Methyl Acetate Market Size 2025-2029

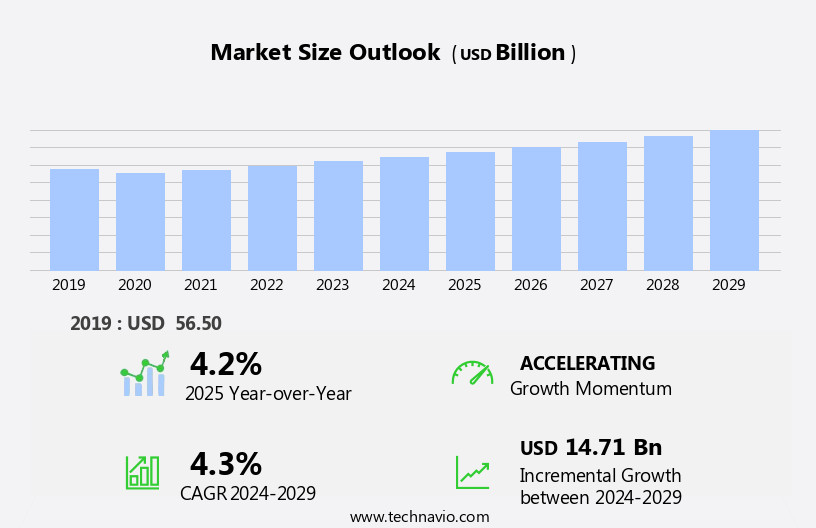

The methyl acetate market size is forecast to increase by USD 14.71 billion at a CAGR of 4.3% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand in the paints and coatings industry. This sector's expansion is attributed to the superior performance characteristics of methyl acetate, such as its high solvent power and ability to enhance the viscosity and gloss of coatings. Furthermore, advancements in the packaging industry are fueling market growth, as methyl acetate is extensively used as a solvent and monomer in the production of various packaging materials. Moreover, the personal care, cosmetics, and fragrances industries also rely on methyl acetate as a solvent for producing various cosmetic products, such as eye makeup, perfumes, and lotions. However, the market faces challenges due to growing concerns regarding the health hazards associated with methyl acetate. It is classified as a hazardous substance, posing risks such as irritation to the eyes, skin, and respiratory system.

- Companies operating in this market must invest in research and development to create safer alternatives or improve safety measures to mitigate these risks and maintain regulatory compliance. By addressing these challenges and capitalizing on the growing demand, market participants can effectively navigate the competitive landscape and capitalize on the opportunities presented in the market.

What will be the Size of the Methyl Acetate Market during the forecast period?

- Methyl acetate, an organic compound with the chemical formula CH3COCH3, is a colorless liquid with a fruity, pleasant odor, commonly used as a solvent in various industries. Its non-polar nature makes it an effective choice for dissolving other non-polar substances. The ongoing urbanization trend drives the demand for methyl acetate in the production of coatings and commercial solvents, while its biocompatible properties make it suitable for use in cosmetics and personal care products. The market is characterized by continuous evolution, with new applications and patterns emerging regularly. For instance, its low volatility and fast evaporation rate make it an ideal solvent for moisture-sensitive paints.

- In the food industry, methyl acetate is used as a flavoring ingredient in various fruits, including apples and bananas. The market's dynamics are influenced by several factors, including the purity level, evaporation rate, and solvent activity. The demand for high-purity grade methyl acetate is increasing due to its exceptional properties, making it a preferred choice for industrial and commercial applications. However, its flammable nature and potential irritation to the eyes and dizziness at elevated temperatures are concerns that need to be addressed. Methyl acetate is produced through the esterification reaction of methanol and acetic acid.

- Its production process involves careful monitoring to ensure the purity level remains high. The ongoing research and development efforts in the market aim to improve its properties and reduce its environmental impact, with a focus on producing biodegradable and low-VOC content alternatives. Methyl acetate's versatility and unique properties make it an essential component in various industries, from personal care and cosmetics to coatings and solvents. Its applications continue to expand as new technologies and consumer preferences emerge, making the market a dynamic and evolving space to watch.

How is this Methyl Acetate Industry segmented?

The methyl acetate industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- High purity

- Low purity

- Application

- Paints and coatings

- Inks

- Personal care

- Others

- End-user

- Chemical manufacturing

- Pharmaceuticals

- Automotive

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- South America

- Argentina

- Brazil

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

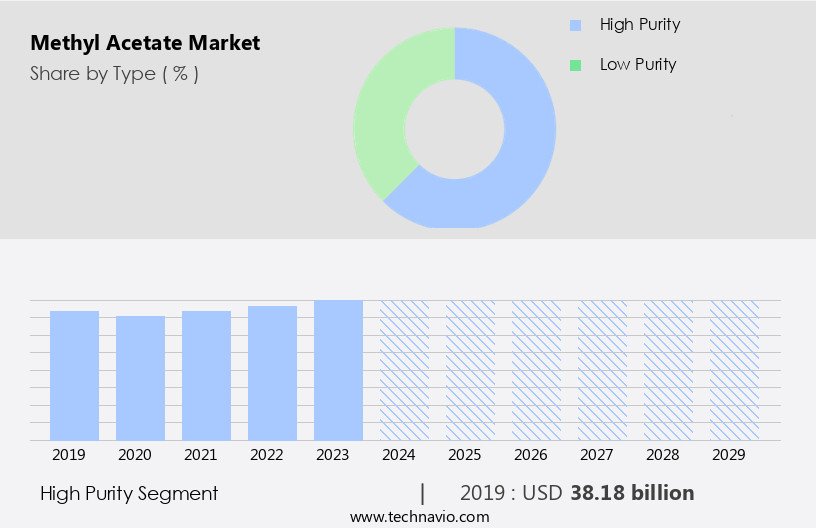

By Type Insights

The high purity segment is estimated to witness significant growth during the forecast period.

Methyl acetate, a colorless liquid with a fragrant odor and the chemical formula CH3COOCH3, is an organic compound extensively used in various industries. Its non-polar nature makes it an effective solvent for several applications. In the cosmetics industry, methyl acetate is employed as a flavoring ingredient and in the production of high-purity cosmetic-grade methyl acetate for grooming purposes. Its fast evaporation rate and low odor make it suitable for use in personal care products. Urbanization and the growing youth population have led to an increase in consumption of fruits, leading to the use of methyl acetate as a byproduct in the production of fruit essences.

Methyl acetate is also produced industrially through the esterification reaction of methanol and acetic acid. Methyl acetate is biodegradable and has limited solubility in water, making it an environmentally friendly alternative to other solvents. It is also used as a commercial solvent and biocompatible solvent in various industries, including coatings and paints. In coatings, methyl acetate is used for its exceptional properties, such as its ability to dissolve resins and pigments efficiently, leading to improved coating quality and faster drying time. However, methyl acetate can cause irritation to the eyes and may lead to dizziness and drowsiness at elevated temperatures.

It is essential to handle methyl acetate with care due to its flammable nature and low VOC content. Methyl acetate is also used in the production of acetate derivatives, such as ethyl acetate, which is used as a solvent in various applications. In conclusion, methyl acetate is a versatile organic compound with a wide range of applications in various industries. Its unique properties, such as its fast evaporation rate, low odor, and biodegradability, make it an attractive alternative to other solvents. The growing demand for eco-friendly products and the increasing urbanization and youth population are expected to drive the demand for methyl acetate in the coming years.

The High purity segment was valued at USD 38.18 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 72% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Methyl acetate, a colorless, non-polar, organic compound with the chemical formula CH3COOCH3, is a key ingredient in various industries. Its biodegradable nature makes it an attractive choice for manufacturing cosmetics and personal care products. In the food industry, methyl acetate is used as a flavoring ingredient, particularly in fruits like grapes and bananas. The esterification reaction between methanol and acetic acid produces methyl acetate. Methyl acetate's limited solubility and fast evaporation rate make it an ideal solvent for commercial applications. In the industrial sector, methyl acetate is used as a high purity grade, low VOC content solvent in coatings and paints.

It's also used as a solvent in the production of acetate derivatives. The urbanization trend has led to an increased demand for methyl acetate in APAC, where it's used as a blowing agent in the manufacturing of Polyurethane (PU) foams. These foams are extensively used in the production of mattresses and cushions. With a significant population growth in countries like China, South Korea, India, and Japan, the demand for furniture and bedding is expected to surge, leading to an increased consumption of methyl acetate. Methyl acetate is also used as a fragrant ingredient in cosmetics and grooming products due to its pleasant, low odor.

Its exceptional properties make it a valuable component in various industries, from personal care to industrial applications. However, methyl acetate can cause irritation and dizziness if inhaled in large quantities. It's essential to handle this flammable liquid with care.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Methyl Acetate Industry?

- The paints and coatings industry's growing requirement for methyl acetate serves as the primary market driver.

- Methyl acetate, a non-polar, colorless liquid with the chemical formula CH3COCH3, is a common additive in the production of paints and coatings. Its biodegradable nature makes it an attractive choice for various industries, including automotive, construction, and cosmetics. In paints and coatings, methyl acetate acts as a solvent due to its high purity and low volatility. The market is driven by the increasing urbanization and subsequent demand for infrastructure development and aesthetic enhancements. In the automotive sector, the rising production of vehicles fuels the demand for paints and coatings, leading to an increased usage of methyl acetate.

- Additionally, methyl acetate is used as a flavoring ingredient in various food and beverage applications, further expanding its market reach. Despite its benefits, methyl acetate can cause irritation to the eyes, skin, and respiratory system, necessitating proper handling and safety measures. Methyl acetate is produced through the esterification reaction of methanol and ethyl acetate. Its limited solubility in water makes it an effective solvent for various non-polar substances. Overall, the market is expected to grow steadily during the forecast period due to its wide range of applications and functional benefits.

What are the market trends shaping the Methyl Acetate Industry?

- The packaging industry is currently experiencing significant advancements, serving as the prevailing market trend. These innovations are shaping the future of product presentation and preservation.

- Methyl acetate, an organic compound with the chemical formula CH3COCH3, is a significant player in various industries due to its unique properties. In the realm of grooming products, it functions as a solvent and provides a fast evaporation rate, contributing to the creation of popular items like nail polish removers and perfumes. For industrial applications, methyl acetate is utilized in large quantities as an intermediate in the production of acetic acid, a strong acid used in numerous industries. Moreover, methyl acetate is naturally derived from fermented grapes, adding to its appeal as a sustainable alternative.

- Its fast evaporation rate and pleasant aroma, reminiscent of bananas, make it a popular choice among consumers, particularly the youth population. In the packaging industry, methyl acetate's high purity grade is essential for producing flexible packaging materials, ensuring effective bonding and strong adhesion. This eco-friendly solvent's low VOC emissions further contribute to its popularity, as manufacturers strive to meet sustainability requirements and minimize their environmental impact.

What challenges does the Methyl Acetate Industry face during its growth?

- The methyl acetate industry faces significant growth challenges due to increasing awareness and concerns regarding the health hazards associated with its production and use.

- Methyl acetate is a colorless, volatile solvent with a fruity, pleasant odor, commonly used in various industries for its low VOC content and solvent activity. In commercial applications, it serves as a key ingredient in coatings, adhesives, and commercial solvents. In the personal care sector, methyl acetate is utilized as a biocompatible solvent in grooming purposes. However, it is essential to maintain a high purity level to mitigate potential health risks. Exposure to methyl acetate can cause mild irritation to the eyes and respiratory system, as stated by the US National Library of Medicine (NLM). At elevated temperatures, methyl acetate can release moisture sensitive paints and is used as a solvent in the production of certain plastics, such as poly(methyl methacrylate) and polystyrene.

- It is also used as a solvent in the production of cellulose acetate, a common component in various consumer products, including Food Packaging and filters. Despite its widespread use, methyl acetate can pose health hazards. Prolonged exposure or inhalation of high concentrations can lead to central nervous system depression, dizziness, and headaches. Additionally, methyl acetate is derived from saturated hydrocarbons, which can contribute to greenhouse gas emissions. Therefore, efforts are being made to explore alternative, more sustainable solvents for various applications.

Exclusive Customer Landscape

The methyl acetate market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the methyl acetate market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, methyl acetate market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alpha Chemika - Methyl acetate is a versatile chemical compound extensively utilized in various industries for the production of coatings, inks, resins, and adhesives.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alpha Chemika

- Anhui Wanwei Group Co. Ltd.

- Celanese Corp.

- Central Drug House P. Ltd.

- Chang Chun Group

- China Petrochemical Corp.

- Choice Organochem LLP

- Eastman Chemical Co.

- EuroChem Group AG

- Gayatri Industries

- Henan Haofei Chemical Co. Ltd.

- Jiangsu Ruifeng Polymer Materials Co. Ltd.

- Otto Chemie Pvt. Ltd.

- RXChemicals

- Shanxi Sanwei Group Co. Ltd.

- Sinochem Group Co. Ltd.

- Solventis Ltd.

- Sontara Organo Industries

- Wacker Chemie AG

- Zhengzhou Meiya Chemical Products Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Methyl Acetate Market

- In February 2024, INEOS Styrolution, the world's leading styrenics supplier, announced the expansion of its methyl acetate production capacity at its Marl facility in Germany. This expansion aimed to cater to the increasing demand for methyl acetate in the adhesives and coatings industries (INEOS Styrolution press release, 2024).

- In July 2025, BASF Corporation, a leading chemical producer, entered into a strategic partnership with BioAmber Inc., a biotech company, to produce methyl acetate from renewable feedstocks. This collaboration was expected to reduce the carbon footprint of methyl acetate production and strengthen BASF's position in the eco-friendly chemicals market (BASF press release, 2025).

- In October 2024, SABIC, a global manufacturer of chemicals, announced a significant investment of USD1.5 billion to expand its methyl acetate production capacity in Saudi Arabia. This expansion was expected to increase SABIC's global market share and cater to the growing demand from the solvents and esters markets (SABIC press release, 2024).

- In March 2025, the European Chemicals Agency (ECHA) approved the renewal of the authorization of methyl acetate under REACH regulation. This approval ensured the continued production and use of methyl acetate in Europe while maintaining strict safety and environmental standards (ECHA press release, 2025).

Research Analyst Overview

The market encompasses the global trade of Ch3COCH3, an organic compound with a chemical formula identical to methyl ethanoate and a colorless liquid appearance. This flammable liquid is known for its limited solubility in water and is commonly used in various industries, including cosmetics and personal care. Its voc contents contribute to the fruity scents found in these products, reminiscent of bananas, grapes, and apples. Methyl acetate's use extends to the grooming sector, where its fragrant odor is desirable. However, its flammability necessitates caution during handling. Ethyl acetate, a related compound, is also used in the industry but is less preferred due to its higher voc contents and drowsiness side effects.

In the coatings sector, methyl acetate serves as a solvent for saturated hydrocarbon resins. Its elevated temperature stability makes it an ideal choice for this application. However, its use in this sector may lead to dizziness and eye irritation for workers. Methyl acetate's production involves the reaction of acetic acid and methanol. The resulting product is used in the production of various chemicals, including acetic anhydride and methyl vinyl acetate. The youth population's growing interest in natural and organic cosmetics may impact the demand for methyl acetate, as it is used in the production of some of these products. The market's growth is influenced by factors such as increasing demand from the cosmetics and personal care industries, expanding applications in the coatings sector, and the availability of raw materials like acetic acid and methanol.

However, concerns over the compound's flammability and potential health hazards may pose challenges to its market expansion.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Methyl Acetate Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.3% |

|

Market growth 2025-2029 |

USD 14.71 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

US, China, Japan, India, South Korea, Australia, Canada, UK, France, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Methyl Acetate Market Research and Growth Report?

- CAGR of the Methyl Acetate industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the methyl acetate market growth of industry companies

We can help! Our analysts can customize this methyl acetate market research report to meet your requirements.