Micronized PTFE Market Size 2024-2028

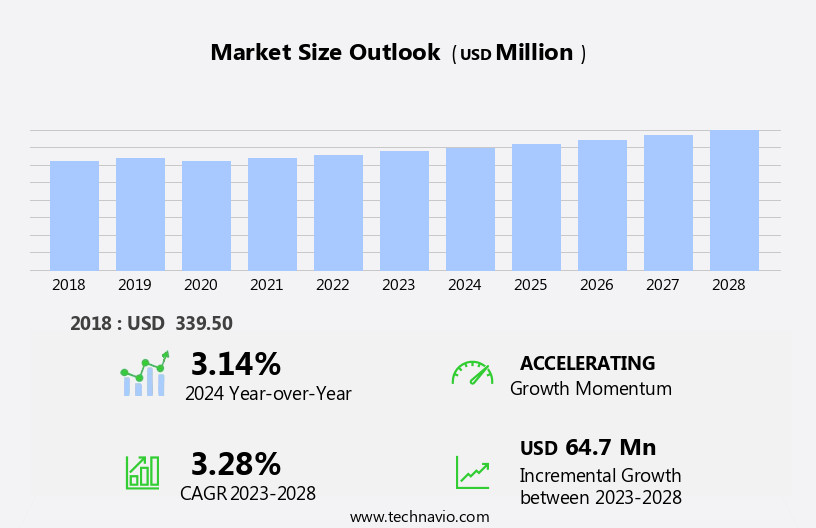

The micronized PTFE market size is forecast to increase by USD 64.7 million at a CAGR of 3.28% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by innovation in product range and surging demand from the inks industry. Micronized PTFE, a form of polytetrafluoroethylene, offers enhanced properties such as high temperature resistance, chemical inertness, and excellent lubricity, making it an ideal choice for various industries. In the inks sector, micronized PTFE is increasingly being utilized in the production of high-performance inks due to its ability to improve ink flow and reduce viscosity. However, the market growth is not without challenges. Regulatory hurdles, particularly the restriction on the use of perfluorooctanoic acid (PFOA), pose significant obstacles.

- PFOA, a common processing agent in the production of PTFE, has been linked to health concerns, leading to stringent regulations on its use. Supply chain inconsistencies also temper growth potential, as the market relies heavily on a few key players for raw materials and finished products. Companies seeking to capitalize on market opportunities must navigate these challenges effectively by investing in alternative production methods and building strategic partnerships to secure a stable supply chain.

What will be the Size of the Micronized PTFE Market during the forecast period?

- The PTFE market encompasses a range of applications for high-performance polymers, including PTFE fillers, dispersions, and resins. In the realm of food processing, PTFE's non-stick properties make it an ideal choice for equipment components. PTFE tapes and sealants & adhesives offer superior resistance to heat, chemicals, and wear in industrial settings. PTFE composites and plastics find extensive use in electrical insulation and aerospace applications due to their excellent insulating properties and low friction. Surface modification techniques, such as atomic layer deposition and plasma treatment, enhance PTFE's performance in various industries. Furthermore, PTFE-based materials are increasingly used in fiber & fabrics, membranes & filters, and pharmaceutical applications.

- In the electronics sector, PTFE films and water-based coatings ensure reliable insulation and protection. PTFE's wear resistance and low friction make it an essential component in automotive and aerospace applications, from engine components to fuel lines and gaskets. Powder coating and dip coating processes are popular methods for applying PTFE to various substrates. Industrial coatings, including PTFE suspensions and additives & fillers, provide enhanced durability and resistance to harsh environments. Construction applications benefit from PTFE's water resistance and chemical inertness. Overall, the PTFE market continues to evolve with advancements in processing techniques, such as extrusion and spray coating, and expanding applications in diverse industries.

How is this Micronized PTFE Industry segmented?

The micronized PTFE industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Chemical and industrial processing

- Automotive and aerospace

- Electrical and electronics

- Building and construction

- Others

- Geography

- North America

- US

- Canada

- Europe

- Germany

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

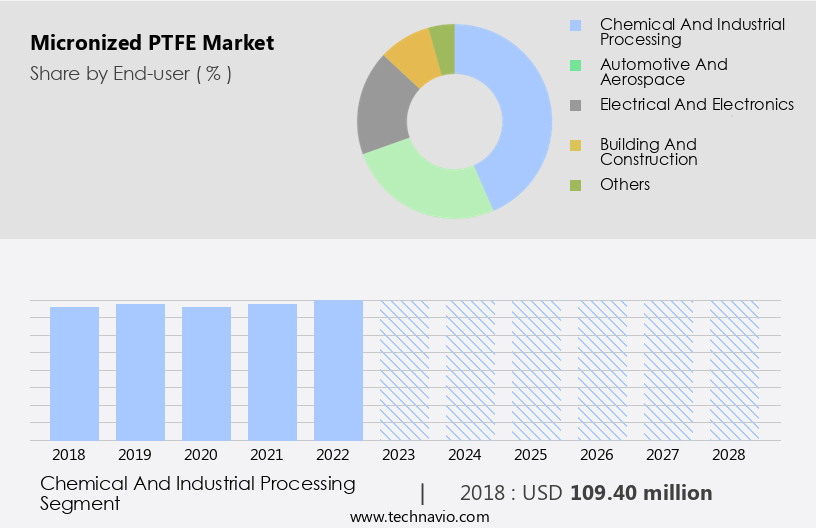

The chemical and industrial processing segment is estimated to witness significant growth during the forecast period.

Micronized PTFE, a form of Polytetrafluoroethylene (PTFE), is a versatile additive used to enhance the properties of various host products, including plastics, coatings, inks, elastomers, and lubricants. Its widespread application lies in the chemical and industrial sectors due to its unique features, such as high temperature resistance, non-stick properties, and low friction. These attributes enable micronized PTFE to withstand harsh processing conditions, making it an essential ingredient in numerous industrial applications. In the realm of coatings, micronized PTFE is utilized in protective industrial coatings, which are applied to equipment, storage vessels, heat exchangers, impellers, tanks, containers, reaction vessels, and material handling systems.

By incorporating micronized PTFE into these coatings, manufacturers can enhance their protective capabilities, ensuring better performance and longevity under demanding conditions. Furthermore, the addition of micronized PTFE powder to coatings results in improved mold release and increased processing rates. Moreover, micronized PTFE finds extensive use in membranes and filters, PTFE composites, and PTFE tapes. Its chemical resistance and electrical insulation properties make it a popular choice for membranes and filters in various industries, such as water treatment and gas separation. In the case of PTFE composites and tapes, micronized PTFE enhances their mechanical strength, flexibility, and resistance to wear and tear.

In the realm of food processing, micronized PTFE is employed as a lubricant and additive to ensure smooth operation and prevent equipment from sticking or wearing down. Additionally, its non-stick properties make it an ideal choice for non-stick cookware and food processing equipment. Micronized PTFE is also used in high-performance polymers, such as those used in aerospace and automotive industries, to improve their heat resistance, wear resistance, and chemical resistance. In these applications, micronized PTFE ensures the longevity and reliability of the components, enabling them to perform optimally under extreme conditions. Furthermore, micronized PTFE is used in various processing techniques, such as sintering, chemical vapor deposition, and surface modification, to enhance the properties of the final product.

For instance, in sintering, micronized PTFE is used to improve the bonding between particles, resulting in stronger and more durable components. In chemical vapor deposition, micronized PTFE is used as a precursor material to deposit thin films with superior properties. In summary, micronized PTFE is a valuable additive used in a wide range of industries and applications due to its unique properties. Its ability to enhance the processing and performance of various host products, such as plastics, coatings, inks, elastomers, and lubricants, makes it an indispensable ingredient in numerous industrial processes. Its versatility and adaptability have led to its widespread use in various sectors, including chemical and industrial processing, food processing, aerospace, automotive, and medical devices.

The Chemical and industrial processing segment was valued at USD 109.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

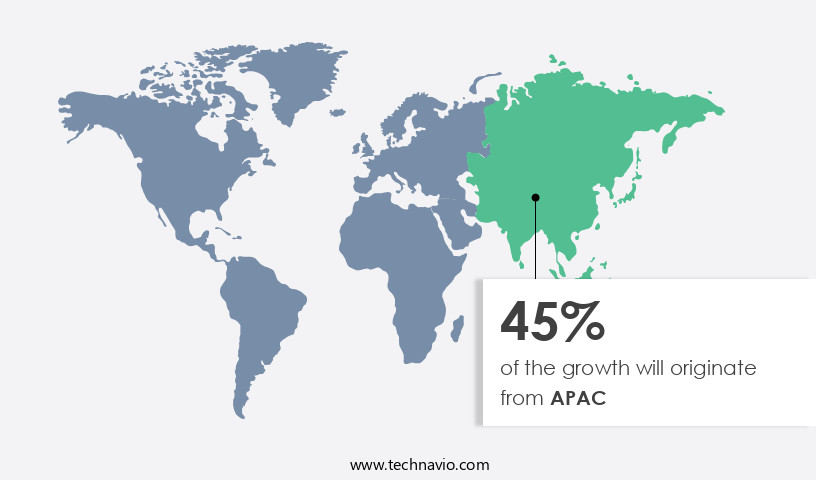

APAC is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, particularly in the Asia Pacific region, where it holds the largest share. The expansion can be attributed to the increasing utilization of micronized PTFE in the automotive and aerospace industries, which are experiencing a surge in manufacturing activities in countries like China and India. PTFE resin and suspension are key components used in producing micronized PTFE, which finds applications in various industries such as membranes and filters, composites and plastics, sealants and adhesives, and industrial coatings. PTFE's unique properties, including chemical resistance, electrical insulation, and non-stick properties, make it a preferred choice for numerous applications.

In food processing, PTFE's high-performance polymers are used for sintering and film production, while chemical vapor deposition and surface modification techniques are employed to enhance its performance. The market is also witnessing the emergence of new technologies like plasma treatment and water-based coatings. Additionally, the use of micronized PTFE as an additive and filler in composites, plastics, and lubricants is gaining popularity due to its heat resistance and wear resistance properties. Medical devices are another growing application area for micronized PTFE. The market is expected to continue its growth trajectory, driven by the increasing demand for micronized PTFE in various industries and its versatile applications.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Micronized PTFE market drivers leading to the rise in the adoption of Industry?

- The innovation in a company's product range serves as the primary catalyst for market growth.

- The market is characterized by intense competition, with companies employing strategies such as product differentiation and innovation to gain an edge. Superiority and desirable properties of micronized PTFE products are key factors influencing end-users' selection of companies in industries like automotive and aerospace, as well as building and construction. Recent advancements in the market include Lubrizol Performance Coatings' October 2020 launch of new micronized PTFE wax additives. Surface modification techniques, such as plasma treatment and water-based coatings, enhance the non-stick properties of PTFE filler and coatings, further expanding their applications.

- Additives and fillers play a crucial role in improving the heat resistance and overall performance of PTFE materials. Companies continue to invest in research and development to cater to the evolving demands of various industries, driving market growth.

What are the Micronized PTFE market trends shaping the Industry?

- The inks industry is experiencing a significant increase in demand, representing a noteworthy market trend. This growth is a key development within the industry, underscoring its continued importance and potential for future expansion.

- Micronized PTFE is an essential additive in the production of printing inks and industrial coatings, enhancing their wear, abrasion, and heat resistance. Its unique properties include water resistance, inertness to surfaces, and solvent guard, contributing to improved sliding properties, surface smoothness, and gloss. By reducing clogging, micronized PTFE caters to the demands of high-speed printers. The global packaging industry, which is the fifth largest and expanding at a rate of 22%-25% according to the Packaging Industry Association of India (PIAI), is a significant consumer of printing inks. Consequently, the demand for micronized PTFE is expected to grow, driven by the increasing use of advanced coatings and inks in various industries.

- Micronized PTFE also finds applications in various industries such as automotive, aerospace, and electronics, where low friction and wear resistance are crucial. PTFE processing techniques, including dip coating, PTFE extrusion, PTFE dispersion, and PTFE membrane, enable the versatile use of micronized PTFE in diverse applications.

How does Micronized PTFE market faces challenges face during its growth?

- The implementation of regulations limiting the use of perfluorooctanoic acid (PFOA) poses a significant challenge to the industry's growth trajectory.

- Micronized PTFE, a form of polytetrafluoroethylene (PTFE), has gained significant attention due to its versatile applications in various industries, particularly in fiber & fabrics, membranes & filters, and composites & plastics. PTFE resin and PTFE suspension are the primary forms of PTFE used in these applications. However, the EU's Regulation (EU) 2020/784, which came into force on July 4, 2020, has imposed restrictions on the use of perfluorooctanoic acid (PFOA) and its related compounds due to their persistent organic pollutant properties. This regulation has affected the production of micronized PTFE through the irradiation process, which generates PFOA. Alternative methods, such as atomic layer deposition, have emerged as potential solutions to produce micronized PTFE without the generation of PFOA.

- PTFE additives and PTFE composites are also being explored as alternatives to traditional PTFE in various applications. Additionally, PTFE tape, solvent-based coatings, sealants & adhesives continue to find extensive use in industries where high-performance materials are required. Despite the regulatory challenges, the market for micronized PTFE is expected to grow due to its unique properties, such as chemical inertness, high temperature stability, and excellent non-stick properties.

Exclusive Customer Landscape

The micronized ptfe market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the micronized ptfe market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, micronized PTFE market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - This company specializes in providing a diverse range of micronized PTFE products.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- AGC Chemicals

- BYK Chemie GmbH

- ChenGuang Research Institute of Chemical Industry

- Clariant International Ltd.

- Daikin Industries Ltd.

- DEUREX AG

- Dreyplas GmbH

- Fluorez Technology Inc.

- Gujarat Fluorochemicals Ltd.

- Maflon SpA

- Micro Powders Inc.

- Nanjing Tianshi New Material Technology Co. Ltd.

- Reprolon Texas

- Shamrock Technologies Inc.

- Solvay SA

- The Chemours Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Micronized PTFE Market

- In February 2024, DuPont, a leading chemical company, introduced a new line of micronized PTFE powders, named the "Grade A" series, which offers enhanced flow properties and improved dispersion characteristics (DuPont press release). This innovation is expected to cater to the increasing demand for high-performance PTFE powders in various industries, including automotive, aerospace, and electronics.

- In May 2025, W.L. Gore & Associates, a major player in the market, formed a strategic partnership with Honeywell International to develop advanced PTFE-based materials for the energy sector. This collaboration aims to leverage Gore's expertise in PTFE technology and Honeywell's market reach in the energy industry, creating new opportunities for both companies (Honeywell press release).

- In October 2024, Solvay, a global chemical company, announced the acquisition of Rhodia's PTFE business from INEOS. This acquisition significantly expanded Solvay's PTFE production capacity and market share, making it one of the leading players in the market (Solvay press release).

- In January 2025, the European Union approved the renewal of PTFE registrations under the European Chemicals Agency's REACH regulation. This approval ensures the continued use and production of micronized PTFE in Europe, maintaining the market's stability and growth prospects (European Chemicals Agency press release).

Research Analyst Overview

The market continues to evolve, driven by the diverse applications of this high-performance polymer across various sectors. PTFE, known for its exceptional chemical resistance and low friction properties, finds extensive use in industries such as fiber & fabrics, composites & plastics, and electrical insulation. In the realm of fiber & fabrics, micronized PTFE is utilized in the production of non-stick properties for textiles, enhancing their durability and ease of use. In the composites & plastics industry, PTFE additives and composites are employed to improve wear resistance and heat resistance. The electrical insulation sector benefits from PTFE's excellent electrical insulation properties, ensuring reliable performance in high-voltage applications.

PTFE membranes & filters are indispensable in water treatment and filtration systems, providing superior filtration efficiency and chemical resistance. Furthermore, PTFE's low friction properties make it an ideal choice for various industries, including food processing, where it is used in equipment components to minimize wear and ensure efficient operations. PTFE processing techniques, such as sintering, film formation, and coating applications, continue to advance, expanding the potential applications of this versatile material. In the realm of industrial coatings, PTFE dispersion, dip coating, powder coating, and spray coating are employed to enhance surface properties, such as wear resistance, chemical resistance, and non-stick properties.

PTFE sealants and adhesives offer superior sealing performance in extreme temperatures and harsh environments. PTFE's applications extend to the medical device industry, where it is used in the production of implants and surgical instruments due to its biocompatibility and excellent chemical resistance. The ongoing research and development in surface modification techniques, such as atomic layer deposition and plasma treatment, continue to expand the potential applications of PTFE. The continuous evolution of the market is fueled by the ongoing research and development efforts in various industries, ensuring its relevance and importance in modern technology and manufacturing processes.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Micronized PTFE Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

149 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.28% |

|

Market growth 2024-2028 |

USD 64.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.14 |

|

Key countries |

US, China, Germany, Japan, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Micronized PTFE Market Research and Growth Report?

- CAGR of the Micronized PTFE industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the micronized ptfe market growth of industry companies

We can help! Our analysts can customize this micronized ptfe market research report to meet your requirements.