on-premises/installed solutions cater to varying operational efficiency and capital expenditure requirements. MT software, like Dragon medical speech recognition by Nuance Communications, offers advanced features, such as increased accuracy, rapid processing, and end-to-end security. These solutions enable healthcare professionals, including radiologists, clinicians, surgeons, and healthcare providers, to focus on patient care instead of burdensome administrative tasks. Patient forms, discharge summaries, patient history, doctors' dictations, clinical data, medical examination findings, and treatment plans are all crucial components of healthcare documentation that can be efficiently processed through MT.

- Ensuring the highest level of accuracy and security, MT plays a vital role in improving operational efficiency and enhancing patient care.

What challenges does the Medical Transcription Industry face during its growth?

Increase in concerns for medical data privacy is a key challenge affecting the industry growth.

- Medical transcription (MT) plays a crucial role in healthcare documentation, enabling the conversion of spoken words into written records. Hospitals, healthcare facilities, clinics, and physicians rely on MT to maintain accurate and comprehensive patient records for chronic illnesses such as melanoma, cardiovascular problems, and diabetes. Advanced technologies like audio identification, voice capture, and voice recognition streamline the process, while data-driven technologies like artificial intelligence (AI) and machine learning enhance efficiency. However, the adoption of these technologies raises concerns regarding data security. Confidential patient information must be protected, as per regulatory requirements such as HIPAA In the US. Encryption technologies, data breach prevention measures, and ransomware attack defenses are essential to safeguard sensitive data.

- Telemedicine services, telehealth, and electronic health records (EHR) have increased the use of cloud/web-based MT solutions. This shift to digital documentation necessitates the implementation of data security mechanisms. Healthcare professionals, including radiologists, clinicians, and surgeons, must adhere to strict data protection guidelines when handling patient information. The MT market continues to evolve, with EHR manufacturers and healthcare providers investing in operational efficiency and patient care. Voice capture and dictation technologies facilitate quick documentation, while clinical data analysis helps in developing treatment plans and medical examination findings. Patient forms, discharge summaries, and patient history are essential components of healthcare documentation, requiring secure and efficient MT solutions.

Exclusive Customer Landscape

The medical transcription market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the medical transcription market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, medical transcription market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Aquity LLC

- Athreon Corp.

- CareCloud Inc.

- Ditto Transcripts

- Excel Transcriptions Inc.

- Flatworld Solutions Pvt. Ltd.

- Global Medical Transcription LLC

- iMedX Inc.

- Lingual Consultancy Services Pvt. Ltd.

- Med Scribe Inc.

- Microsoft Corp.

- Outsource Accelerator Ventures OPC

- Pacific Solutions Pty Ltd.

- Same Day Transcriptions Inc.

- Savista LLC

- TransPerfect Global Inc.

- VIVA Transcription Corp.

- World Wide Dictation Service of New York Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The medical transcription (MT) market plays a crucial role In the healthcare industry, facilitating the conversion of spoken words into written documents. This process is integral to the efficient functioning of hospitals, healthcare facilities, clinics, and other healthcare centers. The demand for MT services is driven by the increasing number of healthcare professionals, such as physicians, surgeons, clinicians, and radiologists, who rely on accurate and timely documentation to deliver high-quality patient care. Chronic illnesses, including melanoma, cardiovascular problems, and diabetes, account for a significant portion of healthcare expenditures and require extensive documentation. The complexity and volume of clinical data necessitate advanced technologies to streamline the MT process.

ADT normalization and audio identification technologies are essential tools for MT service providers. These technologies enable the standardization and organization of patient data, ensuring consistency and accuracy. Urbanization and the proliferation of telemedicine services and telehealth have further expanded the scope of the MT market. Data security mechanisms, including encryption technologies, are becoming increasingly important In the MT industry. With the growing concern over data breaches and the protection of confidential information, healthcare providers are investing in security measures to safeguard patient information. The adoption of data-driven technologies, such as artificial intelligence (AI) and machine learning, is transforming the MT landscape.

These technologies enable faster and more accurate transcription, reducing the burden on healthcare staff and improving operational efficiency. The regulatory requirements governing healthcare documentation are stringent, necessitating adherence to specific standards. EHR manufacturers have integrated MT capabilities into their systems to ensure compliance and streamline clinical documentation. Despite the benefits, the MT market faces challenges, including the threat of ransomware attacks and the need to balance cloud/web-based and on-premises/installed solutions. Voice capture and voice recognition technologies are also gaining popularity, offering a more convenient and efficient alternative to traditional dictation methods. The MT market is expected to grow as the healthcare industry continues to evolve, driven by the increasing demand for accurate and timely documentation, the adoption of advanced technologies, and the need to improve operational efficiency and patient care.

The market is also expected to be influenced by the growing trend towards personalized medicine and the integration of over-the-counter drugs into clinical documentation. The MT market plays a vital role In the healthcare industry, facilitating the conversion of spoken words into written documents. The market is driven by the increasing number of healthcare professionals, the complexity and volume of clinical data, and the need for data security and regulatory compliance. The adoption of advanced technologies, such as AI and machine learning, is transforming the MT landscape, offering opportunities for growth and innovation.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.55% |

|

Market growth 2024-2028 |

USD 28.63 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.04 |

|

Key countries |

US, Canada, Japan, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Medical Transcription Market Research and Growth Report?

- CAGR of the Medical Transcription industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the medical transcription market growth of industry companies

We can help! Our analysts can customize this medical transcription market research report to meet your requirements.