Metal Sawing Machine Market Size 2025-2029

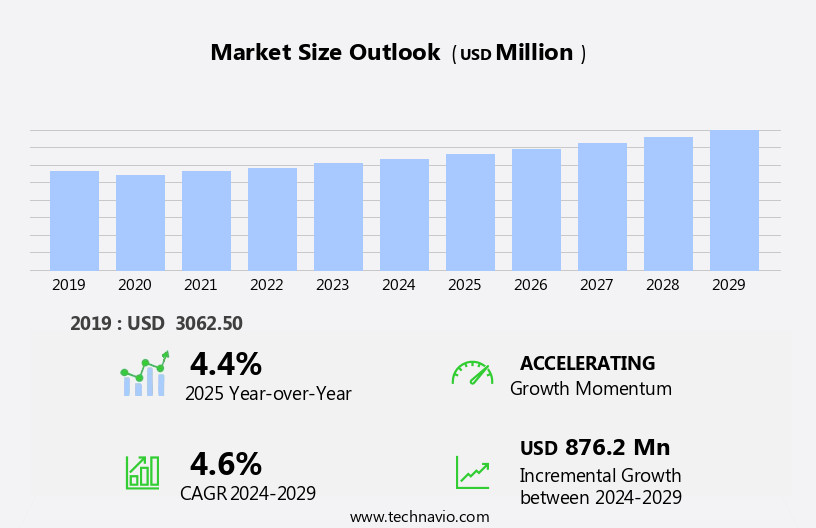

The metal sawing machine market size is forecast to increase by USD 876.2 million at a CAGR of 4.6% between 2024 and 2029.

- The market is experiencing significant growth due to increasing demand for metal parts in major end-user industries, particularly in automotive, construction, and manufacturing sectors. This trend is driven by ongoing industrialization and urbanization, leading to increased infrastructure development and the production of metal-intensive goods. Additionally, the integration of 3D printing technology in metal sawing processes is revolutionizing the industry by enabling faster and more precise production of metal components. However, the market faces challenges such as the fall in commodity prices, which has reduced the demand for scrap metal and affected the profitability of metal sawing machine manufacturers. Despite this, the market is expected to continue its growth trajectory, driven by the increasing demand for metal parts and the adoption of advanced technologies.

What will be the Size of the Metal Sawing Machine Market During the Forecast Period?

- The market encompasses a range of innovative technology solutions designed for precision cutting of various metals. These machines cater to diverse industries, including material handling, building and construction, aerospace and defense, and advanced manufacturing technologies. The market is driven by the demand for customized sawing solutions that deliver high-quality cuts in beveling, mitering, contouring, and other applications. Lightweight materials, such as aluminum and titanium, are increasingly being used, necessitating the development of sawing machines capable of handling these materials with ease. Automatic metal cutting, fiber laser cutting, micro cutting, waterjet cutting machines, and other specialized cutting technologies are gaining popularity due to their ability to provide high precision and consistent results.

- Moreover, the market is expected to grow significantly, driven by the increasing adoption of computer numerical control (CNC) and other advanced manufacturing technologies in various sectors. Exports also play a crucial role in the market's expansion, as these technologies find demand in international markets. Overall, the market is a dynamic and evolving landscape, characterized by continuous innovation and a focus on delivering high-quality, efficient, and cost-effective solutions for precision metal cutting.

How is this Metal Sawing Machine Industry segmented and which is the largest segment?

The metal sawing machine industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Automotive

- General machinery

- Aerospace and defense

- Marine

- Others

- Product

- Flame cutting machine

- Laser cutting machine

- Plasma cutting machine

- Waterjet cutting machine

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- Italy

- North America

- Canada

- US

- Middle East and Africa

- South America

- APAC

By End-user Insights

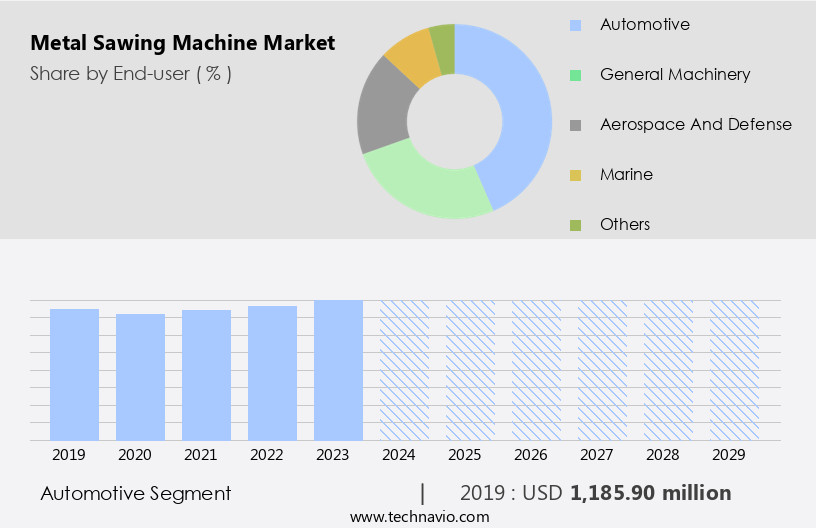

- The automotive segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to increasing demand from various sectors, including automotive, defense, building and construction, and aerospace and defense. Innovative technologies, such as CNC equipment, automated laser cutting, and automatic metal cutting, are driving market expansion. Customized sawing solutions catering to materials like aluminum, titanium, composites, and lightweight materials are gaining popularity. Precision cutting techniques, including beveling, mitering, contouring, and advanced manufacturing technologies like fiber laser cutting and micro cutting, are essential for producing high-quality components. The defense industry, with military budgets prioritizing high precision components, is a major consumer of metal sawing machines. Key sectors, such as electronics, telecommunication, marine, and eco-friendly manufacturing, also contribute to market growth. The trend towards real-time monitoring and high-precision components in various industries ensures a continuous demand for metal sawing machines.

Get a glance at the Metal Sawing Machine Industry report of share of various segments Request Free Sample

The automotive segment was valued at USD 1.19 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

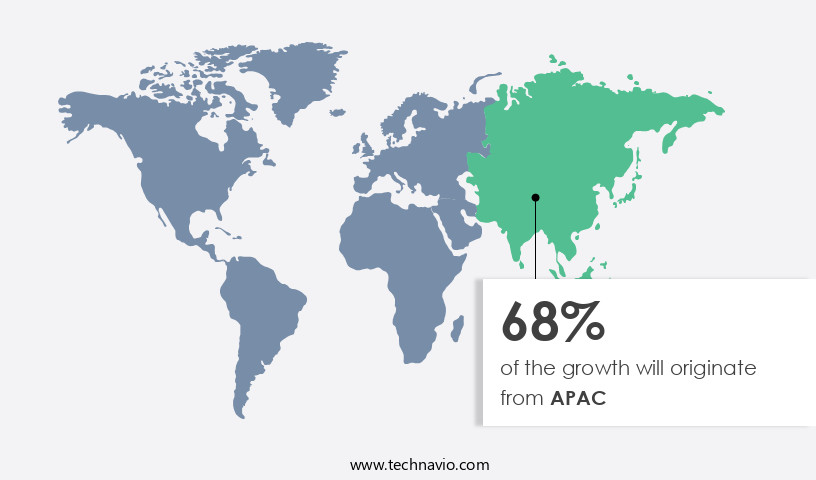

- APAC is estimated to contribute 68% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific (APAC) region is a significant manufacturing hub for various industries, including those that utilize metal sawing machines as key equipment. The expanding population in APAC has driven the demand for consumer goods and commodities, leading manufacturers to enhance their production capacities. This is achieved through the expansion of existing facilities or the construction of new ones, equipped with advanced machinery such as metal sawing machines. Advanced machinery reduces operational costs and improves efficiency. Several APAC countries are investing in the development of advanced aircraft and sophisticated onboard systems for enhanced aerial defense capabilities. Innovative technologies, including customized sawing solutions, precision cutting, beveling, mitering, contouring, and lightweight materials like aluminum, titanium, and composites, are transforming the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Metal Sawing Machine Industry?

Increasing demand for metal parts in major end-user industries is the key driver of the market.

- The market is driven by the significant demand from the automotive and aerospace and defense industries. These sectors rely heavily on metal as a primary raw material due to its ease of transformation and adaptability to various application needs. With a growing focus on lean manufacturing and operational efficiency, metal sawing machines become an indispensable tool for Original Equipment Manufacturers (OEMs). The automotive and aerospace and defense industries, being major consumers in the metal industry, witness substantial investments, thereby propelling the market growth. Innovative technology, such as CNC equipment, automated laser cutting, and automatic metal cutting, is revolutionizing the market.

- Furthermore, these advanced manufacturing technologies enable high precision cuts in lightweight materials like aluminum, titanium, composites, and other high-quality metals. The market caters to diverse applications, including beveling, mitering, contouring, and intricate part production, making it a versatile solution for various industries, such as building and construction, electronics, telecommunication, and marine. Moreover, the defense industry, with military budgets continuing to increase, is another significant end-user. The demand for high precision components in defense applications necessitates the use of specialized cutting machines like laser cutting machines, plasma cutting machines, and flame cutting machines. The eco-friendly approach to manufacturing is also gaining traction, with waterjet cutting machines and plasma cutting machines being preferred for their minimal waste generation.

What are the market trends shaping the Metal Sawing Machine Industry?

Integration of 3D printing technology is the upcoming market trend.

- The market is experiencing significant changes due to the integration of innovative technologies, such as 3D printing, into traditional sawing solutions. This technology allows for the reduction of raw material usage by up to 70%, leading to cost savings and increased efficiency for manufacturers. Incorporating 3D printing technology into metal sawing machines enables the production of high quality, precise cuts in various materials, including lightweight ones like aluminum, titanium, and composites. Moreover, industries such as defense, aerospace and defense, automotive, electronics, telecommunication, and infrastructure are increasingly adopting advanced manufacturing technologies like laser cutting, plasma cutting, and waterjet cutting for precision engineering of intricate parts.

- In addition, the defense industry, in particular, benefits from high precision components produced using these specialized cutting machines, contributing to national security and the production of high-quality metal for various applications. In addition to these industries, the building and construction sector also relies on metal sawing machines for general machinery applications, including circular saws, band saws, and plate saws. The integration of CNC equipment, automated laser cutting, and automatic metal cutting further enhances the capabilities of these machines, providing real-time monitoring and improved productivity. Furthermore, the eco-friendly approach of using advanced manufacturing technologies like 3D printing, laser cutting, plasma cutting, and waterjet cutting instead of traditional methods is gaining popularity in various sectors. This trend is expected to continue, driving the growth of the market.

What challenges does the Metal Sawing Machine Industry face during its growth?

Fall in commodity prices reducing demand for scrap is a key challenge affecting the industry growth.

- The market has been influenced by the price drop of key metals, including steel and iron ore, leading to a decrease in scrap metal prices. This reduction in demand for scrap metals has caused a stall in the auto-shredding industry, resulting in the idling of over 50 metal scrap yards. This trend negatively impacts the economy, as the US scrap industry is valued at over USD 100 billion annually. Innovative technology, such as laser cutting, plasma cutting, and waterjet cutting, are increasingly being adopted for customized sawing solutions in various industries, including material handling, building and construction, aerospace and defense, automotive applications, electronics, telecommunication sectors, and marine.

- Moreover, precision cutting techniques, such as beveling, mitering, contouring, and advanced manufacturing technologies, are essential for high-quality cuts in lightweight materials like aluminum, titanium, composites, and high-precision components. The defense industry, with military budgets, CNC equipment, and automated laser cutting, plays a significant role in the market's growth. An eco-friendly approach is also gaining popularity, as companies focus on reducing waste and increasing efficiency.

Exclusive Customer Landscape

The metal sawing machine market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the metal sawing machine market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, metal sawing machine market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Akiyama Machinery Co. Ltd: The company offers metal sawing machines such as band saw machine 600S and 600ST.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accurate cutting Systems Pvt. Ltd.

- Amada Co. Ltd.

- Behringer Saws Inc.

- Bekamak Band Saw Machines

- BHA TRADERS

- Carif Sawing Machines Srl

- Cosen Saws International Inc.

- Ernest Bennett Sheffield Ltd.

- EVERISING MACHINE CO.

- Fong Ho Machinery Industry Co. Ltd.

- ITL Industries Ltd

- KASTO Maschinenbau GmbH and Co. KG

- Maxmen Metal Sawing Co.

- MEBA Metall Bandsagemaschinen GmbH

- Mega machine Co. Ltd.

- Multicut Machine Tools

- PRECI CUT TOOLS STEELTECH AUTOMATIONS

- Prosaw Ltd.

- Water Jet Sweden AB

- Zhejiang weilishi machine Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of innovative technologies designed to provide customized sawing solutions for various industries. These machines are integral to material handling processes, enabling precision cutting of metals such as aluminum, titanium, and composites. The demand for sawing machines is driven by the need for high-quality cuts in sectors like building and construction, defense, aerospace and defense, automotive application, electronics, healthcare, telecommunication, and infrastructure activities. Sawing machines come in various forms, including circular saws, band saws, plate saws, vertical saws, and horizontal saws. Each type caters to specific requirements, offering advantages such as beveling, mitering, contouring, and the ability to handle lightweight materials.

Moreover, the integration of advanced manufacturing technologies, such as CNC equipment, automated laser cutting, and automatic metal cutting, enhances the capabilities of these machines, enabling real-time monitoring and improved productivity. The defense industry is a significant consumer of metal sawing machines due to the demand for high precision components in military applications. These machines are essential in the production of intricate parts required for national security and defense systems. The aerospace and defense sectors also rely on metal sawing machines for manufacturing high-quality metal components, which are critical in the production of aircraft and spacecraft. In the automotive application sector, metal sawing machines are used extensively for manufacturing various components, including engine parts, chassis, and body panels.

Furthermore, the electronics and electrical sectors also utilize these machines for producing precision parts, while the marine industry relies on them for fabricating components for boats and ships. The adoption of eco-friendly approaches in manufacturing processes has led to an increased focus on the use of laser cutting, plasma cutting, and waterjet cutting machines. These technologies offer advantages such as minimal material waste, improved accuracy, and reduced energy consumption. Fiber laser cutting and micro cutting are some of the advanced laser cutting techniques that have gained popularity due to their ability to cut thin and intricate materials with high precision.

Therefore, the market is a dynamic and evolving industry, driven by the demand for high-quality cuts and precision engineering. The integration of advanced manufacturing technologies and the adoption of eco-friendly approaches are key trends shaping the future of this market. The versatility of metal sawing machines makes them an essential tool in various industries, including building and construction, defense, aerospace and defense, automotive application, consumer electronics, telecommunication, and infrastructure activities.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 876.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

China, US, Germany, Japan, UK, India, Canada, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Metal Sawing Machine Market Research and Growth Report?

- CAGR of the Metal Sawing Machine industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the metal sawing machine market growth of industry companies

We can help! Our analysts can customize this metal sawing machine market research report to meet your requirements.