Metalworking Machinery Accessories Market Size 2024-2028

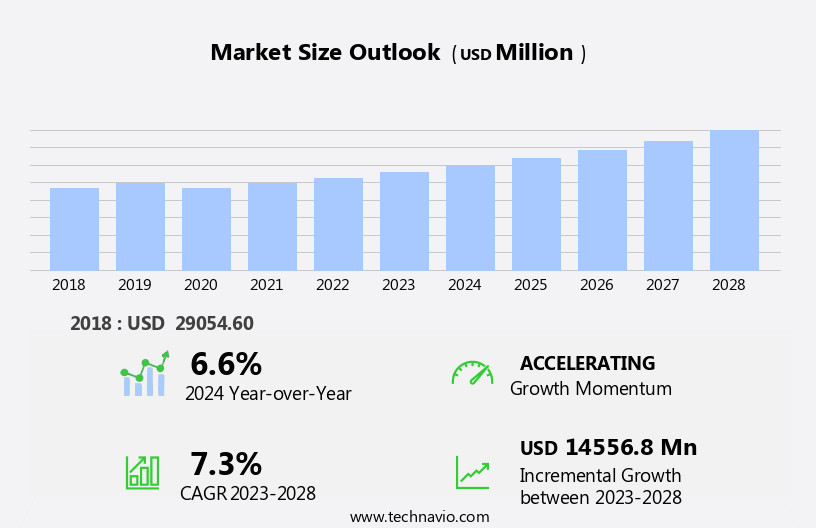

The metalworking machinery accessories market size is forecast to increase by USD 14.56 billion at a CAGR of 7.3% between 2023 and 2028.

What will be the Size of the Metalworking Machinery Accessories Market During the Forecast Period?

How is this Metalworking Machinery Accessories Industry segmented and which is the largest segment?

The metalworking machinery accessories industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Workholding

- Metalworking fluids

- Powertools accessories

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- France

- South America

- Middle East and Africa

- APAC

By Application Insights

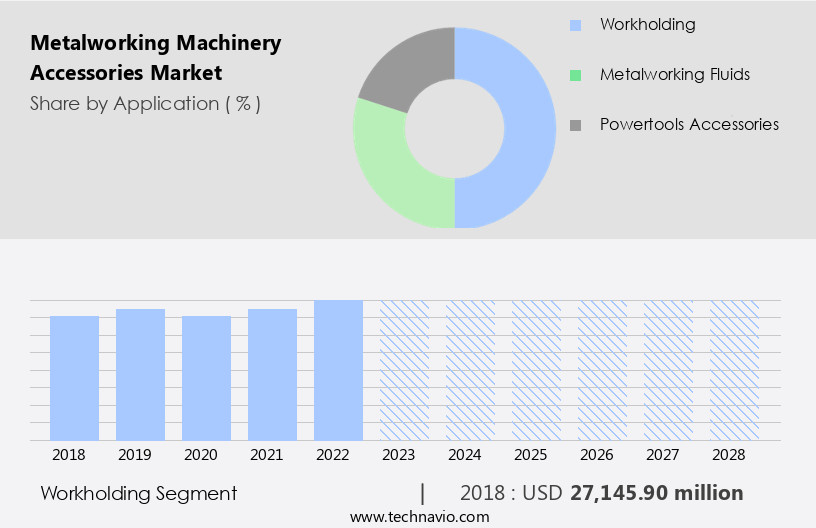

- The workholding segment is estimated to witness significant growth during the forecast period.

In the realm of metalworking machinery, workholding components play a pivotal role In the manufacturing process. These tools, which include chucks, vises, and rotary tables, serve to secure the workpiece during machining operations. Rotary tables, specifically, offer the advantage of adjusting a workpiece's position, thereby enhancing machining capabilities. An optimal workholding solution is essential to provide support, precise location, and secure clamping, ensuring the accuracy of the final product. Different machining processes necessitate distinct workholding solutions. For instance, CNC Routers, CNC Lathes, Boring Mills, and Drills employ various workholding techniques to facilitate subtractive manufacturing processes. Synthetic fluids and safety requirements, such as safety glasses, are crucial considerations to ensure occupational exposure is minimized during machining.

The integration of high-tech features, including index control systems, high-pressure coolant systems, and pneumatic or hydraulic switching valves, further enhances the flexibility and precision of metalworking machinery.

Get a glance at the Metalworking Machinery Accessories Industry report of share of various segments Request Free Sample

The Workholding segment was valued at USD 27.15 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

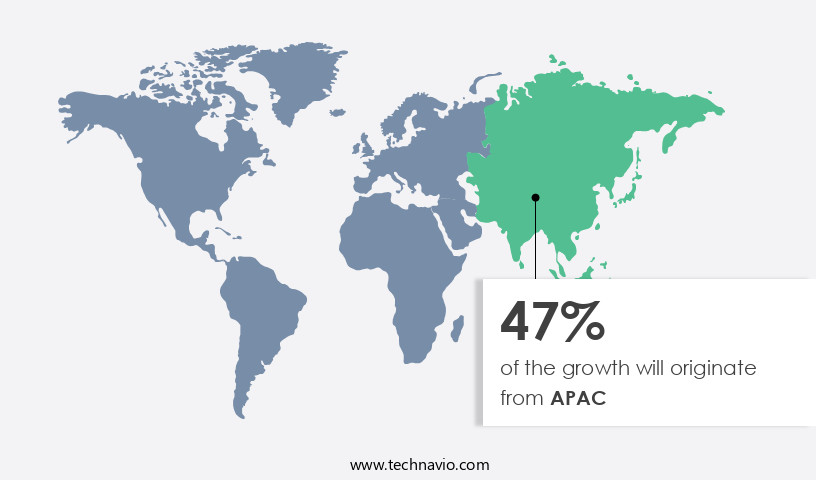

- APAC is estimated to contribute 47% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific (APAC) region is currently leading The market due to the increasing adoption of machine tools in countries like China, Japan, India, Taiwan, and South Korea. The region's substantial manufacturing base is driving the demand for machine tools, thereby fueling market growth. APAC's dominance is expected to persist over the forecast period, with the demand for metalworking machinery accessories continuing to surpass that of North America and Europe. This trend is primarily due to the ongoing establishment of new manufacturing facilities In the region. Metalworking machinery accessories play a crucial role in enhancing the capabilities of various machines, including Aluminum, Brass, Ferrous metals, Stainless steel, and Cast iron, used in subtractive manufacturing processes such as CNC Routers, CNC Lathes, Boring Mills, Drills, Drill press, Grinders, and Fabricating equipment.

Safety requirements, including the use of Safety glasses to protect against Occupational exposure to Flying debris, are essential considerations In the market. Additionally, the use of Synthetic fluids in machining equipment and advanced features like High-pressure coolant systems, Index control systems, and Automatic tailstocks contribute to the market's growth. Key players In the market offer a range of accessories, including Manual and Automatic tailstocks, Rotary tables, Wood-turning lathes, Engineering lathes, and Milling machines, among others. The market's future growth is expected to be influenced by factors such as the increasing demand for fine-tuning capabilities, higher rigidity, and flexible manufacturing solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Metalworking Machinery Accessories Industry?

Rise in automation is the key driver of the market.

What are the market trends shaping the Metalworking Machinery Accessories Industry?

Emergence of adhesive fixturing for common workholding challenges is the upcoming market trend.

What challenges does the Metalworking Machinery Accessories Industry face during its growth?

Fluctuating raw material prices is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The metalworking machinery accessories market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the metalworking machinery accessories market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, metalworking machinery accessories market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Apar Industries Ltd. - Metalworking machinery accessories play a crucial role in enhancing the efficiency and productivity of industrial manufacturing processes. These accessories encompass a wide range of components, including industrial equipment oils, cooling systems, clamping devices, and tool holders, among others. These accessories are essential for maintaining optimal machinery performance, ensuring precision, and extending the lifespan of metalworking equipment. By investing in high-quality metalworking machinery accessories, manufacturers can minimize downtime, reduce maintenance costs, and improve overall operational excellence.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apar Industries Ltd.

- Chevron Corp.

- Columbia Petro Chem Pvt. Ltd.

- Daljit Machines

- DM Italia S.r.l.

- Dover Corp.

- Enerpac Tool Group Corp.

- Exxon Mobil Corp.

- FUCHS SE

- Idemitsu Kosan Co. Ltd.

- Jergens Inc.

- Jiangsu Dongcheng M and E Tools Co Ltd

- Kurt Manufacturing

- Makita USA Inc.

- PJSC LUKOIL

- Robert Bosch GmbH

- Sandvik AB

- Sturmer Maschinen GmbH

- The Lubrizol Corp.

- TotalEnergies SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The machinery accessories market encompasses a wide range of components designed to enhance the capabilities of various machining equipment. These accessories cater to the needs of different industries, including those working with aluminum, brass, ferrous metals, stainless steel, cast iron, carbon steel, and other hard materials. Safety is a significant consideration In the machining process, with accessories such as safety glasses and synthetic fluids playing crucial roles in protecting operators from occupational exposure to flying debris and other hazards. Machining equipment, which includes CNC routers, CNC lathes, boring mills, drills, drill presses, grinders, hand-held angle grinders, bench grinders, lathes, milling machines, sanders, fabricating equipment, and various deformation techniques, all benefit from the addition of appropriate accessories.

Subtractive manufacturing processes, which involve removing material to create a part, rely on machining equipment and their accompanying accessories to achieve precise results. CNC routers, for instance, can be outfitted with index control systems and high-pressure coolant systems to improve accuracy and efficiency. Lathes, available in manual, automatic, and rotary configurations, can be fine-tuned with manual tailstocks, automatic tailstocks, rotary tailstocks, and various types of indexing systems. Machining processes can be demanding, with machining equipment subjected to heavy workloads and the generation of significant heat. Accessories such as pneumatic switching valves and hydraulic switching valves help manage power distribution, ensuring smooth operation and reducing downtime.

High-tech accessories like rotary tables and longitudinal rotary axes offer increased flexibility and precise positioning, allowing manufacturers to produce complex parts with greater accuracy. The machining process can involve significant deformation techniques, including boring, cutting, shearing, grinding, and shaping. Accessories designed for these applications can help improve the rigidity of the machining equipment, reducing chatter and excessive bending. For instance, the use of manual sliding and lead screws can lead to more accurate positioning, while the implementation of higher rigidity tailstocks and foot stocks can help maintain stability during the manufacturing process. In summary, the machinery accessories market plays a vital role in enhancing the capabilities of various machining equipment, enabling manufacturers to produce high-quality parts from a range of materials with increased efficiency and precision.

Accessories cater to various aspects of the machining process, from safety and fluid management to power distribution and deformation techniques, ensuring that manufacturers have the tools they need to meet the demands of their industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.3% |

|

Market growth 2024-2028 |

USD 14556.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.6 |

|

Key countries |

US, China, Japan, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Metalworking Machinery Accessories Market Research and Growth Report?

- CAGR of the Metalworking Machinery Accessories industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the metalworking machinery accessories market growth of industry companies

We can help! Our analysts can customize this metalworking machinery accessories market research report to meet your requirements.