Metal Powders Market Size 2024-2028

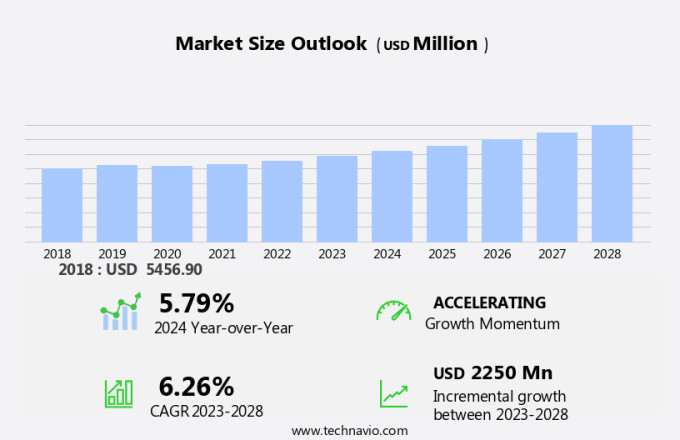

The metal powders market size is forecast to increase by USD 2.25 billion at a CAGR of 6.26% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing adoption of powder metallurgy (PM) technology for metal part production. This technology is particularly prominent in the manufacturing of radiators and automotive components. In the automotive industry, metal powders are employed to create engine parts, brakes, bearings, gears, and clutch plates. One of the key trends in this market is the increasing focus on titanium metal powders, driven by their superior properties and environmental benefits. However, challenges persist in the form of particle size distribution, surface condition, and particle shape inconsistencies. These issues are being addressed through advancements in atomization towers and additive manufacturing (AM) technologies. For instance, the Catamold business in Shanghai, China, is pioneering innovative solutions to produce high-quality metal powders with consistent particle size and shape.

What will the size of the market be during the forecast period?

- The market has experienced significant fluctuations due to various external factors. The onset of lockdowns and travel restrictions worldwide has led to disruptions in the supply chain, resulting in quarantined workforces and the shutdown of factories. This situation has affected the production and demand for metal powders, particularly in industries such as automotive and chemical. Despite these challenges, the market continues to show promise, particularly in emerging countries. The increasing adoption of 3D printing technology and the rise of lightweight electric vehicles have fueled the demand for metal powders in these regions.

- The automotive sector, a significant consumer of metal powders, has been impacted by the disruptions. However, the trend towards producing lightweight and fuel-efficient vehicles is expected to drive the demand for metal powders in the long term. The ferrous type segment, which includes iron and steel powders, is expected to dominate the market due to its extensive use in the automotive industry. The chemical method is the primary production process for metal powders. This process involves the reduction of metal salts or metal oxides in a liquid medium to produce metal powders. Other production methods include the mechanical and thermal reduction processes.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Automotive

- Aerospace and defense

- Healthcare

- Construction

- Others

- Type

- Ferrous metal powder

- Non-ferrous metal powder

- Alloy

- Geography

- North America

- US

- Europe

- Germany

- Italy

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

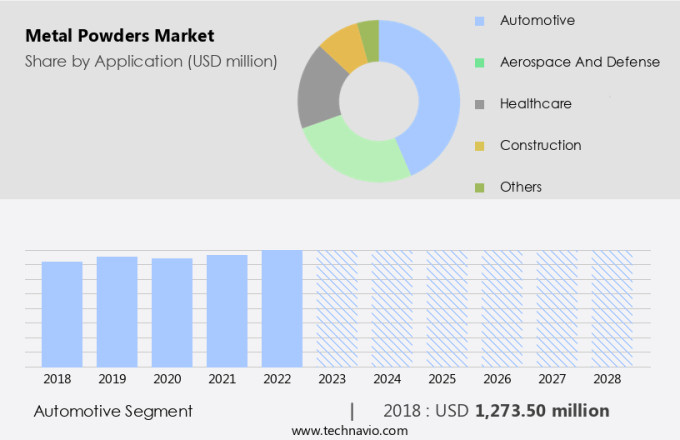

By Application Insights

- The automotive segment is estimated to witness significant growth during the forecast period.

The market holds substantial importance in the US manufacturing sector, particularly in industries such as automotive, medical, and defense. Metal powders, including those of iron, aluminum, bronze, and nickel, are extensively utilized in the production of various components. In the automotive industry, metal powders are employed to create engine parts, brakes, bearings, gears, and clutch plates. The escalating preference for lightweight materials and superior performance components in the automotive sector is fueling the expansion of the market in the US. The application of metal powders in the automotive industry offers numerous benefits. These advantages include enhanced strength, improved wear resistance, decreased weight, and heightened efficiency.

For example, the adoption of aluminum powders in the fabrication of automotive components can lead to a substantial reduction in vehicle weight and enhanced fuel efficiency. However, the market in the US has been impacted by the disruptions caused by quarantined workforces and the shutdown of businesses. These challenges have resulted in a disrupted supply chain, affecting the production and distribution of metal powders. Despite these hurdles, the market is expected to recover and grow steadfastly due to the increasing demand for lightweight materials and high-performance components.

Get a glance at the market report of share of various segments Request Free Sample

The automotive segment was valued at USD 1.27 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is projected to expand due to the significant usage of iron powder in various industries. Iron powder is primarily utilized in applications like brazing, steel cutting, and surface coating. The increasing demand for steel in sectors such as rail, manufacturing, automotive, infrastructure, energy, machinery, and equipment is anticipated to fuel the growth of the market in North America. The United States is the primary consumer of iron powder in North America, with a substantial demand originating from the automotive industry. PM parts, which are extensively used in the automotive sector for applications including accessory motors and sensors, are made from iron powder.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Metal Powders Market?

Increasing use of PM technology is the key driver of the market.

- Metal powders have gained significant traction in various industries due to the increasing adoption of Powder Metallurgy (PM) technology. PM is a manufacturing process that transforms metal powders into intricate parts and components with high precision and efficiency. This technology is extensively utilized in sectors like automotive, aerospace, medical, and electronics. PM offers advantages such as cost savings, reduced material wastage, enhanced mechanical properties, and increased design flexibility. The burgeoning airplane fleet in the global deliveries sector, coupled with the expanding domestic aviation market and the air passenger market, is driving the demand for metal powders in the aerospace industry.

- Furthermore, the increasing production of new energy vehicles, including electric cars and buses, is fueling the demand for metal powders in the automotive industry. In the electronics sector, the production of electronic products such as laptops, TVs, mobile phones, and refrigerators is driving the demand for metal powders. PM technology's ability to create complex shapes with high precision and efficiency makes it an ideal choice for manufacturing components in these products.

What are the market trends shaping the Metal Powders Market?

Increasing focus on titanium metal powders is the upcoming trend in the market.

- Titanium metal powders have gained significant attention market due to their increasing demand in various industries. The need for lightweight, strong materials in sectors such as aerospace, automotive, and healthcare drives the market growth. Titanium metal powders offer desirable mechanical properties, including high strength, low density, and excellent corrosion resistance. Furthermore, they have a high melting point, making them suitable for high-temperature applications. In recent times, the utilization of titanium metal powders in additive manufacturing, also known as 3D printing, has witnessed a notable surge. This advanced technology enables the production of complex geometries and structures, leading to increased efficiency and reduced production costs.

- As a result, industries are increasingly adopting titanium metal powders for manufacturing components with intricate designs and enhanced performance. Cobalt metal powders, another significant segment in the market, are widely used in the production of superalloys and hard materials. They offer high melting points, excellent wear resistance, and high strength. The increasing demand for these properties in various industries, such as automotive, energy, and aerospace, is expected to fuel the growth of the cobalt market. Metal carbides, another type of metal powder, are gaining popularity due to their excellent hardness and high melting points. They are extensively used in the production of refractories, abrasives, and cutting tools.

What challenges does Metal Powders Market face during the growth?

Environmental issues regarding metal powders is a key challenge affecting the market growth.

- Metal powders, particularly those derived from base materials used in radiator manufacturing, can pose significant health risks when inhaled or come into contact with the skin. These microscopic particles, often invisible to the naked eye, can be absorbed into the body through respiration or skin contact, leading to various health concerns. One of the primary hazards of metal powders is their combustibility. When ignited, metal dust can result in explosive reactions, posing a severe threat to workers in industries that utilize additive manufacturing (AM) processes, such as those using atomization towers or Catamold business. The health risks associated with metal dust exposure are extensive and can range from minor respiratory irritation to life-threatening conditions, including pneumoconiosis, systemic poisoning, hard metal disease, inflammatory lung injuries, cancer, and allergic responses.

- The severity of these health risks depends on the specific properties of the metal powder, including its particle size distribution, surface condition, and shape. For instance, chromium-containing metal powders have been linked to increased health risks due to their toxicity. Therefore, it is crucial for industries dealing with metal powders to implement stringent safety measures to minimize exposure and protect their workforce. In conclusion, metal powders, particularly those derived from base materials used in radiator manufacturing, can pose significant health risks when inhaled or come into contact with the skin. The hazards associated with these powders depend on their specific properties, including particle size distribution, surface condition, and shape. Implementing safety measures to minimize exposure is essential to protect workers and mitigate potential health risks.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alcoa Corp.

- American Chemet Corp.

- AMETEK Inc.

- AMG Advanced Metallurgical Group NV

- Allegheny Technologies Inc.

- BASF SE

- Carpenter Technology Corporation

- CNPC Powder Group Co. Ltd.

- FOMAS S.p.A.

- GKN Sinter Metals Engineering GmbH

- Hoganas AB

- Jiande Yitong Metal Powder Co. Ltd.

- JFE Holdings Inc.

- Kennametal Inc.

- Kymera International

- Linde Plc

- Miba AG

- Rio Tinto Ltd.

- Sandvik AB

- voestalpine AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Metal powders have gained significant attention in various industries due to their application in advanced technologies such as 3D printing. The market is experiencing disruptions due to lockdowns and travel restrictions caused by the ongoing pandemic. The automotive sector, a major consumer of metal powders, has been significantly impacted by the shutdown of factories and quarantined workforces. The ferrous type segment, which includes iron, aluminum, and nickel, dominates the market. Emerging countries are expected to witness substantial growth in the market due to the increasing demand for lightweight electric vehicles and the expansion of the domestic aviation market.

Moreover, 3D-printing technologies have revolutionized the production of lightweight parts in industries such as aerospace, medical, and defense. The chemical method is the most commonly used process for producing metal powders. The market demand for metal powders is driven by their unique bulk properties, such as reactivity, flow ability, compressibility, porosity, hardenability, and surface condition. The market for metal powders is forecasted to grow significantly in the short term due to the increasing demand for metal parts production in various industries. The electronics industry, including the production of laptops, TVs, mobile phones, refrigerators, and radiators, is a significant consumer of metal powders.

Furthermore, the environmental implications of metal powder production are a concern, and efforts are being made to minimize the impact on the environment. The market for metal powders is expected to grow in the medical industry, particularly in the dental field, due to the production of implants and other medical devices. The defense industry also uses metal powders for the production of magnetic products, pulleys, differential gear sets, helical gears, bevel gears, planetary gears, sprockets, output pulleys, fuel system flanges, exhaust flanges, access covers, spacers, racks, and other components. Exporters play a crucial role in The market, particularly in countries such as China, which is a major producer and exporter of metal powders.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

184 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.26% |

|

Market Growth 2024-2028 |

USD 2.25 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.79 |

|

Key countries |

US, China, Germany, Italy, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch