Military Augmented Reality Headgear Market Size 2024-2028

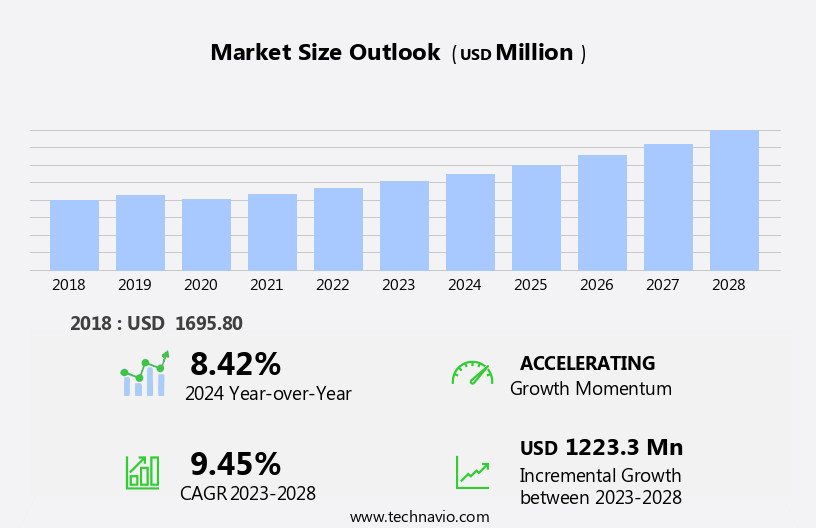

The military augmented reality (AR) headgear market size is forecast to increase by USD 1.22 billion at a CAGR of 9.45% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. One major driver is the increasing expenses involved in real-time military training, which AR headgear can help reduce by providing enriching and interactive training experiences. Additionally, the advancement of wireless connectivity is enabling seamless integration of AR headgear into military operations. However, challenges such as battery issues with AR headgears remain a concern, as prolonged usage can impact performance and mission success. To address these challenges, manufacturers are focusing on developing lightweight and energy-efficient designs, as well as improving battery technology. Overall, the military AR headgear market is poised for growth, driven by the need for advanced training tools and the integration of technology into military operations.

What will be the Size of the Market During the Forecast Period?

- The market encompasses headworn display systems, also referred to as smart helmets, that integrate virtual elements with real-world environments for various military applications. Key industries driving market growth include aircraft controls, simulation and training, healthcare, media and entertainment, and dismounted soldiers. These systems enable real-time digital information delivery through visual overlays, sensors, cameras, computing units, and high-resolution displays.

- Moreover, they provide decision makers with critical data for navigation, target acquisition, and mission execution in operational scenarios. AR headgear enhances situational awareness and improves operational efficiency by merging computer generated data with the physical world. Applications span across various domains, including enriching storytelling, virtual training, and real-time information display. The integration of advanced technologies, such as sensors and cameras, further enhances the functionality and versatility of these systems.

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Flight

- Combat

- Maritime

- Type

- Head-mounted displays

- Monitor-based

- Video see-through HMD

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By Application Insights

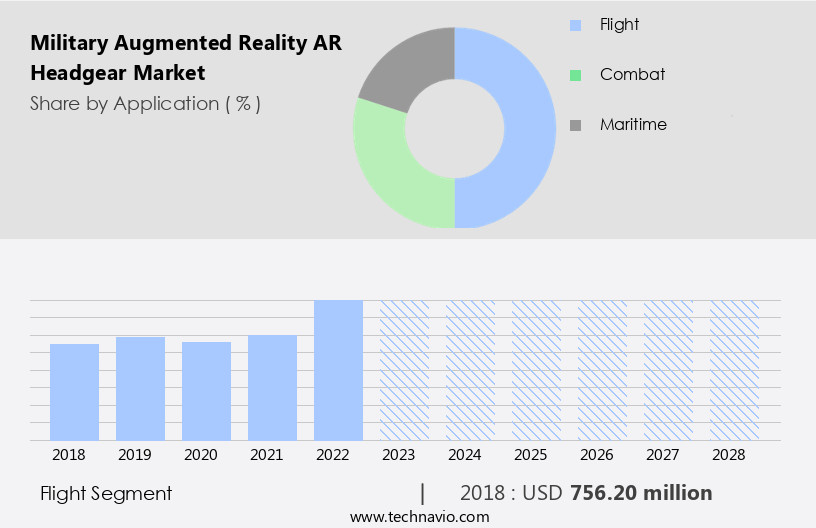

- The flight segment is estimated to witness significant growth during the forecast period.

Military augmented reality (AR) headgear, also known as head-mounted displays (HMDs), plays a significant role in aircraft control training for the military. Given the risks associated with exposing trainees to actual aircraft environments without prior experience, AR headgear provides a safer and more efficient alternative to traditional monitor-based simulators. The aerial sector, which includes airplanes, is a major adopter of AR headgear due to its rapid growth in the defense market and the need for complex, time-sensitive missions. AR headgear offers real-time digital information, visual overlays, and operational scenarios through sensors, cameras, computing units, high-resolution displays, and computer-generated data. It enhances decision making, navigation, target acquisition, mission execution, and situational awareness for pilots.

Get a glance at the Military Augmented Reality (AR) Headgear Industry report of share of various segments Request Free Sample

The flight segment was valued at USD 756.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

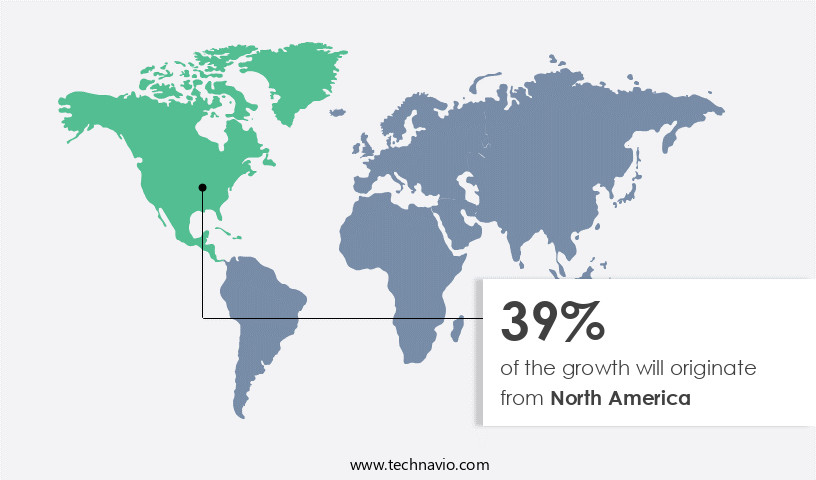

- North America is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is experiencing notable growth due to escalating defense expenditures in North America, particularly in the United States. This region's defense forces prioritize modernization, with AR headgear being a transformative technology that aligns with their goals. Major defense contractors and technology companies in North America are actively developing and producing military AR headgear through collaborative efforts between government and industry. AR headgear enhances military capabilities by providing real-time digital information, visual overlays, and operational scenarios through sensors, cameras, computing units, high-resolution displays, and computer-generated data. It aids in decision making, navigation, target acquisition, mission execution, and safety. Key features include head-up displays, augmented reality goggles, cognitive strain reduction, and mobility.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Military Augmented Reality (AR) Headgear Industry?

Expenses involved in real-time military training is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for cost-effective training solutions in the defense sector. Traditional training methods, such as aircraft flights and ammunition usage, come with substantial expenses, including fuel costs, procurement expenses, and depreciation and depletion of military platforms. These factors put pressure on defense budgets, leading defense ministries worldwide to explore alternative training methods. AR headgear, which integrates virtual elements with the real world, offers a solution to these challenges. It enables enriching training experiences, including simulation and training for dismounted soldiers, without the need for expensive resources. Moreover, AR headgear provides real-time digital information, visual overlays, and operational scenario simulations, enhancing decision-making, navigation, target acquisition, and mission execution capabilities.

- In addition, the market is further driven by advancements in technology, such as high-resolution displays, computer-generated data, sensors, cameras, and computing units. Additionally, the integration of 5G networks and e-commerce platforms facilitates the commercial availability of off-the-shelf headworn display systems, such as smart helmets and augmented reality goggles. Despite the benefits, challenges, such as battery life concerns and the need for lightweight, comfortable, and safe AR headgear, remain. Materials science and engineering advancements will play a crucial role in addressing these challenges and expanding the market's potential applications, including air, combat, and maritime scenarios.

What are the market trends shaping the Military Augmented Reality (AR) Headgear Industry?

Increasing wireless connectivity is the upcoming market trend.

- Military AR headgear, including smart helmets and augmented reality goggles, is experiencing significant advancements due to the integration of 5G networks and edge computing capabilities. These technologies offer ultra-low latency and high data transfer rates, enabling real-time digital information and visual overlays for dismounted soldiers. This enhances situational awareness, facilitates remote collaboration, and ensures seamless connectivity between soldiers and command centers. Edge computing also increases processing power, allowing for faster response times and reduced dependence on centralized data centers. Cloud-based services are being utilized for data storage, sharing, and analytics, enabling the storage of large volumes of mission-critical data and collaborative data analysis.

- Furthermore, head-Mounted Displays (HMDs), such as video see-through HMDs and headup displays, are incorporating high-resolution displays, sensors, cameras, computing units, and computer-generated data to provide enriching storytelling, simulation and training, aircraft controls, healthcare, and trauma treatment. Lightweight AR headgear is being developed to reduce cognitive strain, improve comfort, and enhance mobility. Materials science and engineering are crucial in creating comfortable and durable AR headgear. The market for military AR headgear is expected to grow significantly due to the increasing demand for real-time battlefield information, training and simulation, and enriching virtual training environments. Battery life remains a concern, and efforts are being made to address battery issues through advancements in battery technology.

What challenges does the Military Augmented Reality (AR) Headgear Industry face during its growth?

Battery issues with AR headgears is a key challenge affecting the industry growth.

- Military Augmented Reality (AR) headgear, also known as smart helmets, plays a crucial role in various sectors such as Aircraft Controls, Media and Entertainment, Healthcare, and Simulation and Training. These headgears offer real-time digital information through visual overlays, enhancing operational scenarios for users. The technology includes Head-Mounted Displays (HMDs), monitor-based systems, and video see-through HMDs. In the military context, AR headgear is utilized for military simulation, trauma treatment, and mission execution. Virtual elements are integrated into the real world through sensors, cameras, computing units, and high-resolution displays. Computer-generated data provides decision-making support for navigation, target acquisition, and mission execution.

- However, a significant challenge lies in the battery life and capacity of these devices. Dismounted soldiers, who heavily rely on military AR headgears, are particularly affected by this issue. Carrying external battery packs to extend battery life adds to the soldiers' burden and may discourage the use of AR headgears. To address this challenge, advancements in battery technology, 5G networks, and e-commerce platforms are crucial. Lightweight AR headgear, made from advanced materials science and engineering, also plays a role in enhancing mobility and visual clarity for soldiers. Comfortable AR headgear designs are essential for long-term use, ensuring a productive and enriching experience.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Applied Research Associates Inc.

- BAE Systems Plc

- Elbit Systems Ltd.

- Microsoft Corp.

- RealWear Inc.

- RTX Corp.

- Six15 Technologies

- Thales Group

- Vuzix Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses head-worn display systems designed to enhance the performance and situational awareness of military personnel. These innovative technologies integrate real-time digital information with the user's real-world environment, creating an enriching experience that can significantly impact various operational scenarios. AR headgear is gaining traction in military applications due to its potential to provide real-time battlefield information, improve decision making, and enhance situational awareness. These headgear systems often incorporate sensors, cameras, computing units, high-resolution displays, and visual overlays to deliver critical data in a format that is easily accessible to the user. One of the primary benefits of military AR headgear is its ability to provide real-time information, enabling users to make informed decisions quickly and effectively.

In addition, this can be particularly crucial in combat situations, where the ability to process information rapidly and accurately can mean the difference between success and failure. Another advantage of military AR headgear is its potential to reduce cognitive strain and improve safety. By providing relevant information in a visually engaging way, these systems can help reduce the amount of mental effort required to process complex data, allowing users to focus on the task at hand. Additionally, AR headgear can help improve safety by providing real-time information on potential hazards, such as enemy positions or environmental hazards. Military AR headgear is also becoming increasingly lightweight and comfortable, making it easier for soldiers to wear for extended periods.

Furthermore, materials science and engineering advancements are contributing to the development of more comfortable and durable headgear, ensuring that soldiers can maintain their focus on the mission without being distracted by discomfort or weight. The market for military AR headgear is driven by several factors, including the need for advanced training and simulation tools, the desire to improve operational efficiency, and the need to enhance safety and situational awareness. As military budgets continue to grow, defense expenditures on AR headgear are expected to increase, with commercial off-the-shelf (COTS) solutions becoming increasingly popular due to their cost-effectiveness and ease of integration.

In addition, despite the potential benefits of military AR headgear, there are still challenges to be addressed, such as battery life and integration with 5G networks. Addressing these challenges will be crucial for the continued growth of the military AR headgear market, as these technologies become increasingly important tools for military personnel. With its potential to improve situational awareness, enhance decision making, and reduce cognitive strain, military AR headgear is becoming an essential tool for military personnel in a variety of operational scenarios. As technology continues to advance, we can expect to see even more innovative applications of AR headgear in military applications, from enriching training environments to real-time battlefield information systems.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.45% |

|

Market growth 2024-2028 |

USD 1.22 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.42 |

|

Key countries |

US, China, Germany, Canada, and UK |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Military Augmented Reality (AR) Headgear Market Research and Growth Report?

- CAGR of the Military Augmented Reality (AR) Headgear industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the military augmented reality (ar) headgear market growth of industry companies

We can help! Our analysts can customize this military augmented reality (ar) headgear market research report to meet your requirements.