Metal Additive Manufacturing Market Size 2025-2029

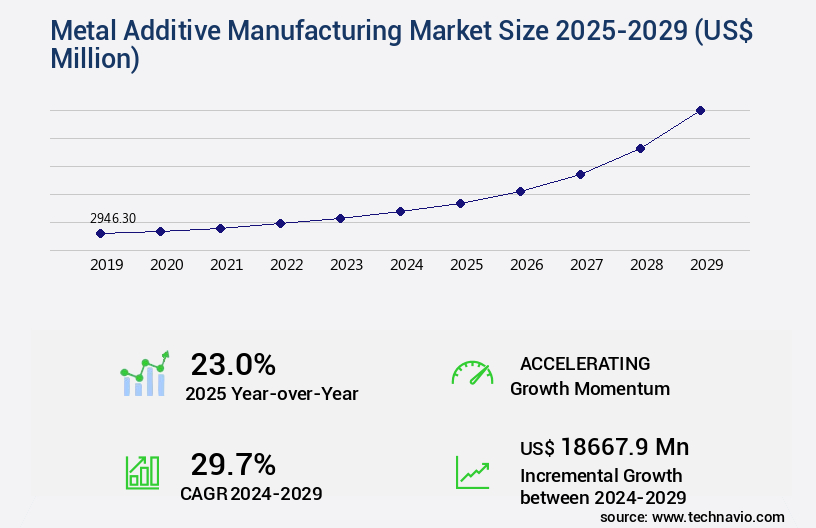

The metal additive manufacturing market size is valued to increase USD 18.67 billion, at a CAGR of 29.7% from 2024 to 2029. Increased preference for additive manufacturing will drive the metal additive manufacturing market.

Major Market Trends & Insights

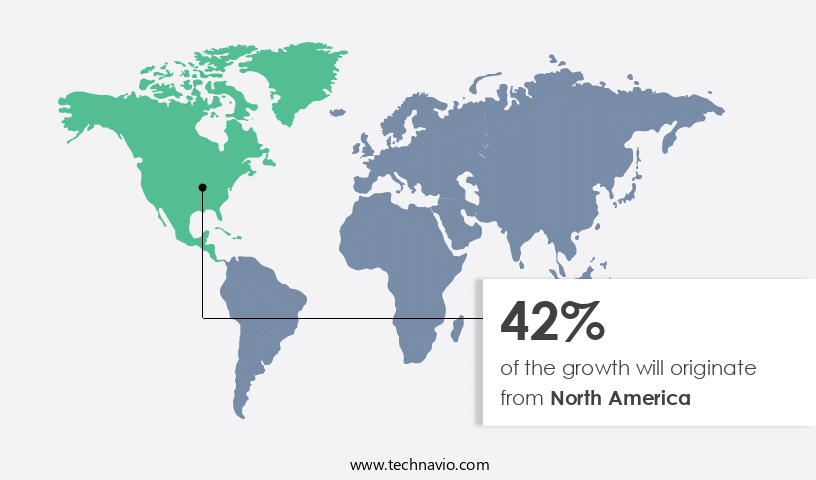

- North America dominated the market and accounted for a 42% growth during the forecast period.

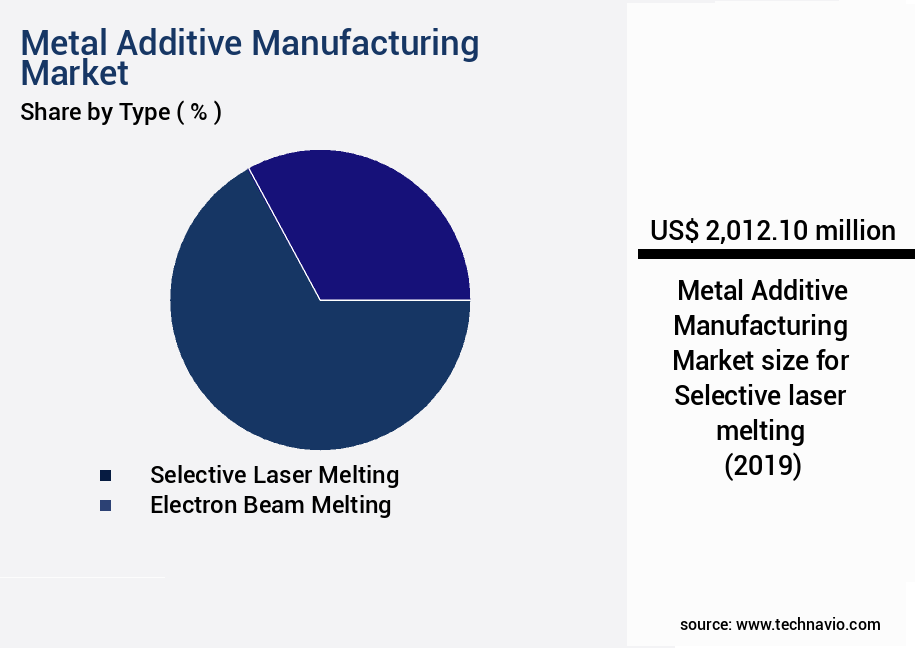

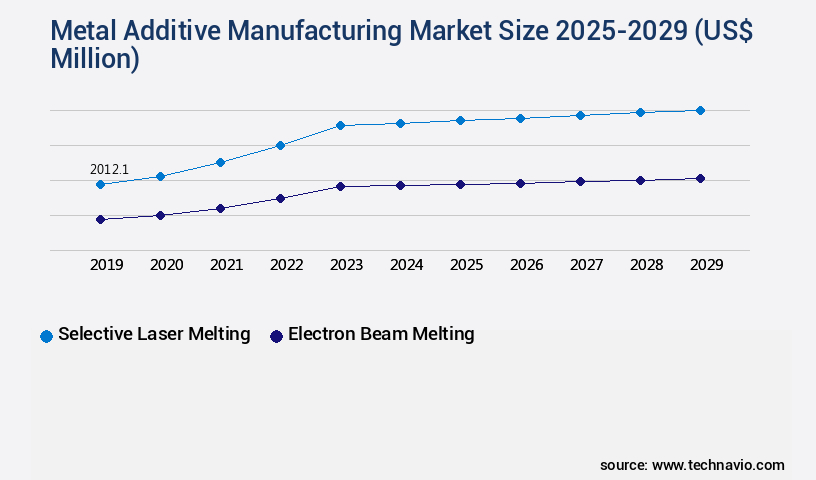

- By Type - Selective laser melting segment was valued at USD 2.01 billion in 2023

- By Application - Aerospace segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 771.10 million

- Market Future Opportunities: USD 18667.90 million

- CAGR : 29.7%

- North America: Largest market in 2023

Market Summary

- The market encompasses the production of three-dimensional metal components using additive manufacturing technologies. This sector is characterized by continuous evolution, driven by advancements in core technologies such as Selective Laser Melting (SLM) and Electron Beam Melting (EBM), which enable the production of complex geometries and high-performance alloys. Applications span industries like aerospace, automotive, and healthcare, with service types including design, engineering, and post-processing gaining traction. Despite the advantages of additive manufacturing, challenges persist, including high production costs. However, the market's potential is vast, with The market share in the industrial 3D printing sector projected to reach 28% by 2025, according to recent market research.

- The ongoing development of new materials and increased industry adoption further underscores the market's dynamism and potential for growth.

What will be the Size of the Metal Additive Manufacturing Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Metal Additive Manufacturing Market Segmented and what are the key trends of market segmentation?

The metal additive manufacturing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Selective laser melting

- Electron beam melting

- Application

- Aerospace

- Healthcare

- Tools and mold

- Automobile

- Others

- Component

- Systems

- Materials

- Service and parts

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The selective laser melting segment is estimated to witness significant growth during the forecast period.

Metal additive manufacturing, a cutting-edge technology, is revolutionizing industries with its capacity to create complex metal parts layer by layer. The market is currently experiencing significant growth, with selective laser melting (SLM) being the largest segment. SLM, an additive manufacturing process, utilizes a high-powered laser to melt and fuse metal powders, resulting in parts with isotropic thermal and mechanical properties. This method produces strong and durable components, primarily from metals like titanium alloys, nickel alloys, stainless steel, and cobalt chrome alloys. SLM's market dominance is expected to persist due to its ability to create high-strength steel, aluminum alloys, and other advanced materials with superior mechanical properties.

SLM's applications extend across various sectors, including aerospace, automotive, healthcare, and energy. The market for metal additive manufacturing is projected to expand further, with industry experts anticipating a 21.3% increase in demand for metal 3D printing in the automotive sector by 2025. Additionally, the market for aerospace applications is projected to grow by 25.5% during the same period. SLM's process parameters, such as scan speed, energy density, and layer thickness, are crucial in ensuring the quality of the final product. Post-processing techniques, including heat treatment, surface roughness reduction, and microstructure analysis, are essential for optimizing the mechanical properties of the printed parts.

Quality control measures, such as build parameters and defect detection, are also essential to ensure the reliability and consistency of the final product. Emerging technologies, like electron beam melting and binder jetting, are gaining traction in the market due to their unique advantages. For instance, electron beam melting offers higher resolution and better surface finish, making it suitable for producing high-precision components. Binder jetting, on the other hand, uses a liquid binder to bind metal powders, enabling the production of large, complex parts. In conclusion, The market is experiencing robust growth, with selective laser melting leading the charge.

The market's expansion is driven by advancements in process technologies, materials, and applications across various industries. The future of metal additive manufacturing looks promising, with experts anticipating continued growth and innovation in this evolving technology.

The Selective laser melting segment was valued at USD 2.01 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Metal Additive Manufacturing Market Demand is Rising in North America Request Free Sample

The market in North America: A Key Growth Driver in the Global Industry The North American region dominates the global Metal Additive Manufacturing (AM) market, accounting for a significant revenue share. The US, Canada, and Mexico are major contributors to the market's growth in this region. The aerospace and healthcare industries are primary drivers, with increasing demand for metal AM in these sectors. In the US, the healthcare industry, particularly the demand for dental and implants, is a significant growth factor.

The mature North American economy, with investments in industries like automotive, chemical, and tools and molding, further boosts the market. The US and Canada are expected to maintain their market leadership due to their robust industrial sectors and continuous technological advancements.

Market Dynamics

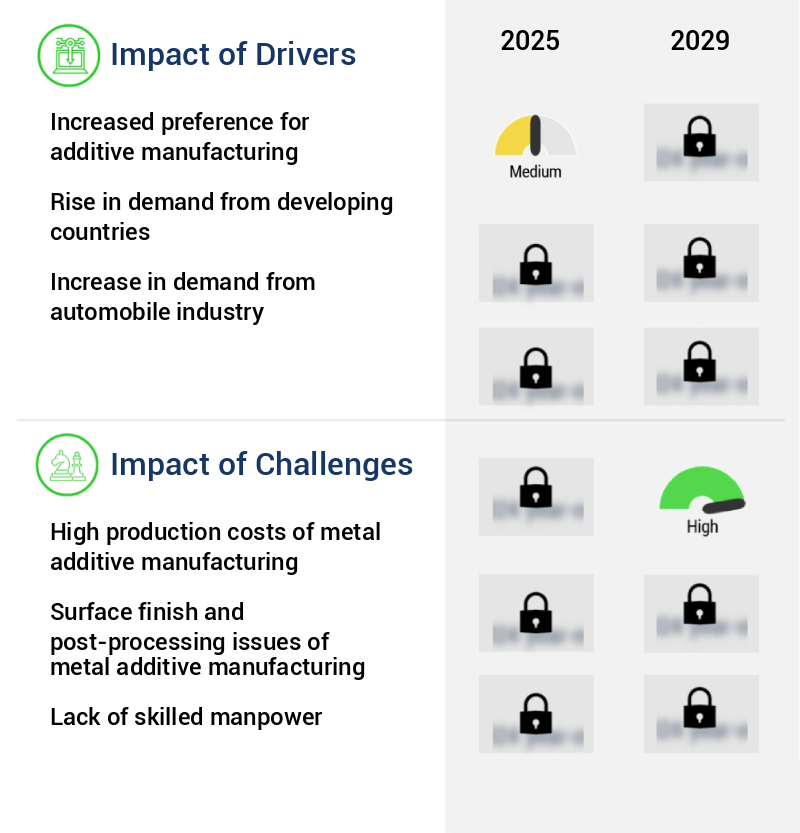

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses various technologies, including titanium alloy laser powder bed fusion, high-strength steel electron beam melting, aluminum alloy directed energy deposition, and stainless steel selective laser melting. These processes offer unique advantages, such as complex part geometry optimization and support structure design strategies, making them increasingly popular in industries like aerospace and automotive for manufacturing components. One significant trend in the market is the optimization of process parameters to influence mechanical properties. For instance, nickel alloy binder jetting process optimization leads to improved microstructure analysis in COCr alloys. Moreover, additive manufacturing design guidelines play a crucial role in ensuring the production of high-quality components.

Defect detection methods in additive manufacturing are continually evolving to address challenges related to real-time monitoring of melt pool dynamics and computational fluid dynamics simulation. These advancements are essential for cost optimization strategies in additive manufacturing, which is crucial as production scaling becomes increasingly challenging. Comparatively, the aerospace industry accounts for a significantly larger share in the adoption of additive manufacturing compared to the automotive sector. More than 70% of new aerospace component developments utilize additive manufacturing technologies, with medical implant manufacturing also showing strong growth. Despite these advancements, the industry faces hurdles, such as material selection criteria for various applications and the optimization of process parameters to achieve desired mechanical properties.

Post-processing heat treatment effects and defect detection methods are critical areas of ongoing research to ensure the production of high-quality, reliable components. In conclusion, the market is experiencing rapid growth, driven by advancements in technology and increasing adoption across various industries. Understanding the market dynamics, including process optimization, material selection, and defect detection, is essential for businesses looking to leverage the benefits of additive manufacturing.

What are the key market drivers leading to the rise in the adoption of Metal Additive Manufacturing Industry?

- The significant surge in the preference for additive manufacturing is the primary factor fueling market growth. Additive manufacturing, also known as 3D printing, is revolutionizing industries by enabling the production of complex components with minimal material waste and customization possibilities. This technology's increasing adoption across various sectors, including automotive, aerospace, healthcare, and consumer goods, is driving market expansion.

- Additive manufacturing, also known as 3D printing, is revolutionizing the production of complex engineering structures with its ability to create parts directly from computer-aided design (CAD) models. The market's growth is fueled by the high flexibility and low production costs associated with this technology. By producing fewer parts, less material waste, and reducing assembly time for intricate components, additive manufacturing eliminates the need for tooling. This allows for the creation of components with minimal requirements and any geometry, leading to improved process chains. Metal additive manufacturing is a significant contributor to this market's growth. Its advantages, such as reduced material waste and the ability to produce complex geometries, are driving demand.

- The process's versatility enables engineers and designers to innovate and optimize existing product designs, making it an essential tool for various industries, including aerospace, automotive, and healthcare. Moreover, additive manufacturing's potential for customization and rapid prototyping has made it a valuable asset in various sectors. It enables businesses to quickly adapt to market demands and produce bespoke solutions, giving them a competitive edge. As the technology continues to evolve, it is expected to disrupt traditional manufacturing processes and create new opportunities. In conclusion, the additive manufacturing market is experiencing significant growth due to its numerous advantages, including flexibility, low production costs, and the ability to create complex components directly from CAD models.

- The technology's potential for customization and rapid prototyping further enhances its value, making it an essential tool for various industries.

What are the market trends shaping the Metal Additive Manufacturing Industry?

- Advancements in new materials are currently shaping market trends. The adoption of innovative materials is a significant development in various industries.

- In 2024, additive manufacturing, also known as 3D printing, experienced significant advancements as innovators continued to explore the boundaries of printable materials. High-performance polymers emerged as a key focus due to their superior quality outcomes in additive manufacturing processes. These polymers offer unparalleled adaptability, making them an attractive option for various applications. Their resistance to extreme heat and stress, coupled with their ability to create intricate geometries, sets them apart. Furthermore, metals like steel and titanium have gained popularity in additive manufacturing for industrial applications. The unique features of these materials have contributed to the growing appeal of additive manufacturing across diverse industries.

- The potential for producing complex parts with enhanced properties continues to drive the evolution of this technique.

What challenges does the Metal Additive Manufacturing Industry face during its growth?

- The high production costs associated with metal additive manufacturing represent a significant challenge that can hinder industry growth. To expand, the intricacies and complexities involved in producing metal components using additive manufacturing technologies contribute to increased expenses, which may deter potential investors and hinder the industry from achieving more widespread adoption.

- Metal additive manufacturing, or 3D printing with metal powders, is a rapidly evolving industry that presents significant opportunities for businesses seeking innovative production methods. However, the high production costs associated with metal powders and the limited build envelopes of current technologies pose challenges to market growth. For instance, the cost of small coarse-grain metal powders, such as aluminum, steel, and iron, is approximately twice that of materials used in conventional manufacturing processes. This price disparity can hinder market expansion. Furthermore, large components produced through metal additive manufacturing often require additional processes, such as mechanical joining and welding, which can add to the overall production cost.

- Despite these challenges, the industry continues to advance, with ongoing research and development efforts aimed at reducing costs and expanding build envelope sizes. As a result, businesses across various sectors are increasingly exploring the potential of metal additive manufacturing to improve efficiency, reduce waste, and create complex components that were previously unfeasible with traditional manufacturing methods.

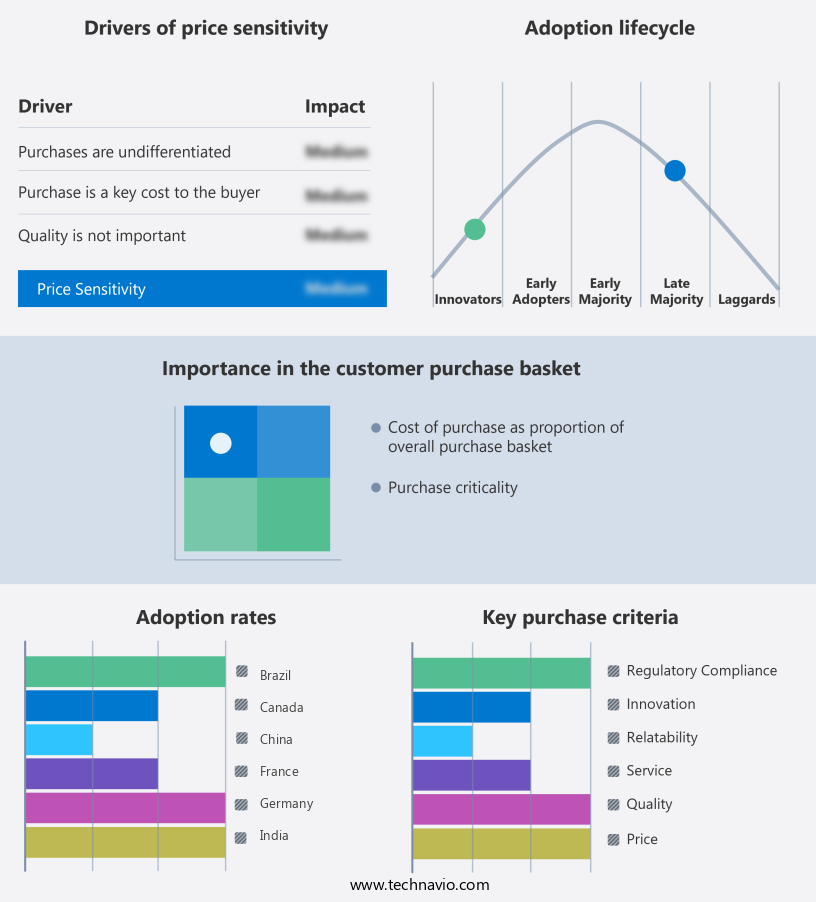

Exclusive Customer Landscape

The metal additive manufacturing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the metal additive manufacturing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Metal Additive Manufacturing Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, metal additive manufacturing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3D Systems Corp. - This company specializes in metal additive manufacturing systems, featuring fully integrated machines with a Removable Print Module. The vacuum-sealed module ensures a controlled print environment, while its mobility between printer and powder modules streamlines continuous production workflows.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3D Systems Corp.

- 3DEO Inc.

- Additive Industries BV

- Desktop Metal Inc.

- DMG MORI Co. Ltd.

- EOS GmbH

- General Electric Co.

- Hoganas AB

- MATERIALISE NV

- Norsk Titanium AS

- Optomec Inc.

- Renishaw Plc

- Sciaky Inc.

- SLM Solutions Group AG

- Stratasys Ltd.

- The Lincoln Electric Co.

- Titomic Ltd.

- TRUMPF SE Co. KG

- Xjet Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Metal Additive Manufacturing Market

- In January 2024, GE Additive, a leading player in the Metal Additive Manufacturing (AM) market, announced the launch of its new Arcam EBM System, the EBM Q10 Plus, designed for the production of high-performance metal parts in the aerospace and automotive industries. This new product expansion underscores GE Additive's commitment to driving innovation in the AM sector (GE Additive press release).

- In March 2024, 3D Systems and Desktop Metal, two major players in the AM industry, announced a strategic partnership to combine their respective strengths in metal and polymer additive manufacturing. This collaboration aims to provide a comprehensive additive manufacturing solution for businesses, enabling them to produce both polymer and metal parts under one roof (3D Systems press release).

- In May 2024, SLM Solutions, a German metal AM technology provider, secured a significant investment of €30 million from Siemens AG to expand its production capacity and accelerate the development of new technologies. This strategic investment underscores Siemens' commitment to the AM market and its belief in SLM Solutions' potential (Reuters).

- In January 2025, the European Union (EU) approved the Horizon Europe research and innovation program, which includes a focus on additive manufacturing technologies. This €95.5 billion funding initiative will support research and innovation in various sectors, including AM, with the aim of making Europe a global leader in technology development (European Commission press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Metal Additive Manufacturing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 29.7% |

|

Market growth 2025-2029 |

USD 18667.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

23.0 |

|

Key countries |

US, Canada, Germany, China, Japan, UK, France, India, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, with key technologies such as Directed Energy Deposition (DED) and Selective Laser Melting (SLM) leading the charge. DED, which includes processes like Laser Engineered Net Shaping (LENS) and Electron Beam Melting (EBM), excels in the production of large, complex components. In contrast, SLM, a form of Powder Bed Fusion, is renowned for its high-resolution capabilities, enabling intricate part geometries and lattice structures. Support structures play a crucial role in both DED and SLM processes, ensuring part stability during manufacturing and reducing the risk of warping or distortion. Topology optimization and part geometry optimization techniques are increasingly being employed to minimize material usage and enhance part performance.

- Heat treatment, a critical post-processing technique, significantly impacts the mechanical properties of additively manufactured components. Titanium alloys, nickel alloys, stainless steel, and Cocr alloys are popular choices for additive manufacturing due to their high-strength and excellent mechanical properties. Surface roughness and thermal management are ongoing concerns in the metal additive manufacturing industry. Advancements in process parameters, scan speed, energy density, and build parameters are continuously being explored to address these challenges. Material extrusion and binder jetting are alternative additive manufacturing technologies, each offering unique advantages. Aluminum alloys and high-strength steel are common materials used in material extrusion processes, while binder jetting is often employed for the production of sand molds and cores.

- Microstructure analysis and defect detection techniques are essential for ensuring the quality of additively manufactured components. Process parameters, layer thickness, and electron beam melting are key factors influencing the microstructure and mechanical properties of the final product. In summary, the market is characterized by continuous innovation and technological advancements. From DED and SLM to heat treatment and post-processing techniques, the industry is focused on improving part performance, reducing material usage, and enhancing manufacturing efficiency.

What are the Key Data Covered in this Metal Additive Manufacturing Market Research and Growth Report?

-

What is the expected growth of the Metal Additive Manufacturing Market between 2025 and 2029?

-

USD 18.67 billion, at a CAGR of 29.7%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Selective laser melting and Electron beam melting), Application (Aerospace, Healthcare, Tools and mold, Automobile, and Others), Geography (North America, Europe, APAC, South America, and Middle East and Africa), and Component (Systems, Materials, and Service and parts)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increased preference for additive manufacturing, High production costs of metal additive manufacturing

-

-

Who are the major players in the Metal Additive Manufacturing Market?

-

Key Companies 3D Systems Corp., 3DEO Inc., Additive Industries BV, Desktop Metal Inc., DMG MORI Co. Ltd., EOS GmbH, General Electric Co., Hoganas AB, MATERIALISE NV, Norsk Titanium AS, Optomec Inc., Renishaw Plc, Sciaky Inc., SLM Solutions Group AG, Stratasys Ltd., The Lincoln Electric Co., Titomic Ltd., TRUMPF SE Co. KG, and Xjet Ltd.

-

Market Research Insights

- The market encompasses the production of complex geometry parts using real-time monitoring technologies. This industry continues to advance, with significant growth in the production of automotive and aerospace components. According to industry estimates, the market for metal additive manufacturing is projected to reach USD50 billion by 2025, representing a compound annual growth rate of 20%. Dimensional accuracy and surface finish are critical factors in the production of high-quality parts. Advanced process simulation and in-situ monitoring technologies enable part qualification and design validation. Material selection and certification standards are essential considerations in the manufacturing process.

- Cost optimization is a key driver in the adoption of metal additive manufacturing, particularly for custom designs. Melt pool dynamics and heat transfer modeling are essential in optimizing the manufacturing process. Automated systems with closed-loop control enhance production scaling and improve process monitoring. In the medical field, metal additive manufacturing is revolutionizing the production of implants, with a focus on custom design and improved surface finish. Finite element analysis and computational fluid dynamics are used extensively in the design and testing of aerospace components to ensure safety and efficiency. Two significant advancements in metal additive manufacturing are the integration of AM process simulation and powder characterization.

- These technologies enable the optimization of manufacturing processes and the improvement of material properties, respectively. With continuous innovation and advancements, the future of metal additive manufacturing is promising.

We can help! Our analysts can customize this metal additive manufacturing market research report to meet your requirements.