Melatonin Market Size 2024-2028

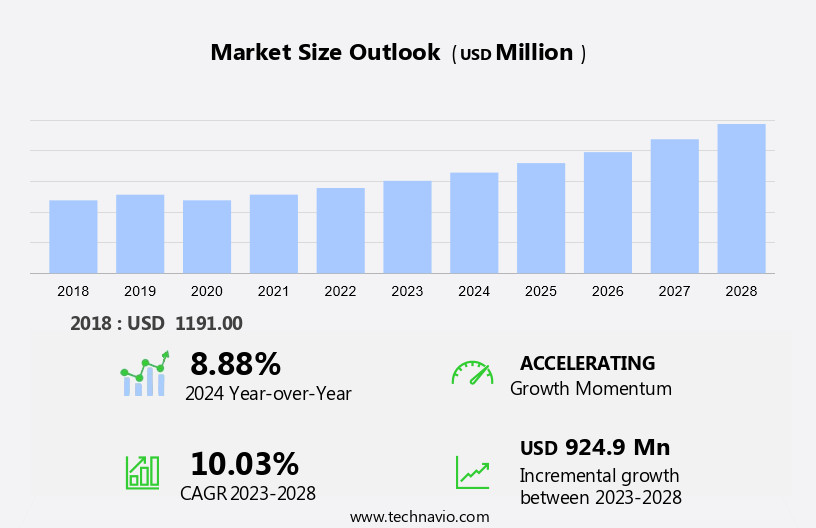

The melatonin market size is forecast to increase by USD 924.9 million at a CAGR of 10.03% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing prevalence of sleep disorders, including insomnia and jet lag, as well as circadian rhythm disorders. Additionally, the market is driven by the rising incidence of neurodegenerative diseases and cancer, leading to an increased demand for melatonin as an antioxidant. Melatonin production naturally decreases with age, contributing to sleep disturbances and the development of age-related diseases such as type 2 diabetes, cardiovascular diseases, neurodegenerative diseases, and cancer. Melatonin gummies have gained popularity as a dietary supplement due to their ease of use and effectiveness in addressing these health concerns. However, the market faces challenges from government regulations and rules, which vary by region, impacting market access and pricing. Overall, the market is poised for continued growth as more individuals seek natural solutions to improve their sleep quality and overall health.

What will be the Size of the Melatonin Market During the Forecast Period?

- Melatonin, a naturally occurring hormone produced by the pineal gland, plays a crucial role in regulating sleep-wake cycles. This hormone has gained significant attention In the medical field due to its therapeutic effects on sleep disorders and various age-related diseases. Sleep quality is a critical aspect of overall health and well-being. Disruptions in sleep patterns can lead to several health issues, including insomnia, jet lag, anxiety, depression, migraines, and more. Melatonin supplements have emerged as a popular natural alternative to pharmaceutical sleep aids, offering potential benefits for individuals seeking to improve their sleep quality.

- Melatonin's role in sleep regulation stems from its ability to influence circadian rhythms. These internal biological clocks govern various physiological processes, including sleep-wake cycles. Melatonin supplements can help restore optimal melatonin levels, promoting healthy sleep patterns and contributing to the prevention and management of these conditions. Furthermore, melatonin's antioxidant properties make it an effective tool in combating oxidative stress, a common factor in various health issues. Melatonin gummies have become a popular choice for those seeking a convenient and palatable way to consume melatonin supplements.

- These supplements are available in various dosages, allowing individuals to customize their intake according to their specific needs. Melatonin's therapeutic effects extend beyond sleep regulation. It has been shown to help alleviate symptoms of anxiety and depression, making it a valuable addition to holistic mental health treatment plans. Additionally, melatonin's potential role in cancer prevention and treatment is an active area of research. In summary, melatonin supplements offer a natural and effective solution for individuals seeking to improve their sleep quality and address various health concerns. As research continues to uncover the full extent of melatonin's therapeutic potential, its role In the healthcare landscape is poised to grow significantly.

How is this Melatonin Industry segmented and which is the largest segment?

The melatonin industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Pharmaceutical grade melatonin

- Food grade melatonin

- Geography

- North America

- Canada

- US

- Europe

- Germany

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Product Insights

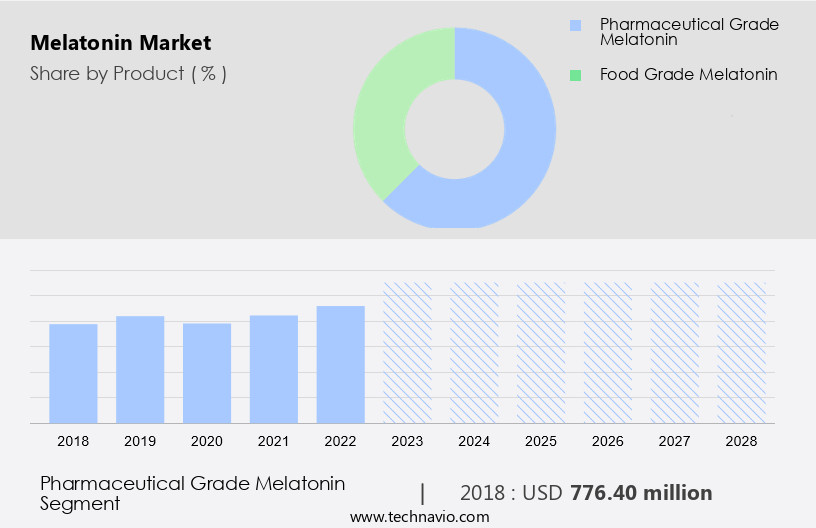

The pharmaceutical grade melatonin segment is estimated to witness significant growth during the forecast period. Melatonin, a naturally occurring hormone, holds significant potential in addressing various health concerns, including neurodegenerative diseases, cancer, and oxidative stress. The market for melatonin gummies and other dietary supplements has experienced substantial growth due to their effectiveness in treating sleep disorders, such as insomnia, jet lag, and circadian rhythm disorders. Pharmaceutical-grade melatonin, available in various forms like capsules, tablets, liquids, balms, roll-ons, vaping products, and gummies, dominates the market.

This is primarily due to its rapid effect in treating sleep disorders and the expanding health-conscious population, facilitated by the increasing penetration of e-commerce. The prevalence of sleep disorders continues to rise, leading to an increased demand for melatonin products, which can be obtained through prescriptions. Pharmaceutical-grade melatonin offers quick results compared to other alternatives, making it a preferred choice for many. Additionally, the introduction of pharmaceutical drugs to induce sleep has expanded the market, catering to diverse age groups with minimal side effects.

Get a glance at the market report of share of various segments Request Free Sample

The pharmaceutical grade melatonin segment was valued at USD 776.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

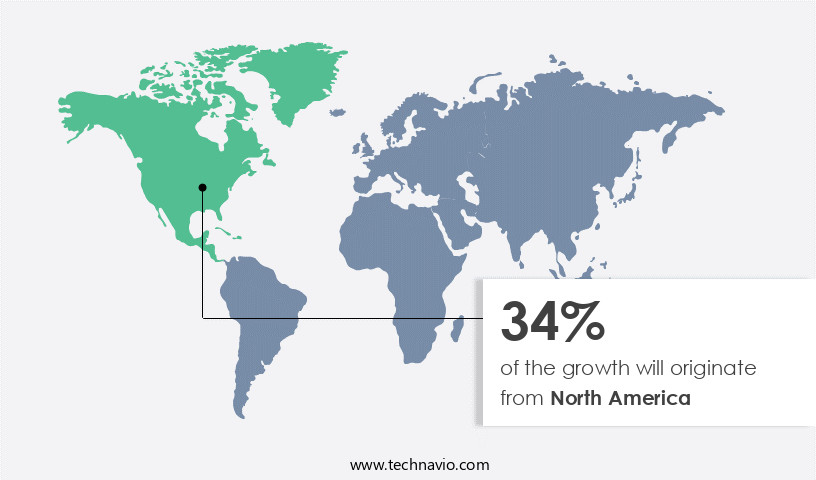

North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America holds a significant share In the global market due to the high prevalence of sleep disorders among the population. In the US and Canada, the incidence of sleep disorders is on the rise, with one-third of adults In the US experiencing insomnia at some point In their lives. This condition is characterized by difficulty in falling and staying asleep, which significantly impacts an individual's quality of life. The increasing awareness about sleep disorders and their consequences has led to a rise In the number of diagnostic tests and checkups. As a result, the demand for sleep aids, including melatonin supplements, has grown.

Melatonin, a hormone produced by the pineal gland, plays a crucial role in regulating sleep-wake cycles and circadian rhythms. Its therapeutic effects extend beyond sleep disorders, as it is also used to manage anxiety, depression, and migraines. Furthermore, melatonin possesses antioxidant properties, making it an attractive option for managing aging-related conditions. The market in North America is expected to grow due to the increasing prevalence of sleep disorders and the growing awareness about the benefits of melatonin supplements.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Melatonin Industry?

- Increase in human life expectancy and number of working hours is the key driver of the market. The aging population is a growing demographic trend in many countries, including the United States, due to advancements in healthcare and medicine that enable people to live longer. Some individuals choose to continue working past the traditional retirement age, either out of financial necessity or a desire to remain active. This trend is observed in countries with large geriatric populations, such as Japan, South Korea, China, Germany, Israel, and the United States. Stressful lifestyles are prevalent in today's fast-paced society, leading to various health issues, including insomnia. Healthcare professionals have identified melatonin as a potential sleep aid for individuals suffering from sleep disorders, developmental disorders, and neurological conditions.

- Melatonin is a biogenic amine that helps regulate sleep-wake cycles, making it an effective solution for those struggling with sleep. In the medical field, melatonin is gaining popularity as an insomnia medicine due to its ability to improve sleep quality without causing the next-day drowsiness associated with other sleep aids. The use of melatonin supplements has been studied extensively, and the results suggest that it can help individuals fall asleep faster and stay asleep longer. As the population ages and stressful lifestyles become more common, the demand for effective sleep aids like melatonin is expected to increase. Healthcare professionals recommend melatonin as a natural and safe alternative to prescription sleep medications, making it an attractive option for those seeking relief from insomnia.

What are the market trends shaping the Melatonin Industry?

- Rise in geriatric population is the upcoming market trend. The aging population is a significant demographic trend in major countries, including the US, Japan, South Korea, China, and Germany. This demographic shift increases the prevalence of sleep disorders and related conditions among older adults. As people age, their bodies undergo natural changes that can disrupt sleep patterns. According to research, over half of all adults aged 65 and above experience chronic sleep-related issues. These issues include difficulty staying asleep, insufficient nightly sleep, and difficulty falling asleep. These sleep disorders are common in older adults due to the natural aging process. The increased life expectancy, driven by advancements in healthcare and treatment options, has led to a larger geriatric population.

- Sleep disorders in older adults are a growing concern due to their potential links to age-related diseases such as Type 2 diabetes and cardiovascular diseases. To address these sleep issues, many individuals turn to melatonin supplements as a natural alternative to pharmaceutical sleep aids. Melatonin, a hormone naturally produced by the body, helps regulate sleep-wake cycles. Its use as a dietary supplement has gained popularity due to its potential benefits for improving sleep quality.

What challenges does the Melatonin Industry face during its growth?

- Government rules and regulations is a key challenge affecting the industry growth. Melatonin, a naturally occurring hormone, plays a crucial role in regulating the sleep-wake cycle. As a dietary supplement In the US, its use is governed by the Food and Drug Administration (FDA). However, the American Academy of Sleep Medicine (AASM) advises against its use for treating insomnia due to limited efficacy and insufficient evidence. Chronic insomnia and sleep disorders, particularly in children, are prevalent health issues, leading to an increasing demand for sleep aids. According to sleep statistics, approximately 70 million Americans suffer from sleep disorders. Melatonin is also used for muscle protection and women's health. However, its use for jet lag is not recommended by the UK's National Health Service (NHS), and it's not routinely funded by them.

Exclusive Customer Landscape

The melatonin market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the melatonin market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, melatonin market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aspen Pharmacare Holdings Ltd.

- Biotics Research Corp.

- BYHEALTH Co. Ltd.

- Church and Dwight Co. Inc.

- Harbin Pharmaceutical Group Co. Ltd.

- Jamieson Wellness Inc.

- Joshi Agrochem Pharma Pvt. Ltd.

- Natrol LLC

- Nestle SA

- NOW Health Group Inc.

- Otsuka Holdings Co. Ltd.

- Pfizer Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Melatonin supplements have gained significant attention In the health and wellness industry due to their potential therapeutic effects on sleep quality and sleep patterns. As people seek natural alternatives to pharmaceutical sleep aids, melatonin has emerged as a popular choice. Melatonin is a hormone produced by the pineal gland, which regulates sleep-wake cycles and circadian rhythms. Its production decreases with age and certain health conditions, leading to sleep disorders such as insomnia, jet lag, and circadian rhythm disorders. Melatonin supplements, available in gummies, powder, or tablets, can help improve sleep quality in individuals suffering from age-related diseases like type 2 diabetes, cardiovascular diseases, neurodegenerative diseases, and cancer.

Melatonin's antioxidant properties also help protect against oxidative stress, making it an essential supplement for those dealing with anxiety, depression, migraine, and other neurological conditions. The increasing aging population and stressful lifestyles have led to a rise In the prevalence of sleep disorders, further fueling the demand for melatonin supplements. Healthcare professionals often recommend melatonin as a safe and effective sleep aid for chronic insomnia, pediatric ingestions, and women's health concerns. With the growing self-care trends, melatonin supplements continue to gain popularity as a natural and effective solution for managing sleep disorders and promoting overall health.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

136 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.03% |

|

Market growth 2024-2028 |

USD 924.9 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

8.88 |

|

Key countries |

US, Germany, China, Canada, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Melatonin Market Research and Growth Report?

- CAGR of the Melatonin industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the melatonin market growth of industry companies

We can help! Our analysts can customize this melatonin market research report to meet your requirements.