Autonomous Vehicle ECU Market Size 2024-2028

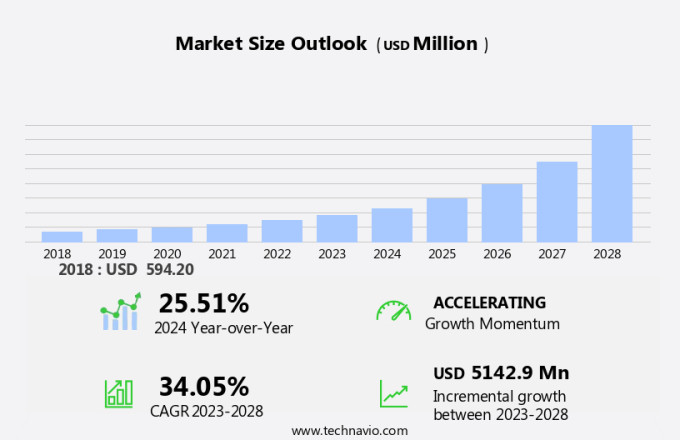

The autonomous vehicle ECU market size is forecast to increase by USD 5.14 billion at a CAGR of 34.05% between 2023 and 2028.

- The autonomous vehicle ecosystem is witnessing significant advancements, driven by the increasing number of road accidents caused by human error. To mitigate this issue, engine fuel scheduling and vehicle performance optimization are becoming crucial. The market is segmented into 32-bit and 64-bit segments based on the processing power of the powertrain control unit. The 64-bit segment is expected to dominate due to the increasing adoption of advanced technologies in passenger cars. However, the high cost associated with semi-autonomous and autonomous technologies remains a challenge. Vehicle-to-cloud over-the-air (OTA) solutions are gaining traction, enabling real-time updates and improvements in vehicle performance. As the market evolves, internal combustion engines continue to play a vital role in powering autonomous vehicles, necessitating the need for efficient fuel scheduling and performance optimization. The market growth is influenced by these factors and is expected to exhibit steady progression in the coming years.

What will be the Size of the Market During the Forecast Period?

- The Electronic Control Unit (ECU) market for autonomous vehicles is experiencing significant growth due to the increasing demand for advanced safety features and vehicle efficiency. ECUs play a crucial role in managing various vehicle functions, including lane departure monitoring, collision avoidance, and automatic emergency braking. Safety is a top priority in the automotive industry, and ECUs are integral to implementing safety systems such as airbags, blind spot detection, and anti-lock braking systems (ABS). These safety features help prevent road accidents and ensure passenger safety in both fully autonomous and semi-autonomous vehicles.

- Moreover, ECUs also contribute to reducing fuel consumption and pollutant emissions by optimizing engine performance and managing vehicle electrification systems. With government mandates and growing consumer awareness towards reducing carbon emissions, the demand for ECUs that enhance vehicle efficiency is expected to increase. However, the increasing use of ECUs in autonomous vehicles also poses cybersecurity challenges. With the collection and processing of vast amounts of data, data triangulation and privacy concerns are becoming significant issues. Therefore, vehicle manufacturers must prioritize cybersecurity measures to ensure the safety and privacy of vehicle occupants and data. ECUs are also essential in managing tire pressure monitoring systems (TPMS) and parking guidance systems, enhancing the overall driving experience for consumers.

- Furthermore, the integration of semiconductors and advanced ECU software enables vehicle manufacturers to offer more advanced features and functionalities. The ECU market for autonomous vehicles is expected to grow significantly due to the increasing demand for advanced safety features, vehicle efficiency, and consumer preferences for connected and automated vehicles. With the continuous advancements in technology, ECUs are set to play a pivotal role in shaping the future of the automotive industry. In conclusion, the ECU market for autonomous vehicles is a critical component of the automotive industry's evolution towards connected, automated, and electrified vehicles. ECUs enable advanced safety features, optimize vehicle performance, and enhance the overall driving experience while addressing cybersecurity challenges and regulatory requirements.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Vehicle Type

- Passenger car

- Light commercial vehicle

- Heavy commercial vehicle

- Application

- Semi-autonomous

- Autonomous

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Vehicle Type Insights

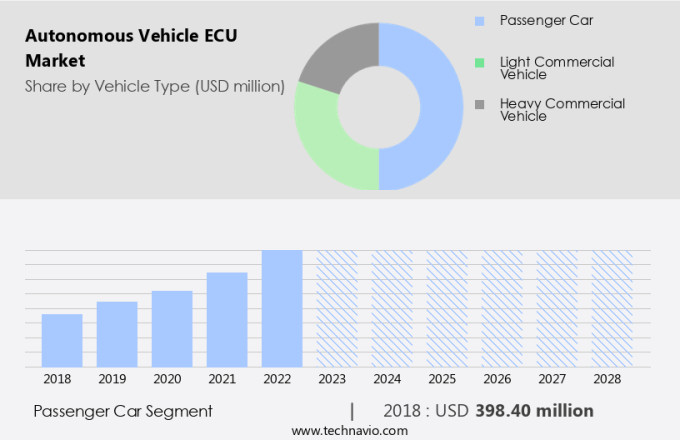

- The passenger car segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth, particularly in the passenger car segment. Automakers are prioritizing the development of autonomous technology for passenger cars due to increasing demand from ride-hailing and logistics companies. North America and Europe are leading regions in the adoption of autonomous cars, with luxury car manufacturers playing a pivotal role. The market's expansion is driven by the growing preference for luxury cars and the integration of advanced safety and convenience features in these vehicles. The implementation of automatic emergency braking and other safety technologies is a priority for these manufacturers. However, cybersecurity issues and data triangulation are emerging challenges that need to be addressed at the country level by OEMs and governments.

Innovation and early adoption are key factors fueling the market's growth. The market is expected to continue its upward trajectory in the coming years.

Get a glance at the market report of share of various segments Request Free Sample

The Passenger car segment was valued at USD 398.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 49% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the United States, regulatory standards pave the way for the testing and implementation of autonomous vehicles, signifying the country's readiness to adopt advanced driving technologies. These regulations open significant opportunities for Original Equipment Manufacturers (OEMs) to integrate sophisticated safety systems and infotainment features in passenger cars, including electric vehicles. The consolidation of Electronic Control Units (ECUs) in vehicles, such as those responsible for displays and infotainment systems, will support the growth of these advanced technologies. The integration of multiple Advanced Driver-Assistance Systems (ADAS) in vehicles enhances safety levels and reduces road fatalities. Regulatory initiatives, like Corporate Average Fuel Economy (CAFE) and the National Highway Traffic Safety Administration (NCAP), drive the market for these advanced in-vehicle systems. The US market for ADAS in passenger cars is expected to grow significantly due to these regulatory requirements and consumer demand for enhanced safety and convenience features.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Autonomous Vehicle ECU Market?

Rising accidents due to human errors is the key driver of the market.

- The growing reliance on personal vehicles for extended commutes has led to an increase in the global automotive fleet and the average distance traveled by passengers. Road transportation is projected to remain a significant mode of travel in the near future, as it is essential for industrial growth. However, the environmental impact, sustainability concerns, and safety issues associated with this mode of transport are becoming increasingly important. In response, the automotive sector has been making strides in enhancing road safety by focusing on driver assistance systems. However, it is essential to address the environmental concerns arising from fuel consumption and pollutant emissions.

- Semiconductor technology is playing a crucial role in vehicle electrification and reducing carbon emissions. Moreover, parking guidance systems are being integrated into vehicles to optimize parking spaces and reduce fuel consumption during the search for parking. ECU software is being optimized to improve vehicle performance, reduce fuel consumption, and minimize pollutant emissions. These advancements are crucial for the sustainability of the automotive industry and the environment.

What are the market trends shaping the Autonomous Vehicle ECU Market?

Vehicle-to-cloud over-the-air (OTA) solutions for autonomous vehicles is the upcoming trend in the market.

- The integration of electronic components and systems in vehicles has witnessed significant growth due to the rising adoption of Advanced Driver-Assistance Systems (ADAS), connectivity, and other advanced technologies. The introduction of autonomous solutions and artificial intelligence (AI) technologies has further complicated the vehicle ecosystem. AI technology is increasingly being utilized in ADAS to mimic human brain functions, thereby enabling the detection and recognition of multiple objects surrounding a vehicle. Notable market players have recently launched AI-based ADAS solutions to overcome the limitations of existing level 2 ADAS systems. These advancements are expected to revolutionize the automotive industry, offering enhanced safety and convenience features.

What challenges does Autonomous Vehicle ECU Market face during the growth?

The high cost associated with semi-autonomous and autonomous technologies is a key challenge affecting market growth.

- Autonomous vehicles are gaining popularity as a safer alternative to traditional vehicles due to their ability to minimize accidents. However, the development of these advanced vehicles comes with significant expenses. The implementation of autonomous operations in vehicles requires the use of high-performance sensors, such as LiDAR, and sophisticated computing systems. For instance, a single LiDAR sensor can cost around USD 8,000. Furthermore, the vehicles are equipped with radars, cameras, powertrain systems, internal combustion engines, and other high-performance hardware, which add to the overall cost.

- In semi-autonomous technologies, the expenses related to the acquisition and maintenance of advanced driver-assistance systems (ADAS) and their complex image analysis algorithms limit their usage to premium passenger cars. Engine fuel scheduling and vehicle performance are crucial considerations in the powertrain segment of autonomous vehicles, with both 32-bit and 64-bit segments playing essential roles.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aptiv Plc

- Autoliv Inc.

- Continental AG

- DENSO Corp.

- Hitachi Ltd.

- Hyundai Motor Group

- Infineon Technologies AG

- Intel Corp.

- Johnson Controls International Plc.

- Magna International Inc.

- Marelli Holdings Co. Ltd.

- Mitsubishi Electric Corp.

- NVIDIA Corp.

- NXP Semiconductors NV

- Panasonic Holdings Corp.

- Renesas Electronics Corp.

- Robert Bosch GmbH

- Stellantis NV

- Texas Instruments Inc.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The autonomous vehicle Electronic Control Unit (ECU) market is witnessing significant growth due to the increasing adoption of advanced safety features in vehicles. These features include lane departure monitoring, collision avoidance, and blind spot detection systems. The integration of these systems in ECUs enhances vehicle safety, reducing the number of road accidents caused by human error. Semi-autonomous vehicles are increasingly becoming common, and ECUs play a crucial role in their functioning. These vehicles are equipped with advanced electronics such as windshield Head-Up Displays (HUDs), camera modules, radar, and Lidar sensors. The ECUs process data from these sensors to enable features like automatic emergency braking and advanced telematics. Vehicle manufacturers are investing heavily in ECUs to meet government mandates for safety systems like Anti-lock Braking Systems (ABS), Tire Pressure Monitoring Systems (TPMS), and airbags. With the rise of electric vehicles, ECU consolidation is a trend in the market, with semiconductors playing a vital role in vehicle electrification.

Moreover, ECUs also manage vehicle performance, fuel consumption, and pollutant emissions, making them essential for both internal combustion engine and battery-powered systems. The market for ECUs in passenger cars is expected to grow significantly in the coming years, with the 64-bit segment leading the way due to its ability to handle complex calculations and larger data volumes. Cybersecurity issues are a concern in the ECU market, with data triangulation and vehicle hacking being major challenges. ECU software plays a crucial role in addressing these issues, with ongoing research and development focused on enhancing security features. Overall, the market is poised for significant growth, driven by the increasing demand for advanced safety features and vehicle electrification.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

187 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 34.05% |

|

Market growth 2024-2028 |

USD 5.14 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

25.51 |

|

Key countries |

US, China, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch