Military Communication Market Size 2025-2029

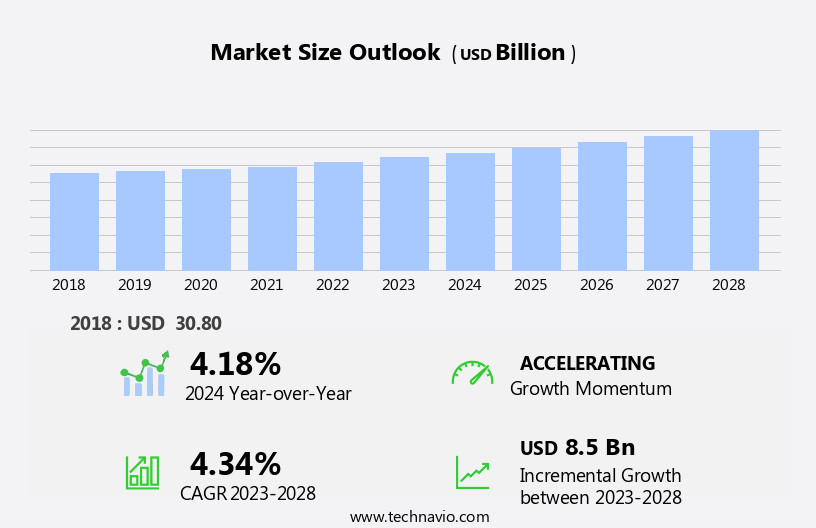

The military communication market size is forecast to increase by USD 12.37 billion at a CAGR of 5.9% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for advanced military communication systems to bolster defense communication security. This trend is driven by the heightened need for secure and efficient communication networks to support military operations and ensure national security. Another key driver is the adoption of artificial intelligence (AI) and machine learning (ML) in military communication systems. These technologies enable real-time data processing, improved situational awareness, and enhanced decision-making capabilities. However, the market also faces challenges, particularly in the complex upgrades of radar subsystems.

- Additionally, ensuring interoperability between new and legacy systems can be a significant challenge. Companies seeking to capitalize on market opportunities must stay abreast of the latest communication technologies and invest in research and development to address the complexities of radar subsystem upgrades. Navigating these challenges requires a strategic approach, with a focus on innovation, collaboration, and adaptability. Radar systems are essential for military surveillance and defense, and their upgrades require substantial resources and expertise. Military communication systems continue to evolve, with cloud-based solutions and software-defined radios gaining traction.

What will be the Size of the Military Communication Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

Real-time data exchange enables decision-makers to respond swiftly to enemy threats, enhancing situational awareness and target identification. Robust communication systems, including high-frequency radio systems and 5G networks, ensure flexibility and agility for troops in the field. Quantum cryptography and advanced encryption techniques secure data exchange, while cost-effectiveness and scalability are key considerations for defense budgets. Satellite communication plays a crucial role in extending communication reach, and intelligence sharing is facilitated through secure channels.

Military communication systems must adapt to the latest technologies, such as quantum cryptography and 5G networks, to maintain a competitive edge. Decision-makers rely on data centralization and advanced networking protocols to ensure efficient information flow and effective response to emerging threats. Emerging technologies, such as 5G networks, software-defined radios, encryption techniques, and quantum cryptography, enhance security and bandwidth capacity.

How is this Military Communication Industry segmented?

The military communication industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Hardware

- Software

- End-user

- Army

- Air Force

- Navy

- Type

- Ground-based communication

- Air-ground communication

- Shipborne communication

- Underwater communication

- Space-based communication

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

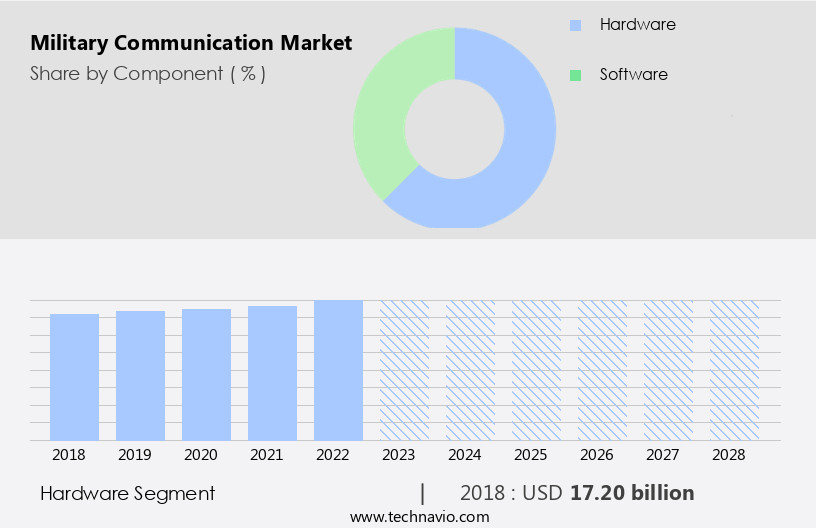

By Component Insights

The Hardware segment is estimated to witness significant growth during the forecast period. The market encompasses various entities that play a pivotal role in shaping its dynamics. Synergy and redundancy are crucial aspects of robust communication systems that military forces rely on for effective coordination. The Telecommunication industry's advancements, including satellite communication and 5G networks, provide military expenditure with cost-effective, scalable, and secure data transmission solutions. Military communication systems face cyber threats, necessitating encryption and advanced networking protocols. Real-time data exchange, intelligence feeds, and sensor data integration are essential for situational awareness and decision-making. Cloud-based solutions offer flexibility and agility for armed forces, enabling real-time updates and disaster recovery. The segment's growth is driven by the increasing demand for advanced communication systems that offer features like Global Positioning System (GPS), encryption, digital voice, and trunking.

Emerging technologies, such as quantum cryptography and IoT-based communication, enhance security and data management. The complexity of the operational environment necessitates advanced communication systems, including software-defined radios and Military communication shelters, for effective intelligence sharing and target identification. The hardware segment, consisting of military-grade communication devices, experiences steady growth due to the need for secure and dependable communication. Lightweight and portable devices with features like GPS, encryption, digital voice, and trunking are in high demand. The segment's expansion is driven by the rising popularity of digital radios and the increasing number of companies providing land mobile radio tactical communications. In the evolving military communication landscape, 5G technology, flexibility, and agility are essential for maintaining a competitive edge against enemies.

The Defense industry continues to invest in advanced communication systems to meet the demands of military personnel and adapt to the ever-changing operational environment.

The Hardware segment was valued at USD 17.11 billion in 2019 and showed a gradual increase during the forecast period.

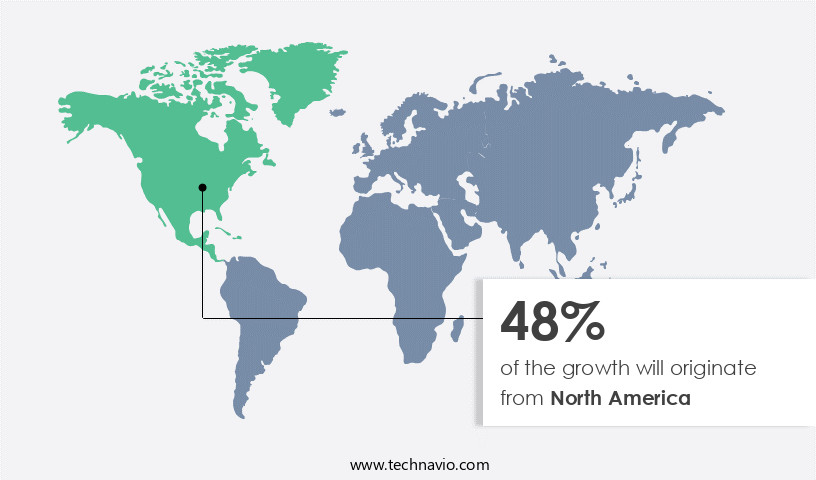

Regional Analysis

North America is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant trends and dynamics, with synergy and redundancy playing crucial roles in ensuring robust communication systems for military forces. Data centralization and high-frequency radio systems are essential for real-time information exchange and coordination among troops. However, cyber threats pose a significant challenge, necessitating advanced encryption techniques and secure data encryption. Satellite communication and 5G networks are transforming military communication, offering cost-effectiveness, scalability, and real-time updates. Military expenditure continues to prioritize user-friendly software and real-time data exchange, enabling decision-makers to access intelligence feeds and sensor data in complex operational environments. Emerging technologies, such as quantum cryptography, advanced networking protocols, and IoT-based communication, are shaping the future of military communication systems.

Disaster recovery and interoperable communication systems are essential for ensuring flexibility and agility in the face of unforeseen circumstances. The market is characterized by its operational complexity and the need for secure data encryption, especially in the context of enemy threats and terrorism. Software-defined radios and military communication shelters are integral components of this market, facilitating target identification and integration of intelligence sharing among allied nations. The defense industry is investing heavily in cloud-based solutions and advanced communication systems to enhance situational awareness and enable real-time updates for armed forces. However, the market also faces challenges, including the cyber security threats associated with military communication systems.

The market's evolution is influenced by the operational environment, with 5G technology and bandwidth capacity playing increasingly important roles. The US, as the largest military power, continues to lead in military communication innovation, while the Middle East and APAC regions are experiencing significant growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Military Communication market drivers leading to the rise in the adoption of Industry?

- To bolster defense communication security, the procurement of advanced military communication systems is a crucial market driver. This investment in sophisticated technology is essential for enhancing the overall defensive capabilities. The defense industry prioritizes the protection of sensitive information and the transmission of real-time data for effective military operations and international security. The importance of secure communication is underscored by the potential risks of compromised data or delayed updates, which could jeopardize public safety and diplomatic relations.

- The growing geopolitical tensions worldwide are driving investments in advanced military communication systems, necessitating the need for agile and adaptive solutions. Military communication encompasses various aspects, including intelligence feeds, encryption, advanced networking protocols, and disaster recovery. Emerging technologies, such as quantum cryptography and 5G networks, are increasingly utilized to enhance security and flexibility. Satellite Communications (SATCOM) and submarine communication systems are essential components of this intricate network.

What are the Military Communication market trends shaping the Industry?

- The adoption of artificial intelligence (AI) and machine learning (ML) in military communication is a significant market trend. This technological advancement is increasingly being utilized to enhance communication efficiency and effectiveness in military operations. The integration of artificial intelligence (AI) and machine learning (ML) in military communication systems is revolutionizing modern warfare. This transformation is driven by the need to heighten operational efficiency, enhance decision-making capabilities, and secure a strategic edge in complex operational environments. The processing of vast real-time data from diverse sources such as sensors, satellites, and unmanned aerial vehicles is a critical application of AI and ML in military communication.

- Cloud-based solutions are increasingly being adopted for their scalability and cost-effectiveness. Interoperable communication systems are essential for seamless information exchange between different military branches and allies. The defense budgets of various nations continue to prioritize the development and implementation of advanced military communication systems. 5G technology is poised to significantly impact military communication, offering increased bandwidth, lower latency, and higher reliability. As military communication systems become more complex, the demand for secure, scalable, and interoperable solutions is escalating.

How does Military Communication market face challenges during its growth?

- The complexity involved in upgrading radar subsystems poses a significant challenge to the growth of the industry. Radar technology is a critical component in various sectors, including aviation, defense, and transportation. Upgrading these systems to incorporate advanced features and capabilities can be intricate and costly, requiring extensive research and development, as well as specialized expertise. This complexity, in turn, can hinder progress and innovation within the industry, making it essential for stakeholders to address these challenges in order to drive growth and remain competitive.

- Budgetary constraints and technical complexities often hinder the adoption of new communication technologies. Despite these challenges, the Defense industry continues to invest in research and development to create more efficient and effective military communication systems. The adoption of AI and ML in military communication is a strategic investment that will continue to shape the future of defense communications. This data-driven approach to situational awareness equips military commanders with unparalleled insights, enabling them to make swift, informed decisions in high-pressure situations. Military communication systems play a crucial role in ensuring the safety and effectiveness of troops during operations.

Exclusive Customer Landscape

The military communication market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the military communication market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, military communication market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Airbus SE - The company specializes in advanced military communication solutions, providing multiband systems and encryption technologies to enhance secure communication channels.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbus SE

- ASELSAN AS

- BAE Systems Plc

- Bittium Corp.

- Cobham Ltd.

- Elbit Systems Ltd.

- General Dynamics Corp.

- Iridium Communications Inc.

- Kymeta Corp.

- L3Harris Technologies Inc.

- Leonardo Spa

- Lockheed Martin Corp.

- Mercury Systems Inc.

- Nemco Ltd.

- Nokia Corp.

- Northrop Grumman Corp.

- RTX Corp.

- Spectra Group UK Ltd.

- Thales Group

- Viasat Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Military Communication Market

- In January 2024, Thales and Nokia announced a strategic partnership to develop advanced military communication systems. The collaboration aimed to integrate Thales' tactical communication expertise with Nokia's 5G technology, enhancing secure military communications (Thales press release, 2024).

- In March 2024, Lockheed Martin completed the acquisition of Aerojet Rocketdyne, significantly expanding its portfolio in the military communication and aerospace sectors. The deal was valued at approximately USD 4.4 billion (Lockheed Martin press release, 2024).

- In May 2024, the U.S. Department of Defense awarded a contract worth over USD 1 billion to Harris Corporation for providing tactical radios to the U.S. Military. The contract marked a significant boost to Harris' market share in the military communication sector (U.S. Department of Defense press release, 2024).

- In February 2025, Leonardo and Huawei signed a memorandum of understanding to collaborate on military communication projects. The agreement focused on developing advanced communication systems for defense and security applications (Leonardo press release, 2025).

Research Analyst Overview

The market continues to evolve, driven by the need for robust and scalable systems to support the dynamic operational environment of military forces. Synergy and redundancy are key elements in ensuring reliable communication, with high-frequency radio systems and satellite communication (satcom) playing crucial roles. Cyber threats necessitate advanced encryption techniques and user-friendly software for real-time data exchange and intelligence feeds. Emerging technologies, such as quantum cryptography and 5G networks, offer enhanced security and bandwidth capacity. Military expenditure remains a significant factor, necessitating cost-effectiveness and interoperable communication systems. Real-time information is essential for coordination and situational awareness, with cloud-based solutions and IoT-based communication facilitating data centralization and decision-making.

Military communication systems must be flexible and agile, adapting to the complexity of the operational environment. This includes integration of sensor data, target identification, and encryption techniques. Defense budgets continue to prioritize secure data encryption and disaster recovery, ensuring the protection of sensitive information. 5G technology and software-defined radios offer enhanced capabilities for military communication, enabling real-time updates and improved situational awareness. Allied nations prioritize intelligence sharing, requiring advanced networking protocols and interoperable communication systems. The defense industry continues to innovate, integrating emerging technologies to meet the evolving needs of military forces. These investments fuel the development of technologically advanced military computers, rugged tablets, laptops, handhelds, wearables, and avionics computers for use in airborne platforms, naval vessels, military aircraft, ground segments, commercial ships, and the national navy.

Secure data encryption is a paramount concern in military communication, and encryption techniques are being continually advanced to safeguard sensitive information. With the increasing threat of terrorism and the need for intelligence sharing among allied nations, advanced communication systems have become essential. The Defense industry is responding to this demand with innovative solutions, such as software-defined radios and Military communication shelters. These systems offer enhanced bandwidth capacity, enabling real-time data management and IoT-based communication. However, the implementation of these advanced systems comes with challenges. The cost of upgrading or replacing existing communication infrastructure is significant, and the decision-making process is complicated.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Military Communication Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

236 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2025-2029 |

USD 12.37 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.2 |

|

Key countries |

US, China, India, UK, Japan, Canada, Germany, France, Brazil, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Military Communication Market Research and Growth Report?

- CAGR of the Military Communication industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the military communication market growth of industry companies

We can help! Our analysts can customize this military communication market research report to meet your requirements.